Businesses, irrespective of their revenues or industries, face many challenges when performing treasury functions like managing cash flows, maintaining adequate liquidity, preventing and mitigating financial risks and so on. That’s where a treasury management system comes into play. It’s a comprehensive software that helps streamline treasury functions and enhance financial performance.

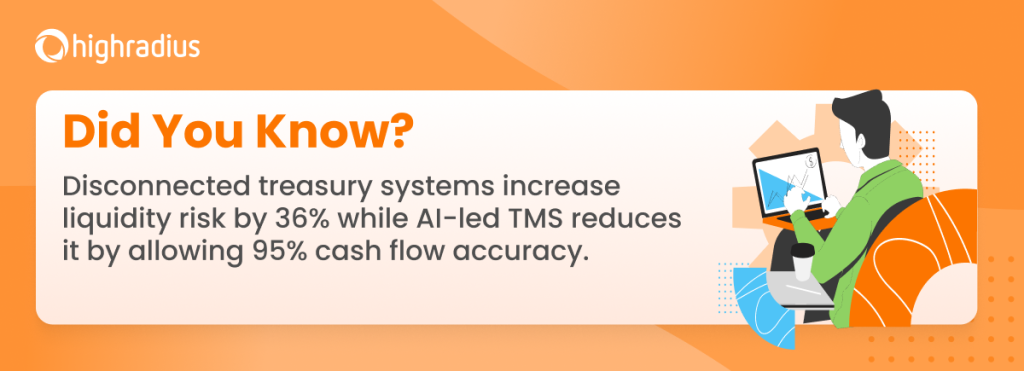

However, treasurers often complain about the complexities of a conventional treasury management system as it often lacks proper integration with banks and ERPs, multiple and siloed systems, forcing them to still work with spreadsheets manually. To fill in these gaps, HighRadius presents its Treasury and Risk Management suite. It offers automated solutions with features like bank connectivity, scenario analysis, auto-ML forecasting, and more.

Now, the question is why a treasury management system is important. Treasury systems enhance visibility over cash positions, minimize borrowing costs, and increase returns through smart investments. Moreover, corporate treasury software help achieve financial stability in a dynamic business environment.

9 out of 10 companies STRUGGLE with cash visibility.

this company achieved 100% real-time accuracy while you’re still guessing!

A treasury management system focuses primarily on optimizing treasury operations and the financial activities of the business. Enterprise resource planning (ERP) system, on the other hand, provides a comprehensive suite of integrated applications to manage core business processes across functions like finance, supply chain, and sales.

While treasury solutions focus on financial management and treasury operations, ERP covers a broad spectrum of business functions, catering to numerous operational needs to ensure operational efficiency. Despite their distinct roles, TMS and ERP can complement each other by sharing data and facilitating seamless workflows. Integrating the two systems can help businesses ensure that financial data is synchronized across departments to support decision-making and improve business performance. For instance, synchronized financial data helps to manage cash flows and optimize resource allocation.

The functions of treasury solutions include automating financial tasks, centralizing financial data, treasury risk management, checking compliance with regulatory frameworks, liquidity management, supporting multi-currency, vendor and bank connectivity, and budgeting and cash projection.

One of the most important functions of a treasury management system is to automate repetitive, manual tasks like gathering data from ERPs, processing spreadsheets, recording and reconciling transactions, posting to the general ledger (GL), getting real-time insights from bank accounts, and more.

HighRadius offers a treasure trove of features that not only automate regular treasury functions but also increase productivity by 30%. Solutions like cash accounting software help businesses handle GL posting rules for bank transactions. It automatically generates GL entries for bank transactions. It also posts GL entries for bank transactions to ERP. In addition to this, bank and cash reconciliation automates the reconciliation between planned prior-day cash transactions and bank statement items and identifies unmatched items in bank statements or cash transactions.

Treasury systems help aggregate financial data from all vendor and bank platforms into one single source of truth. This makes it easy for businesses to access critical information and analyze it for financial reporting and data-driven decision-making.

Our treasury solutions provide 100% bank statement aggregation to help businesses manage the lifecycle of bank accounts, from requesting, opening, modifying, and closing bank accounts. It also offers out-of-the-box support to parse the industry-standard bank file formats (BAI2, MT940), making it easy to access real-time insights into bank statements that have been received and processed.

One of the main purposes of using treasury systems is to create accurate and robust budgets and cash projections. Our automated, machine-learning system is trained on historical data to create accurate forecasts. Businesses can select the best-fit models out of hundreds of pre-designed templates with numerous combinations of categories and time frames.

A treasury management system is also responsible for making sure that financial data and reporting adhere to regulatory requirements. All the transactions posted to accounts must be recorded as per generally accepted accounting principles (GAAP) regulations and in the correct format.

The cash accounting feature in our automated cash management solution makes sure that accounting rules are adhered to when automating the posting of transactions to general ledgers. Additionally, based on the accounting rules defined, the system automatically generates GL entries for bank transactions daily.

Businesses that operate in global markets must be able to handle different currencies. A good TMS helps them manage conversion rates and handle currency fluctuations and risks effectively. Our entire Treasury suite is specifically designed to handle various currencies at once and process transactions across the globe. It provides out-of-the-box connectivity with 75+ global banks and offers pre-built payment format libraries, reducing bank onboarding time.

A treasury management system should be quick and efficient enough to detect any anomalies and fraud in transactions and protect any sensitive financial data. Our automated treasury payment software offers a payment anomaly identification feature that detects 90% of errors in payments, eliminates the risk of fraud, and identifies and flags any suspicious payments.

Treasury solutions primarily aggregate data from various sources, like banks’ ERPs and investment portfolios, giving a comprehensive overview of a company’s financial performance and cash position. This information further enables treasurers to make data-driven decisions, reducing borrowing costs and the risk of cash shortages.

Treasury systems also provide tools to manage financial risk, including foreign exchange risk, interest rate risk, and credit risk. They help businesses track and handle these risks in real time, giving a snapshot of risk exposure and aiding in proactive financial risk management.

A treasury cash management monitors cash inflows and outflows and gives clear visibility of transactions across bank accounts. It ensures that a business has enough funds to fulfill its obligations and operational needs and can utilize idle cash to generate better yields.

HighRadius brings state-of-the-art Treasury Cash Management Software that not only help businesses streamline their cash flows but also generate fully automated global daily cash visibility across all their banks, countries, and currencies to make timely investment and borrowing decisions. It also reduces the manual effort of reconciling and positioning cash, increasing cash management productivity by 70%.

A TMS helps identify and analyze various financial risks arising from internal reasons like operational inefficiencies or inadequate working capital and external factors like market volatility or changing industry trends. Check out our financial risk management software, which offers features like:

These financial forecasting tools help businesses manage and mitigate credit and liquidity risk, enhancing economic performance and operations.

Businesses need just enough liquidity to meet their short-term financial needs. Inefficient liquidity management means a company will have a hard time meeting debts and vendor obligations. But too much reserves is also not a good sign. It means the company is not utilizing its assets or cash efficiently to generate returns and is not making potential investments.

Our financial instrument management tool helps manage debt and investment instruments for both fixed and floating rates of interest. It will auto-populate settlement instructions, view interest payments, repayments, reinvestment, etc., and reflect all related cash flows automatically in cash position and cash forecasting. For instance, the business has a 5-year term loan for $10 million at 6% interest. If the loan starts on April 1, 2024, and ends on April 1, 2029, the system will create an expected outgoing payment of $50,000 in cash management and cash forecasting every month for interest payments.

Treasury solutions help businesses study historical data, trends, and patterns in changing business outcomes and find out the underlying reasons behind alterations. It helps adjust budgets and cash flow planning to maximize reserves and revenues and handle unexpected costs and uncertainties.

Our Automated Cash Forecasting software are thoughtfully designed to empower treasury management solutions for accurate and effective forecasting. It generates highly accurate AI-driven cash projections for up to 12 months for all cash flow categories, like accounts receivables and payables, payroll, etc. Moreover, by auto-generating and auto-consolidating cash predictions, our AI-led forecasting system helps businesses unlock 95% cash forecasting accuracy.

Treasury management software for banks help treasurers manage all operations relating to bank account management : signatory tracking, FBAR reporting, the bank document library, and the opening, changing, and closing of bank accounts.

Our treasury cash management solutions offer the feature of bank account management that levels all these basic treasury functions. Businesses can easily manage all bank account-related documentation in a central online repository, import, update, and terminate signatories in bulk, and create output that allows clients to submit FBAR reporting, both for individuals and companies.

By automating manual processes and streamlining workflows, a TMS increases the efficiency of treasury operations. It helps treasurers execute tasks such as cash forecasting, payment processing, and reconciliation more quickly and accurately, so they can free up their productive time to focus on strategic decision-making.

A treasury management software for banks consolidates and centralizes financial data from multiple sources, ensuring a real-time view of a business’s cash positions. It also gives accurate and effective financial forecasts to help companies better manage liquidity, optimize working capital, identify cash deficits, and ensure sufficient cash reserves.

A TMS helps companies optimize cash utilization and minimize idle cash balances. By centralizing cash positions and automating cash pooling arrangements, treasury departments can effectively manage working capital and reduce borrowing costs.

Treasury systems integrate with multiple sources and automate the data-gathering process. It eliminates the errors that commonly occur in manual processing. Additionally, TMS provides standardized reporting formats and customizable report templates, ensuring consistency.

Through advanced analytics and scenario modeling functionalities, treasury solutions empower treasury professionals to make data-driven financial decisions. Whether evaluating investment opportunities, assessing funding options, or optimizing cash flow, organizations can leverage the insights generated by the TMS to drive strategic initiatives and enhance shareholder value.

Treasury functions are under pressure to manage tighter liquidity, rising volatility, and growing transaction volumes without increasing operational risk. Spreadsheet-driven cash management and fragmented bank connectivity no longer provide the control or speed banks need. Modern treasury management software for banks replace manual coordination with real-time visibility and automated execution.

Treasury management software for banks unifies cash balances, debt positions, and short-term investments across all bank accounts in real time. Direct bank integrations eliminate manual statement uploads and provide continuous intraday updates. Predictive cash forecasting and automated risk monitoring allow treasurers to act immediately on liquidity shortfalls, control funding costs, and strengthen day-to-day cash governance.

Despite helping businesses enhance their treasury functions, treasury management solutions come with significant challenges.

A treasury management system often includes upfront costs and initial purchase expenses. Combined with ongoing maintenance and purchase costs, it becomes difficult for businesses to realize the full potential of a treasury management system and optimize their financial management.

A TMS is often extremely intricate with a complicated interface, leading to slow adoption by the team. The need for rigorous training and resources not only disrupts the workflows but also hinders the potential of deploying a TMS.

Although a treasury management system helps centralize data, the reliability and integrity of the data collected will remain in question. Due to a lack of automation and custom-built models, there are always higher chances of errors, anomalies, and ambiguity when posting data to dashboards from ERPs manually, leading to inaccurate analysis.

One of the biggest problems with a legacy treasury systems is ineffective integration with vendor and bank platforms. A good TMS must be trained on historical transactional data, pull data from various ERPs seamlessly into dashboards, and help businesses make accurate analysis.

The sole purpose of a treasury management system is to adapt and scale with the changing business requirements. This means businesses will have to invest additional funds to implement upgrades or switch to an alternative, incurring more costs and resources.

A treasury management system deals with sensitive financial information. Any unauthorized access or data breaches will have severe implications for the business’s performance and reputation. A TMS must have robust security features and protect transactions and financial data from fraud and breaches.

Regulatory frameworks for recording and processing financial transactions vary across regions and change from time to time. Businesses must keep their treasury systems updated and ensure it complies with financial regulations like GAAP, the Sarbanes–Oxley Act of 2002 (SOX guidelines), IFRS, and so on. Any failure to comply with them will result in penalties and a damaged reputation.

Vendor lock-in with treasury management system providers is one of the major problems. Once a business has invested in a TMS, it becomes difficult for them to switch, given the considerable costs and efforts involved. It creates a dependency on vendors for updates, support, and maintenance that often results in less favorable terms for the organization.

Selecting the right treasury software goes beyond evaluating technologies and features. A business must consider factors like upfront costs, ease of use, integrations, scalability, agility, and flexibility.

Businesses must start by identifying existing challenges, such as highly manual and error-prone processes that hinder efficiency. They then need to assess the time-consuming nature of current tasks and the technology being utilized for these operations and then determine which functions can benefit from automation to streamline processes and reduce errors. They must ensure that this strategic vision aligns with the broader goals and specific requirements of the company.

To begin with, a business would need to understand key requirements such as time savings, ROI, and seamless integration with banks, ERPs, and TMS. They must focus on automating data gathering, improving cash forecasting accuracy, and integrating hedging capabilities. Prioritize these based on their strategic impact. And then evaluate technology options that align with these priorities, ensuring they offer the necessary functionality, scalability, and compatibility with existing systems.

There are innumerable treasury solutions in the market but not all will provide features for seamless integration with ERPs and bank platforms. Additionally, they often lack the scope of adjustments or alterations to the financial data added at later stages. Therefore, businesses must ensure that the TMS balances between automated and manual processing and gives users the option to customize features whenever required.

HighRadius’ thoughtfully designed cash forecasting and cash management solutions provide full integration with all major banks. It automatically imports bank statements, supports real-time connectivity across ERPs, categorizes transactions, reduces IT dependency, and allows users to manually import low-volume bank files in the CSV format. It also allows businesses to leverage custom-built models trained on past financial data and lets them choose the best-fit forecasting template.

HighRadius’ treasury management solutions and Risk Solution redefines the role of treasury from a back-office function to a strategic powerhouse. Our solution helps treasury professionals optimize cash management, forecast accurately, streamline operations, mitigate risks, and ensure compliance. We understand how difficult it could be for businesses to perform treasury functions in spreadsheets without easy integration with ERPs, data gathering from other treasury systems and bank portals, and inaccurate and complex ways to forecast. To help navigate these challenges and cut through them, our cash management and forecasting solutions ensure:

ERP treasury management integrates treasury functions into an enterprise resource planning system. This enables managing finances, liquidity, and risk on a single platform. It automates cash management and financial operations, enabling better visibility, accurate forecasting, and strategic planning.

Implementing a treasury management system involves defining business needs, selecting a suitable system, and planning the project. It includes identifying challenges, selecting a vendor, customizing the system, integrating with existing systems, training users, and testing before full deployment.

The main objective of the treasury systems is to optimize the financial resources, liquidity, and risk exposure of a business to ensure stability, growth, and long-term financial health. This involves optimizing cash flows, liquidity positions, and investment strategies.

The time to implement treasury solutions varies based on factors like system complexity, customization needs, and integration requirements. Typically, it takes from several months to a year to complete the deployment. It also includes phases like testing and user training to ensure operational readiness.

Whether a TMS is suitable depends on your company’s size, complexity, and treasury needs. Companies need to evaluate if the system they are choosing offers features like cash management, risk mitigation, and strong compliance capabilities that align with their business objectives and budget.

Treasury solutions include cash management, cash forecasting, and treasury payments. Cash management monitors and controls cash positions across locations and accounts. Cash forecasting automates daily forecasting across cash flow categories. Treasury payments reduce fraud risk with centralized control.

A treasury cash management system enables a business to completely automate functions like daily cash positioning, bank reconciliations, handling bank accounts across regions, and more. It offers complete visibility into bank balances and optimizes investments and borrowing by tracking financial instruments.

Treasury management software for banks is a digital platform that helps banks manage liquidity, cash positioning, funding risk, and financial exposures in real time. It centralizes bank data, automates cash forecasting, and supports regulatory compliance across treasury operations.

It provides real-time visibility into cash positions, automates forecasting using historical and live transaction data, and alerts treasury teams to potential shortfalls or idle balances. This enables faster funding decisions, optimized liquidity deployment, and stronger balance sheet control.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center