Financial Close Software

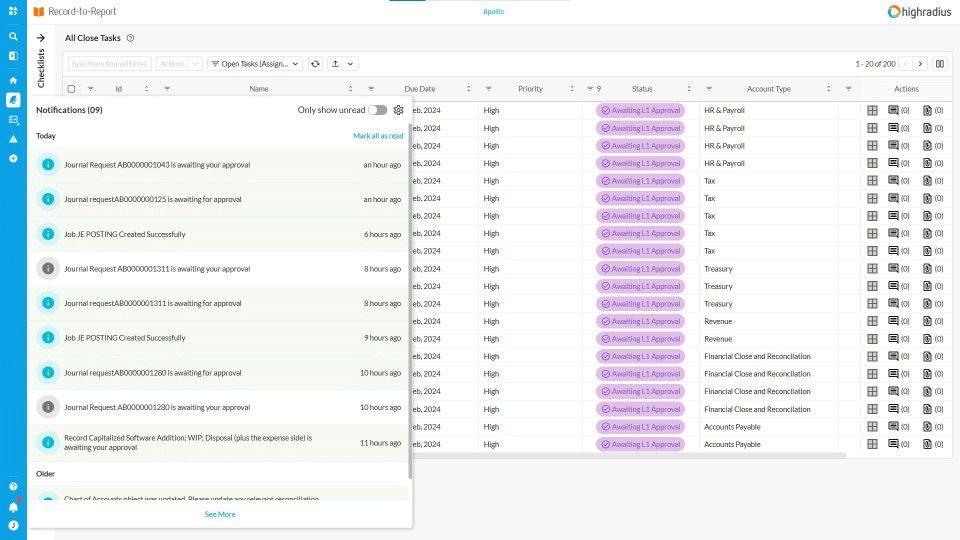

Faster Close with Accuracy & Control

With Agentic AI-Powered Financial Close Software For Enterprise

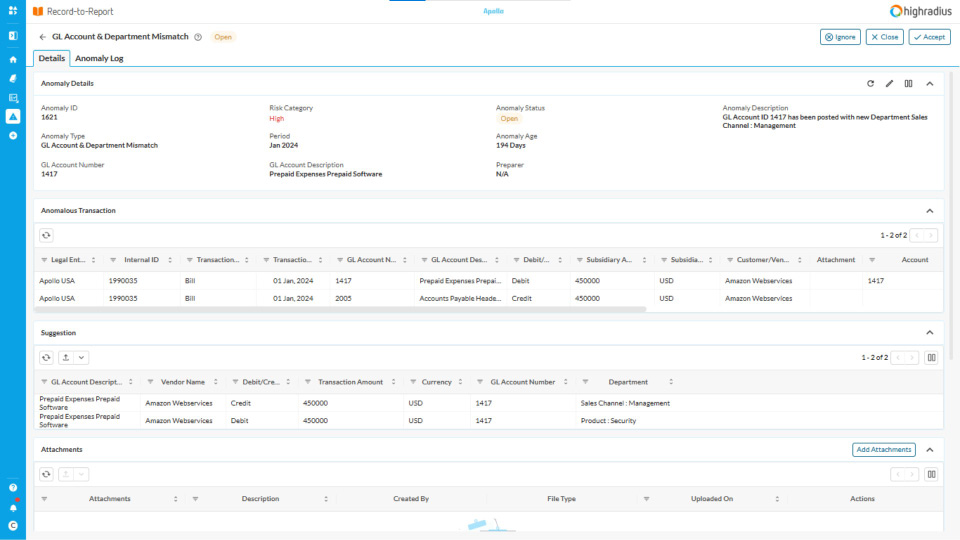

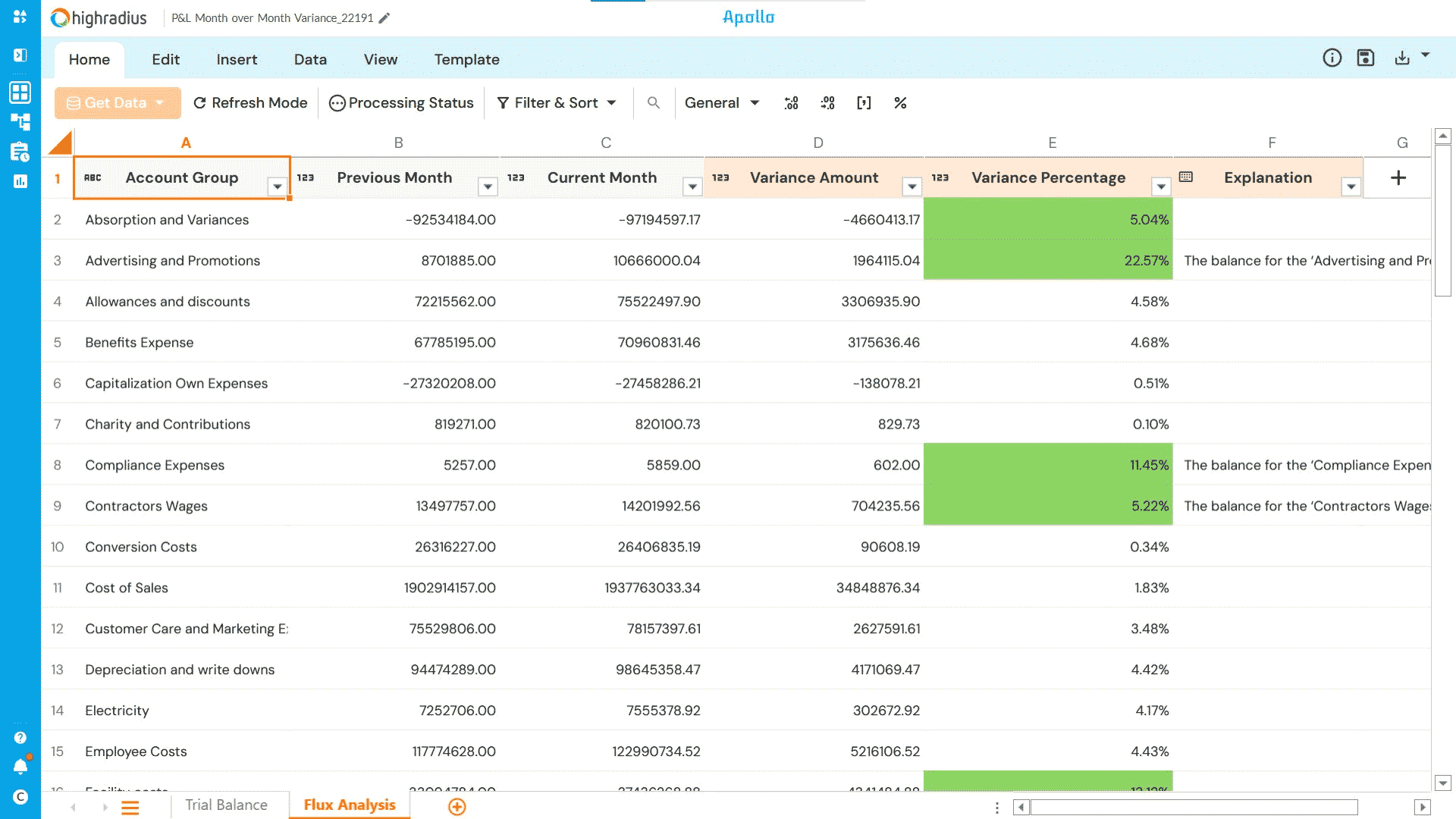

Get audit-ready 30% faster with automated checklists, journal postings, and validations across ERPs using task-specific AI Agents. Unlock real-time visibility through close dashboards and streamline global close execution at scale.

- 100% Close Checklist Completion

- 95% Journal Posting Automation

- 30% Reduction in Close Cycle Time

- 50% Less Effort to Close Books

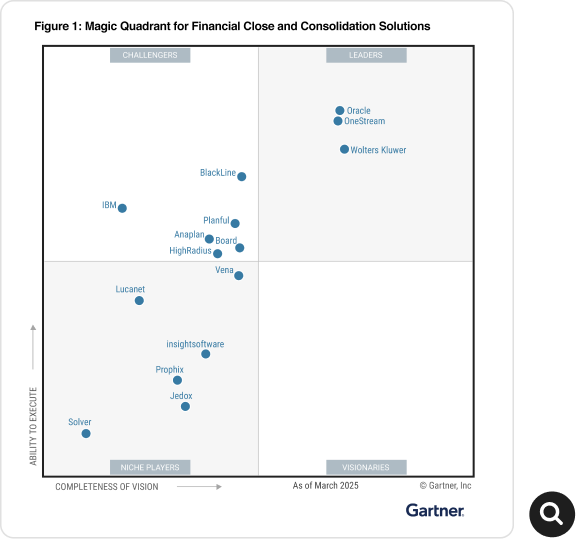

Trusted by 1100+ Global Business

Book a Discovery Call for a Custom Product Tour

15-Minute Call | Best Financial Close Software