77% of CFOs Report a 2x ROI from Gen AI Investments in 2025

Are CFOs investing fast enough or just stuck in pilot mode as AI agents rewrite how work gets done?

77%

see 2x ROI from Gen AI

46%

feel economic pessimism, but still push forward

42%

make scenario planning a daily habit

46%

are revamping supply chains for tariff defense

Tariffs. Trade deals. Tax reforms. If the past few months felt like a corporate rollercoaster, you’re not alone. But for CFOs, this isn’t a ride you hold on to. It’s one you learn to steer.

Grant Thornton’s Q2 2025 CFO survey captures insights from more than 260 finance leaders navigating this volatile terrain. But instead of pumping the brakes, they’re shifting gears and doubling down on strategy. What’s emerging isn’t hesitation. It’s precision.

Let’s break down the data shaping CFO playbooks and explore how volatility is becoming less of a threat and more of a lever.

46% of CFOs Pessimistic on Economy, Yet Planning More Aggressively Than Ever

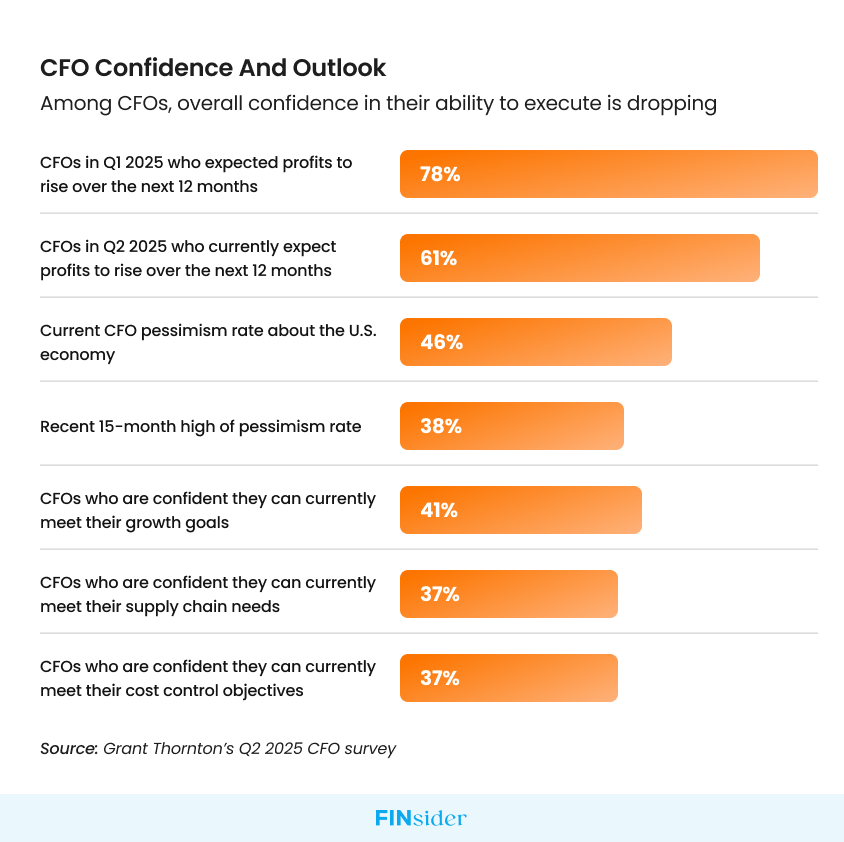

Economic confidence may be slipping. 46% of CFOs say they’re pessimistic about the U.S. economy, a 15-quarter high. And just 61% expect profits to rise, down sharply from 78% last quarter. Confidence around growth, cost control, and supply chain targets has also dipped to a three-year low.

But this isn’t a retreat. CFOs are reacting with clarity and boldness. They’re planning as if volatility is here to stay and reshaping their operations to match.

42% Embrace High-Frequency Scenario Planning as a Daily Discipline

Forget annual strategy offsites. Nearly half of finance leaders now treat scenario planning as an operational core, not an academic exercise.

What’s changing:

- Models now account for tariffs, tax shifts, M&A volatility, and even geopolitical shockwaves

- Acquisitions and divestitures are being pre-baked into base-case planning

- Teams are being trained to update models in real time, not quarterly

In short, it’s chess, not checkers. And CFOs are playing to win in multiple futures at once.

46% of CFOs Rebuilding Supply Chains for Tariff Defense

Almost half of finance leaders are realigning their supply chains to offset tariff risks. That’s the highest level seen in three years.

Manufacturing and retail CFOs are particularly aggressive, investing in domestic sourcing, renegotiating supplier contracts, and incorporating geopolitical risk into procurement strategies.

The days of viewing the supply chain as a back-office function are over. For modern CFOs, it is now a boardroom-level strategic asset.

77% See 2x ROI from Gen AI, Making Tech the New Margin Insurance

Tech is no longer a transformation buzzword. It’s a survival tool and one that’s already paying off.

Among CFOs tracking ROI from their generative AI deployments, 77% report at least a 2x return. That’s up from 68% last quarter.

Where the wins are happening:

- Cost reduction through automated workflows

- Faster close cycles with AI agents

- Infrastructure modernization that’s scalable, not splashy

This isn’t about moonshots. It’s about stacking small wins fast and defending margins in the process.

35% of CFOs Raise Prices, but with a Data-Led Precision Strategy

A third of CFOs are using pricing as a tool to buffer inflation and tariff-driven costs. But blanket price hikes are out. Precision pricing is in.

What they’re doing:

- Applying customer segmentation to determine who can absorb increases

- Using value-based pricing models to stay competitive without racing to the bottom

- Deploying dynamic pricing systems that adjust in real time

CFOs are treating pricing as a growth engine, not just a response to cost pressure.

51% Prioritize Customer Growth as Sales and Marketing Spend Surges

More than half of CFOs say customer acquisition and retention is now a top priority, up 13 points in just one quarter.

That shift is being backed with a budget. Sales and marketing spend is rising sharply, and finance teams are increasingly involved in customer analytics, loyalty models, and lifecycle optimization.

It’s not just about P&L anymore. It’s about understanding and funding the full customer journey.

Only 42% Believe Tax Reforms Will Help. The Rest Are Running Simulations Now

With uncertainty swirling around bonus depreciation, R&D tax treatment, and clean energy credits, tax reform has moved from background risk to active modeling territory.

While just 42% believe proposed tax changes will benefit their businesses, 33% anticipate negative financial impacts. The result?

CFOs are running scenario models early, revisiting investment timing, and getting proactive with capital allocation choices before legislation locks in.

Different Sectors, Different Playbooks: Volatility Hits Unevenly

No two industries are reacting the same way:

- Banking CFOs are doubling down on scenario planning while M&A pipelines slow

- Manufacturing and retail leaders are moving aggressively on cost absorption via domestic sourcing

- Tech and telecom players are leaning hard into automation to balance client-side spending slowdowns

The most astute CFOs are learning from cross-industry strategies and tailoring tactics to their own unique volatility fingerprints.

Confidence Isn’t a Mood. It’s a Model

Yes, 61% of CFOs still believe profits will grow in the next year. That isn’t blind faith. It’s strategic confidence.

They’re budgeting for volatility, modeling for shocks, and finding small wins that compound. They’re not just reacting to a turbulent economy. They’re learning how to weaponize it.

The real question, then, isn’t whether volatility will continue. It’s this:

Are you trying to survive it, or are you ready to make it your competitive edge?

About our survey: Grant Thornton surveyed more than 260 finance leaders from organizations with more than $100 million in revenue from April 30 through May 9. Industry representation was diverse, led by retail (16%), technology and telecommunications (16%), banking (14%), manufacturing (14%), and healthcare (10%).

Want more insights? Subscribe to our finance newsletter for the latest in finance—from the best finance newsletters and compelling finance stories to treasury, R2R and AR insights.

Linkedin

Linkedin

Facebook

Facebook

Twitter

Twitter

Copy url

Copy url