Understanding The Role of a GPO

Global Process Owners (GPOs) are responsible for directing and managing the end-to-end A/R process within a Global Business Service (GBS) organization. End-to-end often entails cross-functional scope as A/R involves collaborating with multiple departments. GPOs analyze the efficiency, quality, and transformation of the A/R process in GBS that has been influenced by technological and infrastructure developments. They create an effective and efficient process, implementing it with the right human, financial, and technological resources, and providing quality outcomes as required by the organization.

A process owner has control and ownership of the end-to-end process, to the extent that changes established within the process cannot be made without the process owner’s permission

Source: Sharedserviceslink Insights

The responsibilities of a GPO are varied but can be broadly categorized into

three areas:

Process related responsibilities

GPOs must define the required processes, map them into the required outputs, standardize and drive for continuous improvement by implementing, monitoring, and measuring process improvement initiatives.

Stakeholder management

GPOs must be able to manage both top management and the employees in the GBS organization. The employees in the GBS organization need to be trained regularly to refresh their knowledge and to prep them for new processes or technologies. Top leadership should be kept in a continuous loop to get buy-in at required levels.

Monitoring team performance

The GPO is the end-to-end process owner and is responsible for the process’s health. A process will function smoothly without any roadblocks only if the team performs in a seamless manner. Setting team KPIs and measuring their performance against accepted top metrics in a timely manner will help GPOs to ensure better process performance.

Apart from these GPOs are also tasked with:

- Leveraging data for making value-driven decisions

- Building a digital enterprise to achieve scalable growth

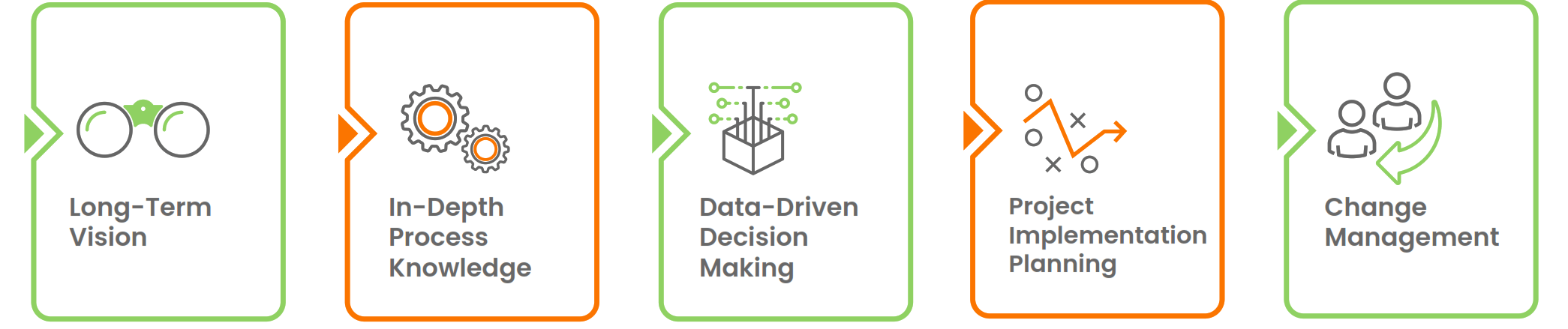

The GPO’s role is an integral part of any shared service model as they are key players in driving value across the process and by large the organization. To make their process world-class, a GPO must possess 5 critical skills.

In this ebook, we will study in brief the importance of each of these skills and how global organizations leverage them to create a best-in-class A/R process.

Related Resources

Drive Operational Efficiency: The Essential Credit &…

Take me to the templateA Strategic Look at Collections Correspondence

Take me to the template10 Best Performing Credit Email (Letter) Templates…

Take me to the templatePlease fill in the details below

Please fill in the details below