Key Takeaways

- Learn the key corporate treasury department functions and responsibilities.

- Understand how a corporate treasury department impacts crucial business areas like staying competitive, making a profit, and growing.

- Get insights into treasury management best practices.

Introduction

In the ever-evolving landscape of modern business finance, one department stands tall as a strategic powerhouse – The Corporate Treasury Department. While traditionally associated with cash management and risk mitigation, the Corporate Treasury department has evolved into a linchpin that shapes a company’s financial success.

What Is Corporate Treasury, and How Has It Evolved Over the Years?

Corporate treasury manages a company’s financial assets and liabilities. The treasury department, often helmed by a Treasury Manager or Treasurer, serves as the central hub for financial decision-making, and handles various responsibilities such as cash management, risk mitigation, capital markets, and compliance, acting as the core for financial decisions.

Gone are the days when the treasury department operated in silos. Forward-thinking organizations now recognize the treasury’s potential as a strategic partner in crucial decision-making processes.

Key Corporate Treasury Department Functions and Responsibilities

Let’s delve into the multifaceted responsibilities of the treasury department that make it a true strategic powerhouse.

Mastering Cash and Liquidity Management

Cash and liquidity management is a big deal for the Treasury department. They basically make sure a company’s money is handled well and cash utilization lines up with what the company wants to achieve. Key responsibilities include:

- Aligning Cash Management with Strategic Goals: Treasury makes sure that spending aligns with the company’s goals. They use cash forecasting and budgeting processes to predict cash needs and allocate resources smartly.

- Leveraging Liquidity to Maximize Returns: Treasury invests extra funds in safe, easy-to-sell assets. This gets better returns while keeping enough cash for day-to-day needs.

- Mitigating Borrowing Costs through Strategic Spending: Borrowing money means paying interest, which affects profits. The Treasury makes sure spending plans make money that covers borrowing costs and adds value to the business.

Pioneering Financial Risk Management

The Treasury department has a critical role in assessing and mitigating business and financial risks to ensure the long-term sustainability of the company. By employing appropriate risk management techniques, they protect the underlying business from the net effects of interest rate changes and exchange rate fluctuations. Key responsibilities include:

-

Quantifying and Addressing Financial Risks: The Treasury carefully identifies and measures different financial risks that the company might encounter. They mainly focus on changes in interest rates and fluctuations in foreign exchange rates. They use strategies like interest rate swaps and currency forwards to reduce the impact of these risks on the company’s financial performance.

-

Safeguarding Against Non-Financial Risks: Apart from financial risks, the treasury department also keeps an eye out for non-financial dangers that could harm the company’s reputation and operations. These dangers might arise from security breaches, instances of fraud, or disruptions in operations.

-

Understanding Risk Appetite and Alignment: Treasury professionals work closely with management and shareholders to understand the company’s risk appetite. And accordingly aligns risk management strategies with the organization’s overall objectives to secure the company’s long-term success.

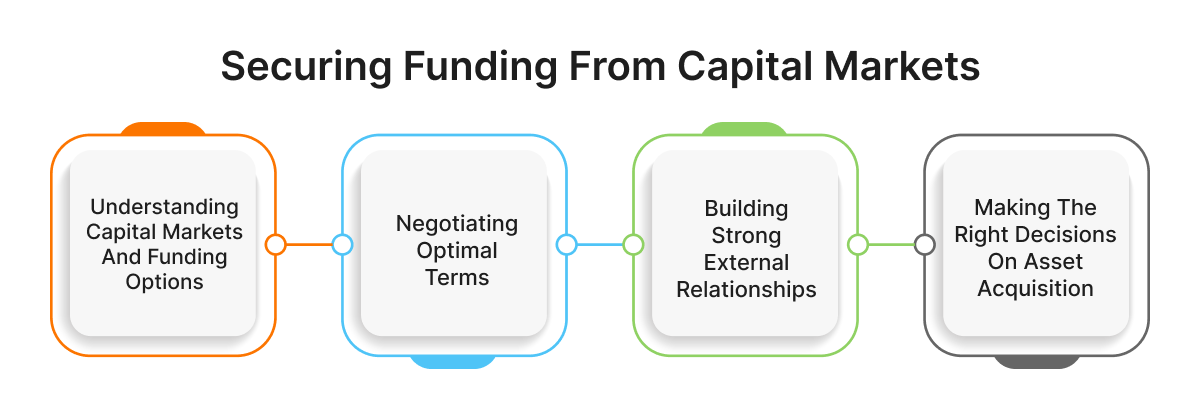

Securing Funding from Capital Markets

Corporate treasury departments play a critical role in securing cost-effective funding options to meet day-to-day obligations. Key responsibilities include:

-

Understanding Capital Markets and Funding Options: Treasury understands capital markets and various funding alternatives available. They know all about how to get money from different places. They can get it by selling a part of the company (equity) or borrowing it (debt), or even a mix of both.

-

Negotiating Optimal Terms: TheTreasury department works on getting the best deals for borrowing money like getting lower interest rates when they borrow or paying less fees when they get money from investors.

-

Building Strong External Relationships: Treasury actively engages with investment banks, private equity firms, venture capitalists, and other financial institutions to gain invaluable insights into market trends and emerging funding opportunities.

-

Making the Right Decisions on Asset Acquisition: When considering asset acquisition, the treasury department carefully assesses the advantages of a capital lease over an outright purchase.

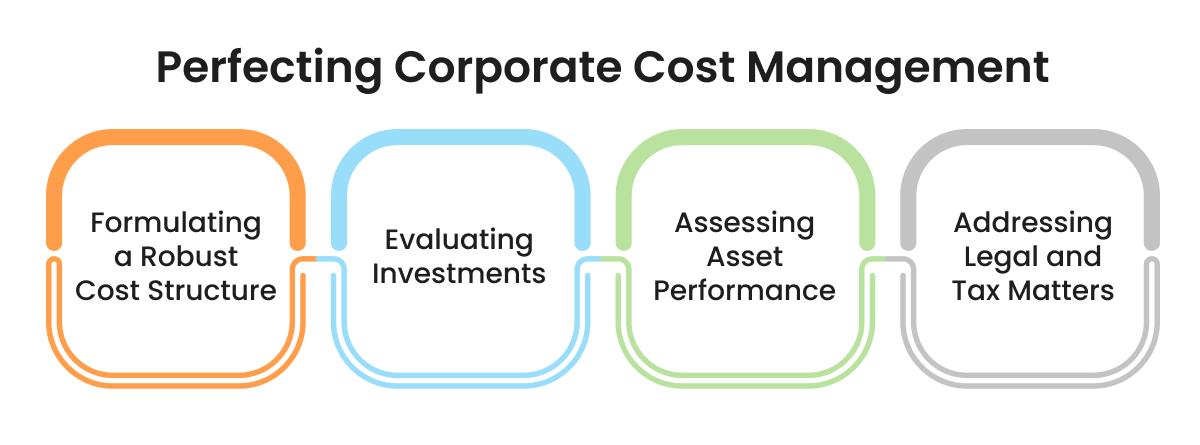

Perfecting Corporate Cost Management

The corporate treasury department plays a crucial role in connecting business and financial strategies to cut costs and make smart investment choices. They do this by carefully evaluating investments and making sure assets deliver the expected returns. Key responsibilities include:

-

Formulating a Robust Cost Structure: Treasury puts together a cost structure that aligns with the company’s strategic objectives. By carefully studying costs, they find ways to spend smarter, allocate resources better, and boost profits.

-

Evaluating Investments: The Treasury department reviews potential projects using financial measures like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. This helps identify valuable ventures that fit the company’s long-term plans.

-

Assessing Asset Performance: Treasury keeps a close eye on how well assets are doing to meet their predicted returns. They spot and get rid of assets that aren’t performing well. This trims unnecessary expenses and makes funds available for better opportunities.

-

Addressing Legal and Tax Matters: The Treasury department manages legal and tax issues efficiently by staying compliant with relevant regulations and tax laws.

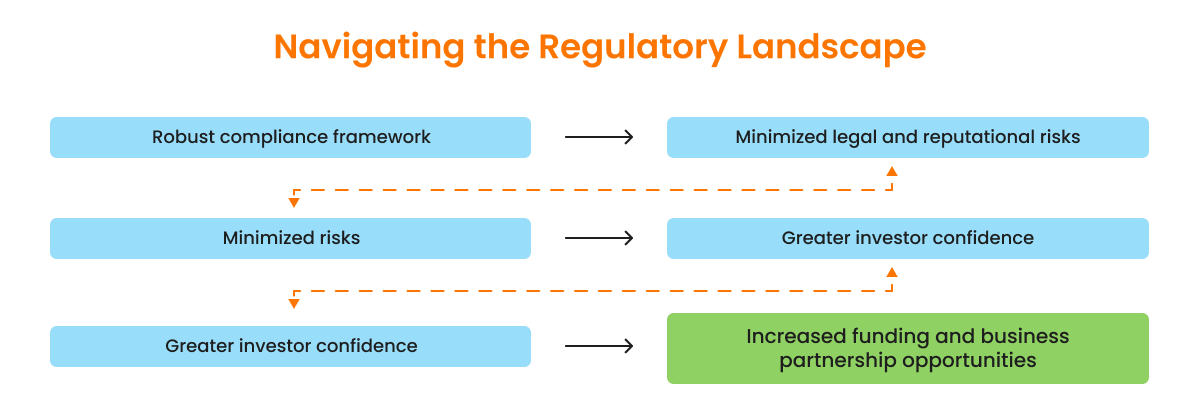

Navigating the Regulatory Landscape

The treasury department plays a critical role in ensuring compliance with financial regulations and navigating a complex landscape of regulatory requirements. Key responsibilities include:

-

Navigating Complex Regulatory Frameworks: Treasury ensures compliance with different financial regulations. By establishing a robust regulatory compliance framework, they proactively address reporting obligations, tax compliance, and adherence to accounting standards.

-

Conducting Risk Assessments and internal audits: The Treasury department identifies potential compliance risks and prioritizes resources to address high-impact areas. By conducting risk assessments and internal audits, treasury professionals proactively mitigate compliance vulnerabilities.

-

Reporting and Disclosure: Treasury ensures the timely submission of financial reports, disclosures, and regulatory filings to maintain accurate and transparent reporting which is crucial for regulatory compliance.

Treasuries Cover All the Bases

Treasuries are often overlooked in organizations. Most people think that the Treasury is only responsible for maintaining financial performance and driving financial returns. But, if we zoom out a bit and look at the five main jobs of the Treasury team, you’ll see they don’t just handle money. They actually lend a hand in crucial business areas like staying competitive, making a profit, and growing.

-

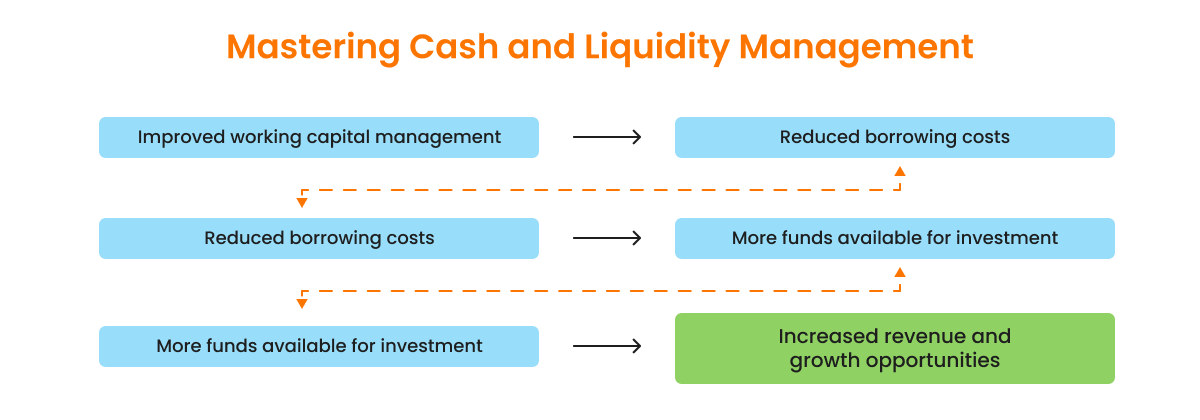

Mastering Cash and Liquidity Management: By optimizing cash flows and liquidity management, Treasury can reduce reliance on short-term borrowing and improve growth opportunities.

-

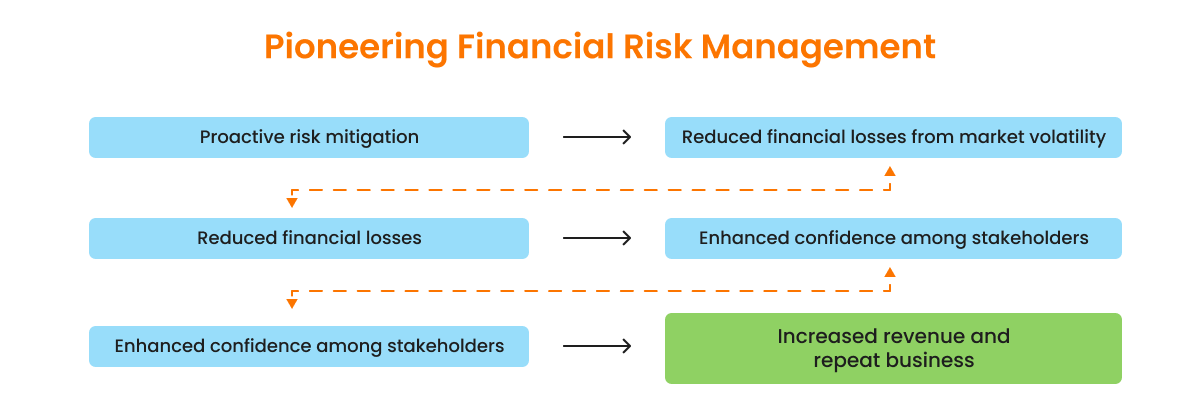

Pioneering Financial Risk Management: By proactively identifying and mitigating risks, the treasury department safeguards the company’s financial health and reputation, leading to increased customer loyalty and enhanced revenue opportunities.

-

Securing Capital Markets and Funding: By securing cost-effective funding options, the treasury department ensures the availability of capital to invest in growth opportunities, product development, and market expansion.

-

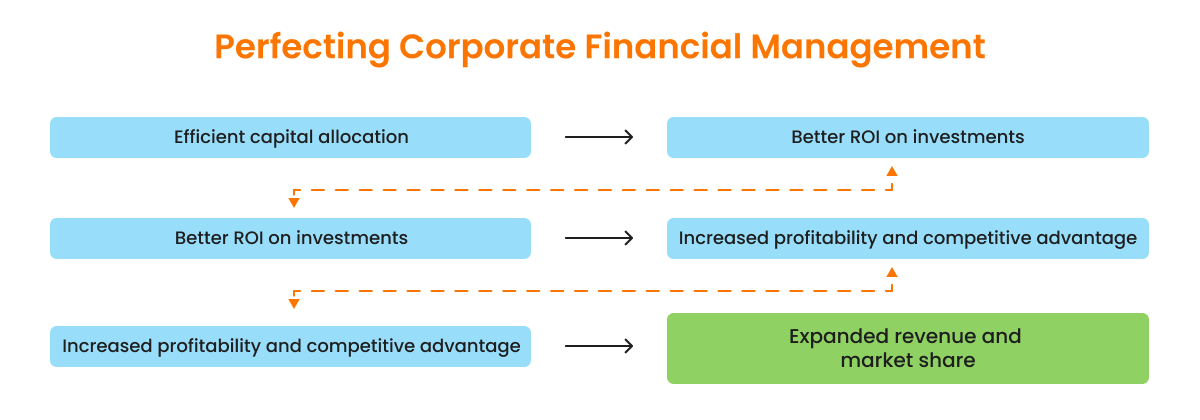

Perfecting Corporate Financial Management: By developing appropriate cost structures and assessing investments, the Treasury department optimizes capital usage and ensures that investments generate sufficient returns to cover financing costs, thus enhancing profitability.

Navigating the Regulatory Landscape: By maintaining a compliance framework the Treasury department meets reporting obligations and stays ahead of regulatory changes. This strengthens investor confidence, attracting more investors and potential business partners, and creating new revenue streams and expansion opportunities.

There are very few teams in a company, outside of the C-suite, who can cover all of these bases. Yet, the underappreciated treasury team does and, if managed well, can significantly benefit the company.

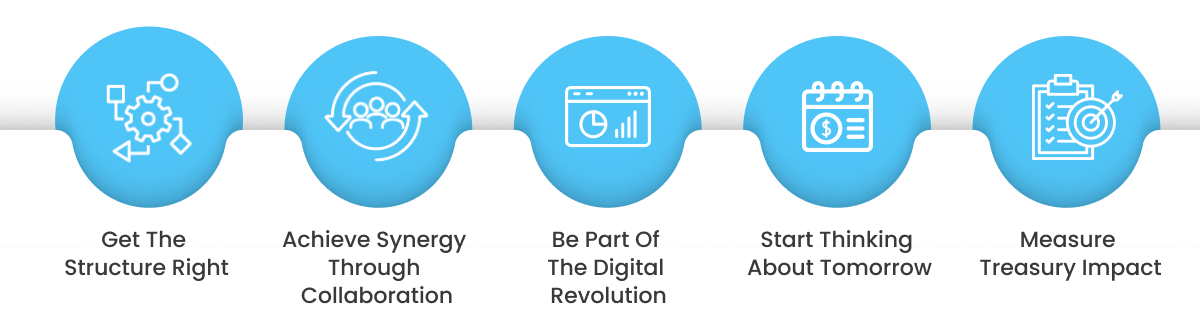

Treasury Management Best Practices

Effective treasury management is crucial for financial success and resilience. Companies must embrace strategic practices that optimize treasury operations and drive value for the organization. Let’s look at five key best practices that empower treasury teams to thrive and make impactful decisions.

- Get the Structure Right: Companies mustplace their treasury in the correct area of the organization. Lots of companies mess up by treating their treasuries as boring backroom jobs tied to accounting. It’s better if they answer directly to the CFO and help out as important players in the company, giving their smart take on the balance sheet.

Below is a representation of how a well-defined Corporate Treasury department structure should look like:

- Achieve Synergy through Collaboration: Companies should unlock the power of cross-departmental partnerships to enhance treasury effectiveness. Collaborating with operations, risk management, relationship management, and investing teams enables the treasury to proactively address financial challenges and capitalize on opportunities. The table below illustrates the benefits of cross-departmental synergy:

Treasury Collaboration

Benefits

Operations

Enhanced financial insights

Risk Management

Proactive risk mitigation

Relationship Management

Access to funding opportunities

Investing

Efficient asset utilization

- Be Part of the Digital Revolution: Companies should leverage technology to transform treasury operations. Implementing treasury management systems, blockchain, AI-powered analytics, and robotic process automation streamlines processes and improves efficiency. Embracing these digital solutions enhances decision-making and elevates the treasury’s strategic role.

- Start Thinking About Tomorrow: Remaining agile in a rapidly evolving landscape is crucial. Hence, companies should embrace emerging trends such as green finance, ESG integration, and real-time payment systems that position treasury teams for future success.

- Measure Treasury Impact: Companies should focus on measuring Key Performance Indicators (KPIs) to get insights for strategic decision-making. Measuring metrics like cash conversion cycle, return on investment (ROI) on treasury initiatives, and liquidity ratios empowers treasury professionals to optimize financial performance and contribute to the company’s bottom line.

A Side Note to Bring the Best Out of Your Treasury Team

In the world of Treasury, modern software is like a game-changer. It’s revolutionizing how businesses manage finances, making things more efficient and less headache-inducing.

At HighRadius we are shaking up the scene and making life easier for businesses. Our Treasury Software is all about optimizing cash flow, automating processes, and making smarter decisions.

With an experience in more than 800+ digital transformation projects, we promise to give your team that extra edge, and you know how valuable that can be.

To know more check out HighRadius’ Treasury Software.

FAQ

- What does a corporate treasurer do?

A corporate treasurer is a key financial professional within a company responsible for managing and overseeing the organization’s financial activities and assets. Their primary role involves optimizing the company’s liquidity, managing financial risks, and ensuring compliance with financial regulations.

- What is the hierarchy of the corporate treasury?

The specific hierarchy can vary depending on the size of the company, industry, and its organizational structure, but generally, the hierarchy may include the following levels:

- Chief Financial Officer (CFO)

- Assistant Treasurer or Director of Treasury

- Treasury Managers or Senior Treasury Analysts

- Treasury Analysts or Specialists

- Treasury Operations Staff

- What does a corporate treasury manager do?

A corporate treasury manager’s primary role is to ensure that the company’s financial resources are effectively managed to optimize liquidity, minimize risk, and enhance overall financial performance.