Learn how you can Increase cash flow, improve worklist prioritization and reduce DSO through AI Powered Collections Management Solution

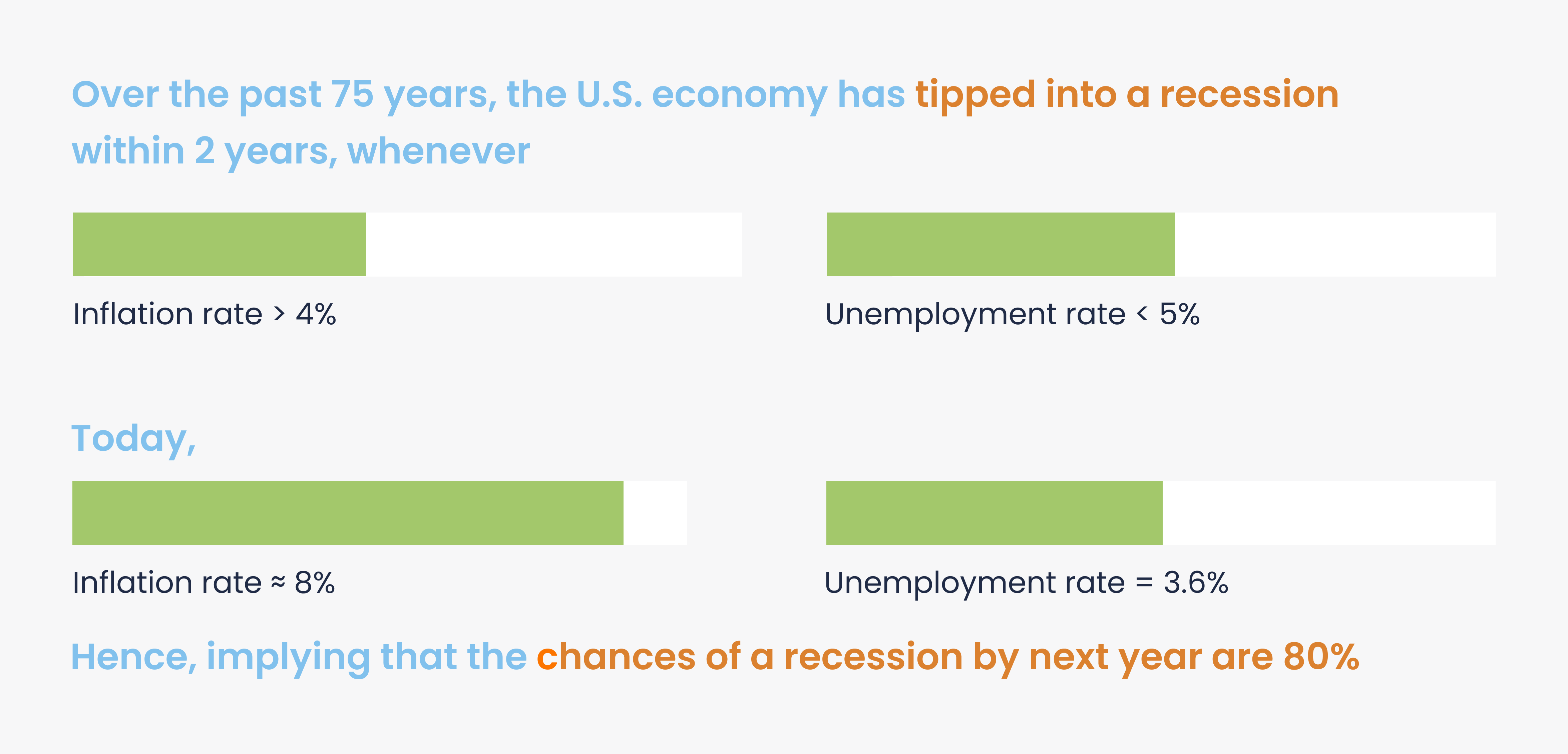

The Federal Reserve is increasing short-term interest rates and reducing its balance sheet to curb inflation, rising faster than it has in the past four decades. Consequently, experts and economists are forecasting a recession.

Preparing for a downturn begins with a cash flow analysis to evaluate your working capital and continues with rolling forecasts to help you adapt dynamically to economic changes.

This business guide provides CFOs with actionable financial insights and strategies for the next 100 days to withstand a potential recession and inflation surge.

The report is structured to provide immediate, interim, and long-term solutions to economic disruptions. The first chapter outlines the implications of an ongoing inflation rise and strategies for optimizing cash for a swift recovery.

The second chapter offers strategies for navigating the inflationary and intermediate periods preceding a recession. The third chapter presents a digital transformation journey while highlighting a gradual recovery plan.

Even if a recession never materializes, these best practices can make your company more resilient and prepared for practically any economic turmoil.

Key topics covered:

Under a typical Goldilocks scenario, inflation and economic growth are neither “too hot” nor “too cold” and the economy advances at just the right pace. However, if the Feds keep raising the rates as predicted, it will inevitably breach its “neutral” level, and the so-called “soft landing” for the United States economy will turn into a recession.

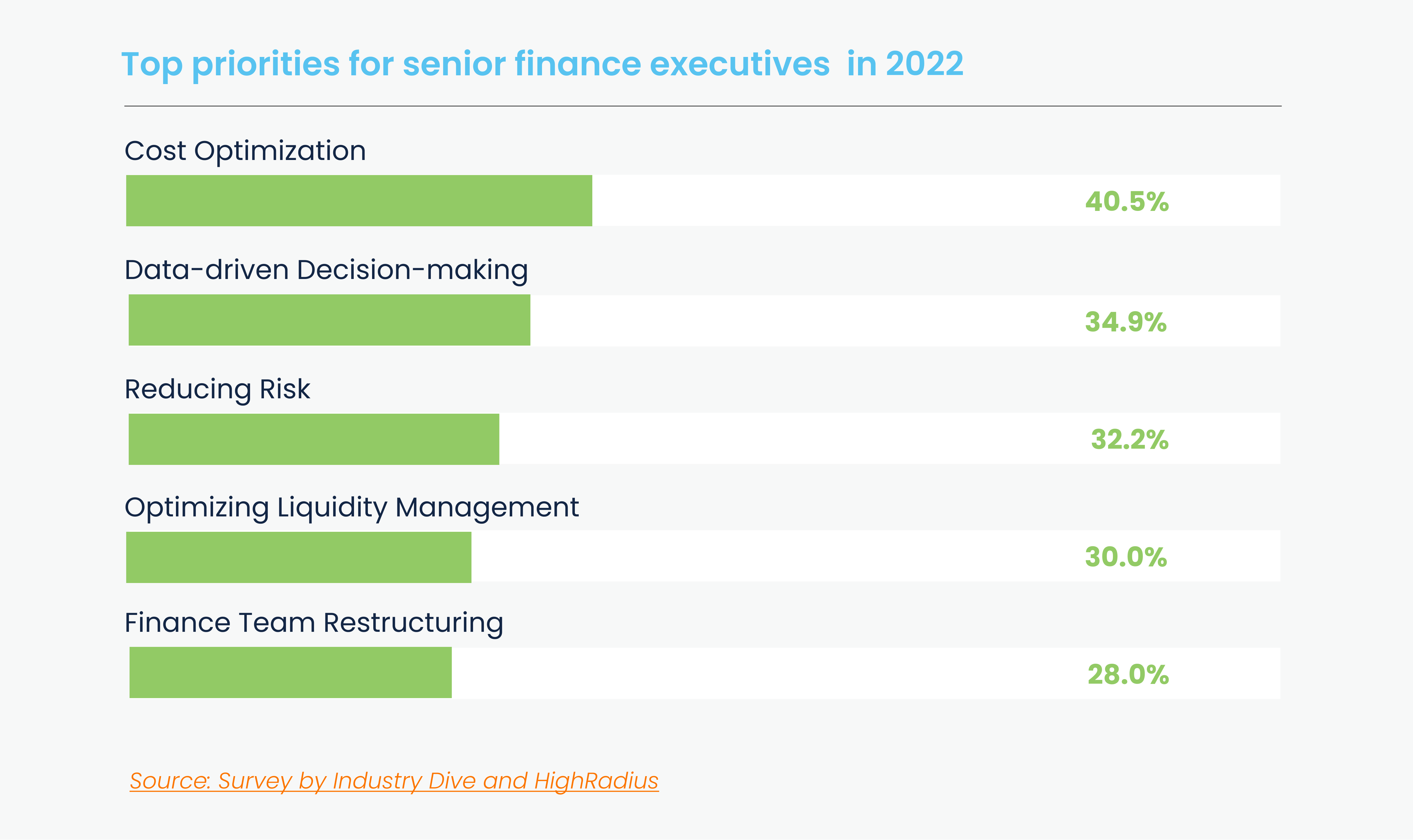

Facing the possibility of a flagging economy, the most crucial thing a business can do is take control of its finances, particularly cash flow. Finance leaders need to know how to pull back on expenses, and put a cease to all discretionary spending during these periods of tightened credit conditions and muted demand.

The United States is experiencing its highest inflation rate in nearly 40 years due to the supply chain disruptions and the pandemic relief funding.

If input costs continue to rise at this rate, keeping a recession at bay will become difficult. Reduction in sales, lender investments, and delayed client payments come hand-in-hand with recessions, all of which contribute to a major cash crunch.

The discontinuation of research initiatives due to financial constraints limits the ability of industries, like pharmaceuticals, to innovate and grow. Similarly, a drop in consumer demand and a rise in import and export fee pushes supply chain industries to reduce staff, which in turn delays the delivery of goods.

Discrepancies in invoices arise due to several reasons, such as:

Customers delay making payments when such errors occur, raising DSO and negatively affecting the company’s cash flow. In an ideal situation, disputes would be resolved in three days. However, the traditional dispute resolution process, which entails tedious, error-prone steps, might take weeks to complete.

Reducing invoice errors makes it easier for customers to make payments, thereby enhancing the cash flow. Below we discuss three strategies to minimize invoicing errors and the risk to cash flow:

When a recession strikes, less money flows in as a result of banks and lenders withdrawing funds. To keep up with payments, CFOs of companies with a large proportion of debts are forced to cut costs more aggressively, often through layoffs. These drastic reductions may have an impact on the business’s productivity and capacity to fund new investments.

However, another approach for businesses to avoid debt commitments is to issue equity. By investing in low-risk assets, companies can prioritize opportunistic investing. Thus, by rebalancing their financial portfolios and locking in today’s cost of capital in anticipation of interest rate volatility, companies can make the problem of defaulting less pronounced.

Recessions are often marked by a myriad of financial troubles such as an uptick in bankruptcies, decline in revenue, impact on consumer and business spending, etc. To remain afloat, business owners may be tempted to lay off employees to make short-term savings. However, the alternative – retaining personnel while lowering expenses elsewhere – might result in them being able to hit the ground running faster when the market resumes normalcy.

CFOs can optimize costs and maintain steady cash flows using robust financial projections that help identify the probable outcomes of different assumptions and the best steps to tackle them. There are various models that CFOs may employ to prepare their businesses for the best and worst-case scenarios:

Sensitivity analysis modifies one variable (supply chain expenses, expected sales, delivery costs, etc.) at a time and shows the impact of that modification. CFOs can determine which variables are most important to their company’s success by using these models. These forecasts assist businesses in developing the ideal collection strategies for various scenarios, such as prioritizing the accounts that will have the highest liquidation probability.

Scenario analysis helps modify many factors at once, including past, and future developments that will have an extended impact on the firm. It can be used as a tool to identify and mitigate risks that do not currently exist. Businesses, for example, can maximize credits by identifying which customers are likely to default and then adjust their credit scores and limits accordingly.

When preparing for a market downturn, a scenario approach helps with long-term strategic planning—for example, reducing OpEx by focusing on high-value customers while re-evaluating the low-hanging fruits.

Even though each recession is different, they’re all followed by a period of economic recovery. CFOs should be ready for what comes next – both the best-case and worst-case scenarios.

During the period of recovery, CFOs must effectively communicate to their customers that they are a priority and that the company is available for business, in addition to demonstrating to stakeholders that the company remains economically sustainable.

The fear of uncertainty surrounding a recession makes CFOs frequently resort to conservative, tried-and-tested strategies like cost-cutting or cash preservation. However, they must remember that while these solutions are effective in the short term, they do not put the company on the path to long-term economic growth and profitability.

As economic guardians of their organizations, CFOs need a clear view of the company’s cash flow and financial model to navigate their businesses through the period following the recession.

These can be done with the help of “real-time” planning using forecasting techniques that model rapid changes to external factors through a continuous cycle of data collection and analysis. These models use financial and operational data from ERP systems as well as external market information from government agencies.

The sheer amount of data can be overwhelming during periods of market volatility and rapid change, making analysis difficult. Finance planning and analysis teams spend 75% of their time gathering and processing data.

Thus, CFOs must strive to automate their finance teams’ financial modeling capabilities with a planning and budgeting tool for greater accuracy and efficiency.

Previous recessions and inflation have shown that downturns generate organic and inorganic growth prospects that differ from those that arise during boom times. Before making investment decisions, CFOs must examine the validity of these opportunities by studying long-run industry economics, and not try to catch a falling knife and risk their firms going bankrupt.

Finance automation is fast becoming table stakes for CFOs aiming to eliminate repetitive manual activities while increasing their financial teams’ strategic and analytical contributions in 2023 and beyond. Automation tools provide visibility, actionable insights, and analysis using real-time customer and accounting data.

Automation tools assist CFOs in overcoming hurdles, develop new capabilities, and reposition the business for a new environment. A modern finance solution like autonomous finance can help CFOs build stronger businesses and achieve their goals and priorities for 2023.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Talk To A Financial Expert