40% of CFOs Say Trade Policies Keep Them Awake

What do you get when you raise prices but sell less? For many CFOs, 2025 might just hold the answer, and it’s not pretty.

40%

of CFOs say tariffs are a top worry

6.6%

expected cost increase

41%

delayed investments

13%

building cash reserves

What happens when prices go up, but customers hold back? For many CFOs, 2025 could be the year that answers that question, and not in a good way.

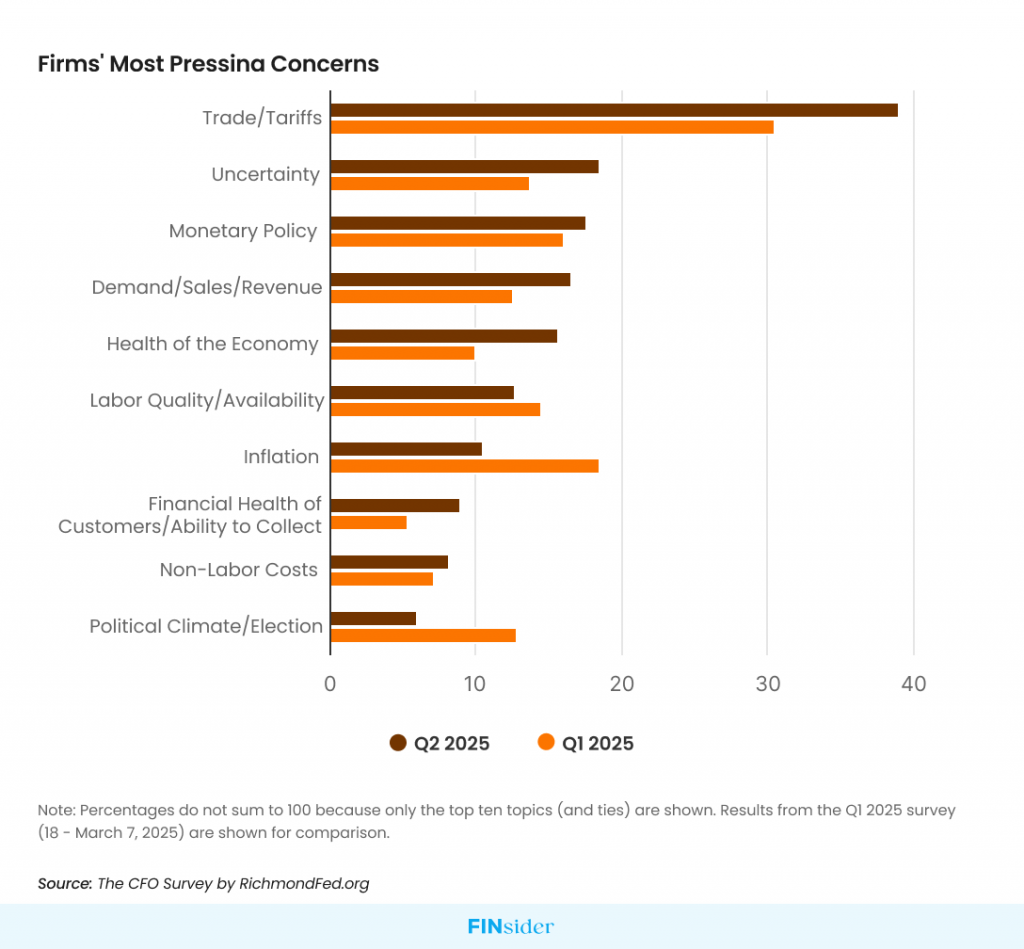

The latest Q2 CFO Survey from Duke University and the Federal Reserve Banks of Richmond and Atlanta paints a clear picture. Forty percent of CFOs now list tariffs and trade policy as one of their top concerns.

That’s the highest level since the pandemic and even higher than during the U.S.-China trade standoff.

This time, it’s not just a policy worry. It’s a real financial problem.

Rising Costs, Shrinking Margins!

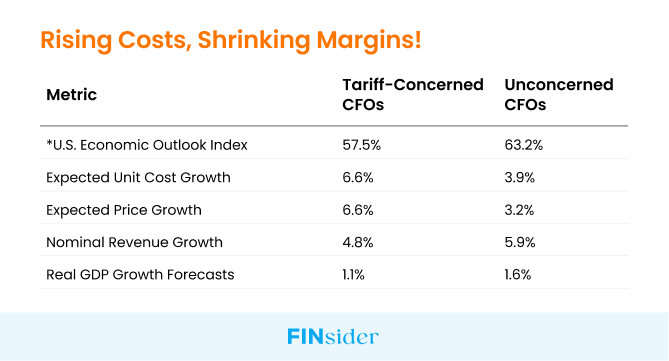

CFOs who are concerned about tariffs expect both unit cost growth and price hikes to hit 6.6 percent. But their revenue expectations don’t match. They’re projecting only 4.8 percent revenue growth, which means real revenue is taking a hit. The costs are rising faster than the returns.

In contrast, CFOs who aren’t worried about tariffs expect cost growth of 3.9 percent and revenue growth of 5.9 percent. So they’re not just keeping pace, they’re growing. The difference is not just a matter of sentiment. It’s shaping performance.

As Brent Meyer from the Atlanta Fed put it, “Nominal revenue is failing to outpace price growth. That means real revenue is falling for these firms.”

How CFOs Are Responding?

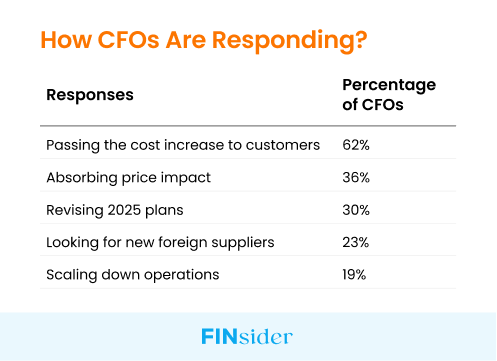

The survey shows most CFOs are making moves, but the responses are all over the place:

Meanwhile, 38% of those not concerned about tariffs say they’re doing nothing. That gap says a lot about how uneven the impact feels and how differently companies are preparing for it.

Investment Freeze Is Real

Tariff uncertainty isn’t just a boardroom conversation. It’s holding back spending. Around 41% of CFOs said they have postponed or pulled back on investments in the first half of 2025. That’s not just defensive. It’s a signal that growth is being pushed to the sidelines.

And the broader numbers back that up. Median GDP growth expectations fell from 1.9 to 1.4 percent since Q1. The chance of a U.S. contraction jumped from 15 to 23 percent. The caution is real and growing.

What’s the Play?

CFOs are weighing tough decisions. Should they raise prices and risk sales, or hold prices and take a margin hit? The survey shows many are still deciding. A few are taking action, but most are stuck in between, adjusting but not transforming.

That middle ground may not hold. 2025 could be the year that separates the ones reacting from the ones leading.

Missed Opportunities?

Here’s the part that stands out. Only 6 percent is nearshoring production. Just 13 percent are building up cash. In a high-risk, high-uncertainty environment, those are some of the lowest-used levers. The door is wide open for CFOs willing to shift from short-term protection to long-term positioning.

If most are stuck playing defense, it might be the right time to play offense.

About the survey: The Q2 2025 CFO Survey by Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta gathered responses from around 465 U.S. CFOs between May 19 and June 6. Response counts varied slightly by question, ranging from 451 to 496.

Want more insights? Subscribe to our finance newsletter for the latest in finance—from the best finance newsletters and compelling finance stories to treasury, R2R and AR insights.

Linkedin

Linkedin

Facebook

Facebook

Twitter

Twitter

Copy url

Copy url