Laying the Foundations to Achieve Excellence in Finance

- Discover the 5 key foundations required to optimise finance and accelerate the journey to achieving excellence in finance

- Understand the finance department of the future

- How to best optimise the finance function for efficiency and effectiveness

- See how to exploit data and advanced analytics to drive business growth

Foundation 1: Reimagine the finance operating model

Moving towards an optimized operating model that allows staff to adjust their work quickly and dynamically so they can focus on the highest value items is key.

World-class organizations are evolving their operating models to become more technology-focused and less functional and hierarchical, enabling global business services capabilities to deliver more value to the organization. By evolving the internal organizational structure to be more fluid, finance, internal technology, digital operations teams, and external suppliers can be deployed to support the highest value items across the enterprise.

The new finance operating model establishes tighter data standards, new data-management practises, enhanced automation, and integration with a wide range of related digital technologies.

Foundation 2: Empower your people

The key finance function competencies have extended from technical accounting and financial reporting focus to the ability to leverage digitalization and efficient data analytics.

To develop world-class capabilities, Finance leaders should equip staff in critical roles with the necessary level of experience, leadership mindsets, and authority to influence the business. By expanding capabilities, talent pools, and leveraging powerful technology, teams can take on new operational practises and support complex processes rather than add more value to the organization.

While pursuing cost efficiency is a constant imperative, finance teams nevertheless need continual capability building if they are to successfully perform their roles as advisors to senior executives in steering the financial trajectory of the business. Many leaders recognize this shift as CFO’s become more integrated with the C-suite, however, it is dependent on technologies such as AI and predictive analytics and ensuring expertise in these areas.

Foundation 3: Align with the wider enterprise on digital transformation and advanced analytics

The technology landscape has changed over the past few years, with some software platforms and tools growing in popularity while others have lost users. Having an enterprise-wide strategy on which technologies to employ not only allows more focused investments but also encourages further collaboration between finance and other functions.

CFOs do and should play an ever-increasing role in defining the corporate strategy for digital transformation. Harmonized cloud-based financial accounting and help ensure organizations stay current with the latest finance digital capabilities. Fit-for-purpose applications for business processes can be easily integrated into modern and open cloud-based financial solutions, rather than endless customization in pursuit of a single solution that serves all functions.

Exploiting data and advanced analytics to drive growth

The use of advanced analytical techniques to solve pressing business problems is increasingly a requirement for finance departments.

“Analytics and business intelligence platforms will shift from delivering capabilities that primarily help analysts manually explore data to those that steer analysts to the most significant insights, as determined by the data available.”

– Gartner: Top Priorities for Financial Leaders in 2021

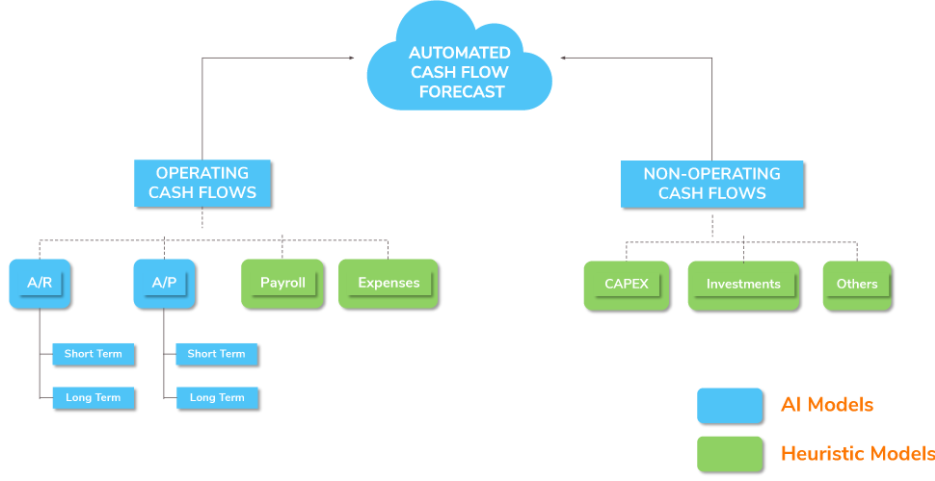

With advances in computing power, machine learning and artificial intelligence (AI) can increasingly be applied to complex tasks, building on the lead started by robotic process automation (RPA) and similar technologies that are used to automate transactional activities.

AI tools can handle huge amounts of manual processes in the areas of cash, credit, collections, and disputes. Often these manual processes overwhelm employees and are subject to manual errors that can lead to major losses and the potential to damage a company’s reputation.

Better use of data and analytics will drive informed business decisions in finance, mostly through the link between financial data and operational performance. Once these analytic capabilities can be determined and implemented, a CFO can drive strategic and operational decision-making to the organization. This might involve finding new products and services, providing input on sales strategies, being able to develop products faster, and identifying new routes to market.

Foundation 4: Ensure you leverage cloud-based solutions

“Finance organizations with large-scale cloud deployments are 32%

more likely than peers to meet enterprise business objectives and 44%

more likely to meet finance functional objectives”.

– The Hackett Group: Six Levers for Digital World Class™

Finance Performance, July 2021

World-class financial transformation involves integrating or retiring legacy systems, adopting emerging technologies, migrating applications into the cloud, and integrating data from disparate sources.

From an O2C perspective, many on-premise finance solutions are bolted together through acquisition, making processes complex, prone to error, and time-consuming. Lack of up-to-date information, low employee engagement, and client satisfaction issues can be eradicated by leveraging one single platform for the entire O2C process. Cloud-based financial software can then seamlessly blend finance with business data, creating one single source of the truth.

Access to huge amounts of data in real-time via the Cloud enables you to understand patterns, predict changing customer buying behavior, innovate quickly, and provide insightful, accurate information to stakeholders. Teams all contribute to the same system, in the same way. No more working in silos, and no more cumbersome sharing of data.

World-class finance organizations are at the forefront of these architecture modernization and cloud migration projects.

Foundation 5: Embed customer success in your DNA

Customer-centricity isn’t just a buzzword, it’s a necessity that is core to the business and valued by every function. It starts with the very first interaction and continues seamlessly throughout the customer lifecycle.

Organizations that see the importance of building a dedicated customer success team with the ability to interpret financial data and provide recommendations on where to invest and grow revenue, will quickly derive value from their solutions and ensure long-lasting customer relationships. Gone are the days of simply selling a product and making a profit. The primary

goal is to ensure a happy customer by accelerating the time to value that they receive from investing in a SaaS solution.

Customers that take this approach can keep ahead of the competition when ongoing regulatory pressures, cost reduction priorities and rapidly shifting market trends and customer needs are at play. Customer centricity can help grow revenues, improve efficiency, and drive sustainable profit.

Conclusion: the finance department of the future

Finance leaders deliver far more than core financial skills: their work guides the functioning of the entire organization every day. With this new recognition, CFO’s are seizing the opportunity to play a bigger role in growing value in the organization outside of the finance function.

By laying these important foundations, the next-generation and world-class finance function can build the insights, performance, and planning capabilities leaders will need to support dynamic decision-making and enhanced execution in the future.