A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

AI agents for automating invoice delivery and enable global electronic payments. Speed up collections & lower costs.

Reduce Cost of Payment Acceptance by 80%

Reduce DSO by 3 Days

Product

Value

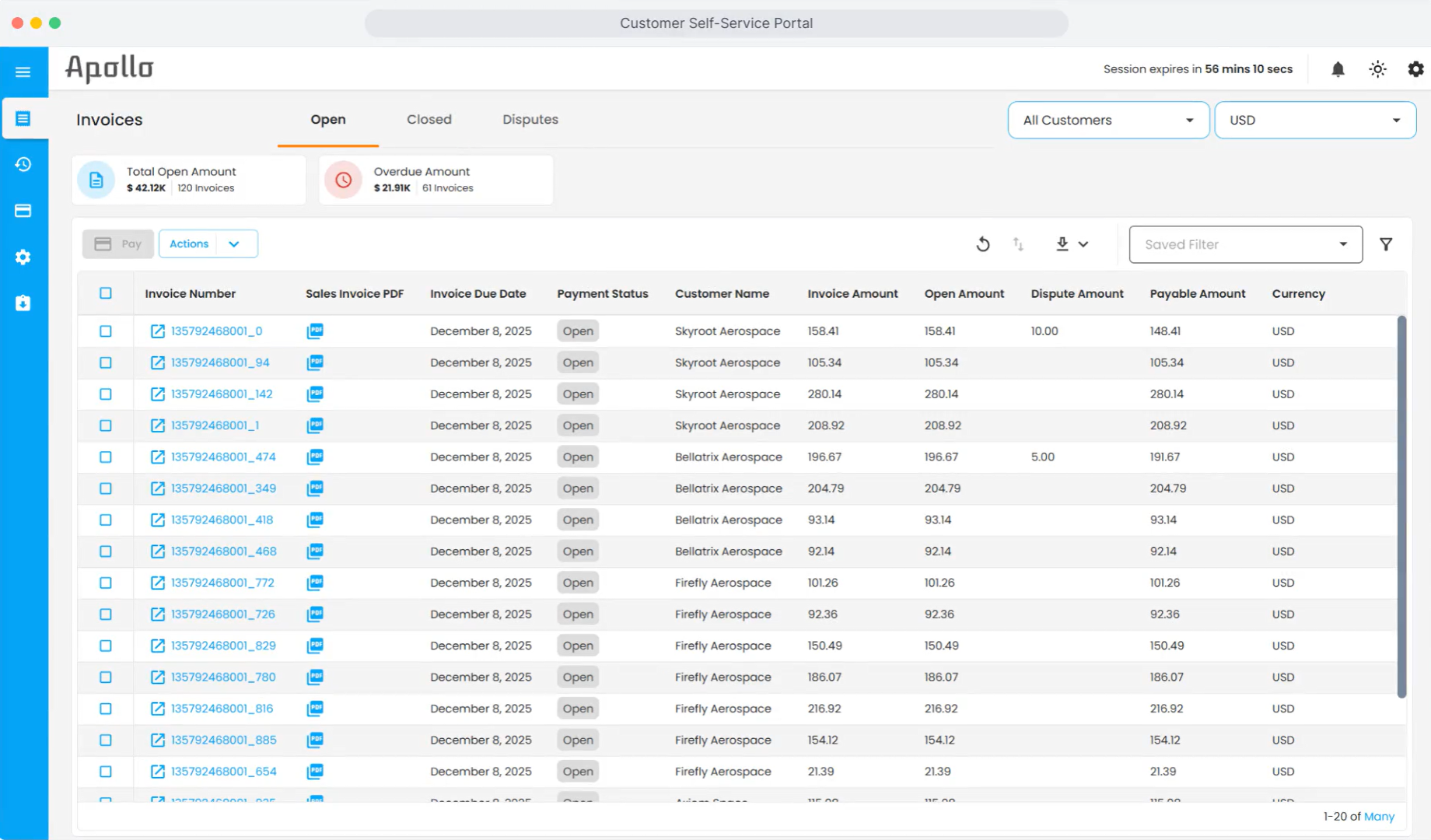

Electronic Invoice Presentment and Payment (EIPP) Software is a digital solution that allows businesses to electronically present invoices to their customers and receive payments online. This technology streamlines the traditional invoicing process by automating the generation, delivery, and payment of invoices.

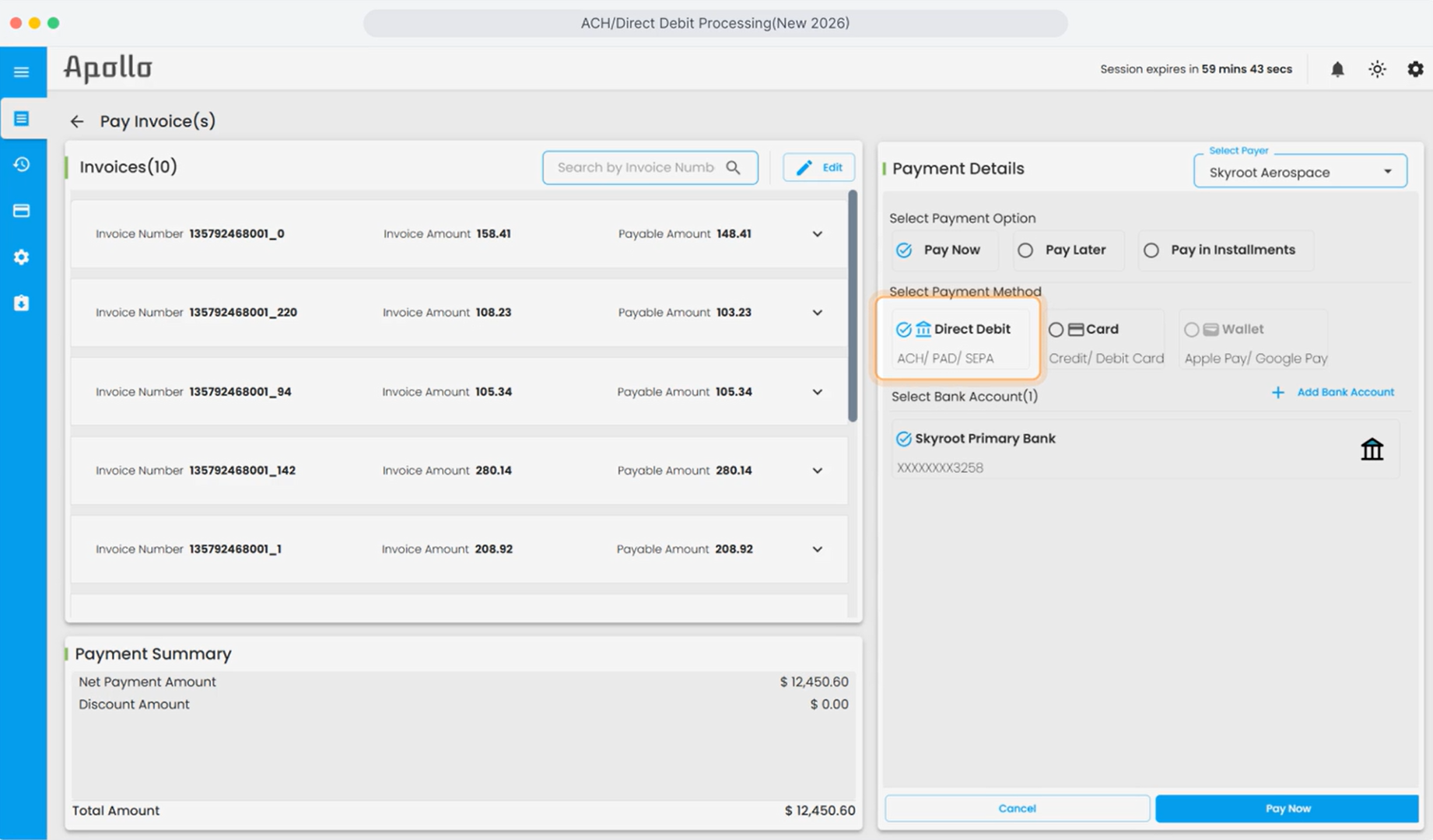

EIPP systems typically include features like automated invoice creation, electronic delivery via email invoice delivery or customer portals, and various online payment options such as credit cards, ACH transfers, and digital wallets. By using EIPP, businesses can reduce the time and cost associated with paper-based invoicing, minimize errors, and improve cash flow through faster payment cycles. The system provides real-time tracking and visibility into the status of invoices and payments, enhancing overall financial management. EIPP payment is particularly beneficial for businesses that manage a high volume of invoices and need a more efficient and scalable invoicing solution.

EIPP solutions offer numerous benefits that enhance the efficiency and accuracy of invoicing and payment processes. First, they significantly reduce the use of paper, thereby cutting costs related to printing, mailing, and storage. By automating invoice generation and delivery, EIPP minimizes manual errors.

Implementing EIPP solution speeds up the invoicing cycle, resulting in quicker payments. This improved cash flow management is crucial for maintaining business liquidity. Additionally, EIPP provides better visibility into the status of invoices and payments, allowing businesses to track and manage their receivables more effectively. Customers also benefit from the convenience of online payments, which can enhance their satisfaction and loyalty. The real-time tracking and reporting features of EIPP systems offer valuable insights into payment trends and customer behaviors, helping businesses make informed financial decisions. Furthermore, EIPP systems often include security measures to protect sensitive financial information, ensuring compliance with industry standards and regulations. Overall, EIPP solutions streamline operations, improve cash flow, and enhance both customer and financial management.

When choosing an EIPP solution, several key factors should be considered to ensure it meets your business needs. First, evaluate the solution’s integration capabilities with your existing accounting, ERP, and CRM systems. Next, consider other factors such as usability, scalability and security features.

Seamless integration is crucial for streamlining workflows and maintaining data consistency. The solution should be intuitive and user-friendly to facilitate quick adoption by your team. You must choose a solution that can grow with your business and handle increasing volumes of invoice presentment and payment. Ensure the solution offers robust encryption and compliance with industry standards to protect sensitive financial data.

EBPP (Electronic Bill Presentment &Payment) and EIPP (Electronic Invoice Presentment & Payment) are both solutions designed to facilitate online billing and payments, but they cater to different user groups and use cases. EBPP is typically used for consumer billing whereas EIPP is designed for B2B transactions.

EIPP solutions often include more complex features to manage the invoicing needs of businesses, such as support for multiple payment methods, integration with accounting and ERP systems, and the ability to handle high volumes of invoices. While EBPP focuses on simplifying the billing process for individual consumers, EIPP aims to streamline and automate the invoicing process for businesses, improving efficiency and cash flow management. Both solutions enhance the payment experience but are tailored to different audiences and requirements.

Implementing an electronic invoice presentment and payment solution involves several steps to ensure a smooth transition and effective use. First, businesses should assess their current invoicing processes and identify specific goals for the EIPP system. Next, research and select a suitable EIPP provider that offers the features and capabilities required.

Integration with existing accounting, ERP, and CRM systems is crucial, so ensure the chosen solution can seamlessly integrate with these platforms. Once the provider is selected, configure the EIPP system to align with your invoicing workflows, including setting up automated invoicing, payment reminders, and customizable templates. Train staff on how to use the new system effectively, providing comprehensive training sessions and support materials. Migrate existing invoice data into the EIPP system to ensure continuity and accuracy. Finally, monitor the system’s performance and gather feedback from users to make necessary adjustments and improvements.

Yes, e-invoicing software seamlessly integrates with your ERP and supports API integration for other financial management systems. It also supports Excel and CSV formats for low-volume ERP data imports, enabling easy accounts receivables extraction.

The implementation time for HighRadius EIPP Software varies based on the complexity of your organization’s requirements. However, our Speed to Value methodology guarantees swift implementation and ROI realization within 3 to 6 months.

The right EIPP Software needs little IT participation. It easily integrates with ERPs using real-time APIs and Hex (SFTP) connectors, plus it comes with pre-built modules and industry-specific best practices. This means customers can deploy remotely without much hassle or IT reliance.

Yes, Electronic Invoicing Software can integrate with the merchant’s print and mail delivery vendor of choice or HighRadius Print and Mail Partner to send invoice copies and additional supporting documentation.

Yes, the Merchant Administration Portal enables merchant’s billing analysts to set up and manage buyers’ preferences & actions the buyers can perform in the self-serve portal.