Key Takeaways

- Empower your accounts receivable teams to streamline credit management and automate collections workflows, making informed credit decisions and optimizing collection strategies.

- Use advanced analytics and real-time data to assess creditworthiness, establish clear credit policies, and maintain proactive collections and strong customer relationships.

Introduction

In the fast-evolving landscape of modern business, credit and collection operations are critical to the financial stability of an organization. However, many businesses often struggle with managing overdue payments and are unable to take proactive measures to improve receivables collection. Now imagine if you can streamline overdue payment collection, reduce costs, and elevate the customer experience. Leveraging collection technology provides you with the capability to achieve this and much more.

How can AI/ML and data analytics reshape traditional approaches, optimizing efficiency and transforming customer engagement? The answer lies in embracing technology as the cornerstone for agile, responsive, and customer-centric credit mand collections management.

In this article, we understand the processes that encompass credit and collection operations, the pivotal role that technology is playing in transforming credit and collection and the future outlook.

What is Collections Technology?

Collections technology is leveraging digital methodologies in the process of collecting overdue or outstanding payments from customers while reducing the total cost and effort to collect. This involves utilizing tools and technologies such as artificial intelligence/machine learning (AI/ML) powered credit and collection solutions and data-driven analytics to streamline credit and collection operations and ensure a seamless customer experience.

The utilization of collection technology ensures that organizations can proactively and intelligently enhance credit and collection efficiency while ensuring that they can work with the customers and effectively engage with them to structure payment plans and improve receivables collection.

Understanding B2B Credit and Collection Operations

Credit and collection operations involve a set of activities that facilitates organizations to efficiently manage their credit and collection activities to reduce credit risk, improve days sales outstanding (DSO), reduce bad debts and receive timely payments. This encompasses two major areas i) credit management ii) collection management.

Credit management includes ascertaining and managing credit limits, setting up a workflow to mitigate issues related to sales order hold and proactively reviewing customer credit score based on real-time data insights.

Collection management involves utilizing the accounts receivables collection information to send timely payment reminders as well as working with the customers to expedite payment. The core goal of the efficient collection is to ensure proactive and timely payments from customers while ensuring a superior customer experience.

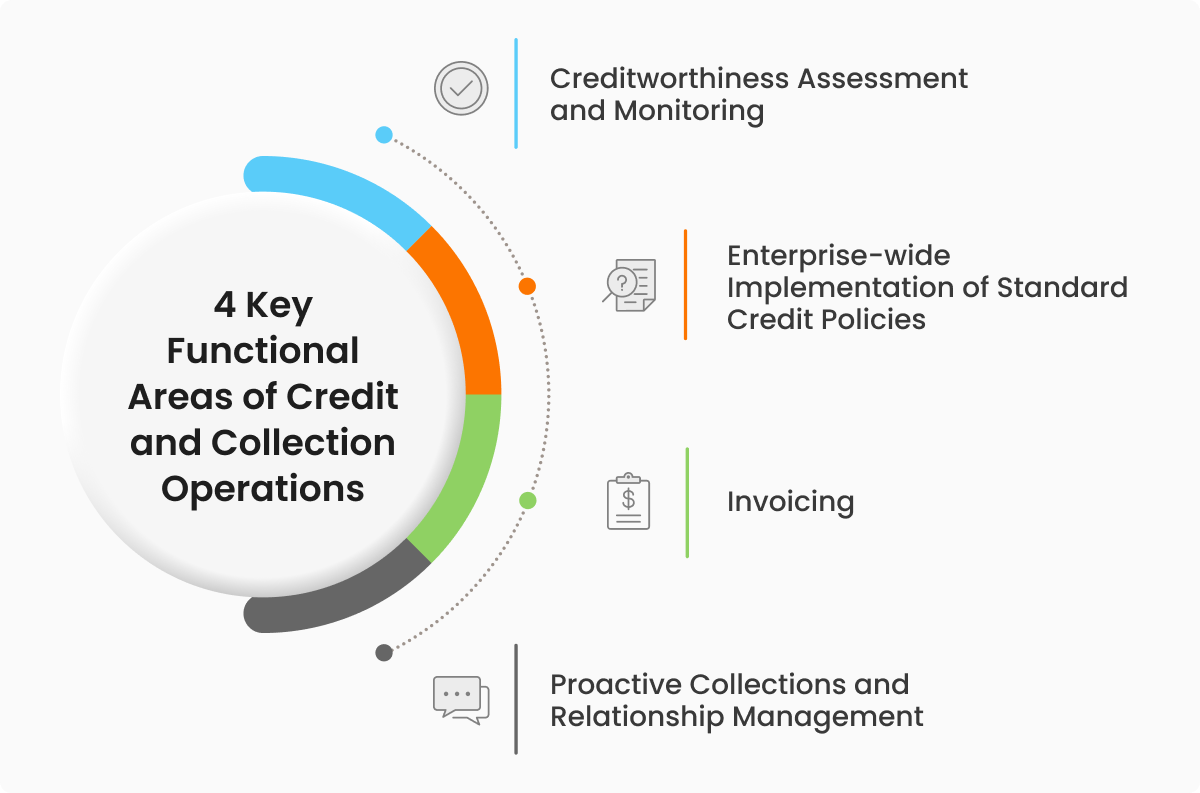

Credit and collection operations largely include four key functional areas: i) Creditworthiness assessment and monitoring ii) Enterprise-wide implementation of standard credit policies ii) Invoicing iv) Proactive collections and relationship management.

-

Creditworthiness assessment and monitoring

Before extending credit to a business, it is crucial to assess its creditworthiness. This involves evaluating the financial health, payment history, and credit references of the potential customer. Conducting thorough credit checks, obtaining financial statements, and analyzing industry data can help assess the risk involved.

Furthermore, ongoing monitoring of the customer’s creditworthiness is important to identify any changes in their financial situation or payment behavior that may impact their ability to meet payment obligations.

-

Enterprise-wide implementation of standard credit policies

Establishing clear credit policies is essential for B2B collections. These policies should outline the terms and conditions of credit, including payment due dates, late payment penalties, and credit limits.

It is crucial to communicate these policies to customers before extending credit and have them acknowledge and agree to the terms. Clear policies provide a basis for collections efforts and help manage customer expectations regarding payment obligations.

-

Timely invoicing

Organizations need to ensure that their invoicing and payment process align with their customer’s needs and make it extremely hassle-free for the customers to complete payment.

E-Invoicing is the key here as this ensures minimal manual efforts which reduces invoice-related errors which in turn expedites invoicing and reduces disputes.

Providing customers with timely invoices and offering a self-service option for bill review and payment significantly enhances the effectiveness of the collections process.

-

Proactive collections and relationship management

Proactive collections involve regular and systematic follow-up with customers to ensure timely payment. Maintaining regular communication, both before and after extending credit, is crucial in B2B collections. It is essential to establish strong relationships with customers and understand their payment cycles and preferences.

Early intervention, such as sending payment reminders, making courtesy calls, and offering payment plans, can help prevent overdue payments from becoming problematic. Additionally, maintaining open lines of communication and addressing any payment issues promptly can help preserve the customer relationship and increase the likelihood of successful collections.

Challenges in Credit and Collection Operations

Now that you have a fair understanding of B2B credit and collection operations let’s discuss some of the challenges faced by organizations due to a lack of technology adoption:

-

Limited resources and high reliance on manual processing

Many organizations are facing challenges related to staffing constraints, rising transaction volumes, increased compliance and regulatory issues with employees spending a lot of time on manual low-value tasks. This has resulted in organizations grappling with high operational expenses, reduced productivity and inability to cater to critical customers during credit and collection operations.

-

Lack of streamlined collection process

Without a strategy-driven, automated collection process, organizations lack a streamlined workflow that enables the collection team to identify the best mode of action for increased collection recovery. Owing to this, different stakeholders can follow disparate credit and collection processes. Further, as tasks are performed manually organizations are unable to optimize performance.

-

High adjustment volumes

High adjustment volumes are aggravated when there is difficulty in identifying and resolving disputes. The result is low customer satisfaction, unresolved discrepancies and teams spending considerable time and effort on resolving these issues.

-

Inconsistent credit assessments

Without systematic and real-time reviews of accounts receivable portfolio, and other customer parameters the credit limits and associated credit score and risk ratings are likely to become outdated. As a result, organizations might face excessive credit holds, a lack of visibility into actual portfolio risk, and missed opportunities in terms of mitigating risks or taking advantage of sales opportunities.

-

Limited data visibility

When receivables related data is maintained manually or in disparate systems, teams do not have a complete overview and face challenges while accessing information. It becomes challenging for teams to ascertain the number of outstanding invoices and the corresponding liabilities. This complicates the ability to recognize trends in delayed payments and assess whether corrective measures are necessary.

Role of Collections Technology in B2B Credit and Collection Operations

In the dynamic landscape of business, maintaining a robust cash flow is paramount. Effectively managing AR collection is not just a business function; it’s a strategic imperative for sustaining financial health and stability. While certain ERP and accounting systems come equipped with order-to-cash modules, their efficacy, particularly in credit and collections, is limited. Recognizing the pivotal role that credit and collection operations play in ensuring consistent cash flow and overall business success, it becomes imperative for organizations to align with the latest technological trends.

Organizations need to modernize and streamline their credit and collection operations to bolster efficiency. The adoption of collection technology allows organizations to achieve operational precision and customer centricity by empowering credit and collection teams to focus on higher-value tasks. Let’s explore some pivotal areas where technology takes center stage:

AI-driven Automation

In the journey toward operational efficiency, automation reduces the burden on credit and collection teams while minimizing the risks associated with manual processing. AI reduces manual efforts in mundane tasks like data entry, affording credit and collection teams the bandwidth to engage with customers and formulate long-term strategies for overdue payments.

The true strength of AI and automation lies in its ability to translate vast datasets into actionable insights, enhancing processes and optimizing cash flow. Leveraging customer payment data, AI personalizes payment reminders, increasing the likelihood of timely responses and payments. Moreover, AI can predict future customer behavior, providing businesses with the foresight to identify potential payment issues early on and take proactive measures.

Recommended Reading: 7 Automation Technologies Revolutionizing Receivables Collections Today

Advanced data analytics

AI and Machine Learning (ML) based analytics empower organizations with key insights, allowing them to get a comprehensive 360-degree view of their customers. This offers a more reliable understanding of outstanding payments, providing the team with an overview of the strategies to utilize to maximize collections.

AI-powered analytics further detect anomalies in customer behavior—changes in payment or communication patterns early on that can provide organizations early signals regarding future payment issues. Armed with this foresight, organizations can proactively address potential delays. Additionally, AI analysis allows organizations to review customer credit scores and limits in real time and make changes as the customer attributes get modified.

In essence, the role of collections technology is not just about automating processes; it’s about redefining the way businesses understand, interact with, and manage their credit and collection operations. Embracing these technological advancements is not just a choice for organizations; it’s a strategic imperative for organizations seeking not only financial stability but also a competitive edge in the ever-evolving business landscape.

The Impact of Collections Technology on AR Operations

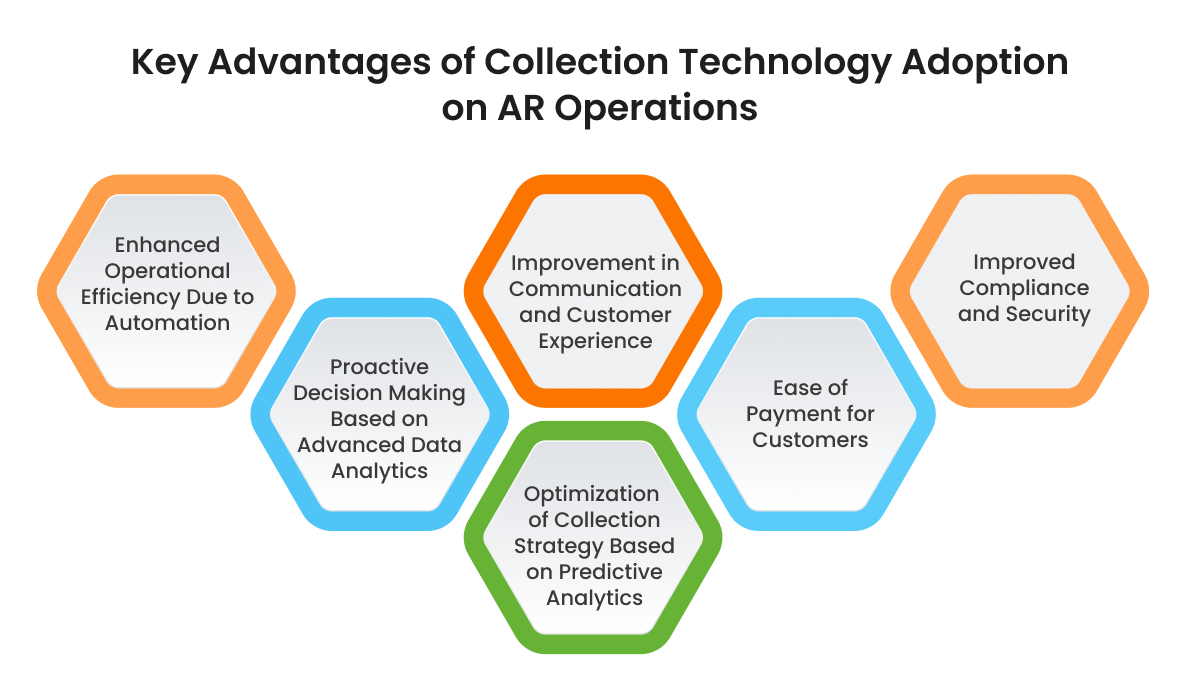

Technology has significantly impacted credit and collection operations, bringing about several changes and improvements by improving efficiency, data analysis, communication, customer experience, and security. Embracing technological advancements has become essential for organizations to stay competitive and optimize their credit and collection operations.

Here are some ways technology has impacted credit and collection operations.

Enhanced operational efficiency due to automation: Technology has enabled the automation of various credit and collection processes, such as invoice generation, payment reminders, and debt tracking. Automated systems and software streamline workflows, reducing manual efforts and increasing operational efficiency.

Proactive decision-making based on advanced data analytics: Advanced data analytics tools and algorithms help analyze vast amounts of customer and financial data seamlessly. This allows credit and collection professionals to gain valuable insights into customer behavior, creditworthiness, and payment patterns. Data-driven decision-making improves risk assessment, collection strategies, and customer segmentation.

Improvement in communication and customer experience: Technology has revolutionized communication channels, enabling faster and more efficient interactions between creditors and debtors. Online portals, email, text messaging, and chatbots provide convenient and immediate communication options. This enhances the overall customer experience, encourages timely payments, and reduces disputes.

Optimization of collection strategy based on predictive analytics: AI-powered technologies can predict payment behavior, identify high-risk accounts, and forecast collection outcomes. These predictive analytics tools help optimize collection strategies, prioritize efforts, and allocate resources effectively.

Ease of payment for customers: The availability of online payment gateways, electronic fund transfers, and digital wallets has made it easier for customers to make payments. Convenient and secure online payment options facilitate faster transactions and reduce barriers to payment.

Improved compliance and security: Technology has played a vital role in enhancing compliance and security measures in the credit and collection operation. Robust systems and encryption technologies protect sensitive customer information, ensuring data privacy and compliance with regulations such as GDPR and PCI DSS.

Recommended reading: 5 Benefits of Automation in Credit Risk Management

The Future of Collections Technology in AR Operations

Credit and collection teams must prioritize critical customers and devise strategies to recover past dues—an endeavor that can be simplified and expedited through collection technology. Intelligent automation and AI-based systems not only alleviate the burden of manual tasks for these teams but also furnish actionable insights regarding the anticipated timing of the customer’s next payment, derived from their prior behavior.

Subsequently, in what can be likened to a reverse engineering process, the collection team can devise a dunning strategy based on the AI-predicted payment date. Several pivotal areas where technology will continue to wield a significant impact on credit and collection operations include.

AI ML technology-driven proactivity in credit and collections operations

By leveraging AI and ML technologies, organizations can instantaneously process vast amounts of data, extracting valuable borrower information from diverse sources. This includes income analysis, credit history scrutiny, and payment behavior assessment. The insights obtained enable businesses to forecast risks more efficiently, overcoming challenges associated with traditional credit and collection methods.

The integration of AI/ML technology allows for the aggregation of relevant customer data, facilitating accurate profiling and segmentation. The ability to tap into these insights provides a comprehensive understanding of customer payment behavior patterns, minimizing the risk of non-payment. Collections teams can further design personalized collection strategies developed through AI/ML inputs to enable businesses to communicate with customers in a manner that aligns with their preferences, ultimately optimizing receivables collection.

AI can create significant value, speed and efficiency for credit and AR teams, reducing past-due by as much as 30%, controlling bad debt risk and helping to optimize working capital.

Advanced predictive analytics for credit and collection optimization

The true power of AI/ML lies in predictive analytics, which aids in identifying customers at risk of non-payment well in advance. By analyzing patterns in customer data, organizations can proactively manage accounts, preventing them from becoming delinquent. This proactive approach allows for tailored solutions, such as payment extensions and customized payment terms, mitigating the likelihood of bad debt scenarios.

A one-size-fits-all approach does not work in collections and based on the analytics-generated insights organizations can implement targeted collection strategies, achieving higher efficiency and identifying potential risk proactively.

Superior customer experience and engagement

The transformation of credit and collection operations is reshaping customer engagement strategies. Speech analytics and AI-driven customer profiling are leading towards effective digital customer interactions throughout the credit and collection life cycle. Businesses adopting digital and omnichannel communication techniques experience reduced operating costs and increased collection rates, with customers favoring non-invasive, convenient, and self-service options. The implementation of AI-based platform solutions further enhances customer experiences, contributing to improved overall customer satisfaction and collection recovery outcomes.

How HighRadius Can Transform Credit & Collection Operations?

At HighRadius, we provide you with solutions that enable you to streamline and automate your credit and collection operations, ensuring you make informed credit decisions while minimizing risk. Our AI-based credit cloud enables you to automate credit reviews, and proactively manage credit risk and order management with a prioritized credit worklist and AI-driven blocked order management.

Moreover, our solution enables organizations to automatically calculate their credit scores, determine risk classes, and set credit limits using pre-configured credit scoring models. Through harnessing advanced analytics and real-time data offered by our credit and collection solutions, organizations gain the ability to make data-driven credit decisions, resulting in decreased bad debt and enhanced cash flow

Our order to cash solutions empower organizations to automate all financial processes, including credit risk monitoring, collections, invoices, deductions, cash application, and more. Additionally, our solutions provide organizations with the tools to empower their teams, offering insights to predict customer behavior, recommend immediate actions, analyze productivity, and ensure seamless collaboration between the collections and credit teams.

FAQ’s

1. Why is credit and collection important?

Credit and collection are important because they facilitate economic activity by allowing individuals and businesses to access capital and goods on credit, promoting spending and investment. Effective credit and collection processes also help maintain financial stability and mitigate the risk of default, ensuring the overall health of the financial system.

2. What are the credit and collections activities?

Credit and collections activities encompass a range of tasks related to extending credit to customers and managing the collection of outstanding debts. This includes evaluating creditworthiness, setting credit terms, monitoring payment timelines, sending invoices, negotiating payment arrangements, and, when necessary, pursuing legal or collection actions to recover overdue payments.

3. What are the emerging trends in collections technology?

Emerging trends in collections technology include the widespread adoption of automation, artificial intelligence, and machine learning for predictive analytics, aiming to enhance efficiency and optimize debt recovery strategies. Additionally, digital platforms, chatbots, blockchain, mobile solutions, and a focus on personalized customer engagement are shaping the future of collections technology.