Automated Accounts Receivable Forecasting

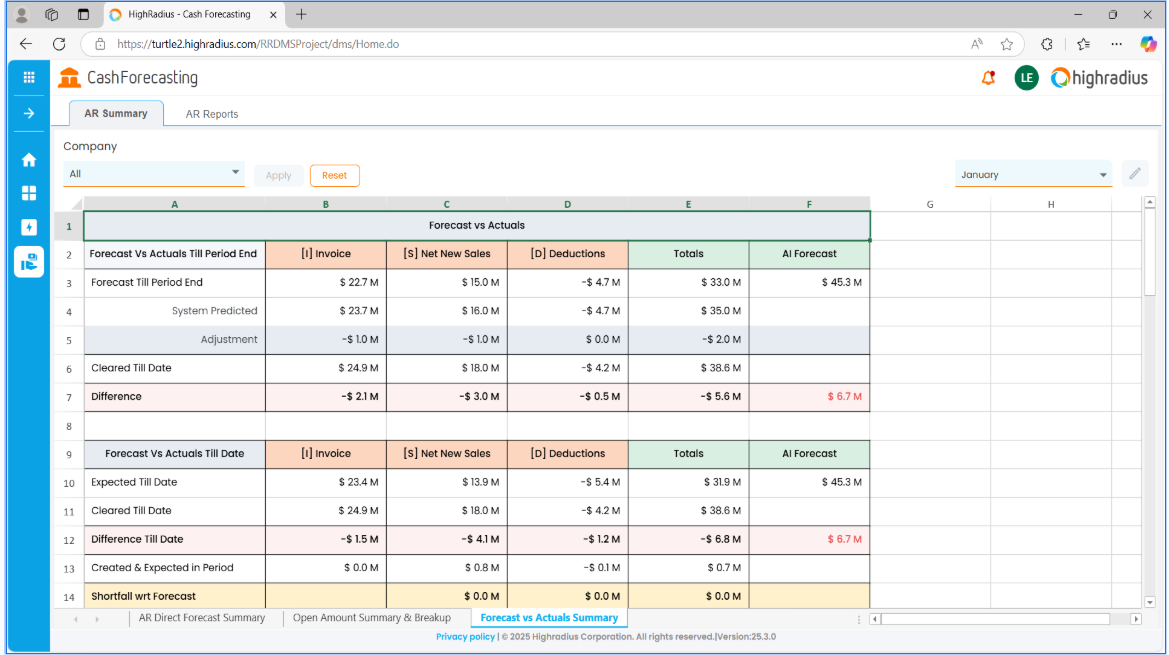

Late collections don’t break your cash flow, inaccurate forecasts do. A 3-day AR forecasting error can cause $4M gaps in cash flow.

- 95%+ Forecast Accuracy

- 70% boost in forecast productivity

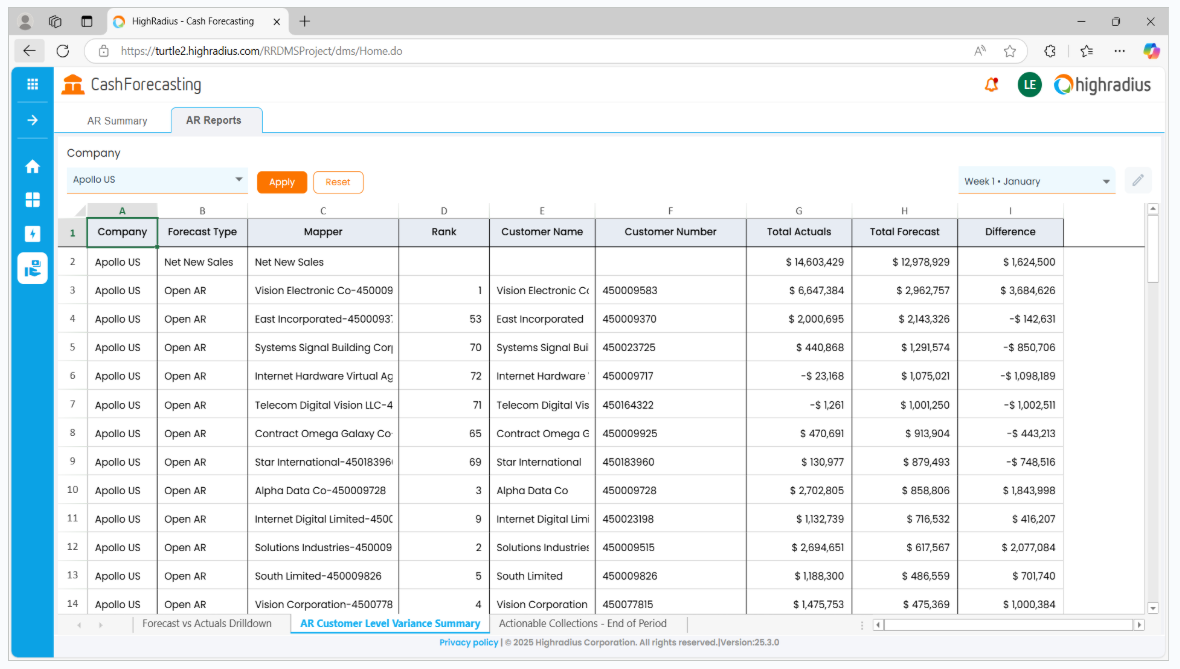

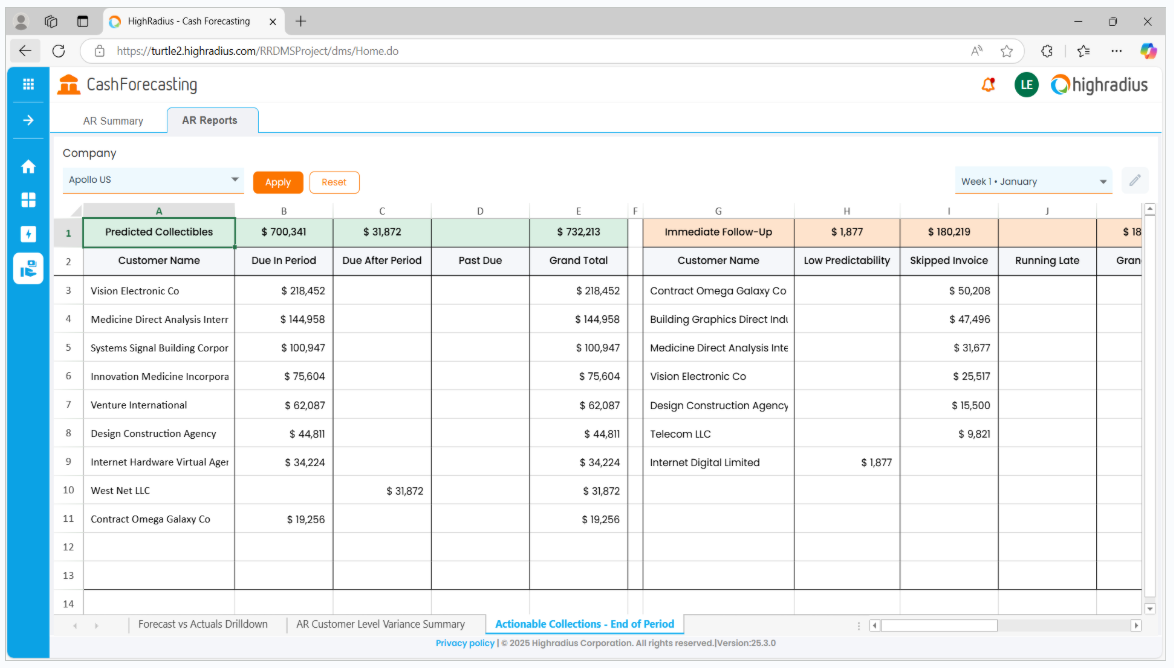

- Predict invoice-level payments using historical data

Trusted By 1100+ Finance Teams Globally

See how AI can build 95% accurate cash forecast

Just complete the form below