Automated Transaction Matching Software

Achieve a 90% transaction auto-match rate with AI Agents

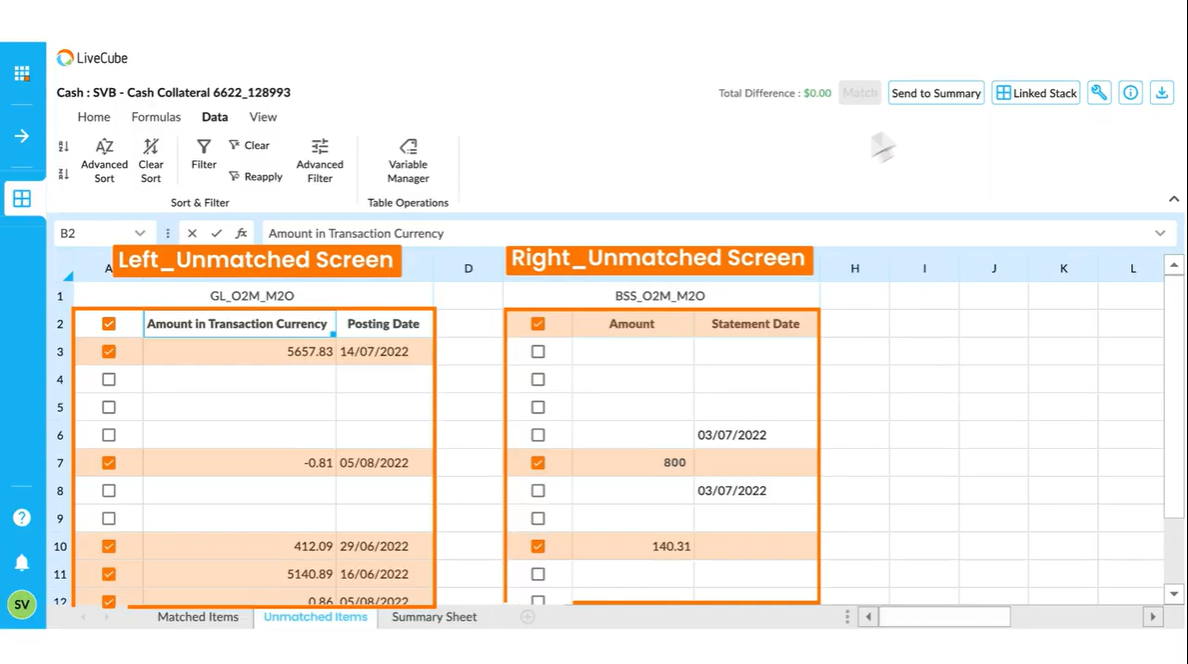

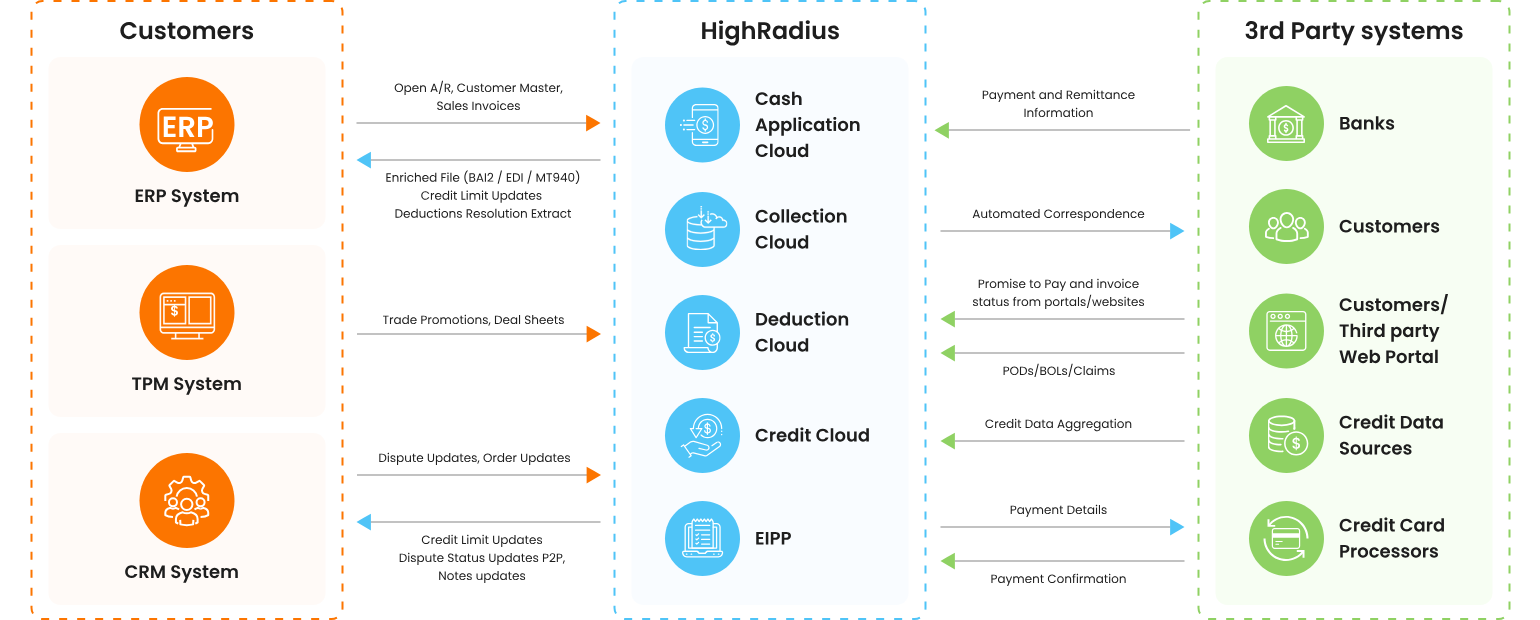

- Auto-extract data from multiple sources.

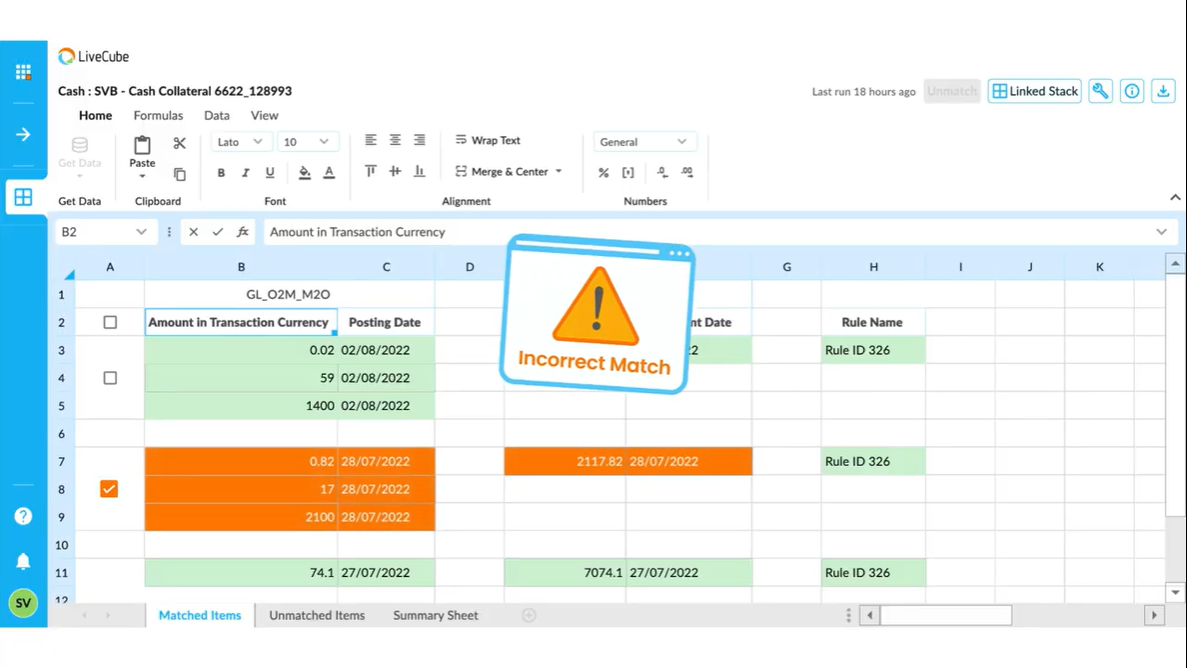

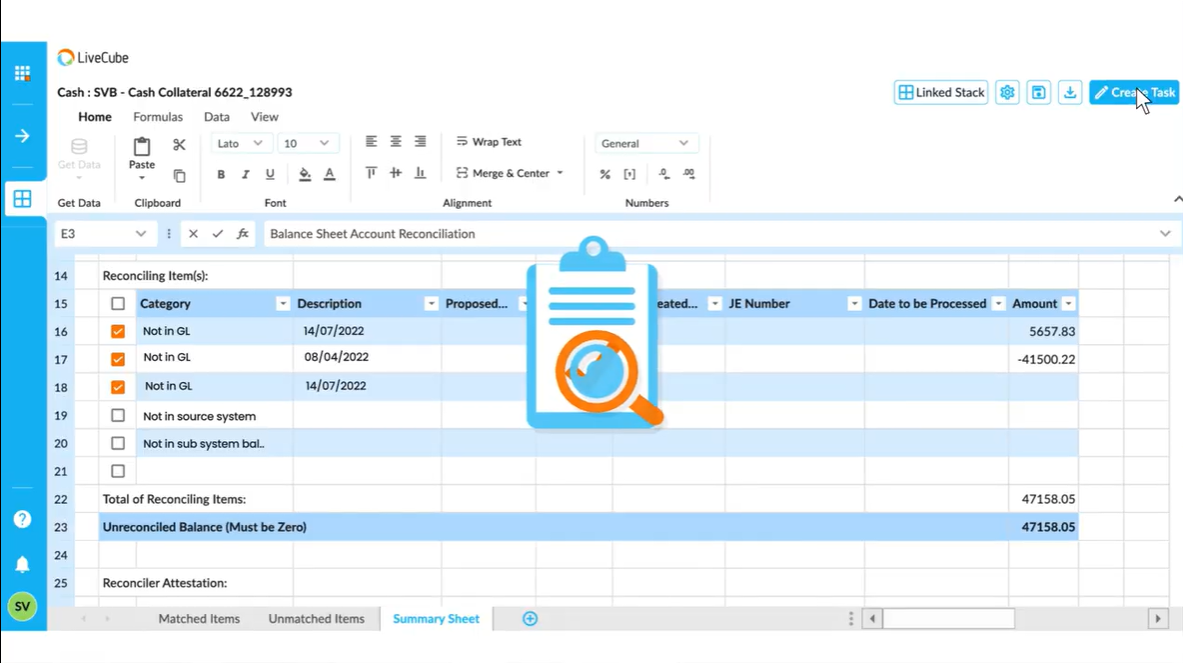

- Leverage AI/ML-driven matching to seamlessly reconcile transactions across data sets.

- Reconcile accounts faster with improved precision for an accelerated month-end close.

Trusted by 1100+ Global Businesses

Gain 99% Recon Accuracy with AI

Just complete the form below