Evolving Role of Treasury: Transactional to Strategic In Recent Times

Learn how AI and automation could help Treasury professionals to shift from transactional role to strategic advisors of the CFO.

Executive Summary

Treasury performed a critical role during the Great Recession and has been a reliable partner in the crisis years thereafter. Organizations reduced CAPEX spending while maintaining cash reserves, emphasizing the significance of liquidity planning and cash management. In the decade since the role of treasurer has evolved from transactional worker to become strategic advisors to the C-suite.

Now, with COVID-19, Treasury is dealing with uncertainties such as foreign exchange (FX) volatility and market complexity, changing regulations, and compliances.

According to a recent Deloitte survey, 80% of the CFOs want their treasury department to focus on crucial tasks such as Liquidity and Risk Management as well as being a strategic and value-added partner to the CFO. CFOs started recognizing the need for technology in the Treasury department as that enables them to spend less time on transaction administration and more time on “value-adding” activities for CFOs and business units.

Treasurers must see this as an opportunity and take strategic advantage of these trends and developments in order to modernize the treasury department and improve profitability, performance, and value.

This eBook focuses on the evolving role of the treasury – the changing expectations and increasing influence they have on the organization.

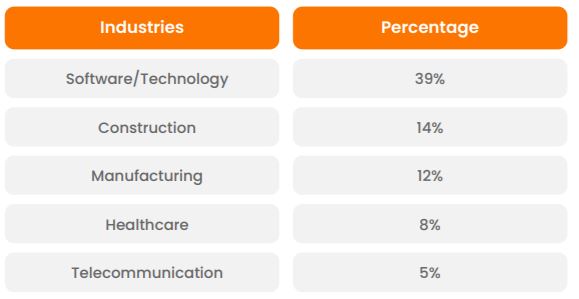

Survey – Demographics

Overview

HighRadius conducted a joint survey in partnership with Treasury Webinars in Q2 of 2021, focused to help the treasury align with the current state of cash forecasting.

There were 282 active respondents involved in the study. Respondents belong to small companies with around 25 employees to large companies with more than 5,000 employees.

Key Reasons for the Strategic Growth of Treasury

Treasury has been playing an important role in organizations during the COVID-19 crisis. The mandated lockdowns—full or in part—severely impacted numerous industries, leaving companies cash strapped. To remain viable, organizations looked to their treasury function to lead the way in helping resolve or mitigate the crisis. During this unprecedented time, the two vital activities driving treasury’s strategic growth at organizations are:

- Liquidity Management.

- Cash Flow Management and Forecasting

Also, the factors that have contributed to treasury’s expanding strategic role include:

- Senior management and the Board of Directors seeking visibility of their companies’ liquidity and risk exposure.

- Organization’s focus towards closer monitoring of financial metrics.

How can treasury do more with less?

Today, treasurers are charged with monitoring the changing economy, interpreting market trends, complying with industry regulatory issues, and warding off threats of fraud or technology disruption. Beyond these duties, a treasurer’s responsibilities also often include:

- Improving treasury process efficiency

- Consolidating banking partners and optimizing bank account infrastructure

- Leveraging technology to improve process automation, visibility of positions, and cash flow forecasting.

And all that’s in addition to managing cash and investments or achieving cost savings, as the role traditionally has had it.

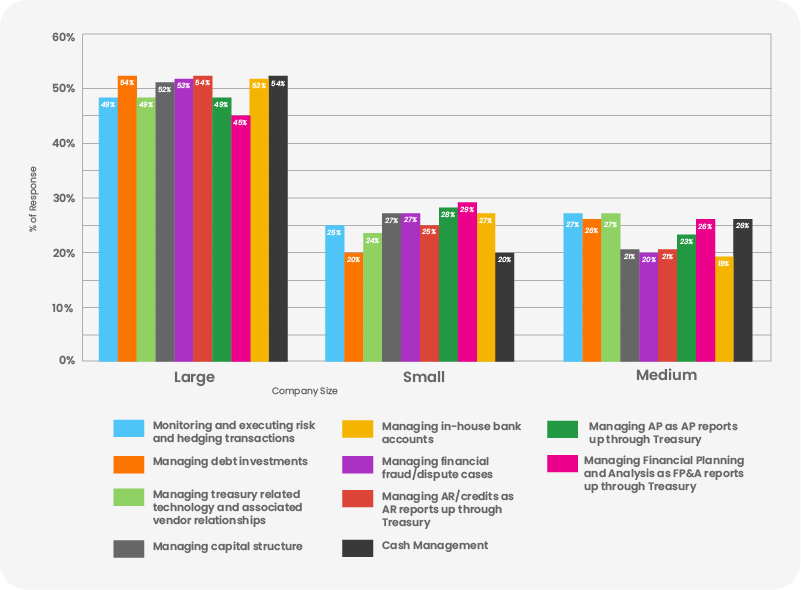

Scope of Treasury: What is included in the scope of treasury operations at your organization?

- Large firms tend to be more cost-conscious since they adopt proactive and strategic cost measures, freeing up cash for reinvestment in key areas of the business.

- Small firms are not able to focus more on Cash Management since they generally have limited and under trained accounting staff. As a result, they place a greater emphasis on Financial Planning Management in helping stakeholders track company growth.

By leveraging technology, such as APIs, RPA, AI/ML, BI tools, the transactional tasks such as data gathering, consolidation, building reports, are automated which enables Treasurers to focus on strategic tasks such as risk management, optimizing working capital, and participate in M&A decisions.

Influence of Treasury: To what extent of control/influence your treasury department has in the following areas of your organization?

- In recent times 69% of CFOs agreed that treasury have direct control on the decision making.

- The high number reflects the reliance on treasury to make confident liquidity decisions during the pandemic.

Role Of Treasury Department In An Organization

The treasury is the custodian of cash and manages financial risks of an organization. Their objective is to guarantee that the organization has enough cash to meet its day-to-day business requirements while also assisting in the development of its long-term financial plan and policies.

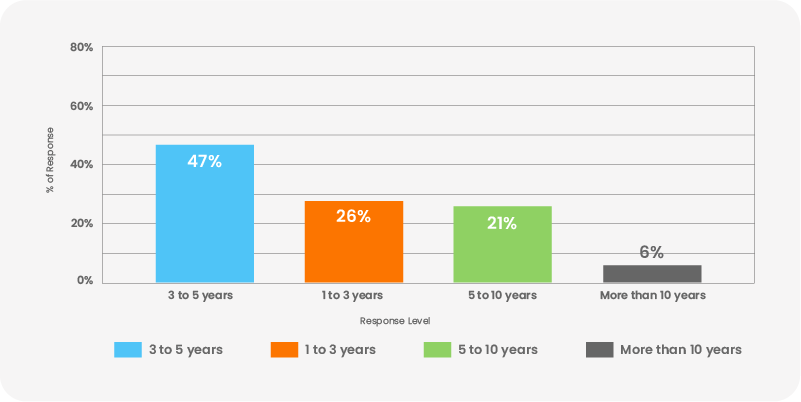

Tenure: What is the average tenure of your treasury team?

- 47% of respondents said three to five years as the average tenure of their treasury team.

- 26% and 21% respondents said one to three and five to ten years respectively as the average time period of their treasury team.

- Only 6% of the respondents voted for their treasury team’s average tenure to be more than ten years.

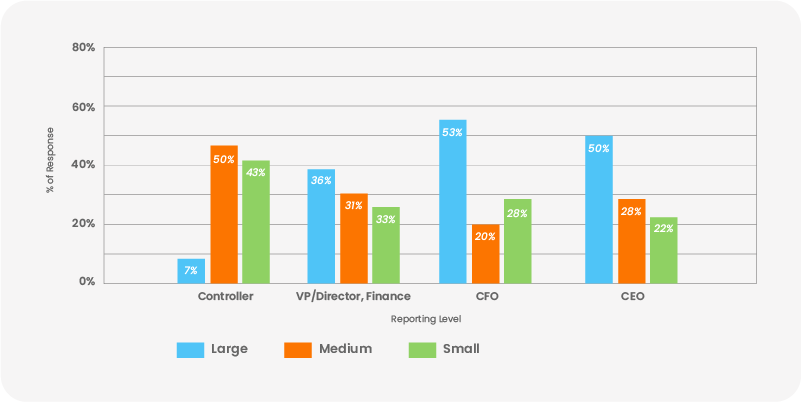

To whom does your Treasury Leader report?

- In large-sized companies, the treasury leaders directly report to the C-Suite executives as treasury provides cash insights that are critical in decision making.

- In medium-sized companies, the treasury leader reports to the controller as their treasury system is yet to be optimized.

- In small-sized companies, the CFO oversees the treasury activities or Treasury reports to the Director of finance as the team is lean.

As we move from small to large organizations, the treasury hierarchy becomes complex.

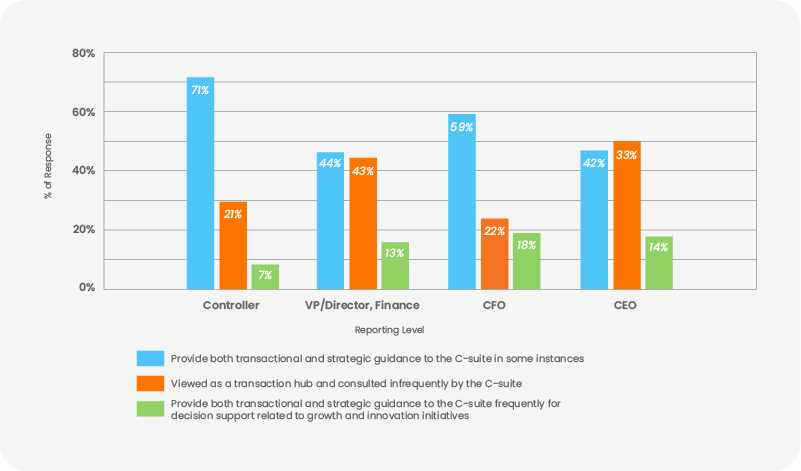

How would you characterize your treasury department as a provider of strategic value to the C-Suite?

- The Treasury department reports to the Controller in most organizations, so they provide transactional and strategic guidance to them. They have a say in the decision-making process of C-suite executives.

- In companies where technology is leveraged, most of the daily tasks are automated, so the Treasury is involved in the decision making process more frequently.

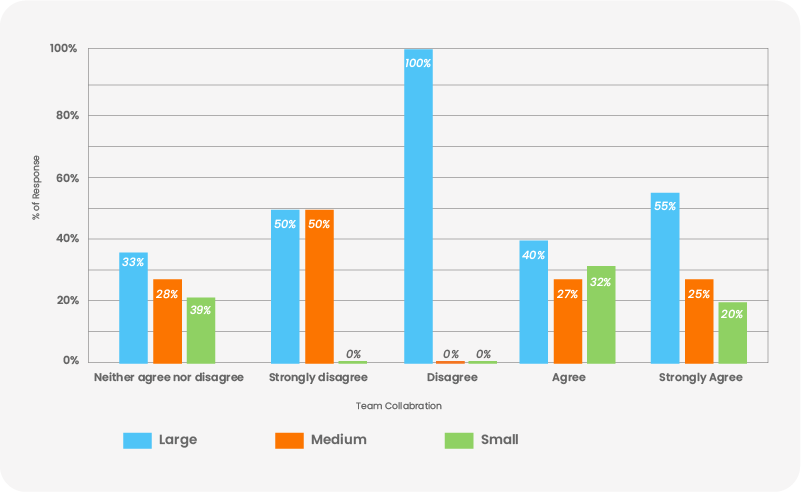

Does your treasury team regularly work with the business (AP, AR, Sales, Operations) to better understand and manage working capital?

- Small and medium organizations work with other teams for working capital management because they believe that there is scope to achieve centralization.

- Large organizations are slowly shifting their focus towards a more centralized process to improve visibility, streamline operations, and increase efficiency throughout the working capital cycle.

Evolution Of Treasury In The Past 12 Months

The ongoing COVID-19 pandemic since the past 12 months, led to a downfall in the world economy. Markets are slumping even though central banks are pushing more liquidity into the system to decelerate the economic slowdown as much as possible.

According to the survey:

- Organizations are increasingly focused on cross-training their teams in order to reduce the effects of COVID-19.

- Organizations are securing extra liquidity by drawing on credit lines, padding balances and securing loans.

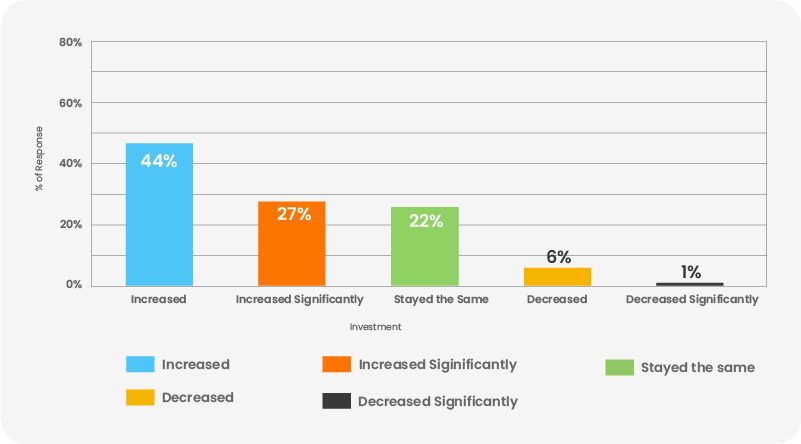

Over the past 12 months, investment in the professional development of our Treasury Team has:

- 44% of respondents said that they have increased their efforts in the professional development of their team to adjust to the new normal environment

- Treasurers now are more becoming more tech-savvy

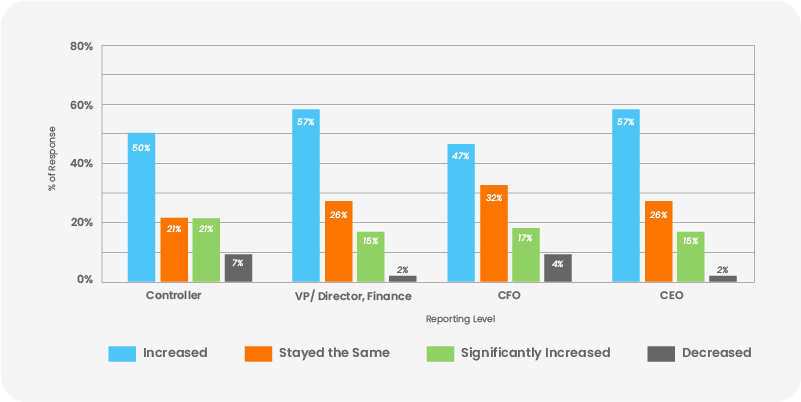

The strategic role of treasury at my company over the past 12 months has:

- Survey finds majority of employees feel the strategic role of treasury in their organization has increased. This could be due to the economic crisis hit due to the pandemic as treasury had an instrumental role in securing funds so that the business could survive and maintain its operations.

- Organizations that previously transferred funds between accounts on a monthly or weekly basis began doing so on a daily basis, resulting in a more accurate cash forecast.

Conclusion

Clearly, transforming treasury from a transactional to a strategic function will not happen overnight. It will initially involve rethinking of processes, implementation of new operating models. Treasury evolution can be intense but given the uncertainties and complex environment organizations face, treasuries don’t have the luxury of standing still. Treasury is already uniquely placed to mitigate risks and enable their companies to capture opportunities that will take their businesses forward. They will need to continue to evolve their influence to create the capacity and capability to respond to the increasing demand and establish themselves at the helm of their organizations.