| Agentic AI Platform for the Office of the CFO |

180+ AI agents automate R2R, O2C, AP, Treasury, and P2P with real-time insights. |

Mostly rule-based workflows; limited end-to-end automation beyond close. |

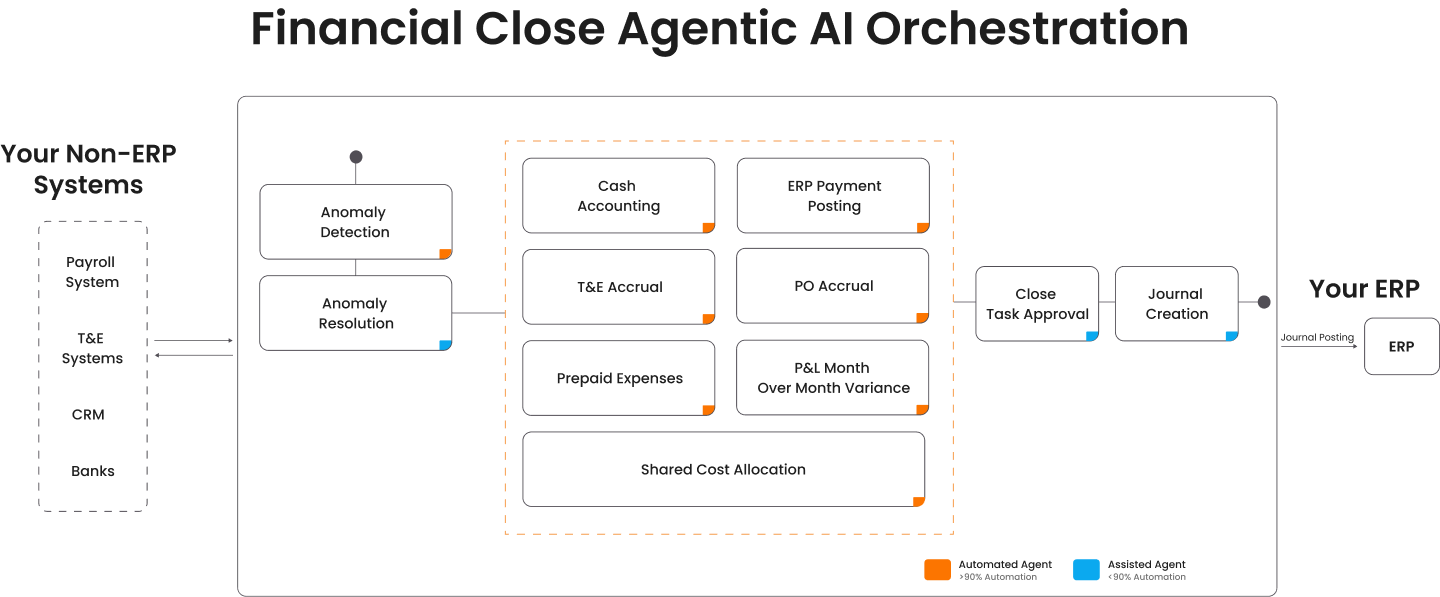

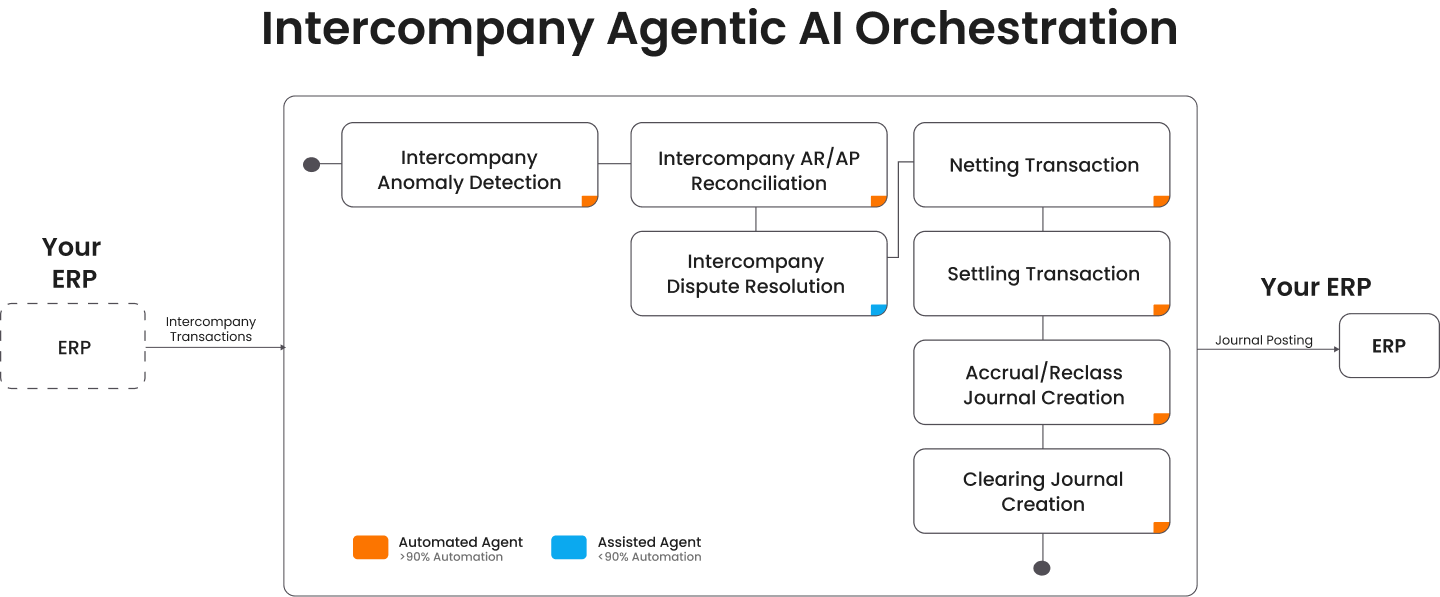

| Record-to-Report (R2R) |

End-to-end AI-driven reconciliations, journals, intercompany, and close orchestration. |

Focused on checklists and reconciliations; broader R2R automation is limited, still very much Excel-driven for complex or multi-entity processes. |

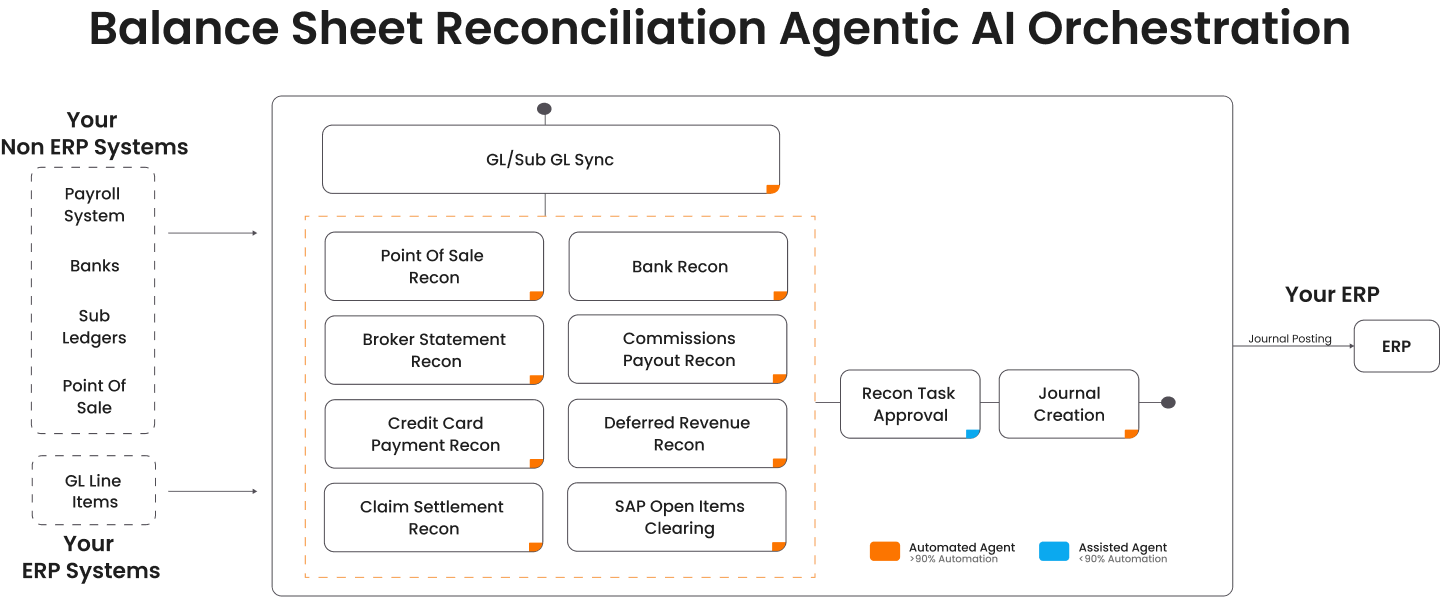

| Account Reconciliation |

Unified AI-powered matching and exception resolution across all tiers. |

Automates reconciliations with templates and configurable workflows; largely manual oversight still required. |

| Transaction Matching |

Real-time AI matching with predictive suggestions and anomaly detection. |

Handles high-volume matching using rules; batch-based, slower, human intervention often needed. |

| Journal Entry Automation |

AI-suggested entries with embedded controls. Learns account approval patterns over time; auto-certifies accounts; fully automates journal posting back to ERP. |

Automation mostly rule-driven, approvals often manual. |

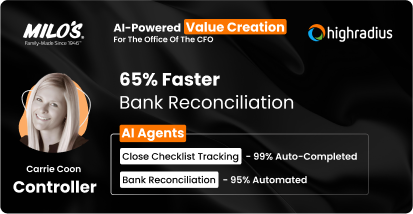

| Close Task Management |

Enterprise orchestration with real-time visibility and AI guidance. |

Provides a cloud-based task center; automation limited to checklist management. |

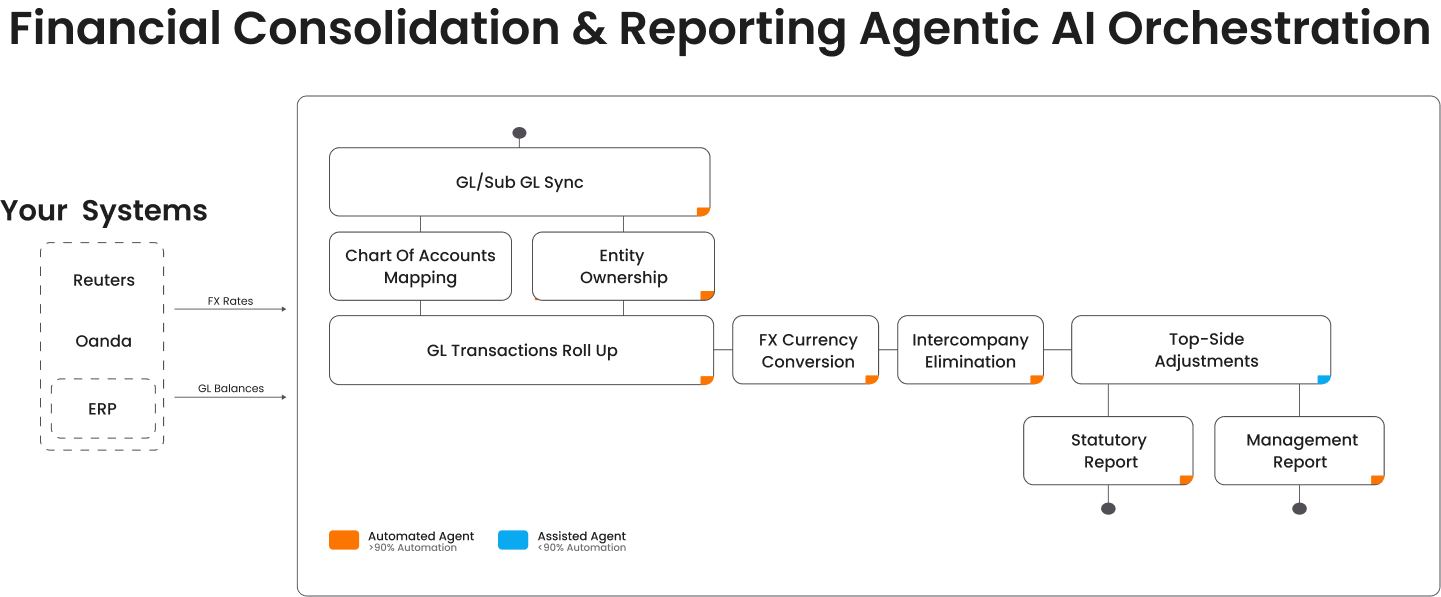

| Consolidation & Reporting |

Automated multi-entity, multi-currency reporting with continuous audit readiness. |

Consolidation and adjustments configurable; AI insights mostly advisory, not autonomous. |

| Automated Variance Analysis |

AI-driven detection, investigation, root-cause analysis, and predictive anomaly detection across all accounts. |

Detects variances automatically for material differences only, anomaly detection is limited, human review needed. |

| Scalability |

Single platform scales mid-market to Fortune 100 seamlessly. |

Modular platform scales, but integration effort and license management can be complex for larger deployments. |

| Order-to-Cash (O2C) |

AI agents automate cash application, collections, credit, disputes, and payments. |

No specific module. |

| Accounts Payable (AP) |

AI automates invoice capture, approvals, payments, and exceptions. |

No specific module. |

| Treasury |

AI forecasts cash, manages liquidity, and payments with 95% accuracy. |

No specific module. |

| ERP Integration |

Certified connectors with real-time data flow (SAP, Oracle, Workday, NetSuite). |

ERP-agnostic integration possible; real-time automation limited, setup can be complex. |

| Exception Handling & Insights |

AI classifies, routes, and resolves exceptions autonomously. |

Limited exception handling capabilities. |

| Compliance & Audit Readiness |

Built-in continuous audit trails and regulatory compliance. |

Cloud-based compliance dashboards provide visibility; reliant on manual oversight for audit resolution. |