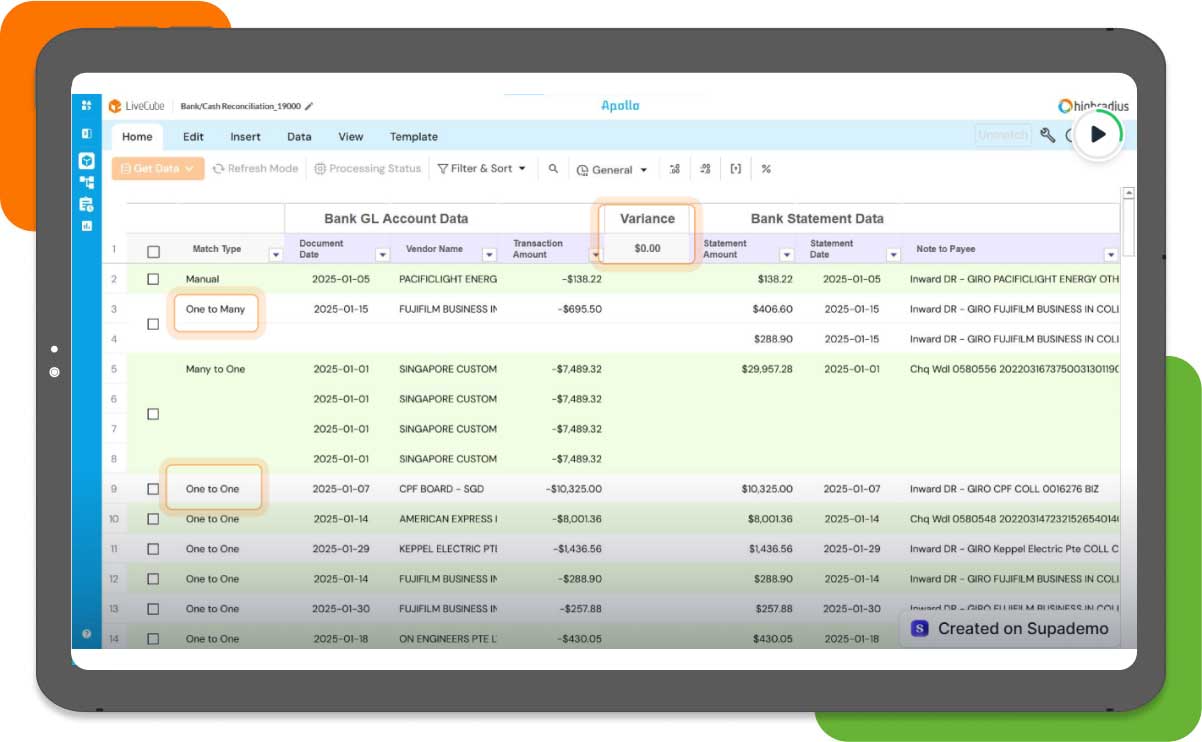

Experience 30% Faster Reconciliation

Streamline your bank reconciliation process with intelligent automation that

ensures real-time transaction matching and risk management. Our AI-driven solution automates

data imports, synchronizes bank statements with cash G/L, and resolves discrepancies across

multiple financial systems.

- Bank statements vs. cash G/L sync

- AI-driven rule discovery and automated matching

- Unified exception handling and journal posting

Learn More

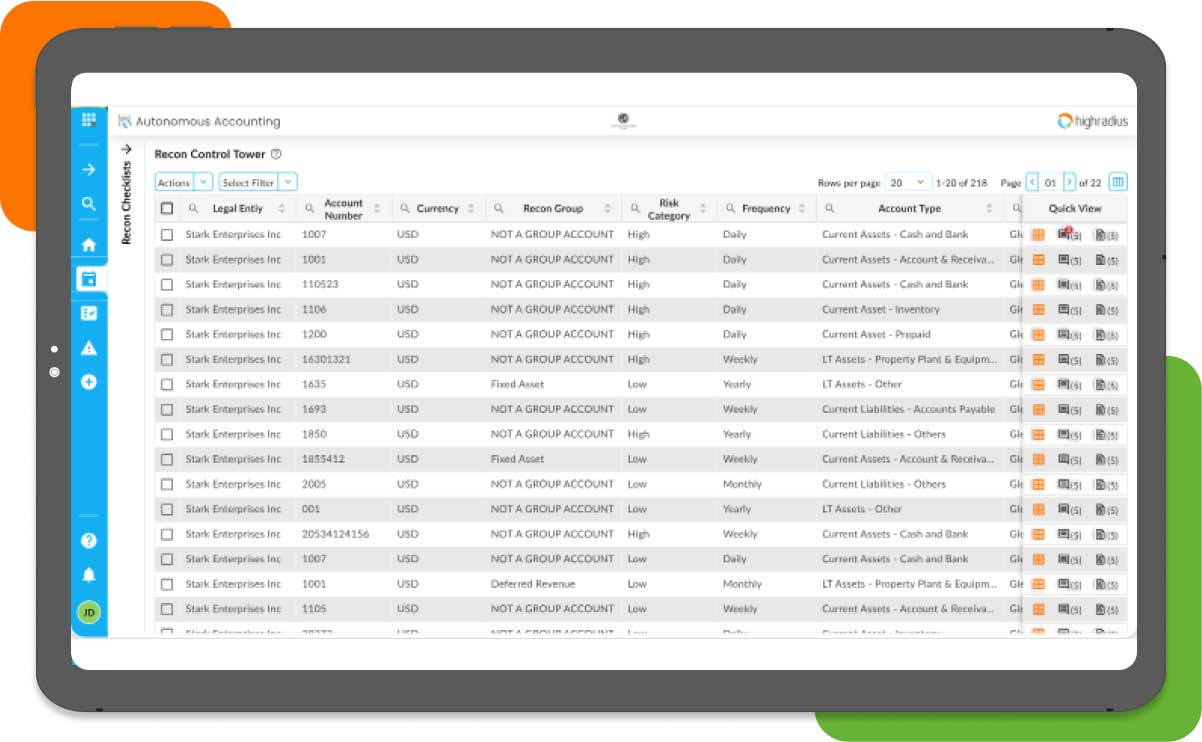

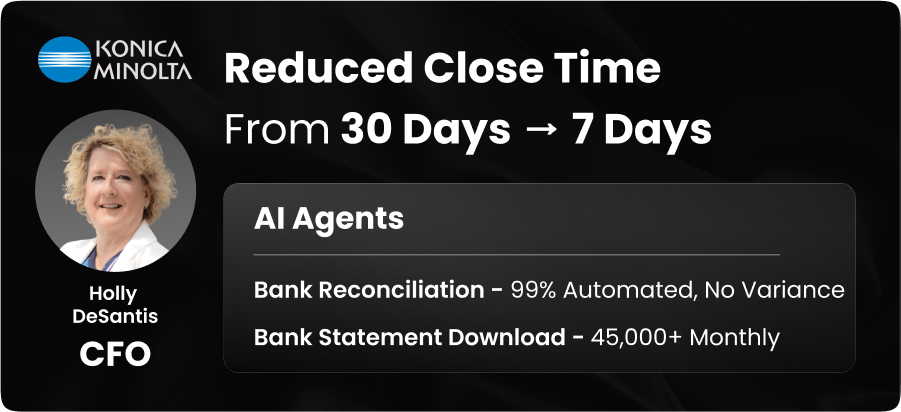

Boost Reconciliation Accuracy by 99%

Achieve real-time precision with intelligent automation designed to simplify even

the most complex balance sheet reconciliations. Our AI-powered solution effortlessly handles

high transaction volumes across multiple accounts, data sources, and entities, eliminating

manual work while ensuring accuracy and compliance.

- Cash accounts vs. bank statements

- Prepaid expenses vs. general ledger

- Fixed assets vs. depreciation schedules

Learn More

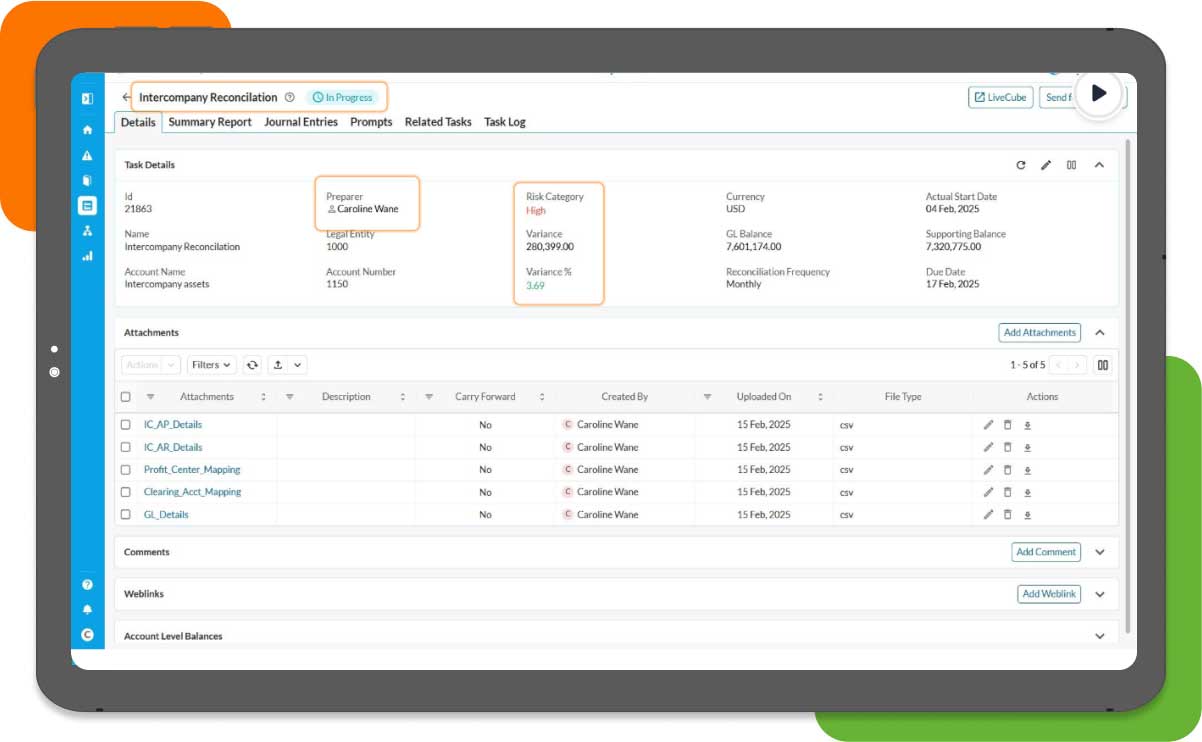

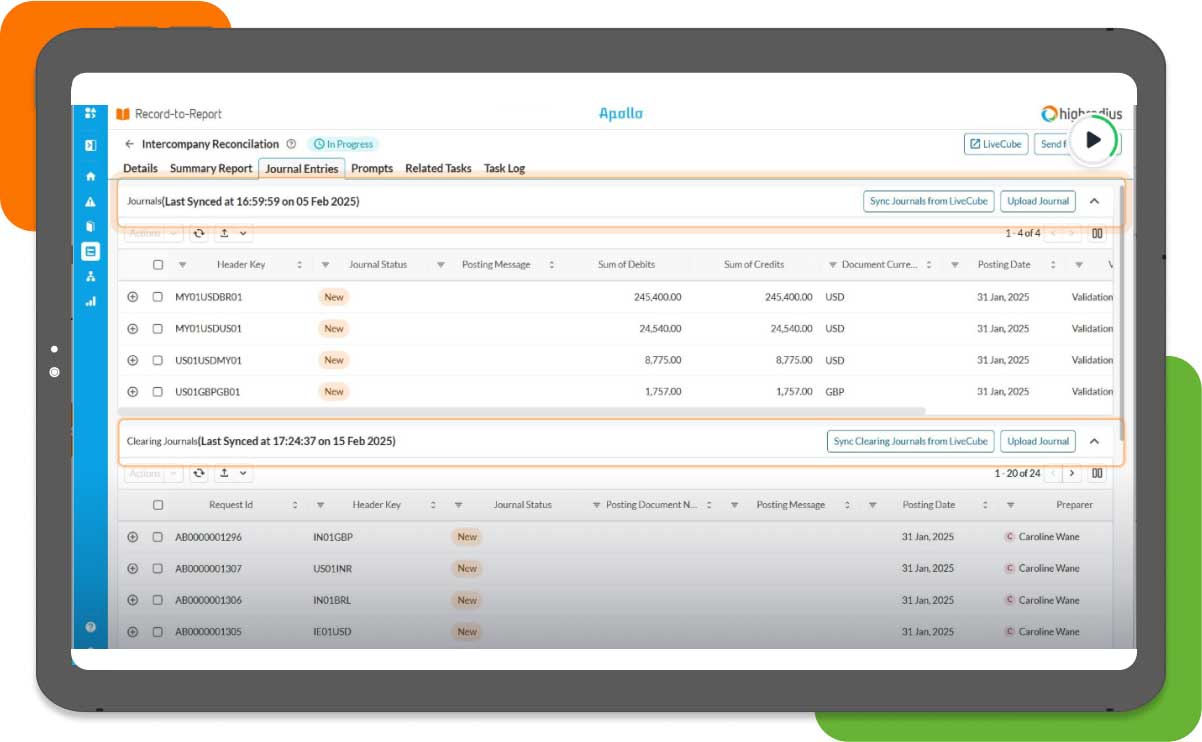

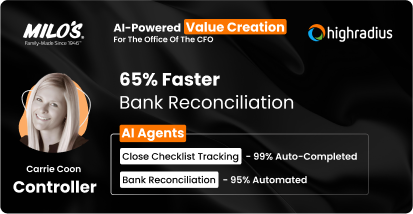

Achieve 100% GL account coverage with AI

Eliminate manual bottlenecks and accelerate financial close with an intelligent

GL reconciliation solution. Our AI-driven software automates high-volume transaction

matching, streamlines intercompany postings, and ensures compliance with built-in policy

controls.

- Bank accounts vs. general ledger

- Intercompany transactions vs. general ledger

- Revenue and expense accounts vs. general ledger

Learn More

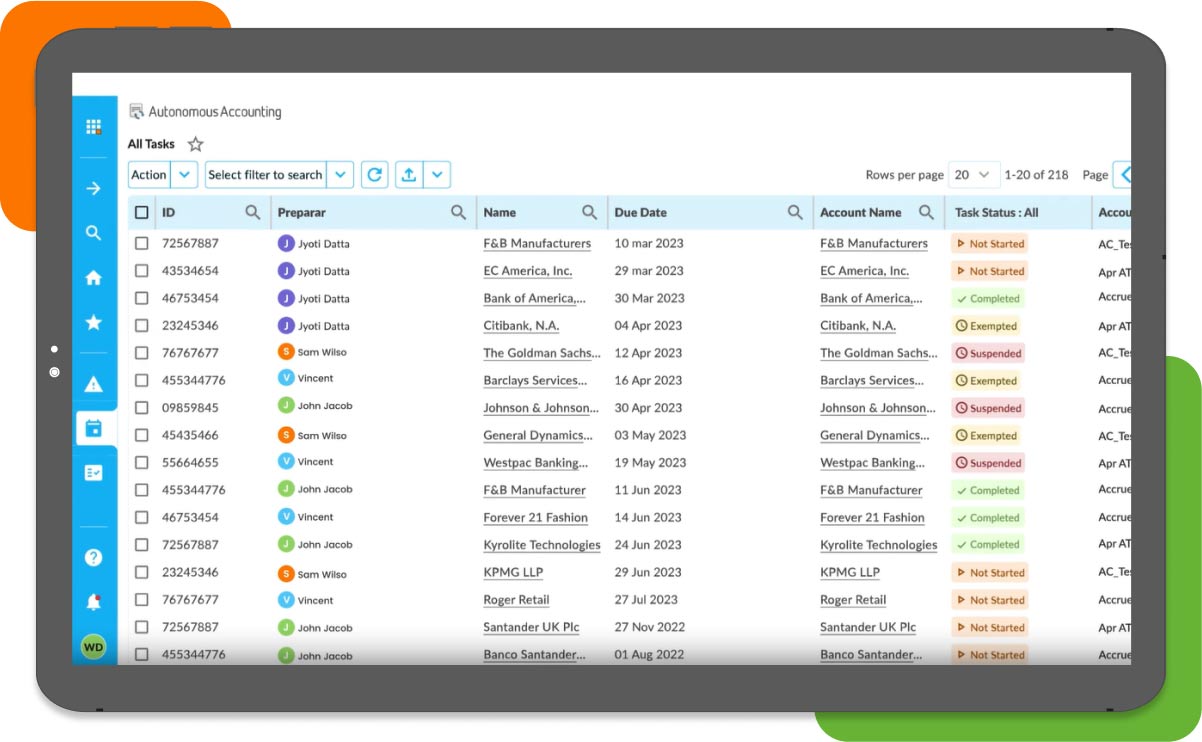

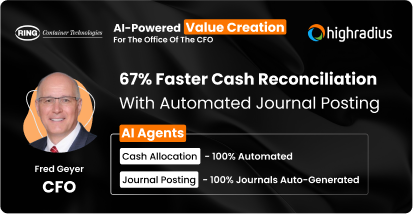

Automate 80% of Reconciliation Tasks

Simplify and accelerate payment reconciliation with intelligent automation that

matches transactions in real time, eliminates discrepancies, and ensures financial accuracy.

Our solution seamlessly integrates with multiple payment channels, ERPs, and bank

statements, reducing manual effort and minimizing errors.

- Multi-channel payment matching and validation

- Auto-identification of unapplied and misapplied payments

- Seamless exception handling and adjustment workflows

Learn More