Key Takeaways

- Learn how Cash Management is essential for managing cash inflows and outflows effectively.

- Challenges faced with traditional Cash Management methods such as lack of control and visibility.

- How technology is transforming the Cash Management process, leading to improved visibility, efficiency, and decision-making.

- Discover how you can build a business case for Cash Management automation for your business

Desperate for a solution, they turned to a cash flow management expert who advised them to optimize their cash flow management with daily cash positioning and automate their bank reconciliations to reduce reconciliation delays. The company was skeptical at first, but they had no choice but to give it a try.

Desperate for a solution, they turned to a cash flow management expert who advised them to optimize their cash flow management with daily cash positioning and automate their bank reconciliations to reduce reconciliation delays. The company was skeptical at first, but they had no choice but to give it a try.

To their surprise, daily cash positioning showed them exactly how much cash they had on hand and where it was going. They were able to identify areas where they were overspending and make adjustments to their budget. And with automated bank reconciliations, they were able to quickly and accurately reconcile their accounts, reducing the risk of errors and delays.

As a result, the company was able to turn their cash flow around. They were able to pay their employees, suppliers, and bills on time, and even had enough cash left over to invest in new projects. They were amazed at how much of a difference cash management could make.

To their surprise, daily cash positioning showed them exactly how much cash they had on hand and where it was going. They were able to identify areas where they were overspending and make adjustments to their budget. And with automated bank reconciliations, they were able to quickly and accurately reconcile their accounts, reducing the risk of errors and delays.

As a result, the company was able to turn their cash flow around. They were able to pay their employees, suppliers, and bills on time, and even had enough cash left over to invest in new projects. They were amazed at how much of a difference cash management could make.

And so, the company learned a valuable lesson: don't neglect cash management, or else you might find yourself in a cash crunch. With daily cash positioning and automated bank reconciliations, they were able to turn their business around and thrive once again.

We know, it might not sound like the most exciting topic, but trust us, it's super important. Before we dive deep into the nitty gritty of cash management, let’s understand what exactly do we mean by the term ‘cash management’ and how getting on top of it can save your business from some serious money headaches. So, grab a coffee (or tea, we don't judge) and let's dive in!

And so, the company learned a valuable lesson: don't neglect cash management, or else you might find yourself in a cash crunch. With daily cash positioning and automated bank reconciliations, they were able to turn their business around and thrive once again.

We know, it might not sound like the most exciting topic, but trust us, it's super important. Before we dive deep into the nitty gritty of cash management, let’s understand what exactly do we mean by the term ‘cash management’ and how getting on top of it can save your business from some serious money headaches. So, grab a coffee (or tea, we don't judge) and let's dive in! Introduction to Cash Management

Cash Management refers to the strategies and processes used by companies to optimize their cash positions and cash flows. Effective cash management allows companies to have enough liquidity to meet their obligations, while maximizing the cash that is available for investment and generating returns. Some of the key components of cash management include:

Breakdown of Key Cash Management’s components:

- Cash Positioning: Monitoring daily cash inflows and outflows to determine current cash balances and foresee future surpluses or shortages. This allows companies to invest excess cash or borrow needed funds in a timely manner. Tools like cash flow forecasts and models are used to gain visibility into future cash positions.

- Bank Reconciliations: Reconciling internal company records with bank statements to minimize discrepancies and delays. Automating reconciliations improves accuracy and timeliness of cash positioning.

- Forecasting Cash Flows: Forecasting future cash inflows and outflows to identify periods where there may be excesses or shortages of cash so plans can be made accordingly. Both short-term and long-term cash flow forecasts provide visibility.

- Risk Management: Monitoring risks like foreign exchange, interest rate changes, and fraud that can impact cash flows and developing mitigation strategies. Risk management supports stable cash management.

Importance of Effective Cash Management:

Effective corporate cash management is crucial for the financial success and stability of any organization. It involves managing cash inflows and outflows in a way that ensures adequate liquidity to meet operational needs and strategic goals. Optimizing cash flow management with daily cash positioning can help businesses make informed decisions about their cash needs and allocate resources accordingly. By monitoring cash balances and forecasting future cash flows, businesses can avoid cash shortages and take advantage of investment opportunities that arise.

Automated bank reconciliations can also play a critical role in cash management. Reconciliation delays can lead to inaccurate cash balances and make it difficult to make informed financial decisions. By automating the reconciliation process, businesses can reduce errors and ensure that their cash balances are up to date. This allows businesses to make decisions with confidence and avoid unnecessary risks.

Overall, effective cash management with daily cash positioning and automated bank reconciliations can help businesses improve their financial stability and position themselves for long-term success.

Challenges with the traditional Cash Management process

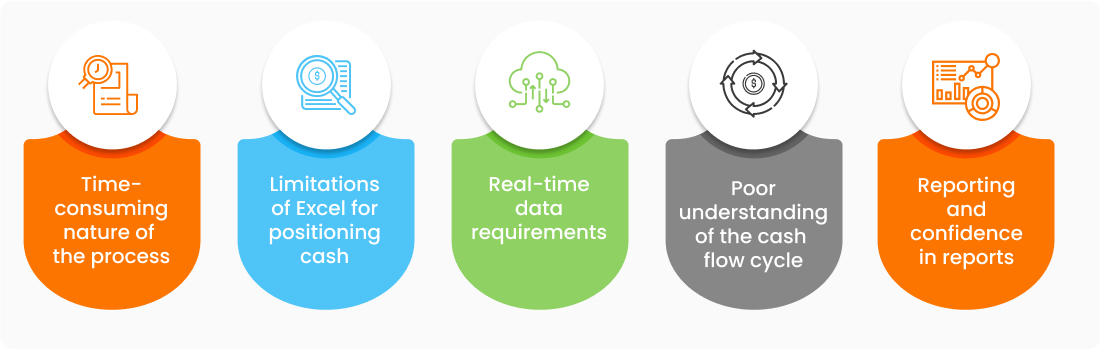

Here are the key challenges with traditional cash management processes:

Traditional cash management processes are often manual, decentralized, and rely heavily on spreadsheets. This results in a number of inefficiencies and challenges, some of the challenges are:

- Time-consuming nature of the process: Manual processes for tasks like bank reconciliations, cash positioning, and reporting are extremely time-consuming. This reduces time available for strategic initiatives.

- Limitations of Excel for positioning cash: Spreadsheets have limited functionality for managing complex bank hierarchies, applying multi-currency and multi-company rules, and providing real-time data and alerts. They are prone to errors.

- Real-time data requirements: Manual processes cannot keep up with the real-time data needed for effective cash positioning and decision making. Daily reconciliation of bank data is required as well as frequent cash flow forecast updates.

- Poor understanding of the cash flow cycle: When cash management tasks are decentralized across an organization, it is difficult to get a holistic view of the complete cash flow cycle. This leads to lost opportunities for optimization.

- Reporting and confidence in reports: Manual reporting from spreadsheets often lacks the transparency, accuracy, and auditability required to have high confidence in cash management reports and KPIs. Decision making is impaired.

Overall, traditional cash management practices focused on manual tasks, spreadsheets, and a decentralized approach result in a reactive, uncoordinated process with limited benefits. Modern technologies for treasury management are enabling a transition to real-time, automated, and strategic cash management with substantial improvements to efficiency, visibility, and control. Optimizing the complete cash flow cycle has become a key source of competitive advantage.

Why does having an effective cash flow management matter?

Effective cash flow management is critical for organizations of all sizes and types because it ensures that the organization has enough cash to meet its financial obligations, invest in growth, and ultimately achieve its goals. Here are some reasons why cash flow management is essential for organizations:

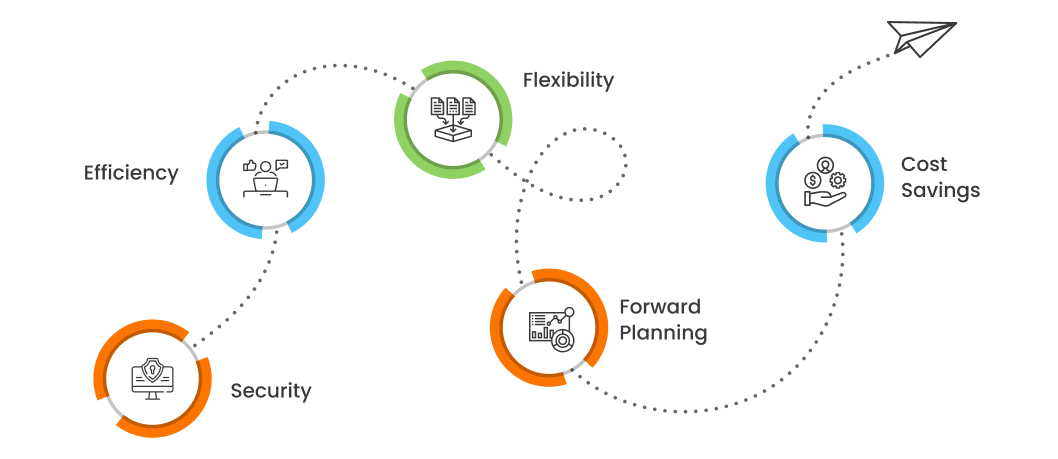

Effective cash management provides companies a competitive advantage through:

- Security: Maintaining enough liquidity through cash management supports operational stability and financial health. This ensures that businesses can meet their obligations as they come due.

- Efficiency: Real-time visibility into cash positions and the cash flow cycle allows companies to optimize liquidity and make strategic decisions. This improves operational efficiency and helps businesses stay competitive.

- Flexibility: Cash management can provide access to additional cash quickly in the case of shortages through borrowing relationships and credit facilities already in place. This flexibility can help businesses weather unexpected financial challenges.

- Forward Planning: Using cash management to create forecasts can help businesses map out major cash outlays like capital expenditures so funding plans can be put in place. This enables growth and avoids cash crunches, allowing businesses to pursue their strategic goals.

- Cost Savings: Effective cash management can reduce fees, lock in discounts, and generate investment income, which drives profitability.

Overall, optimizing the cash flow cycle through a holistic cash management process is essential for any organization. It provides control, visibility, and strategic advantage. Effective cash management supports short-term liquidity needs as well as long-term business goals.

Role of Automation in Cash Management

Automation is transforming the way organizations manage their cash flow. By automating various cash management processes, organizations can improve their accuracy, efficiency, and overall financial performance.

The Technologies Driving Automation:

There are a range of technologies driving automation in cash management, including:

- APIs: APIs enable organizations to connect to their financial data sources more easily, allowing for more streamlined and automated cash management processes.

- Real-time reporting: Real-time reporting technologies enable organizations to access up-to-the-minute data on their cash flow, enabling more informed decision-making.

- Cloud computing: Cloud computing technologies can enable organizations to access their cash management data from anywhere, at any time, while also providing enhanced security and reliability.

With technology in place, the cash management process can be significantly streamlined and automated. For example, an organization might use APIs to connect to its bank accounts and other financial data sources, automatically importing data into its cash management system. Real-time reporting dashboards can provide up-to-the-minute insights into cash flow, while automated reconciliation processes ensure that all transactions are accurately accounted for. Overall, the process of cash management with technology in place is faster, more efficient, and more accurate.

Overcoming Inefficiencies and Challenges with Technology:

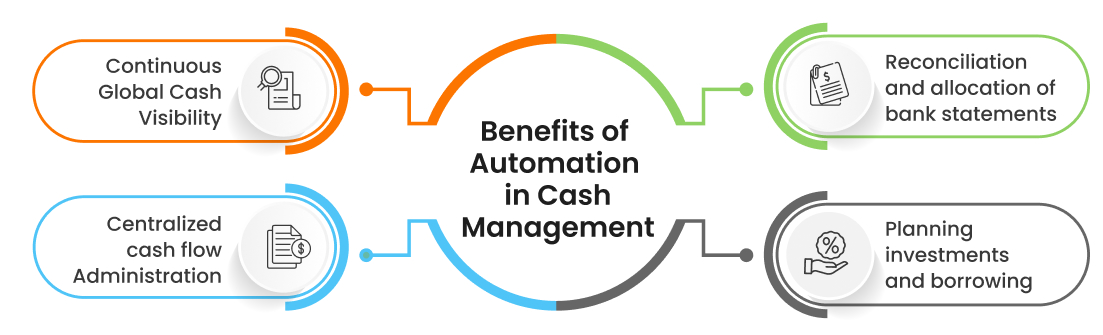

The future of cash management is driven by technology, with a range of new developments and innovations on the horizon. Automation is transforming cash management by enabling organizations to perform tasks more quickly and efficiently, reducing the risk of errors, and providing real-time data and insights. Some of the key benefits of automation in cash management include:

- Continuous Global Cash Visibility: Automated cash flow management helps organizations with real time, comprehensive global cash visibility. With just a quick glance, they can monitor their cash balances, outstanding debts, and receivables. This real-time information is invaluable for generating cash positioning reports, as well as for making well-informed choices about investments, borrowing, and day-to-day operations management.

- Centralized Cash Flow Administration: By automating data flow and centralizing it , organizations can reduce the risk of errors and ensure that their data is accurate and up-to-date streamlining the process and makes it more efficient. This can help to reduce costs, increase productivity, and improve overall financial performance.

- Reconciliation of Bank Statements: Automation can enable organizations to reconcile their bank statements more quickly and accurately, ensuring that all transactions are accurately recorded and accounted for. This helps to prevent errors, identify fraudulent activity, and ensure that all financial information is up-to-date and accurate.

- Planning Investments and Borrowing: Intelligent cash flow management empowers organizations to optimize their investment and borrowing strategies. By gaining a deep understanding of their cash position, organizations can make well-informed decisions about how much to borrow and when, as well as when to invest in new projects or initiatives. This level of insight enables organizations to create more accurate and effective financial plans, which can ultimately lead to improved profitability and sustained growth. With intelligent cash flow management, organizations can confidently navigate the complex financial landscape and stay ahead of the competition.

In summary, having effective cash flow management is critical for organizations because it provides continuous global cash visibility, enables effective planning of investments and borrowing, ensures accurate reconciliation and allocation of bank statements, and allows for centralized cash flow administration. By managing their cash flow effectively, organizations can improve their financial performance, mitigate risks, and achieve their goals.

Identifying Requirements for Cash Management Automation

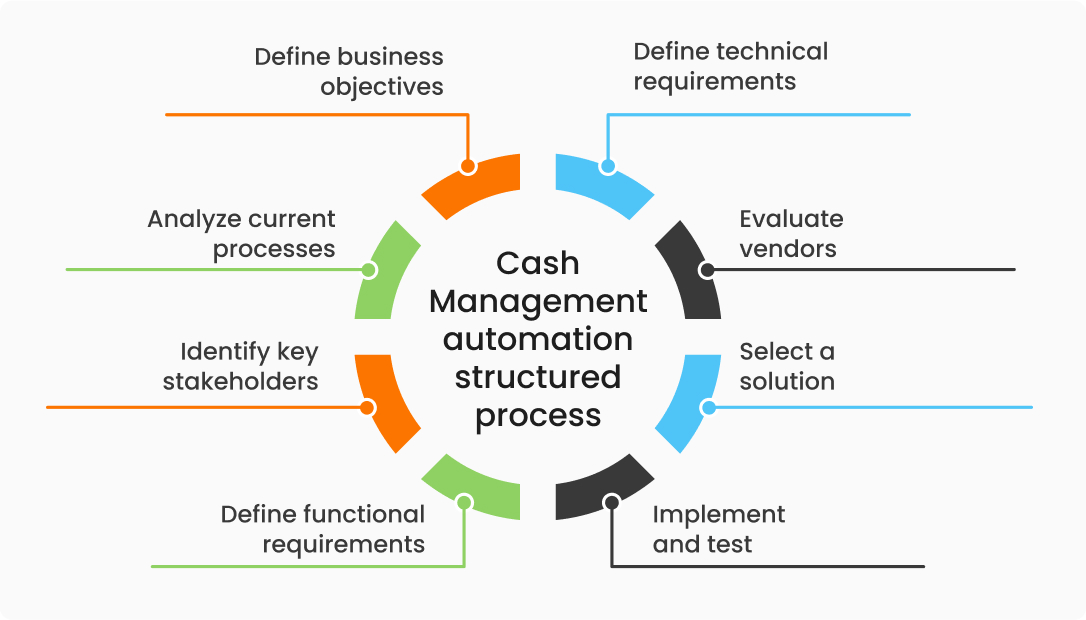

To identify requirements for Cash Management automation solutions, organizations should follow a structured process that involves the following steps:

- Define business objectives: The first step is to define the business objectives for Cash Management automation. This involves identifying the specific goals the organization wants to achieve through the implementation of the solution. For example, the organization may want to improve accuracy, increase efficiency, reduce costs, or enhance visibility.

- Analyze current processes: The next step is to analyze the current Cash Management processes to identify pain points and areas of inefficiency. This involves gathering data on the current state of Cash Management , including the methods used, the frequency of forecasting, the accuracy of forecasts, and the resources required.

- Identify key stakeholders: The next step is to identify the key stakeholders who will be involved in the implementation of the solution. This includes the finance team, IT department, and other relevant stakeholders who will be impacted by the solution.

- Define functional requirements: Based on the analysis of current processes and business objectives, organizations should define functional requirements for the Cash Management automation solution. This includes identifying the specific features and capabilities required, such as the ability to integrate with other systems, support for multiple currencies, and the ability to generate reports.

- Define technical requirements: In addition to functional requirements, organizations should also define technical requirements for the solution. This includes identifying the hardware and software requirements, security requirements, and other technical specifications.

- Evaluate vendors: Once the requirements have been defined, organizations should evaluate vendors who offer Cash Management automation solutions. This involves comparing features, functionality, pricing, and other factors to find a solution that meets the organization’s specific requirements.

- Select a solution: After evaluating vendors, organizations should select a Cash Management automation solution that best meets their requirements. This involves reviewing proposals, conducting demonstrations, and negotiating contracts.

- Implement and test: The final step is to implement and test the Cash Management automation solution. This involves configuring the solution, migrating data, and conducting testing to ensure that the solution meets the organization’s requirements and objectives.

Organizations can identify the requirements for Cash Management automation solutions and select a solution that best meets their specific needs. This can lead to improved accuracy, efficiency, and visibility in Cash Management processes, ultimately helping organizations make better financial decisions.

Finding The Right Partner For You

Finding the right partner when buying Cash Management software is critical to the success of the implementation. The end goal for technology evaluation is to select a system that meets the treasury requirements.

The best way to do that is through a RFP process, it helps you choose the best-fit cash flow planning software and is preferred by most corporations globally and are best utilized to objectively compare answers and select the most suitable solution vendor while choosing a business software, so lets look at the 4 step guide to choosing the right vendor for your organization.

To initiate the RFP process for choosing treasury software solutions, documentation is the first step. To ensure a smooth process, draft a well-structured document. The document should be based on the specific needs of the company. Unique questions should be asked that are tailored to the business type and goals.

As a next step create a vendor evaluation scorecard, Align the scorecard to the questionnaire sent out to evaluate responses more efficiently while assigning weights to the features to help with decision-making and prioritizing important requirements

Next step of evaluation should be getting on a demo call with all shortlisted vendors to understand the product features. When assessing the product, prioritize its effectiveness and value, evaluating its functionality, intuitiveness, user-friendliness, and scalability.

The final stage for corporate treasury software solutions vendor selection is the contracting and negotiating phase. This stage is where the vendors and the users agree upon the terms to ensure a successful treasury software solutions buy-in.

By following these steps, you can find the right partner when buying Cash Management software. A good partner can help ensure a successful implementation and provide ongoing support, while a bad partner can lead to implementation challenges and additional costs.

How HighRadius Transforms the Cash Management Process

Unique features and capabilities of highradius solutions

One of the key solutions they offer is Cash Management Cloud, which transforms the Cash Management process through the following ways:

- Continuous Global Cash Visibility

Continuous global cash visibility, allows user to view bank balances in one place, customize views, and make transactions with a single click. - Updated Balances by Entity, Bank, and Currency

Unified view of balances and cash positions with real time integration with banks to import current and prior-day bank files and auto-populate all data. - Rolling Short-Term Cash Position Keeping

Future cash balance views and customizable cash positions worksheets with real-time data ingestion enabling insights into short-term cash and liquidity requirements. - Automated Reconciliation of Bank Statements

Automate reconciliation of current day or prior day bank statements with cash transaction entries, and easily find and resolve exceptions with a manual matching option. - Centralized Bank Account Administration

Track and manage a consolidated list of all bank account information and signatories with the ability to bulk import, edit, and update as needed. - Automated Financial Instrument Tracking

Secure, centralized database of deal cash flows that automatically populates settlement instructions and generates cash flows while incorporating them into cash positions.

Overview of Highradius’ Automated Cash Management Solution