Payment Gateway

AI agents tokenize payment data, authorize transactions, & manage settlements across cards, ACH, & global direct debits.

90% less processing costs by facilitating e-payment adoption

100% global PCI Compliance

AI agents tokenize payment data, authorize transactions, & manage settlements across cards, ACH, & global direct debits.

90% less processing costs by facilitating e-payment adoption

100% global PCI Compliance

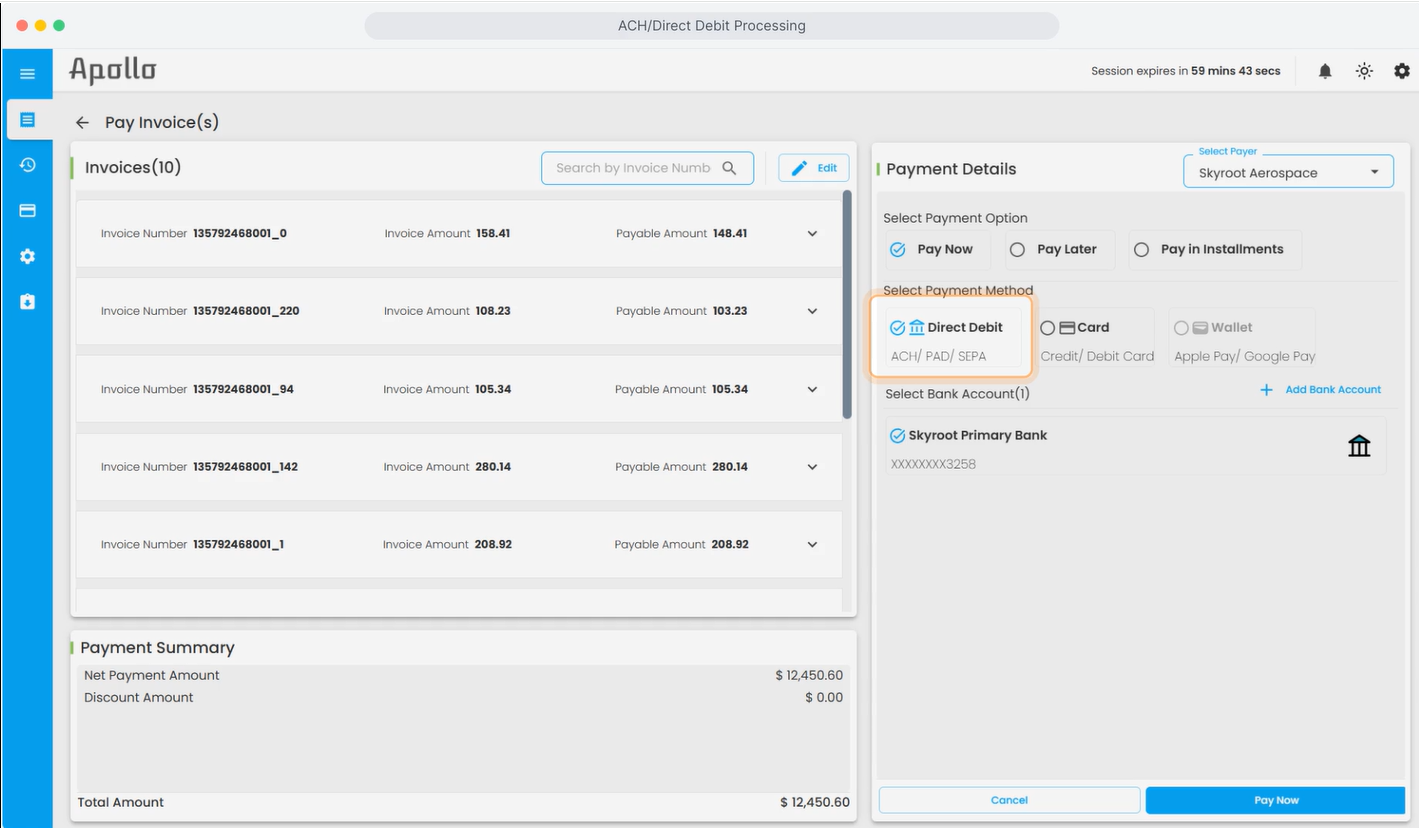

Accept direct debits globally and manage mandates as per the regional regulations.

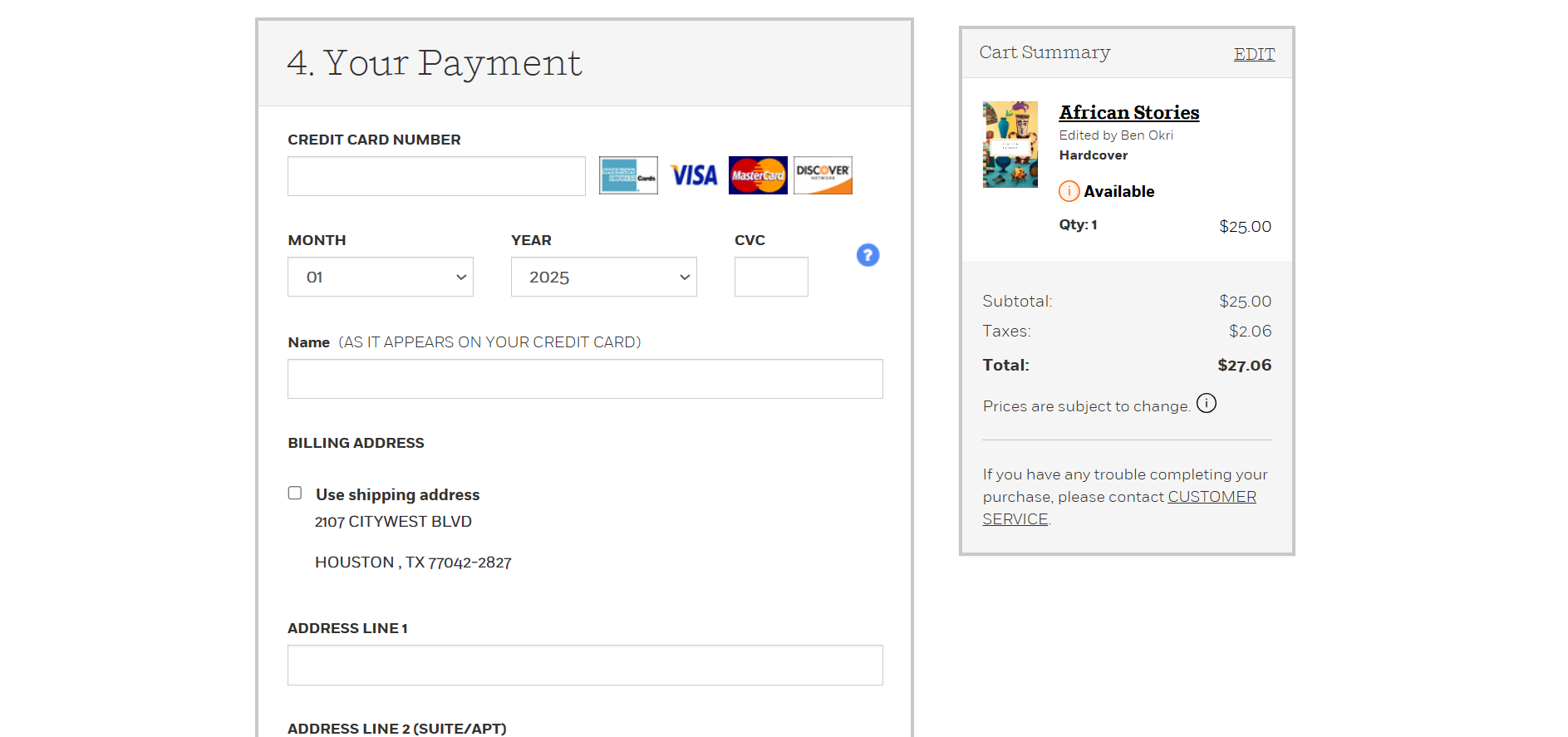

Process card payments in more than 30 currencies & 40+ processors on PCI-compliant rails.

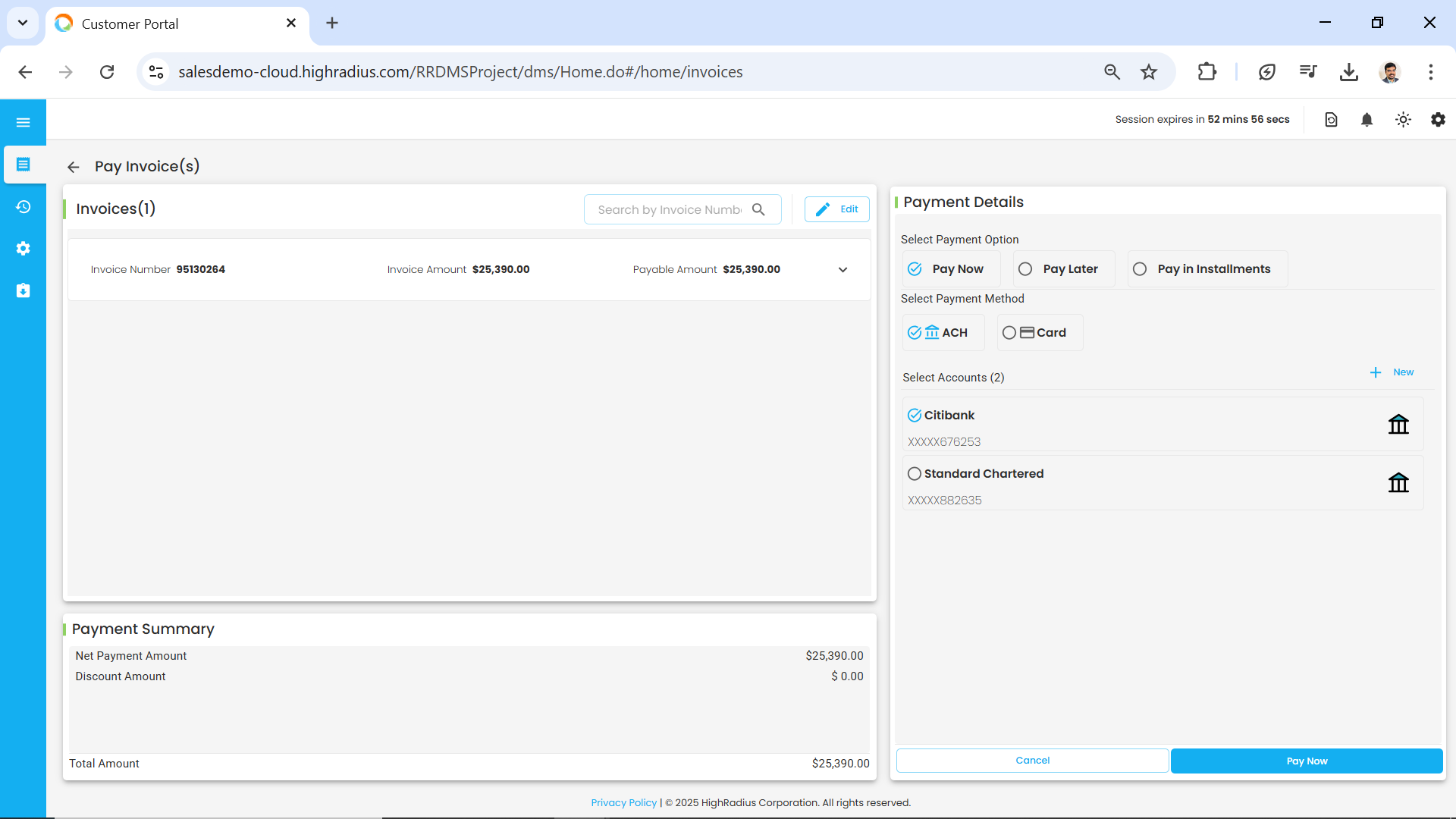

Accept eCheck payments via integrated payment processors.

Process card payments in more than 30 currencies & 40+ processors on PCI compliant rails.

Accept direct debits globally and manage mandates as per the regional regulations.

Accept eCheck payments via integrated payment processors.

Product

Value

A B2B payment gateway routes and secures payment messages between merchants and processors; a payment processor executes the settlement with banks and card networks. Gateways handle tokenization, routing, and integration with ERPs, while processors handle funds movement and acquiring services.

Level 3 data includes invoice line-item details (SKU, quantity, tax) sent with card captures; it qualifies many B2B transactions for lower interchange rates. Sending L3 data can materially reduce card costs for large B2B spend and is a key lever for interchange optimization.

Yes, by embedding payment options in invoices, increasing authorization success, and automating cash application, a payment gateway can shorten the invoice-to-cash cycle. Enterprise customers typically target multi-day DSO reductions when payments are integrated with AR workflows.

PCI DSS applies to any entity that stores, processes, or transmits cardholder data. Using a PCI-compliant gateway, tokenization, and Data Intercept patterns minimizes your PCI scope; however, organizations must still follow controls for any systems that handle payment data indirectly.

Virtual cards generate single-use or vendor-specific PANs that reduce fraud, provide spend controls, and simplify reconciliation because each virtual card maps to an invoice or supplier. They accelerate payments and can produce rebate or interchange benefits for the payer.

Common implementation pitfalls for B2B payment gateways include insufficient ERP mapping, unclear rules for L2/L3 enrichment, lack of supplier enablement, and overlooking local regulatory rules for surcharging or direct debit mandates. Mitigation: run a scoped pilot, align IT + treasury + AR teams, and use vendor templates for global rails.

The payment gateway is a cloud-based software ‘switch’ that is specifically designed to facilitate payment processing of B2B(business-to-business) transactions. It enables secure payments by processing payment tokenization, authorization and settlement requests for credit cards and other alternative payment methods.

As a tier 1 payment service provider, HighRadius holds PCI certification, which merchants using our service can reference for their annual certification filings. Merchants can utilize our PCI-compliant payment gateway that processes card payments through the processor of your choice, effectively shifting the compliance burden from your business to HighRadius.

Our payment gateway supports Credit Cards, Debit Cards, Direct Debit. In addition to this, we also support other alternative payment methods like GiroPay, iDeal, BanContact and other local and popular payment methods.

The implementation time for HighRadius Payment Gateway varies based on the complexity of your organization’s requirements. However, our Speed to Value methodology guarantees swift implementation and ROI realization within 3 to 6 months, setting an industry benchmark. Our dedicated implementation team works closely with you to ensure a smooth transition with minimal disruption to your payments process.