Automated Accounts Payable Forecasting

One-size-fits-all AP forecasting drains working capital.

AI adapts by vendor and timing to forecast smarter and protect your liquidity.

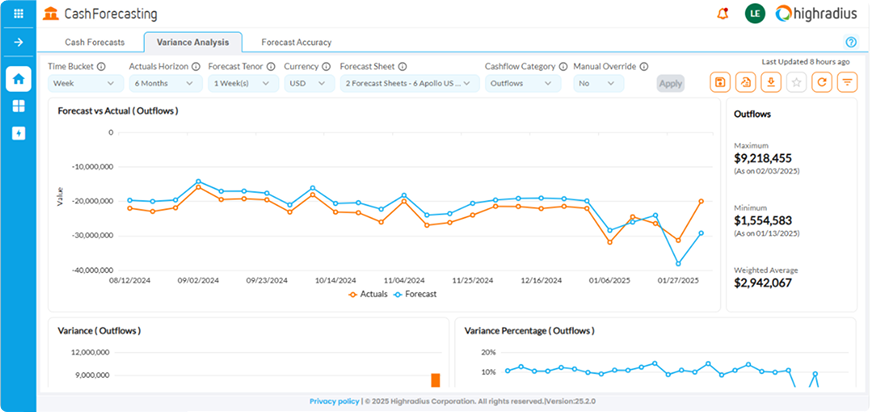

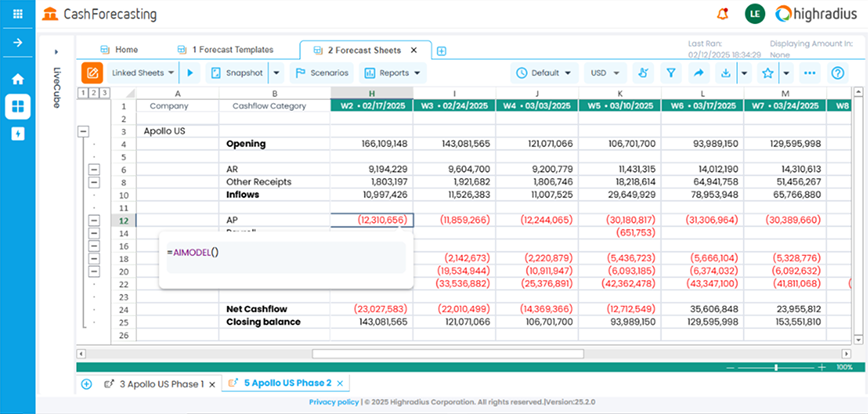

- 95%+ Forecast Accuracy

- 70% boost in forecast productivity

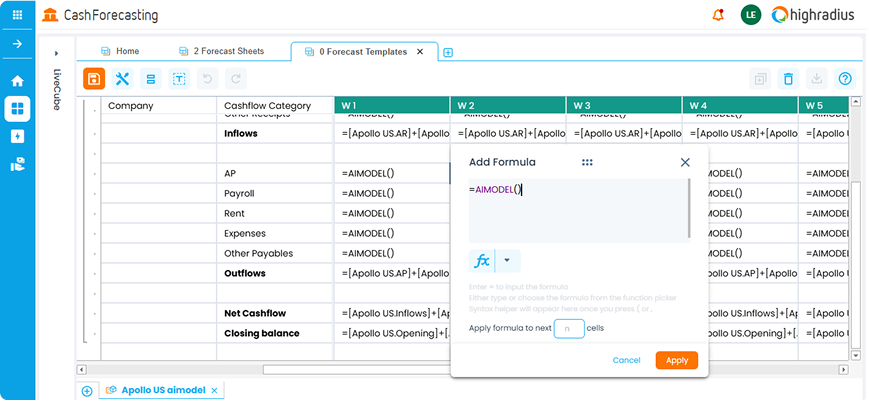

- Predict vendor-level payments using historical trends

Trusted By 1100+ Finance Teams Globally

See how AI can build

95% accurate cash forecast

Just complete the form below