ACH/Direct Debit Processing

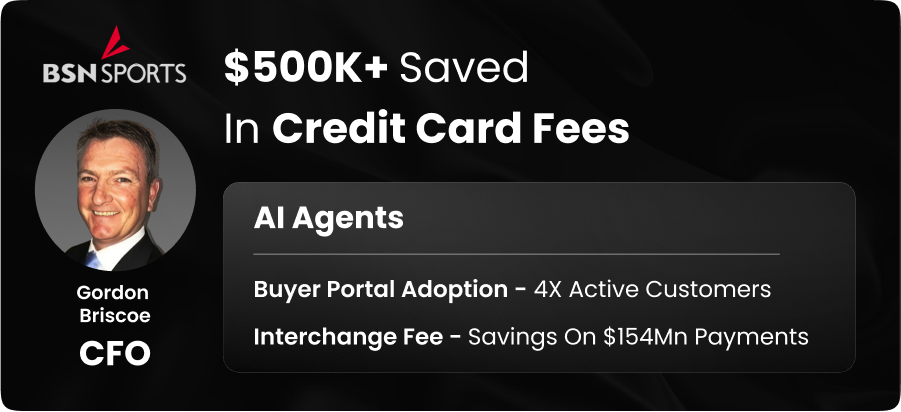

Credit Card Processing

Process Card Payments Globally

Virtual Card Processing

Accept & Process Low-Cost Euro Payments

IVR Payments

Validate, Accept, Process ACH

Payment Gateway for eCommerce

Accept & Process Low-Cost Euro Payments

HighRadius Merchant Services

Lower Fees with Transaction-Level Data