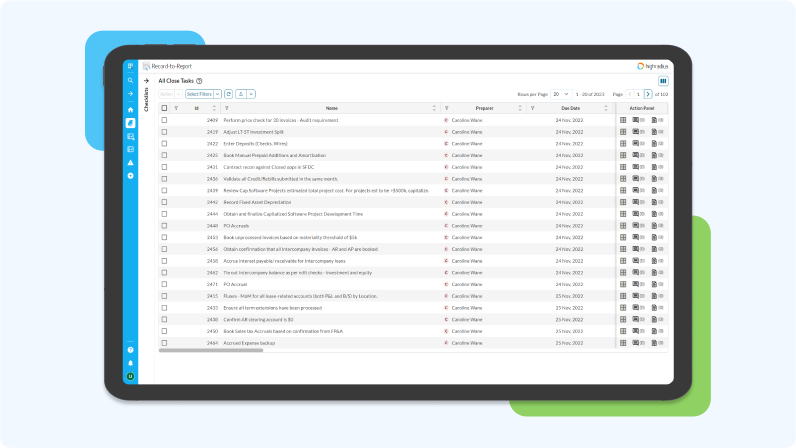

What Can I Do With This AP Internal Control Checklist?

Understand how top finance teams operationalize internal controls not just to check a box, but to enforce accountability, reduce fraud exposure, and drive real business outcomes. This checklist gives you a structured, visual way to review, implement, and track AP control health across the board.