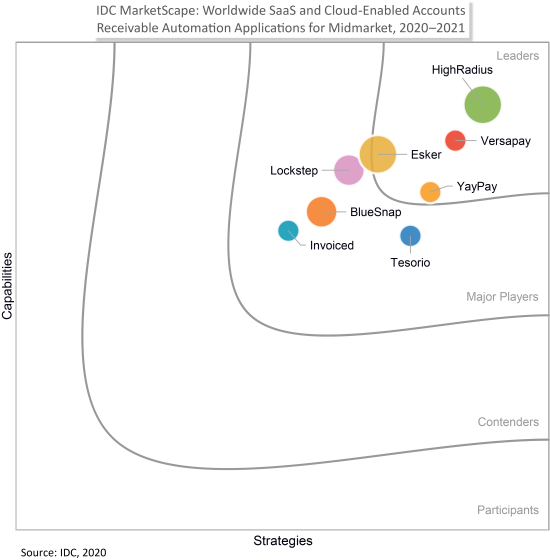

IDC MarketScape: Worldwide SaaS and Cloud-Enabled Accounts Receivable Automation Applications for Midmarket 2020–2021 Vendor Assessment

Kevin Permenter

THIS IDC MARKETSCAPE EXCERPT FEATURES HIGHRADIUS

IDC MARKETSCAPE FIGURE

FIGURE 1

IDC MarketScape Worldwide SaaS and Cloud-Enabled Accounts Receivable Automation Applications for Midmarket Vendor Assessment

IN THIS EXCERPT

The content for this excerpt was taken directly from IDC MarketScape: Worldwide SaaS and CloudEnabled Accounts Receivable Automation Applications for Midmarket 2020–2021 Vendor Assessment (Doc # US47032320). All or parts of the following sections are included in this excerpt: IDC Opinion, IDC MarketScape Vendor Inclusion Criteria, Essential Guidance, Vendor Summary Profile, Appendix and Learn More. Also included is Figure 1, Figure 2, and Figure 3.

IDC OPINION

The COVID-19 pandemic has simultaneously halted and changed much of society as we know it. We are living in times of unprecedented uncertainty and volatility. The first priority for companies is to quickly shore up their money and financial processes. Core financial processes such as collections,cash management, working capital, and managing spend have become even more critical to the business as companies large and small deal with the sudden impact from COVID-19.

FIGURE 2

YoY Growth in the Number of Businesses Planning to Use SaaS for

Accounts Receivable in the Next 12 months

During these times of uncertainty, businesses of all sizes turn to accounts receivable (AR) as an essential element of maintaining positive cash flow. In fact, AR, when done properly, can minimize revenue loss while simultaneously providing your customers with excellent customer service. While AR plays a role in the cash flow of the business, AR also plays a more subtle role as part of the company's customer service profile. While a customer may be in the collections process, the tone and communication must be well considered as they impacts how well or poorly the customer reacts to your collection efforts. Some of these customers may provide essential goods or services for your business. They may be strategic for other reasons as well, including scarcity or location. In any case, businesses must prioritize maintaining customer relationships and be strategic in their collection efforts. This is an essential aspect of a modern AR solution.

Benefits of Accounts Receivable Management

In many ways, the events associated with the COVID-19 pandemic have highlighted the AR professionals' need for transparency, flexibility, and visibility into their collections and cash management activities. Here are the key benefits of AR software:

- Improved cash flow/optimizing working capital. The inherent unpredictability of AR can often leave large sums of money tied up on the balance sheet. This is money the company cannot use to fund its operations. As a result, unlocking these funds becomes one of the top reasons for adopting a modern AR solution.

- Improved management and automation of the credit review processes. The credit review process can be complicated and slow — often requiring multiple exchanges with key stakeholders, both external and internal. This process can result in unnecessary and costly delays. Many modern AR applications offer tools to manage, or the ability to automate, aspects of the credit review process.

- Enhanced business insight. Moving away from manual AR processes and incorporating a modern solution allow greater analytic capabilities. A modern AR application will allow organizations to monitor cash flows and the AR staff to ensure maximum productivity.

- Enhanced customer experience. Not only must businesses effectively collect from their customers, but they must also be strategic about how they go about collecting from their customer as it can heavily impact business relationships. A modern AR application allows for managers to create individual collection plans for key customers or select customer groups to maintain a healthy business relationship.

The AR applications when implemented properly improve productivity, reduce layers of inefficiencies in antiquated technology and business processes, and bring additional flexibility to quickly respond to market changes