The Best-in-Class Digital Approach to Operational Excellence for Shared Service Centres

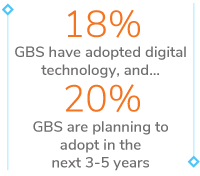

- 18% of GBS have adopted digital technology

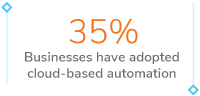

- 35% of businesses have adopted cloud-based automation

- 25% of the accounting department revenue can be saved via automation

- Automation has emerged as the most challenging roadblock with only 15% of the all the Artificial Intelligence projects delivering value for the CIO

- A dotONE approach provides an ecosystem to measure the performance of the digital transformation process

From Performance Maturity to Best-in-Class Approach

that are customized to their business requirements. General strategies to enhance the performance of SSC include:

- Deliver Strong Service: Ensure that business leaders are engaged/involved with the SSCs by adding insights and value to the business decisions. This will improve the visibility of SSC in the system

- Value-added Services: SSCs should look beyond saving costs and focus on strategic value through the centralized use of technologies that automate manual tasks and the workforce is free to take up strategic tasks. For example, in the O2C process, to reduce the amount of repetitive work, AI engines can be deployed to scan through the customer e-mails, invoice details, contracts, and other unstructured data and significantly reduce the manual effort while improving the execution time for collections, deductions, dispute resolutions, shorts payments, cash posting, etc.

- Complete Visibility Across Process: SSCs should be quick to respond to stakeholders’ queries and provide them a complete picture of the process. One of the biggest challenges in the O2C process is the lack of information visibility and communication across its processes, which is critical for ensuring good customer experience

- Retain Talent: High attrition rates in SSCs are due to unchallenging and repetitive work. Using technology to automate simpler tasks and upskilling the workforce for advanced tasks can help in their professional growth

Best-in-class Approach is Needed to Adapt to the Changing Business Environment and to Stand out in the Crowd.

Some focus areas for the SSC leaders while following a best-in-class approach are (as per SSON Survey, 20204):

Building Operational and Location Strategies: The concept of SSCs is more than two decades old, and over time, multiple players have joined the pool of providing ‘cheaper’ shared services. To stand out, leaders should understand, re-evaluate, optimize, and strategize:

- Operating Model: There are two types of SSCs operating in the market. One provides global services support from a centralized location and the other provides regional/in-country support. Although global shared services efficiently provide cross-regional support, their adoption has been low (40%). This is expected to change as businesses move toward digital transformation

- For the O2C process, leaders also need to consider the level of O2C process integration with other parts of the business. In a one-sided integration, only the back office O2C processes such as revenue recognition, sales reporting, and accounts payables are integrated to provide business visibility and better financial reporting. On the other hand, a two-way integration of the O2C process with business planning and financial activities offers overall operation excellence

- Service Location: For setting up new or expanding existing services, an upskilled workforce is required to adapt to digital transformation. For this, the service location should be evaluated in terms of the required support, as different regions offer different expertise and skills

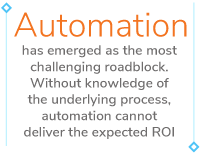

For building an automation roadmap, leaders need to develop a sound understanding of the underlying processes and tools required to automate them. Given that there are layers of processes and sub-processes or components, every component needs to be considered and automated independently

- Process Insights: Leaders need an in-depth understanding of their business processes and must have a transparent view of the current state of processes. This should include:

- Details of shared services business processes and their alignment to stakeholders’ requirements

- Complete understanding of the process hierarchy

- Current level of efficiency or inefficiency of the respective process

- Suitable tools needed for improvement

For example, in the credit management process, having insights on average time to review blocked orders, new applications, existing customers, and approval of existing applications is tied directly to workforce productivity, which in turn impacts the efficiency of making a sale to a potential customer and the overall customer on-boarding process

- Data Analytics: Data is undoubtedly the most important parameter for automation-driven SSCs to generate actionable business insights. Leaders should invest time and money in revamping the structure of existing siloed data for enabling optimal usage of analytics technologies. For example, having insights on the credit risk history of a customer can help in defining credit limits and identifying the risk of blocked order

- Cloud Adoption: Cloud-based automation can be a strategic move for reduced maintenance costs and innovation in processes. It also resolves the issue of siloed

datasets residing across different systems. For example, running a cash application over cloud can result in straight-through processing of payments by analyzing and processing information from emails, attachments, and banking websites. While nearly a third of businesses (~35%) have adopted cloud-based applications in SSCs, a similar share is expected to shift to cloud-based applications (~30%) in the near future. However, due to security concerns, lack of infrastructure, and data accessibility and integration issues, SSCs are struggling to move to the cloud

- Automation: Without detailed insights into processes and tasks, automation projects cannot deliver the expected value and ROI. To reap the long-term benefits of automation, leaders need to build a roadmap to understand the operational efficiencies, different ways of executing the task, and the time required by each process, and identify processes that need to be automated. This can be easily accomplished by leveraging AI. Leaders should also have knowledge about various automation forms such as attended automation and unattended automation, in order to decide what suits their business better.

Collaboration and Real-time Visibility: Better insights can be generated only if there is agility and visibility in cross-functional interactions. When the workforce has real-time visibility of the processes, issues can be resolved much faster, often without escalations. Processes such as O2C and A/R generate a lot of data and require complete visibility over all other peripheral processes, due to the direct impact of these processes on customer satisfaction.

Further, partnerships with business decision-makers add value to the services. Cloud-based applications such as Financial Close solutions provide better collaboration between SSCs and business units, facilitating complete visibility to the decision-makers over every transaction and helps SSCs to build a strong partnership with the business. Moustapha, OTC Market Focal Point Manager at BMS, highlights that technology has helped to shape the meaning of productivity and worthiness of departments. Different departments are no longer required to process a large quantity of information. It can be handled by a single department working from any location, by having access to technology and real-time data.

Benchmarking: Plotting an Improvement

Below is the recommendation for benchmarking as suggested by Bryan DeGraw- Associate Principal, Finance Advisory Services, The Hackett Group

Benchmarking with the Peers and Top Performers:

The value of business benchmarking is more than just knowing how well you perform – the true value lies in realizing quantifiable performance optimization benefits.

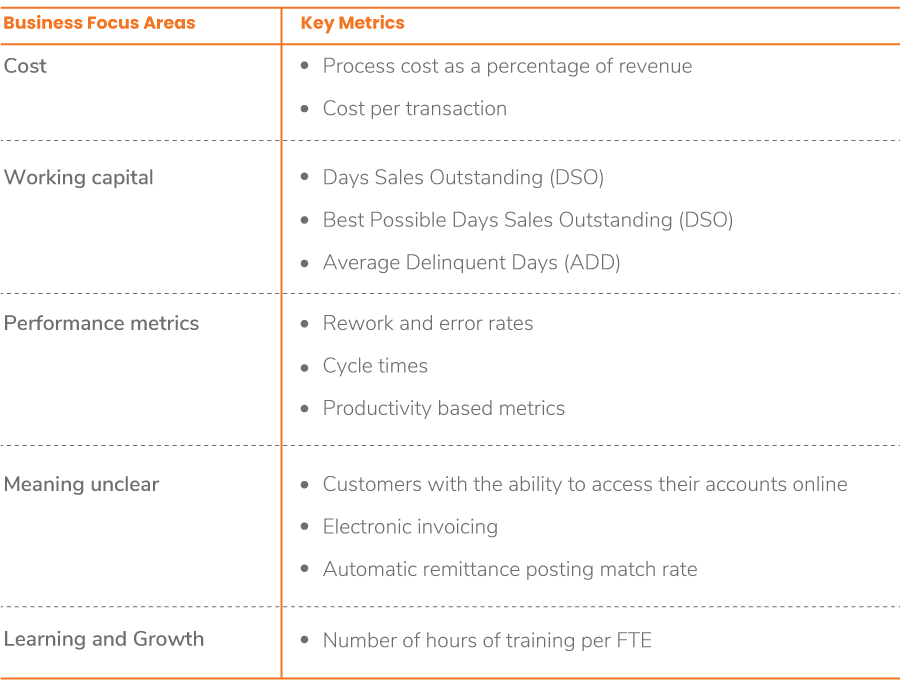

To ensure continuous development and innovation, benchmarking the back-office operations and processes is an essential first step towards performance improvement. How you perform the performance evaluation and to who you draw comparisons is equally important. The best approach is to compare performance of your Shared Services Center with that of your peers and with cross-industry top performers. Peers should not only be drawn from an immediate list of competitive organizations. When comparing performance, it is equally important to consider the size and complexity factors among organizations to draw relative performance levels. Without having a baseline of performance, it is very challenging to determine the set of initiatives that will deliver optimum performance improvement in SSCs. A simple analogy is that it is nearly impossible to chart a course to a destination without first knowing the starting point of your journey. With changing business standards and customer expectations, it is critical that organizations can adapt and deliver services to those constantly changing demands. Traditional benchmarking standards such as cost, expertise, quality and speed remain important measurements. In addition, businesses demand more control, efficiency, scalability and visibility over their processes; and technology is certainly a key enabler to achieve this evolving concept of Digital Transformation in your Shared Services Centers. It is then important to consider the parameters required of the business leaders. A few of the benchmarking parameters that can be considered:

- Determining Business Value Generation: SSCs are expected to derive business value through both the processing of timely/accurate transactions and then by providing data

analytics and insights. For instance, transactional automation in the O2C process can save up to 25%5 of the accounting department revenue. Hence, a clear, quantified, and robust set of KPIs would be a differentiating factor. Some of the metric parameters might be integrated to show the amount of visibility, cost-saving and speed, automation level, ability to enable cross-team and cross-organizational interactions (partnerships), etc. For processes such as O2C, a balanced set of measurable KPIs driving the business value could be Average Days Delinquent (ADD), Days Sales Outstanding (DSO), Perfect order performance, and On-time delivery performance

- The Influence on Customer Experience: Most SSCs are involved in handling customer-centric transactions. The performance levels of executing these transactions should be benchmarked to evaluate patterns in the customer ordering behavior and payment behavior in order to understand the correlations with customer experience. Customer experience is an essential parameter for the management of account receivables and the related, supporting O2C process. It is critical that companies focus on running these processes smoothly

- End-to-end Process Focus: SSC processes should be continuously monitored to keep track of the performance of every process. For the O2C processes, key indicators could be on-time completion percent, auto-reconciliation rate, accuracy, and latency. A “good” balanced end-to-end process scorecard tells the story of a company’s vision and strategy for that particular process. The respective KPIs should reflect performance levels and also influence the behavior of the SSC team to strive to achieve and/or maintain top performance.

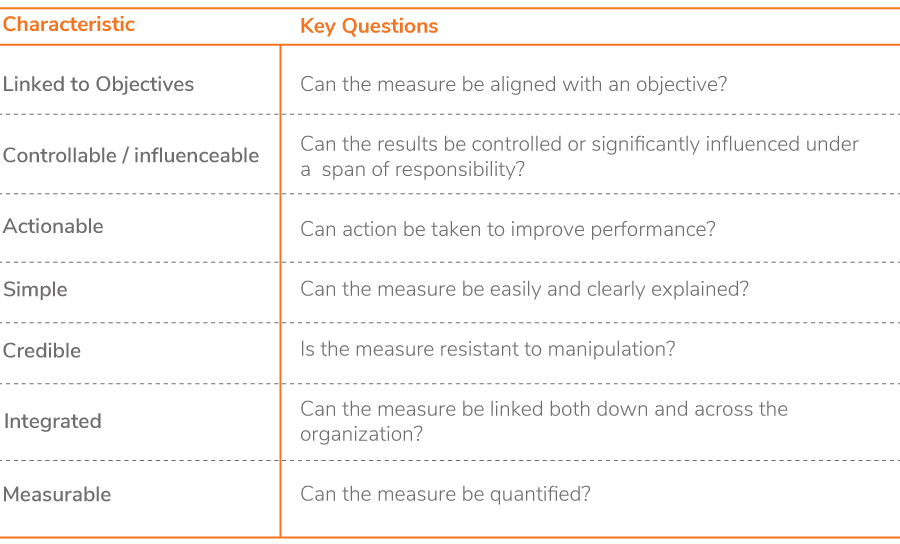

- O2C Process KPIs should have the following characteristics:

Too many metrics spoil the scorecard and make it difficult to focus on the big picture. Limiting the number of metrics focuses the organization on those areas that are most important.

- Based on Technology Adoption: Analytics and Automation are two key technology factors for benchmarking. As per SSON (2020 survey6), 48% of SSCs accepted having a ‘Data

Analytics’ skill deficit among its existing staff. In the same survey, 52% of SSCs accepted getting ‘data in order’ as their biggest hurdle in automation

Going Beyond Performance Maturity

SSC is a very competitive market wherein process owners are seeking opportunities to revamp the process or bring the next change in the market dynamics. General strategies to enhance the performance of SSC can be:

- Deliver Strong Service: Ensure to keep business leaders engaged/involved with the SSCs by adding insights and value to the business decisions. This will improve the visibility of SSCs in the system

- Value-added Services: SSCs should look beyond saving costs for business leaders to adding more strategic value through the centralized use of technology, by automating manual tasks so that the workforce can focus on more strategic tasks. Also, SSC managers should take a lead in upgrading business processes by benchmarking them and continuously improvement. For example, in the O2C process, to reduce the amount repetitive work, AI based OCR applications can be deployed to scan through cusotmers’ e-mails, invoice details, contracts, and other unstructured data and significantly reduce the manual effort while improving the execution time for collections, deductions, dispute resolutions, shorts payments, cash posting, etc., so that the workforce can be redirected to more productive tasks

- Complete Visibility Across Process: Having end-to-end visibility of the process enhances the collaboration of the SSC with the business leaders. SSCs should be quick to respond to stakeholders’ query and provide them a complete picture of the process. One of the biggest challenges in the O2C process is the customer experience owning from lack of visibility across the O2C process as it includes multiple departments such as sales, marketing and warehousing. Providing real-time visibility to customer over the process can significantly improve the customer experience

- Retain Talent: High turnover rate in SSCs are due to unchallenging and repetitive work. Using technology to automate work can enable the workforce to focus on more advanced work, thereby keeping them engaged and upskilling them with the latest tools and technologies used in the industry

Establishing a dotOne Approach for a Successful Digital Transformation

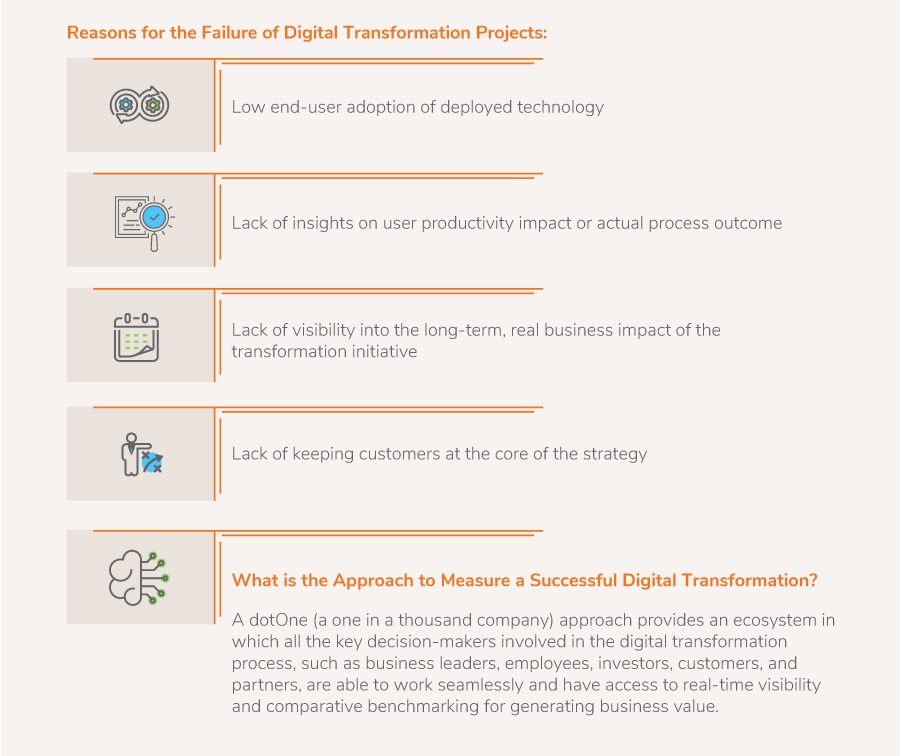

For a successful digital transformation initiative, it is required to continuously monitor the business performance on pre-defined parameters. It has been observed that several digital transformation projects have failed, and some of the observations on the failures of digital transformation are:

- According to McKinsey7, large IT projects overshoot the budgeted cost (~45% over budget), delivering 56% lesser business value

- According to Gartner8, out of 20 AI projects, only 3 projects deliver value for the CIO

- According to Harvard Business Review9, a failed IT project can account for up to USD 150 Bn

Post implementing the digital transformation initiative, the transformation performance should be tracked and monitored at every stage of the business, starting from new technology adoption and end business results from the use of these products. They are explained below:

- Visibility Across Product Usage and Performance: This is the initial level of evaluation in which the product usage is tracked. For this, users should be evaluated if they are using the system and its available features and functionality, and does this fast-track their work and helps them in making better decisions

- Visibility Across Analyst Performance: This is the second level of evaluation in which every analyst’s performance is analyzed. If the users are using the system and its features and functionality as intended, it should affect their performance, such as effectiveness in capturing payment commitments and the ability to recover from invalid deductions

- Visibility Across Customer Performance: In this level of evaluation, the customer’s performance is evaluated from the collections, deductions, billing, and payments point of view. If there is an optimum performance at the initial two levels, then it should have a correlated effect on the customer’s contribution to the top-line and bottom-line business growth

- Visibility Across KPIs: These are the metrics affecting the business outcomes on which the individual team and analyst are evaluated, such as collection effectiveness, credit risk, and blocked order SLAs. It helps to evaluate whether the transformation initiative is trending in the right direction

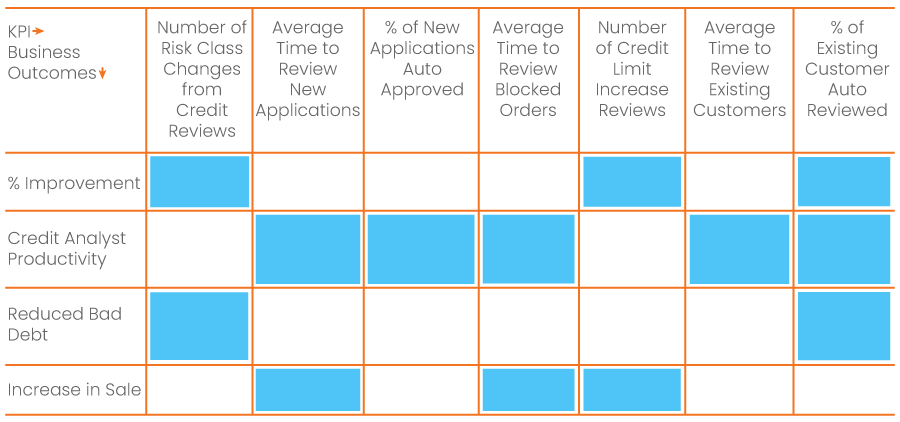

- Visibility Over Business Value: This is the final level of evaluation in which the business performance is evaluated. If all the previous levels of evaluation have a favorable result, then it should affect the end business result in the form of lower DSO and a decrease in bad debt The overall visibility over the business provides the leading and lagging business insights to the leadership team as they get a tab on overall process health as well as end business impact. For every O2C process, such as credit, payments, cash applications, deductions, and collections, it is important to define the business outcomes and KPIs. For example, credit management process KPIs and the outcomes can be mapped as highlighted below:

Defining KPIs makes sure that they make an entry in sale or in some way affect sales. For example, the time taken to onboard a customer in a B2B setup is dependent on analyzing the creditworthiness of the customer to make sure that the customer will be paying on time. This process involves several stages, such as getting information from the third-party credit rating agencies, such as Moody’s and DnB, and assigning a credit rating to the customer. The longer it takes for a credit analyst to process the information, the longer it takes to onboard a customer and make a sale, which is measured by the KPI ‘Average Time to Review New Applications’.

To better understand how dotOne performance simplifies the work for a business with its real-time visibility and goal-setting framework, consider an example of a multinational wine chain recollecting the cash from a geography-based business, on certain KPIs. The dotOne approach provided visibility across pending payments and the relevant KPIs for selecting the defaulters. Based on the analysis, Europe was performing below the set targets and further analysis identified regional businesses having the largest outstanding dues. Once the largest defaulter was identified, the collection team evaluated the business performance with the dotOne approach and compared the performance against targets such as deductions, credit performance, etc.

Case Study: Whirlpool’s 10 Step Approach to Transform AR Operations

Whirlpool has more than 77,000 employees and its operations have expanded across 59 manufacturing and technology research centers globally. The acquisition of Indesit, a major domestic appliances company based out of Italy, added to Whirlpool’s existing scale and complexity of operations across locations. In view of this, it decided to undergo a complete digital transformation for the O2C process and the overall journey included 10-phases, spanning from the initial planning, to the identification of the process to be transformed, business case evaluation, deployment strategies, and tracking the business performance based on certain KPIs, after the transformation.

Need for Centralization and Standardization

After the acquisition of Indesit, Whirlpool decided to consolidate the EMEA finance operations from four shared services into one shared service facility. The major operating model for the Whirlpool account receivable is O2C with operations including Customer Master Data, Credit Management, Cash Collection, Cash Application, Disputes Management, and Trade Partner Incentives Reconciliation (Customer Bonuses). The implementation challenges in front of Whirlpool were:

- Standardization: The inability to focus on standardization in a dynamic environment

- Quality and Trust:Due to the limitations of traditional systems’ integration capabilities while undergoing ERP migration to S/4HANA

- Industry-specific Issues:such as disruptions in the supply chain

Whirlpool executed a 10-step digital transformation approach in which they assessed certain parameters based on a set of questions:

- Automation: To identify the process to automate, assessed all processes to understand if they are transactional/rule-driven, have a high volume of action items, and are labor-heavy. How are other companies in the market going about it? Is there a likelihood for system changes in the near future? The checklist enabled whirlpool to select the cash application process for automation as being labor intensive and high volume of action items

- Vendor Selection:Considering the ongoing change to the ERP system, whirlpool needed a vendor with the following characteristics:

- The ability to provide system agnostic solutions

- Able to handle the increasing complexities and adapt to changes as the organization goes through technology shifts

- Flexible to add more processes to the scope while retaining the organizational level standardization

- Is able to assist with future business requirements and has track records of successful solution implementation

- Onsite Assessment: Partner suggested a hybrid model for cash applications involving SAP and Partner’s Cash Application Cloud. This hybrid model estimated (a) up to 95% automation, (b) optimization in the current operational expenditure, and (c) implementing new technologies

- Stakeholders’ Approval:Whirlpool needed an integrated model having access to manage multiple stakeholders, including the central treasury, information technology, partner banks, local finance teams and vendor. Partner’s relation and engagement with involved parties had helped to develop the hybrid model

- Business Case Evaluation:Evaluated the transformation journey from multiple angles, such as the urgency for the transformation, available options, available banking partners, recommendations, cost, and potential benefits

- Pilot Deployment:Implemented the pilot in three stages:

- Keeping track of the order of implementation across different BUs and bank regulations

- Implementing the transition at one region at a time

- Carefully overviewing the process in case anything goes not as planned

- Change Management: In case any change was needed in the execution, Whirlpool carefully examined the requirement, developed the change plan, identified the workforce, and provided the necessary training required for implementing the change

- Live Implementation:Whirlpool followed a three-phased plan for going live:

- Selected a few countries to implement the process and learn

- Global Accounts Selection: Implemented the process on accounts operating in more than one country

- Tracking Post Go-live Performance: The Vendor proactively tracked the overall performance as well as conducted regular meetings and follow-ups:

- Whirlpool maintained a two-month buffer period or a hypercare period to address new issues arising from deployments that were not a part of the testing phase. They tracked, raised, and resolved issues with the vendor

- Kept a close watch on the success rate of the resolution of the issues

- Conducted weekly, monthly, and ad-hoc meetings to discuss issues with the vendor, along with other critical issues affecting the business performance

- Tracked the overall business performance in conjunction with the vendor and partner bank

- Kept a definite business focus of achieving 90% automation of cash applications, with a first-year target of achieving 75% automation

- Supporting Future Technologies: The vendor also supported Whirlpool in its future vision of implementing a global cloud-based technology, expanding the potential of RPA, business partnering, and a hyper-automation program, with its suite of future-ready solutions

The above eBook was just a glimpse out of an extensive Thought Leadership Whitepaper titled:

Future of Shared Service Centers for Order-to-Cash

Key Highlights of the Whitepaper

- SSCs for O2C have evolved to become a part of the core business operations and play a critical role in the overall digital transformation of businesses.

- 70% of digital transformations fail due to lack of discipline, visibility and tracking of business outcomes and KPIs.

- The best-in-class approach includes adopting digitization as a part of the DNA with continuous improvement and benchmarking.

- RPA was good while it lasted but the next generation technology is AI-native.

- Cloud-based integrated O2C platforms are digitally transforming SSCs.