A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

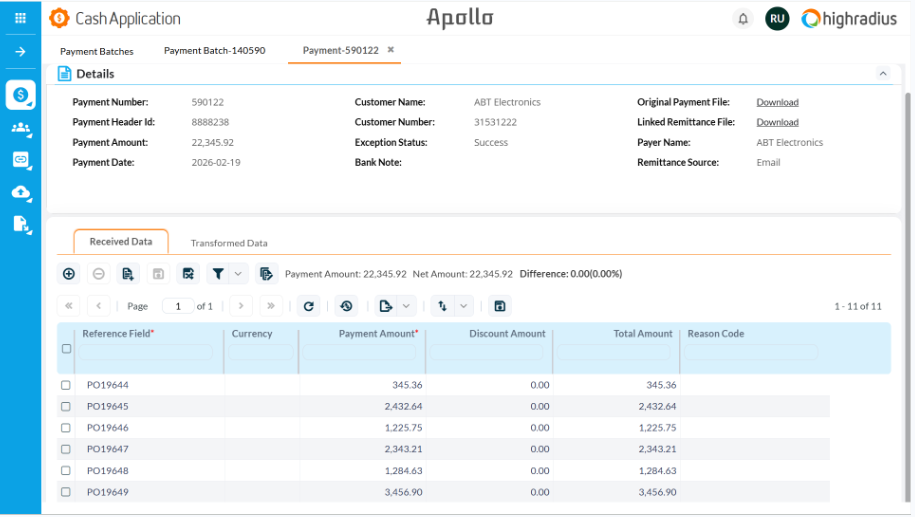

Achieve 90%+ automation in cash application through a seamless blend of AI-powered matching algorithms and human workforce.

Eliminate bank key-in fees for checks by 100%

Increase FTE productivity by 30%

Product

Value

Streamline your procurement process with a comprehensive sample RPF for cash allocation automation.

Learn MoreAn Excel-based calculator to track cash application savings ROI of your cash application process.

Learn MoreThis folder contains an excel sheet and an ebook, justifying the business case for an automated cash application system.

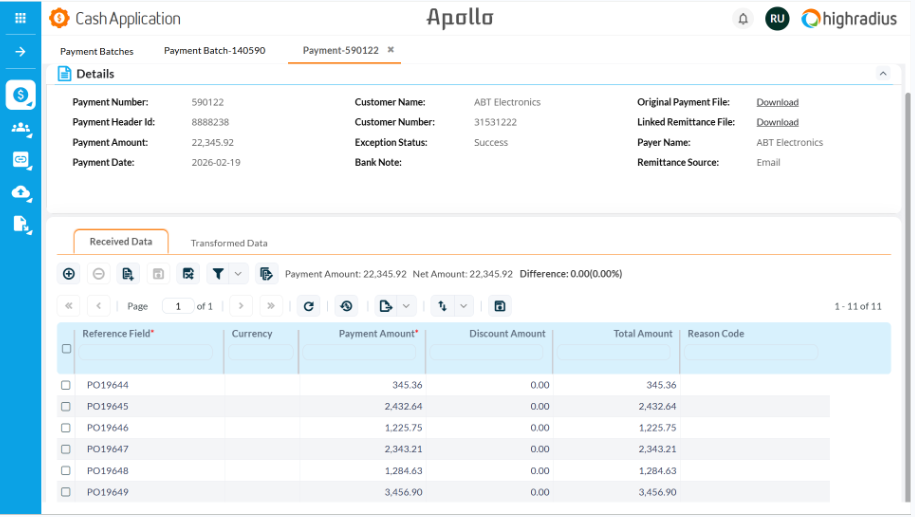

Learn MoreCash Application Automation software simplifies the process of three way matching with remittances, payments and invoices. It uses technologies like artificial intelligence and machine learning to automate this process.

The cash application software improves cash flow management, reduces processing time, and enhances accuracy, making it a valuable tool for businesses.

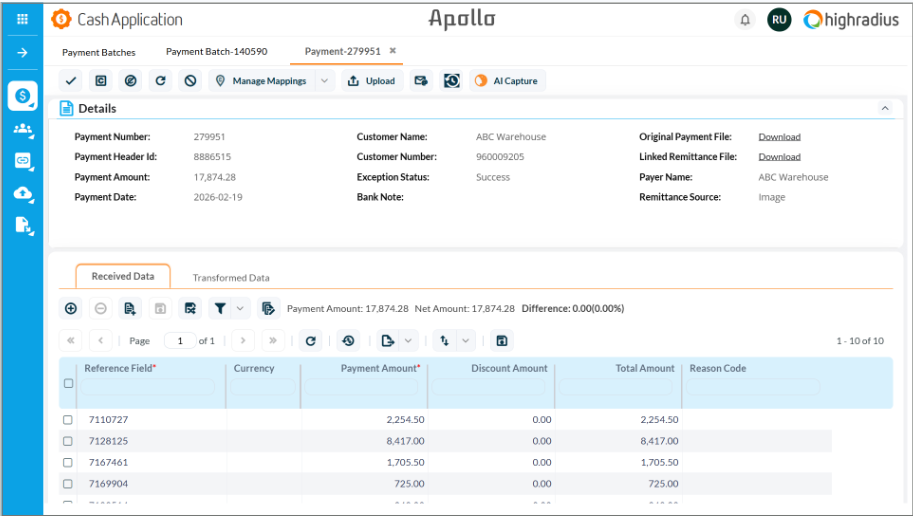

A Cash Application Solution offers several benefits. It automates the matching of payments to invoices, reducing manual effort and processing time, which enhances efficiency. The use of advanced algorithms and data validation minimizes errors, ensuring greater accuracy.

Additionally, real-time insights into payment statuses and cash positions provide better financial visibility. Automation reduces administrative costs by eliminating repetitive tasks, reducing bank key-in fees, and improves customer satisfaction by accurately reflecting payments and reducing disputes. Overall, a Cash Application Solution streamlines operations and boosts financial management.

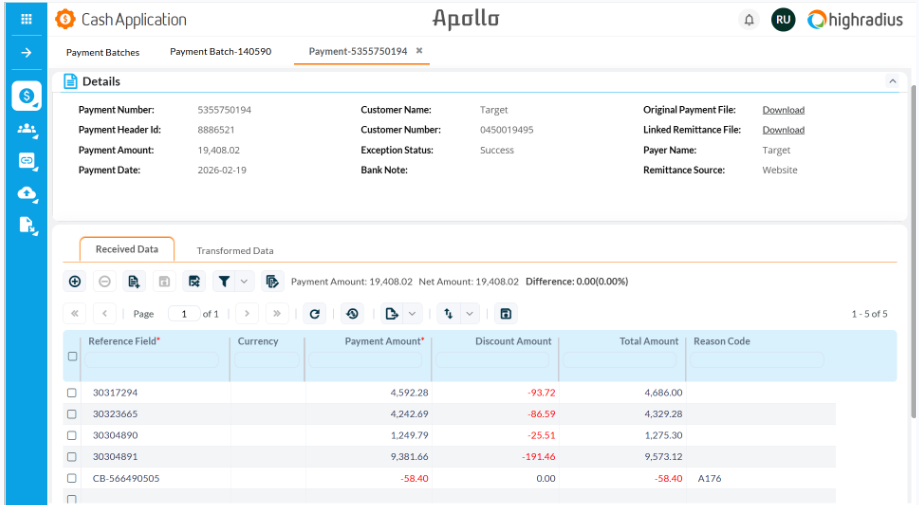

A Cash Application System addresses several challenges businesses face. It solves the problem of manual cash posting by automating the matching of payments to invoices, reducing errors and saving time. It also streamlines the reconciliation process, ensuring that payments are accurately reflected in accounts receivable. This system handles discrepancies between payment amounts and invoices, minimizing the need for manual intervention.

Additionally, it improves cash flow visibility by providing real-time updates on payment statuses. By reducing the administrative burden and enhancing accuracy, a Cash Application System helps businesses manage their finances more efficiently and effectively.

The cash application process can be complex due to several factors. First, there are often discrepancies between payment amounts and invoice totals, requiring manual adjustments. Second, multiple payments can be received in a single transaction. Third, payments may lack sufficient remittance information, complicating the identification process.

Additionally, the process involves handling different payment methods, such as checks, ACH transfers, and credit card payments, each with its own reconciliation requirements. Finally, managing high transaction volumes and maintaining accuracy adds to the complexity. These factors combined make the cash application process challenging and time-consuming. Cash application automation can help simplify the entire process.

Yes, the Cash Application software seamlessly integrates with your ERP and supports API integration for other financial management systems. For low-volume ERP data imports, it also supports Excel and CSV formats, enabling easy extraction of accounts receivables.

The implementation time for HighRadius Cash Application Software varies based on the complexity of your organization’s requirements. However, our Speed to Value methodology guarantees swift implementation and ROI realization within 3 to 6 months, setting an industry benchmark.

The HighRadius Cash Application Automation Software requires minimal IT involvement. With seamless plug-and-play integration into ERPs using real-time APIs and Hex (SFTP) connectors, along with pre-built modules and industry-specific best practices, customers can deploy it remotely with ease, reducing heavy IT dependencies.

AI-powered automation software, like HighRadius Cash Application Management, significantly enhances the cash application process. It automatically captures & matches remittance data from various sources, integrates with customer portals, processes electronic payments, and handles exceptions with AI solutions. The software reduces manual tasks, eliminates bank fees, and boosts analyst efficiency, resulting in faster, more accurate cash posting and substantial cost savings.

Yes. The HighRadius Cash Application Software is capable of handling multiple lockboxes.

It is common practice for banks, such as Bank of America, to send files multiple times a day. Depending on the chosen architecture, we can either provide you with a consolidated file after receiving all files from the bank or deliver them to you within 2 to 4 hours of receiving each file.