70% of CFOs Remain Confident Despite Trade and Supply Issues.

How are CFOs turning uncertainty into opportunity in 2025?

70%

of CFOs feel good about their company’s finances

94%

worry about tariffs and trade risks

57%

plan to invest in tech and digital change

50%

expect to do mergers or acquisitions soon

Nearly 70% of CFOs say their company’s financial health is strong despite market turbulence. If you think finance leaders are just waiting for the storm to pass, think again. They’re managing inflation, tariffs, supply chain chaos, and geopolitical risks while driving growth. The real question is how they balance caution with bold actions to keep their organizations ahead. Let’s explore what’s fueling CFO confidence and what keeps them awake at night.

70% of CFOs Feel Positive About Current Financial Health

CFOs are confident because they have strengthened financial controls and adapted to inflation and supply challenges. Many are also investing in AI and automation tools like Agentic AI to gain clearer insights and accelerate decision-making. These technologies help identify risks early and enhance forecasting. Despite this, CFOs remain cautious due to ongoing trade and market uncertainties. Their optimism stems from combining smart risk management with advanced technology and agility.

94% of CFOs Are Concerned About Tariffs and Trade Policies

Trade disruptions top their risk list. Almost all CFOs worry about tariffs affecting costs and margins. To respond, 68% plan cost cuts, 44% diversify supply chains, and 41% engage with policymakers. This mix of defense and offense shows savvy leadership under pressure.

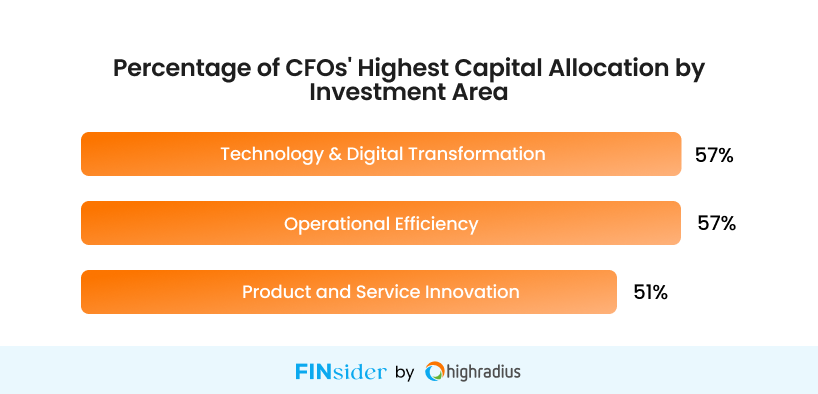

57% of CFOs Are Prioritizing Technology and Digital Transformation

CFOs are betting big on tech to build agility. Over half are investing in digital tools and operational efficiency, while 51% are pushing innovation in products and services. These investments are their ticket to thriving amid disruption.

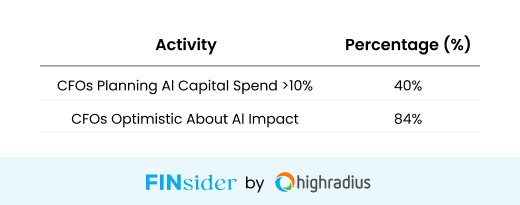

40% of CFOs Will Allocate Over 10% of Their Budgets to AI

Artificial intelligence is no longer just hype. With 84% expecting AI to boost their business this year, CFOs are pouring funds into AI projects. This shows a clear belief that AI will be a game-changer for competitiveness and growth.

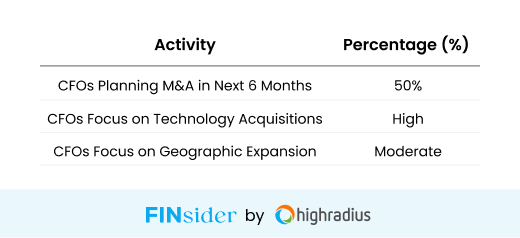

50% of CFOs Plan Mergers and Acquisitions Within Six Months

Deals are heating up. Half of CFOs aim to expand through M&A, focusing on technology, horizontal growth, and new markets. They know success means more than good financials. It requires culture fit and smooth integration.

63% of CFOs Expect Supply Chain Disruptions This Year

Supply chains remain fragile. Most CFOs are preparing for interruptions that could impact costs and delivery. Cost control and diversification strategies show they’re building resilience while chasing growth.

84% of CFOs Are More Optimistic About AI Than a Year Ago

Optimism around AI is climbing fast. CFOs see it as a tool to drive innovation and efficiency, signaling that technology is at the core of future business success.

What’s Driving CFOs to Lead Boldly in Chaos?

CFOs are no longer just keeping the books balanced. They are stepping up as fearless leaders who see opportunity where others see risk. Their mix of sharp strategy and steady optimism is rewriting how businesses navigate uncertainty. In 2025, CFOs are not just managing finances. They are driving growth and innovation in the face of constant change. What is next on their playbook? Stay tuned.

About Survey: A recent survey by Dallas-based professional services firm RGP polled 63 CFOs from companies with over $500 million in revenue. The study highlights how CFOs are taking on bigger roles, balancing financial management with leading organizational change. missed savings, reporting errors, or surprises at year-end.

Want more insights? Subscribe to our finance newsletter for the latest in finance—from the best finance newsletters and compelling finance stories to treasury, R2R and AR insights.

Linkedin

Linkedin

Facebook

Facebook

Twitter

Twitter

Copy url

Copy url