Key Takeaways

- The general ledger is a vital element in a company’s accounting system, meticulously records and summarizes all financial transactions, ensuring transparency and compliance.

- The general ledger, based on double-entry bookkeeping, records transactions with debits and credits, ensuring balance and adhering to the foundational accounting equation.

- A well-maintained general ledger is crucial for financial robustness, decision-making, compliance with regulations, and the preparation of vital financial statements.

- Technology integration in accounting, driven by automation, AI, and ML, enhances efficiency, precision, regulatory compliance, and security in general ledger management.

Introduction

The general ledger serves as the backbone of a company’s accounting system, meticulously recording and categorizing financial transactions. Understanding the intricacies of a general ledger is paramount for effective financial management.

The significance of the general ledger extends beyond its role as a transaction repository; it plays a pivotal role in informed decision-making and ensures compliance with regulatory standards. However, traditional ledger systems pose challenges, particularly in manual record-keeping, leading to potential errors and inefficiencies.

This guide comprehensively explores general ledgers, addressing their functionality, benefits, and challenges linked to traditional systems. Additionally, we’ll delve into the transformative impact of technological advancements, such as automation, artificial intelligence, low code, and no code, on general ledger management—enhancing efficiency, accuracy, and adaptability. But before we dive in, let’s start by understanding what a general ledger is.

What Is a General Ledger?

The General Ledger, integral to a company’s accounting, meticulously records financial transactions, ensuring transparency, accuracy, and compliance. As the financial backbone, it supports robust management, statement preparation, and adherence to standards, playing a vital role in financial infrastructure.

How Does General Ledger Work?

The general ledger serves as a comprehensive record of transactions conducted through the double-entry bookkeeping method, where each transaction impacts two accounts: where one account is debited, and the other account is credited. This method adheres to the principle that the total debit amount must always match the total credit amount, forming a foundational aspect of modern accounting.

Debits and credits are the language of accounting. They represent the left and right sides of a transaction, shaping the financial equilibrium within the ledger.

Assets = Liabilities + Shareholder’s Equity

This is the foundational accounting equation that embodies the core foundation of the double-entry system. Discrepancies between recorded assets and the sum of equity and liabilities signals anomaly and a need for corrections in account balances.

The brilliance of the double-entry system lies in its self-balancing mechanism, acting as a check-and-balance system to reduce errors and uphold financial data integrity.

How Are Transactions Recorded in the General Ledger?

Transactions are recorded in the general ledger using a double-entry accounting system.

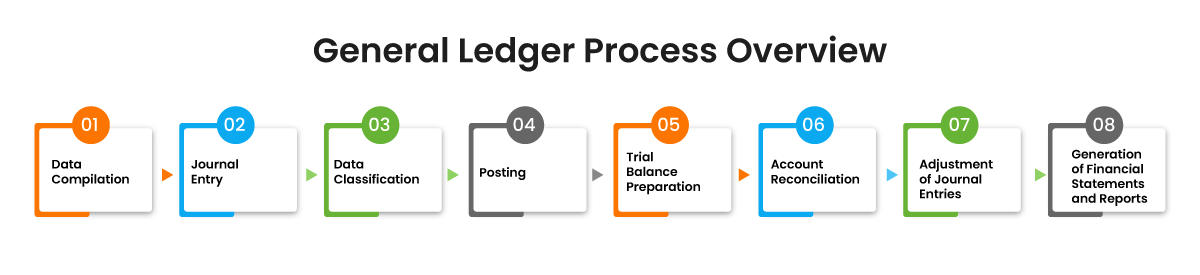

To establish a general ledger using the double-entry bookkeeping approach, transactions must be documented in a minimum of two ledger accounts, forming a T-shaped entry with columns for debits and credits. Below are the steps on creating general ledger accounts:

-

Data compilation

Organizations must gather essential source documents, including bank and credit card statements, point-of-sale records, invoices, receipts, and more, to collect all necessary data.

-

Journal entry

Financial transactions are recorded in journals, capturing both debit and credit aspects according to the double-entry accounting system. Each entry includes a date, affected accounts, debited or credited amounts, and a brief description. These entries serve as a chronological record of financial events.

-

Data classification

After recording, transactions are categorized into specific accounts such as assets, liabilities, equity, revenues, and expenses. This systematic classification ensures organized data for easy retrieval and analysis.

-

Posting

Posting involves transferring all information from the journal entries to the relevant accounts in the general ledger. Every journal entry includes an account number, date, amount, and entry description.

Posting consolidates all individual transactions into comprehensive data that provides a complete overview of each account’s activity and balance. This ensures that the general ledger stays updated.

-

Trial balance preparation

A trial balance is a document that outlines all ledger accounts and their corresponding debit or credit balances at a particular moment in time. Preparation of trial balance involves ensuring that all debit and credit entries for each account are tallied to ensure balance. Any inconsistencies in the trial balance may signify errors in either journaling or posting, prompting the need for a comprehensive review and correction.

-

Account reconciliation

The general ledger reconciliation process is vital for ensuring accuracy. It involves comparing the general ledger account balances with external statements or independent records such as a bank or credit card statement and loan statement. The purpose of reconciliation is to identify any disparities that can exist.

Discrepancies encountered during reconciliation may include missing transactions, variations in transaction values, or entries recorded in the wrong account. Organizations must meticulously analyze these differences as part of the reconciliation process.

-

Adjusting journal entries

Adjusting journal entries is employed to document temporary adjustments in financial records, such as accrued expenses. They also play a role in rectifying any errors discovered during the reconciliation process. The primary purpose of these adjustments is to guarantee that the ledger accurately reflects the company’s real-time financial position and performance.

When organizations post these adjustments, it is crucial to ensure that all changes are well-documented, providing a rationale for the modification and referencing any supporting evidence.

-

Generation of financial statements and reports

Once all transactions are recorded, classified, posted, and adjusted, the general ledger forms the basis for preparing key financial statements (income statement, balance sheet, cash flow statement), ensuring compliance and informativeness.

General Ledger Example

The general ledger is structured with two columns: one dedicated to debit transactions and the other to credit transactions. Debit transactions appear on the left side, while credit transactions are recorded on the right side.

Key components of the general ledger include:

- Account Names and Numbers: Every account is assigned a distinctive name and a unique account number, simplifying identification and categorization.

- Debit and Credit Columns: The general ledger incorporates distinct columns for debits and credits, illustrating the financial impact of each transaction on the relevant accounts.

- Transaction Details: Each entry is accompanied by comprehensive transaction details, encompassing the transaction date, description, and references to the original journal entry.

Below is an example of a general ledger for a small business.

In this example

- On January 10th, 2024, a sale of goods is made on credit for $5,000, and the revenue is credited to the Sales account (representing the revenue earned and debited to the Accounts Receivable account (representing the increase in amounts owed by customers).

- On January 12th, 2024, a cash payment of $2000 was received, reducing the Accounts Receivable balance (credit) and increasing the Cash balance (debit).

Types of General Ledger Accounts

Within the general ledger, accounts are systematically categorized to track and manage financial data. The principal types of accounts in the general ledger include:

Asset accounts

Asset accounts represent resources owned by the company with future economic value. These accounts record assets owned by the company, debiting when assets enter and crediting when they leave. Examples include:

- Accounts Receivable

- Cash

- Inventory

- Investments

- Property, Plant, and Equipment (PP&E)

- Prepaid Expenses

- Intangible Assets

- Accumulated Depreciation

- Notes Receivable

- Land

Liability accounts

Liability accounts denote obligations or debts that a company owes. These accounts record the company’s liabilities, crediting when more debt is incurred and debiting when payments are made. Examples include:

- Accounts Payable

- Notes Payable

- Accrued Expenses

- Customer Deposits

- Loans Payable

- Deferred Revenue

- Bonds Payable

- Warranty Liability

- Income Tax Payable

- Interest Payable

Equity accounts

Equity accounts provide insights into the ownership interest of shareholders. Equity accounts commonly encompass stock, retained earnings, and additional paid-in capital. Stockholders’ equity is determined by deducting liabilities from assets. Examples include:

- Common Stock

- Retained Earnings

- Additional Paid-In Capital

- Treasury Stock

- Preferred Stock

- Accumulated Other Comprehensive Income

- Dividends Payable

- Contributed Capital

- Earnings Per Share (EPS)

- Stock Options

Operating revenue accounts

These accounts capture income generated from the company’s primary operations, such as sales or service fees. Revenue accounts provide insights into activities driving up earnings. Examples include:

- Sales

- Service Fee Revenues

- Product Sales

- Subscription Revenue

- Licensing Fees

- Commission Income

- Royalty Income from Core Business Activities

- Consulting Fees

- Franchise Fees

Operating expense accounts

These accounts record all costs incurred during operations, covering salaries, rent, utilities, depreciation, and other operational expenses. Examples include:

- Salaries and Wages

- Rent

- Utilities

- Advertising

- Cost of Goods Sold (COGS)

- Depreciation

- Insurance

- Maintenance and Repairs

- Office Supplies

- Travel Expenses

Non-operating revenue accounts

Non-operating revenue accounts document income unrelated to core business operations, like gains from selling assets or interest income. Examples include:

- Gain on Sale of Assets

- Interest Income

- Dividend Income

- Royalty Income

- Insurance Recoveries

- Sale of Investments

- Asset Disposal Gains

- Currency Exchange Gains

- Rent Income

Non-operating expense accounts

These accounts cover expenses not tied to core operations, such as interest payments or losses from activities like restructuring or charges on obsolete inventory. Example include

- Interest Expense

- Loss on Disposal of Assets

- Restructuring Costs

- Impairment Charges

- Foreign Exchange Losses

- Write-Offs

- Asset Abandonment Costs

- Unusual or Infrequent Expenses

Importance and Purpose of General Ledger

The purpose of general ledgers encompasses various critical functions within financial management.

Record keeping

The general ledger documents all financial transactions, spanning revenues, expenses, assets, liabilities, and equity. This comprehensive record ensures the organization maintains a thorough and accurate financial history.

Creation of financial reports

The data stored in the general ledger serves as the cornerstone for financial reporting. This information is utilized to craft financial statements, including the income statement, balance sheet, and cash flow statement. These statements offer invaluable insights into the business’s financial health and performance, revealing aspects such as organizations financial position and profitability over specific periods, and provides the ability to monitor cash-based transactions.

Tracking account balances

Each account within the ledger maintains a running balance, empowering businesses to monitor individual accounts’ statuses. This tracking capability aids in identifying trends, patterns, and anomalies within the financial data, contributing to informed decision-making.

Facilitation of internal and external audits

During both internal and external audits, the general ledger is the primary source of information. Auditors rely on it to verify the accuracy of financial statements, assess compliance with accounting standards, and evaluate the reliability of the organization’s financial reporting. By adhering to specific standards, the general ledger ensures the maintenance of financial data in accordance with legal and regulatory mandates, facilitating a smooth auditing process.

Benefits of Having a General Ledger for Your Company

The general ledger offers numerous benefits to businesses, playing a pivotal role in financial management. Some of the key advantages of general ledgers are.

Comprehensive overview of financial transactions

By aggregating every financial transaction, the general ledger provides a comprehensive view of all transactions. Instead of combing through various statements and invoices, stakeholders can consult the general ledger for a comprehensive overview of all accounting records.

This centralized approach offers insights into revenue trends, cost structures, profitability metrics, and more, facilitating a profound understanding of operational successes and challenges. In larger organizations with multiple entities or subsidiaries, the general ledger facilitates the consolidation of financial information.

Generation of financial statements

General ledgers play a key role in facilitating the generation of financial statements. Serving as the foundation for the income statement, balance sheet, and cash flow statement, the general ledger allows business owners to comprehensively track their financial performance, cash flow, and essential metrics such as profitability and liquidity.

Ensuring financial transaction accuracy

By consolidating all financial transactions in one centralized place, general ledger enhances accuracy and transparency. This approach minimizes the risk of errors and fraud, as every entry is meticulously documented and easily traceable.

This feature is particularly valuable in planning business needs, including inventory purchases, product pricing, and financial arrangements.

Proactive fraud prevention

The General Ledger also plays a proactive role in checking and preventing fraud. By ensuring balanced books and employing a trial balance, accountants can promptly identify and rectify mistakes while also detecting potentially fraudulent activities before they escalate into major issues.

The comprehensive documentation of financial transactions provides clarity over inflows and outflows, simplifying the detection and prevention of fraudulent transactions.

Ease of tax reporting

General ledger consolidates all income and expenses, simplifying and expediting tax calculations. This not only ensures compliance with tax requirements but also aids in managing payments for licenses and insurance crucial for tax compliance.

The accuracy of financial information derived from the general ledger is vital for producing precise financial statements, enabling businesses to make informed projections and plans.

Provision of insights for planning and decision making

The data stored in the general ledger is invaluable for strategic planning and decision-making. Offering insights into revenue streams, expenditure patterns, and overall financial health, the general ledger empowers businesses to make informed decisions and devise strategic plans related to budgeting, resource allocation, and strategic planning.

Past financial data enables the projection of future scenarios, allowing for precise and proactive planning.

Enhanced transparency

The general ledger ensures transparency and accountability in financial activities. Every entry can be traced back to its origin, providing a transparent trail during external audits and internal reviews.

This adherence to financial regulations instills confidence among investors, creditors, and other stakeholders, attesting to the business’s commitment to accountability and ethical financial management.

Internal Control

The general ledger contributes to internal control mechanisms by establishing a system of checks and balances. It helps prevent and detect errors, fraud, or other irregularities in financial transactions.

Adherence to compliance and reporting requirements

The general ledger serves as a reliable source for generating financial statements that align with accounting standards, tax laws and regulatory requirements. It provides a transparent and auditable trail of financial transactions, making it easier for external auditors to verify the accuracy and legality of financial records.

General Ledger Challenges

Now that you know the importance and benefits of the general ledger, it’s time to understand the challenges so that you can handle them. Challenges in general ledger management encompass a spectrum of issues ranging from human error to technological constraints. These include:

Accuracy and data entry errors

Manual data entry is especially prone to errors like interchanged numbers or entering incorrect amounts, impacting the integrity of financial statements and decision-making.

Unbalanced journal entries and incorrect account classification

Unbalanced journal and incorrect classification lead to challenges in generating accurate trial balance reports. Regular review and updating of the chart of accounts, clear classification guidelines, and training programs for staff are essential to address these issues.

Timing issues

Timing issues such as recording transactions in the wrong accounting period can impact the accuracy of financial reports. Additionally, large organizations with complex general ledger structures face confusion and errors if not properly organized and documented.

Security concerns

Security concerns are heightened due to the sensitive financial information stored in general ledgers. Robust security measures are vital to prevent unauthorized access and data manipulation.

Compliance issues with latest accounting standards

The ever-evolving nature of accounting standards poses another hurdle. Staying abreast of these changes and ensuring compliance requires constant vigilance. Adjustments to the general ledger structure may be necessary to align with updated standards, demanding meticulous attention to detail.

Risks of frauds and misuse

Fraud and misuse present a real threat, compromising the accuracy of the general ledger. Security protocols and access controls must be robust to prevent internal and external threats. Inadequate measures can lead to manipulated entries or unauthorized transactions.

How Technology Is Transforming General Ledger Management

The integration of technology into accounting has played a pivotal role in addressing challenges associated with the conventional process of creating general ledgers. Automation is a key driver, significantly enhancing efficiency and precision in financial management by automatically documenting day-to-day transactions. This not only reduces human errors and saves time but also guarantees that the data remains up to date.

Automation further ensures regulatory compliance by streamlining workflows related to compliance with the latest accounting standards, tax laws and regulations through automated updates.

By leveraging Artificial Intelligence (AI) and Machine Learning (ML), organizations can automate general ledger reconciliations. Traditionally, businesses have relied on manual reconciliation to validate general ledger data against source systems. With AI, organizations can now automate intricate reconciliations in trial balance calculations and post to general ledger accounts seamlessly. With technology enabled advanced capabilities, accounting teams can access and compare general ledger and sub-ledger data, identify mismatches and anomalies, and make necessary adjustments in real-time.

Additionally, with cloud-based accounting solutions, teams have real-time access to financial data, facilitating immediate decision-making. Technology also addresses the challenges related to security of general ledger data through enhanced security through measures like encryption and multi-factor authentication.

How HighRadius Can Help?

HighRadius Record to Report (R2R) solutions transform general ledger processing, enhancing efficiency and precision. From data fetching to journal entry and analysis, HighRadius empowers organizations to achieve a groundbreaking 50% reduction in manual tasks through its no-code platform, LiveCube. Seamlessly combining the familiarity of an Excel-like interface with pre-configured bi-directional data integrations, LiveCube establishes a new standard in flexibility and user-friendly automation. Accountants can effortlessly retrieve raw data, perform calculations, and seamlessly upload results into various enterprise systems, streamlining the entire general ledger workflow.

HighRadius propels organizations towards a 30% faster close with Journal Entry Management significantly contributing to accelerated month-end close, by offering automated posting options using pre-filled Excel template or LiveCube platform. It further supports reconciliation by automating the posting of adjusted journal entries during reconciliation, reducing manual intervention and expediting the close.

Anomaly Management takes organizations from a reactive to a proactive stance, detecting 12 common types of errors and omissions in real-time. Leveraging historical data to identify transaction patterns within the general ledger, HighRadius anomaly management solution turns anomalies into actionable worklists for a faster close. This proactive approach allows organizations to identify potential risks, flagging any transaction deviating from the historical pattern as a potential anomaly. Once detected, anomalies are promptly displayed to accountants as worklists, facilitating swift resolution and enhancing overall accuracy in financial reporting.

HighRadius R2R solution provides a transformative approach to optimizing accounting processes, ensuring organizations stay ahead in the dynamic landscape of financial management.

FAQ’s

1. What is a general ledger account?

A general ledger account is a record in the accounting system that tracks & summarizes all financial transactions related to a specific asset, liability, equity, revenue, or expense. It provides a comprehensive overview of a company’s financial health & is crucial for accurate financial reporting & analysis.

2. What is the purpose of general ledger?

The purpose of a general ledger is to centralize & organize financial data, recording all transactions in a systematic manner. It serves as a comprehensive financial record, enabling businesses to track & manage their assets, liabilities, equity, revenue, & expenses. It is fundamental for financial reporting.

3. How do you record a general journal ledger?

To record a transaction in a general journal ledger, one debits and credits the appropriate accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) is maintained and following the double-entry accounting system, where each transaction has equal debit and credit amounts.

4. What is the difference between a ledger and a general ledger?

A ledger is a broader term referring to any book or system of accounts, while a general ledger encompasses the complete set of accounts that summarize all financial transactions. The general ledger includes assets, liabilities, equity, revenue, & expenses, providing a holistic view of a company’s transactions.

5. What are general ledger accounts?

General ledger accounts are individual records within the ledger that track, & store financial transactions related to specific categories, such as assets, liabilities, equity, revenue, & expenses. Each account in the general ledger represents a distinct element of the company’s financial performance.

6. What is a general ledger accounts list?

A general ledger accounts list is a comprehensive record that categorizes & organizes all financial transactions of a business, providing a detailed overview of its assets, liabilities, equity, revenue, & expenses. It provides an organized overview essential for financial tracking, reporting, & analysis.

7. What is a general ledger system?

A general ledger system is a centralized accounting software or record-keeping system that tracks & manages a company’s financial transactions, summarizing them into various accounts within the ledger to provide a comprehensive view of its financial health. It facilitates accurate financial reporting.

8. What are general ledger entries?

General ledger entries are recorded financial transactions in accounting, detailing debits and credits for specific accounts like assets, liabilities, equity, revenue, and expenses. They serve to organize and track financial activity, crucial for accurate reporting and analysis in a company’s records.