ACCOUNTS RECEIVABLE SOFTWARE BY HIGHRADIUS

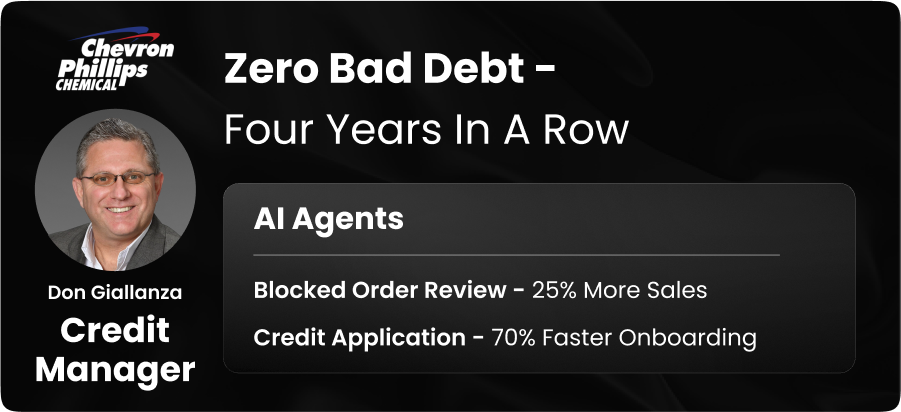

Accounts Receivable Software Built to Reduce Bad Debt by 20%

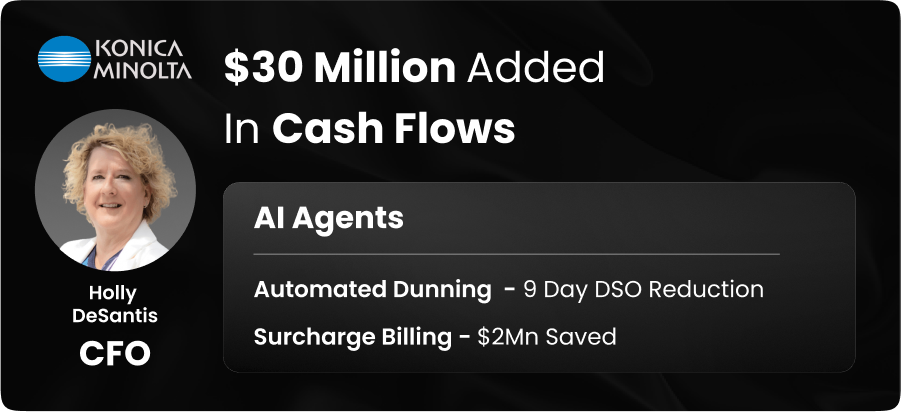

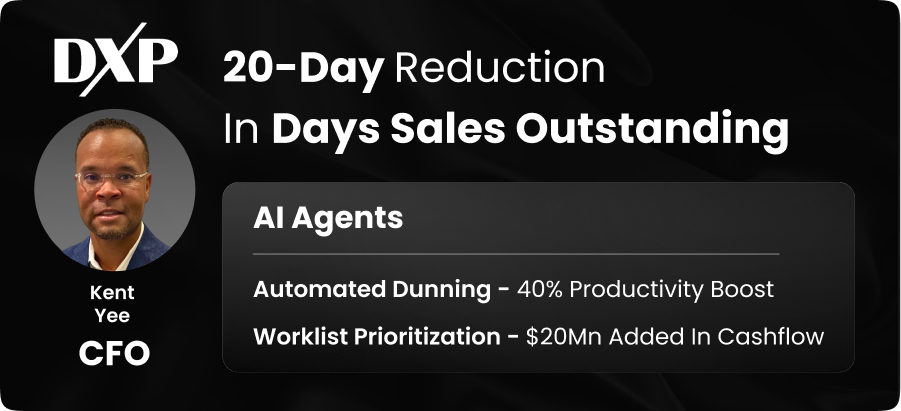

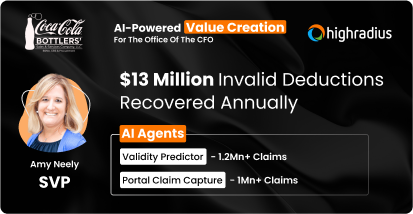

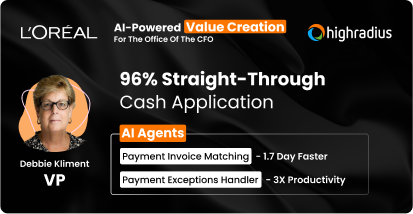

With AI Agents at the core, HighRadius’ AI-powered accounts receivable software offers enterprise-grade compliance you can trust.

- 4X Past-Due Coverage

- 70% Faster Customer Onboarding

- 10X Customer Outreach

Trusted by Fortune 500 companies for Scalable AR Automation

Ask Us How Our Product

Covers Its Cost in <12 Months