41% of companies plan AP automation within a year

68 percent of companies still waste time and money on manual invoice processing. Are you one of them?

68

percent of companies still enter invoice data manually

15

dollars is the average cost to process one invoice

20

percent of AP teams are fully automated

23,333

invoices per year can be processed by one AP employee

If you think accounts payable is just a back-office task, think again. The numbers for 2025 show AP is a critical area that affects cash flow, supplier relationships, and overall financial health. Manual processes are still widespread and costly, but automation is growing fast and changing the game.

Let’s look at the key stats every finance leader should understand to plan for the future.

68% Still Enter Invoice Data Manually

More than two-thirds of businesses still key invoices manually into their ERP or accounting systems. This slows down the process and increases the chance for errors. Manual entry adds a hidden cost in time and money. Paper invoices add to the problem. Around 37% of companies still rely on paper receipts, which increase mailing costs and administrative work.

Even when invoices are digital, 57% of the data must be entered manually. This creates bottlenecks and wastes staff time that could be spent on higher-value work.

$15 to Process One Invoice Manually

Processing an invoice by hand costs an average of $15. This may not sound like much, but multiply that by the number of invoices a business handles each month, and it adds up quickly.

Some companies process over 10,000 invoices a month, leading to millions in annual AP processing costs. Moving to electronic invoicing can cut costs by up to £10 per invoice and reduce errors. Automation also dramatically increases productivity. A fully automated AP employee can process over 23,000 invoices a year compared to just 6,000 in manual setups.

14.6 Days to Process an Invoice on Average

Manual invoice processing takes nearly two weeks. During this time, working capital is tied up, and suppliers wait longer to get paid. This delay often means missed early payment discounts and strained supplier relationships. Longer payment cycles can weaken a company’s negotiating position. Automation shortens this cycle significantly. Faster approvals and payment releases improve cash flow management and help businesses react quickly to opportunities or challenges.

39% of Invoices Contain Errors

Almost four out of ten invoices have errors such as wrong amounts, missing data, or incorrect purchase order matches. Each error causes delays because the AP team must spend time verifying and correcting the problem. This slows payments and adds stress to teams. It also risks damaging vendor relationships. Automation reduces errors by automatically matching invoices to purchase orders and receipts. This lets AP staff focus on exceptions rather than routine fixes.

66% of Businesses Say AP Is Essential

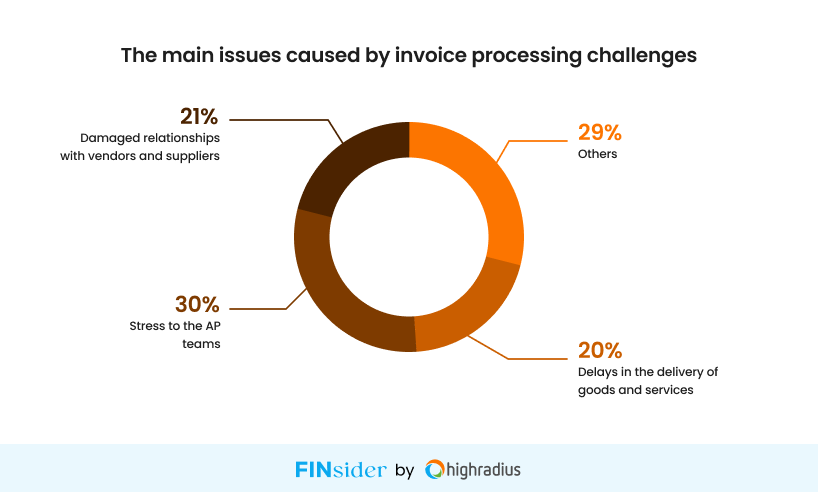

AP is not just a routine task for most companies. Two-thirds say it is essential to their operations. But processing challenges cause stress for 30% of AP teams and lead to damaged supplier relationships in 21% of cases. Delays also cause problems with delivering goods and services. The biggest challenges are managing exceptions and too much manual data entry. Nearly a third of businesses say their AP teams need better tools to handle sudden spikes in invoice volume.

Smaller Businesses Still Lag in Automation

48% of small businesses continue to use paper invoices, which adds costs and slows down payment cycles. Most small and medium businesses manually enter invoice data – 86% for SMEs and 65% for mid-sized firms. Only 38% of mid-sized companies send invoices by email, showing many still balance old and new methods. Larger companies have moved faster; 65% of big firms use automated data entry, and fewer rely on paper invoices. However, complex approval processes remain a hurdle, with 29% of enterprises requiring six or more approvals per invoice.

Late Payments Still a Big Issue

In the US, only 36% of invoices are paid on time, and more than half are paid late. Small businesses typically receive payments about eight days past the deadline. Late payments seriously affect operations. 28% of business owners report delays in hiring due to slow payments. Payment terms vary, with most setting 30 days, but micro businesses often require payment within seven days. These late payments increase pressure on cash flow and complicate budgeting.

Automation Is Growing Quickly

Fully automated AP teams have nearly doubled in two years, now at 20%. Another 41% plan to automate their payables within the next 12 months. The most common automated tasks are invoice management, purchase order management, and expense management. Tools like bank statement converters are becoming popular to help integrate financial data faster. Many expect full AP automation within 1 to 3 years. Despite this, 68% of invoice data still gets entered manually today.

88% Believe Automation Frees Finance Teams for Strategy

Almost nine out of ten finance leaders say automation allows their teams to focus on strategic initiatives. When repetitive tasks are automated, finance staff can work on cash flow forecasting, supplier relationships, and spend analytics. This shift changes AP from a cost center into a growth enabler.

According to Xerox, switching from paper to electronic invoicing can cut costs by up to £10 per invoice. The U.S. government estimates that e-invoicing could save $450 million every year by cutting costs by half. Automation also boosts productivity, as a single AP employee can handle more than 23,000 invoices a year compared to just 6,000 with manual processing.

Market Growth Reflects Rising Demand for AP Automation

The global accounts payable automation market was valued at $3.08 billion and is expected to grow at a 12.8% annual rate through 2030. Spending on invoice automation and supplier e-invoicing software will reach nearly $1.75 billion by 2026, almost doubling since 2021. The total AP market size was $1.219 billion in 2023 and is projected to grow to $2.79 billion by 2032.

Most Businesses Still Struggle with AP Metrics

Only 9% of companies say their method for measuring AP performance is highly effective. Most still rely on spreadsheets or manual tracking with whiteboards and emails. Better data and automation would improve reporting and decision-making.

What CFOs Should Take Away from These Numbers

Accounts payable remains a major challenge for many companies. Manual processes cost time and money, delay payments, and increase errors. Automation is proven to reduce costs, speed up processing, and free finance teams for more valuable work. Businesses that adopt automation quickly will improve cash flow, strengthen supplier ties, and gain a strategic advantage. For CFOs, the question is not if but how fast they can make the change to reap the benefits.ard conversations. Delay increases the chance of missed savings, reporting errors, or surprises at year-end.

Want more insights? Subscribe to our finance newsletter for the latest in finance—from the best finance newsletters and compelling finance stories to treasury, R2R and AR insights.

Linkedin

Linkedin

Facebook

Facebook

Twitter

Twitter

Copy url

Copy url