How to manage a seasonal business using cash flow projection

Read this ebook to explore how forecasting cash flows helps to capture seasonality and know about the solutions to seasonal cash flow problems and other ways to make the most of your peak cash flow.

What is seasonality?

How does seasonality look like in time series?

- In cold regions, heating costs rise during winters and fall in summers.

- The peak season for tax preparation services is between January to April since the regular tax seasons run during this time.

- The peak of retail sales is during the holiday shopping season, the year’s fourth quarter. Retailers experience more consumer spending during this time.

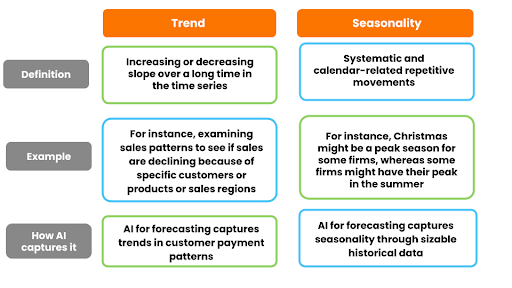

What is the difference between trend and seasonality?

What are the types of seasonality?

There are three types of seasonality:

The simplest approach to determining if there is an aspect of seasonality is to plot and review the data, perhaps at different scales and with the addition of trend lines.

Weekly seasonality – This refers to the general use of products on particular days of the week.Monthly seasonality – This covers the monthly cycle of cyclical demand for goods and services.Yearly seasonality – An annual demand for products and services is predictable and recurring due to this seasonality.

Seasonal forecasting models’ accuracy could be increased by factoring in the following procedures:

- Determine the seasonality of the products

- Recognize the causes and timing of demand peaks

- Examine the size of the spikes to the demand at the baseline

- Analyze the accuracy of forecasting models

What are the main challenges in running a seasonal business?

Seasonal businesses face unique challenges such as:

- Cash crunches during low sales: There are numerous factors that could result in a cash crunch in a seasonal business are:

- Pending invoices

- Improper pricing

- Unexpected expenses

- Lack of strategic investments

- Stock-outs during peak seasons: Stockouts are expensive because they harm the customer experience and prevent companies from making sales. Here are some of the causes of stockouts that often happen during peak seasons:

- Inaccurate inventory data

- Working capital shortage

- Inefficient demand forecast

- Poor stock monitoring & replenishment

- Inability to maximize profit margins: Businesses that deal with seasonal products can reasonably expect to have more units sold during peak season. However, although the demand is high, the supply tends to increase too. Seasonal businesses are forced to offer discounted prices, reducing profit margins.

Thus, while sales increase, it will take more units sold to reach a certain profit level.

- Poor maintenance of a stable cash flow all year long: According to a recent Wells Fargo/Gallup survey, almost half of the business owners reported having predictable times of the year that are significantly busier or slower than others. Moreover, 41% said that seasonable differences make it more difficult to manage cash flow throughout the year. Often, when businesses experience large swings in their revenues, cash flow can be at risk of mismanagement. Delays in client payments can also affect cash flow in a seasonal business.

- Inability to control expenses: Seasonal businesses experience ups and downs not only in sales and revenue but also in terms of expenses. Because these businesses have distinct busy seasons and demand patterns, they also have different times when they’re getting ready for a rise in the business, which results in spending on inventory, staffing, and other things. Here are the factors why seasonal companies are not able to control expenses:

- Inability to create any budget

- Inability to figure out yearly operational expenses and set aside some money for savings.

- Poor inventory management: Seasonal business owners should also be aware of factors leading to poor inventory control. Here are the usual causes for poor inventory management:

- Poor tracking methods

- Higher inventory carrying costs

- Little storage capacity

- Lack of a dedicated inventory team

- Overstocking discounted products

Why is it hard to capture seasonal fluctuations? Why is tracking seasonality important for accurate cash flow projection for business plans?

Seasonality is often difficult to factor in because each business has different peak and low sales times. Seasonal fluctuations might cause an imbalance in the timing of sales income, thereby making cash flow inconsistent and posing difficulties in managing the firm’s finances.

Some businesses struggle to factor in seasonality when forecasting cash flows, which leads to inaccuracy in cash flow projections. This can have an impact on their ability to make long-term decisions.

How to capture seasonality by cash flow projections?

The following are the best practices seasonal businesses should follow to tackle seasonal fluctuations:

- Identify the slow seasons

Look into the historical and recent cash movements, track the seasons where sales are low, and identify similar patterns throughout the year. This helps in borrowing early at lower interest rates to avoid debts.

- Monitor cash flow closely:

A cash flow statement tracks money coming into your business and going out of your business. Forecasting cash flow turns negative when the cash outflows are more than cash inflows. The main objective is to continually maintain a positive cash flow throughout the slow season so that the company meets its financial obligations. This can be done by comparing actual cash flow statements to cash flow forecasts, developing a cash flow analysis for the next 12 months and reviewing financial statements from the prior year and sales forecasts for the next 12 months to create a projection of your cash flow going forward.

- Create best-case and worst-case scenarios:

When creating best and worst-case scenarios, the corporate treasury teams can easily become overwhelmed by various possible outcomes. That is why it is best to keep things as essential as possible- finance leaders must prioritize and establish opinions on each of the possibilities of different scenarios based on their sales cycle or their type of business (midmarket/enterprise).

- Create a budget taking seasonality into account:

Budgeting can eliminate cash flow issues. In addition to assessing when the slow season is likely, it is helpful to identify the times of the year when a company typically has the most fixed and variable expenses. This helps to maximize profit horizons and sales.

Difference between fixed and variable expenses:

- Fixed expenses: Fixed expenses are what you pay monthly and don’t change no matter how many customers you serve. Examples of fixed expenses include:

- Long-term lease payments

- Insurance

- Salaried payroll

- Variable expenses: Variable expenses rise and fall along with cash flow because they typically don’t happen unless sales are made. Examples of variable expenses include:

- Utilities

- Hourly wages for temporary help

- Material costs

- Create a cash flow projection

Cash flow projection for business plans provides the following benefits:

- Gives more profound insight into the finances for creating accurate and realistic budgets.

- Shows the amount of available cash in the bank at any time, based on the budgets vs. actual predictions of income and expenditure.

- Helps cash surplus and cash deficit companies by predicting spikes or lows in cash flows across various cash flow categories.

What does the seasonality factor mean?

A seasonal factor or index is the gap by which the demand for that particular period appears higher (or lower) than the usual demand.

Benefits of factoring seasonality in cash forecasts

The following are the benefits of factoring seasonality:

- Lowers credit risk: Analysis must go beyond the usual credit-risk analysis when considering whether to issue credit for a seasonal business. The supplier must have confidence that the company will have enough cash reserves to cover expenses and make debt payments throughout the off-season. These are the three approaches in which seasonality can help to lower credit risk:

- Consider the borrower’s level of competition

- Gauge ability to manage finances during the off-season

- Effective cash management across multiple entities, currencies, and countries

- Helps in proactive decision making: Understanding seasonal trends can help you make cost-saving decisions. Forecasting seasonality can reduce business expenses and boost bottom-line profitability. From inventory levels to employee hiring plans, business decisions can be influenced by projected seasonal variation.

- Maintains working capital: Some factors in which seasonality helps to maintain working capital are:

- Managing capital investments

- Managing inventory

- Meeting unexpected seasonal needs

- Helps in planning future investments: Seasonality analysis provides investors with accurate, measurable information to improve decision-making for investments and to mitigate potential losses, concentrating on long-term forecasting by avoiding worst-case scenarios, for instance, cash crunches, M&As, capital expenditures, etc.

- Supports proactive borrowing: Businesses can borrow a fixed amount of money at any moment for various short-term business needs by using business lines of credit as revolving loans. Seasonal companies can also pay for peak season necessities over a longer period with the right borrowing arrangement. Several instances of proactive borrowing are:

- Acquiring inventory

- Repairing mission-critical equipment

- Investing in a marketing campaign

- Responding faster to industry trends

- Overcoming a seasonal cash flow shortfall

-

Helps budget accurately: Factoring seasonality in budgeting helps to make adjustments to compensate when business is booming, which means adjusting and using the budget wisely before sales climb. Here are a few ways how factoring seasonality helps to maintain the budget accurately:

- Setting up a baseline for essential costs

- Preparing a year in advance

- Avoiding straying from the budget during hectic seasons

- Creating several budgets

Schedule a demo to learn in-depth how to capture seasonality with cash flow projections.