Best Automated Treasury Reconciliation Software For 100% Cash Control

Even large finance teams fail to match 1 in 5 payments! Automated treasury reconciliation gives 100% visibility and full cash control.

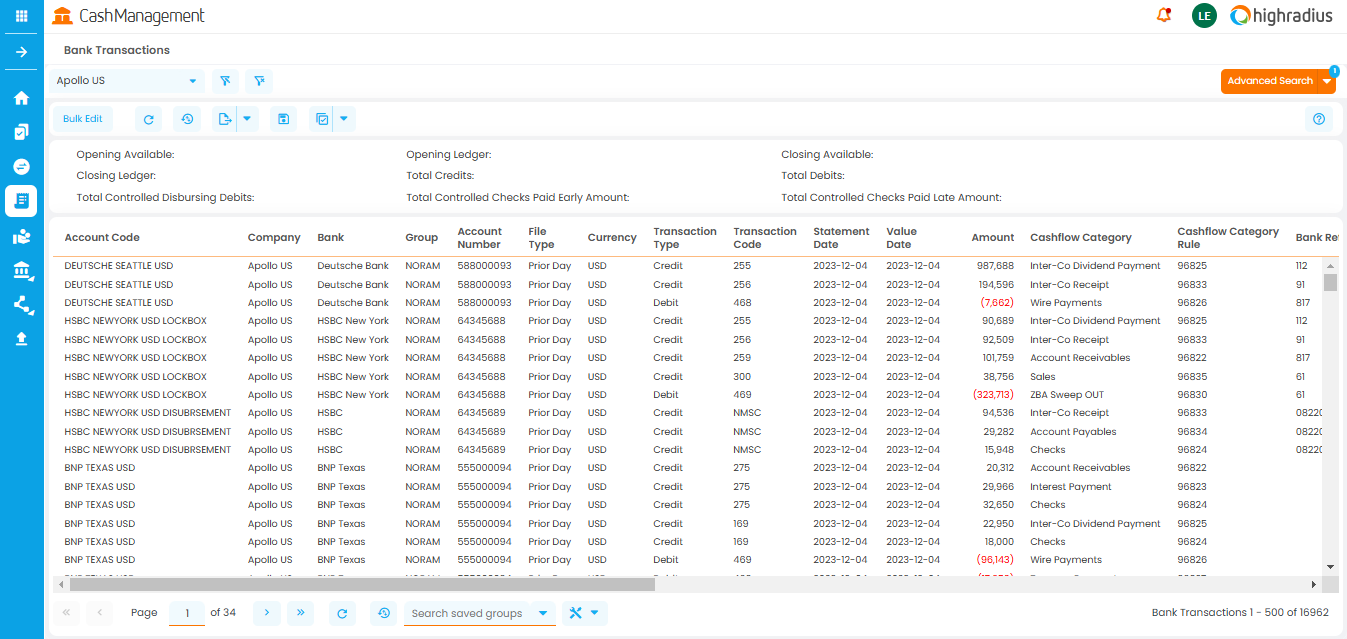

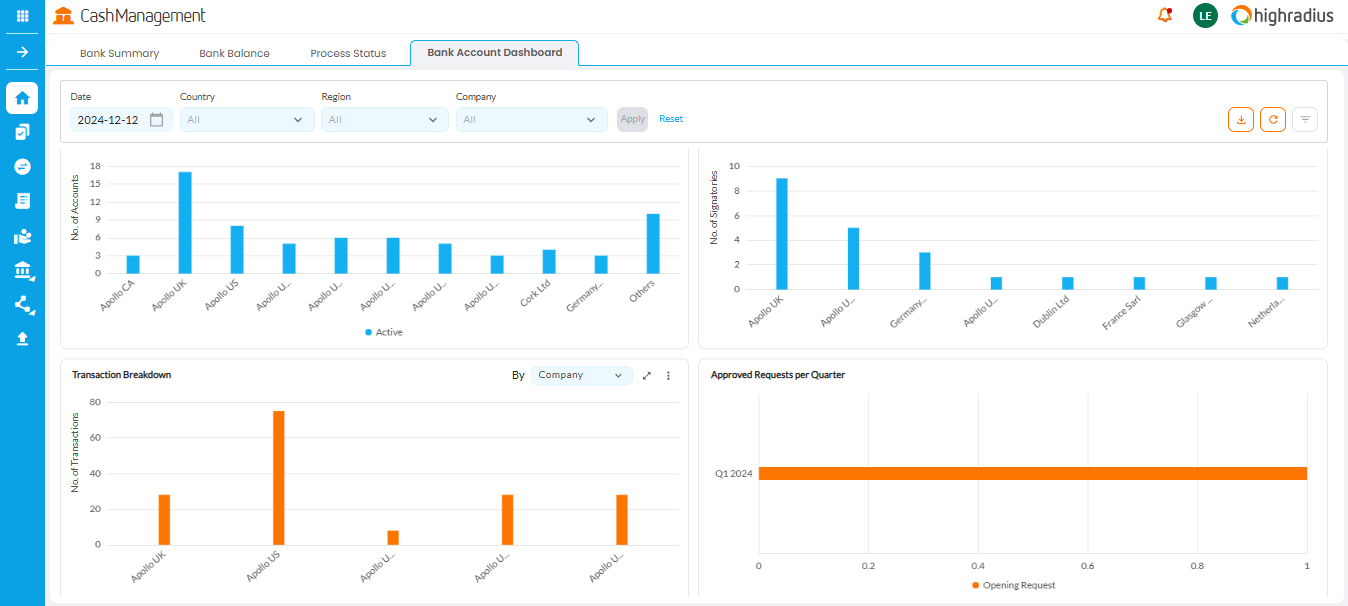

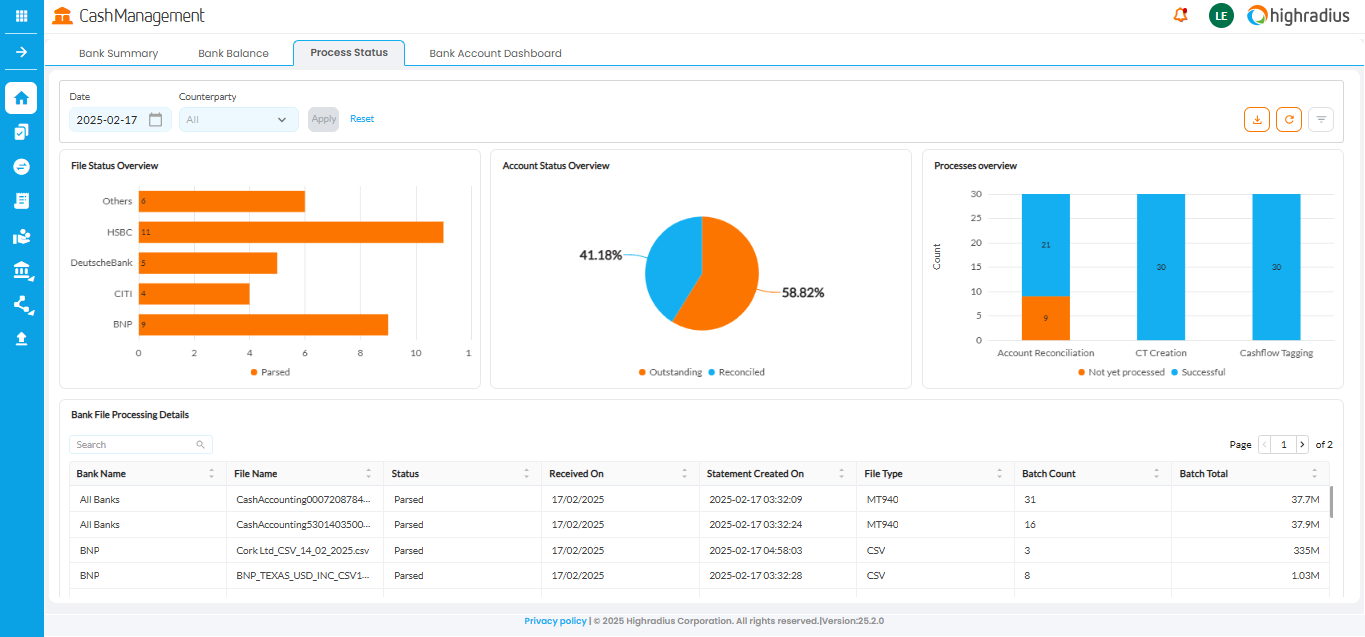

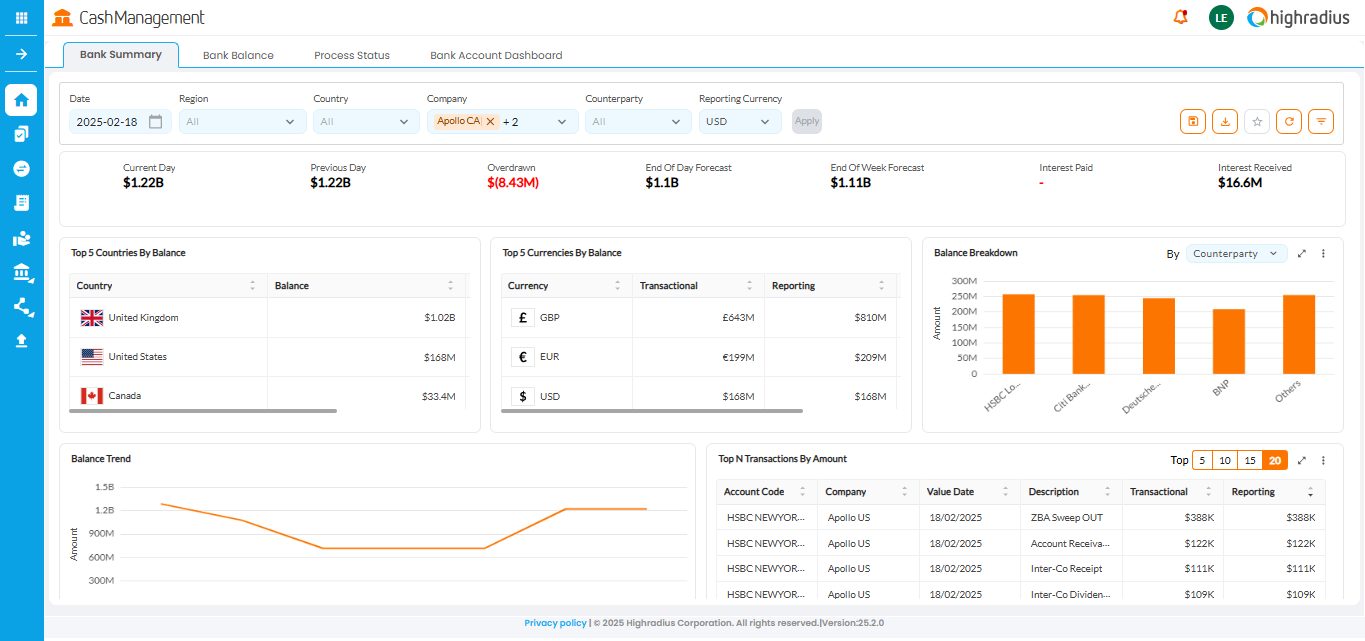

- Unlock 100% cash visibility across accounts, currencies, and regions to drive smarter treasury decisions.

- Cut idle cash by 50% and put working capital back to work, where it belongs.

- Experience up to 70% boost in treasury productivity by eliminating manual processes.

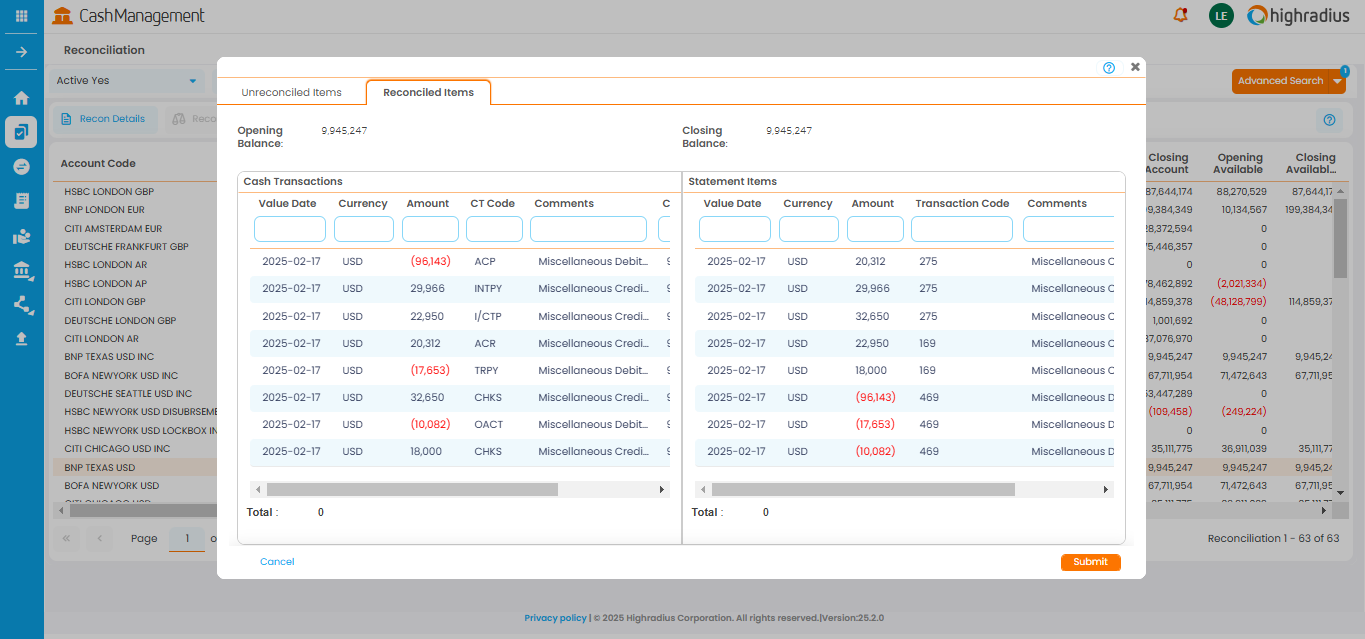

- Auto-reconcile 98% of planned vs. actual cash transactions with AI-powered precision.

Trusted By 1100+ Finance Teams Globally

Auto reconcile 99% of cash & bank transactions

Just complete the form below