Redefining Accounts Receivable with Digital Payments

We’re at the crossroads of understanding how customer demands are changing with time and how businesses are continuously working to meet those demands with the unpredictable economy. This e-book aims to help finance leaders across mid-sized businesses understand how digital accounts receivable (AR) payments can bring value to their business with improved operational efficiency.

Executive Summary

Sign of the Times: The Need for Digital Payments in Mid-Sized Businesses

Cash plays a crucial role in the survival of any business and the ongoing global crisis has prompted businesses to re-evaluate their payment processes to deal with cash flow issues. Late payments coupled with delayed processing for traditional methods of payment such as cash and checks add on to the struggle of preserving cash. For many mid-sized businesses, paper-checks are still relevant but it comes with a steep price to pay. The primary concern is the manual processing time as they take a long time to reflect on the open AR on top of being error and fraud-prone.

Digital payment methods have emerged to address these pain points by streamlining payment processing with added benefits such as real-time payment, better visibility, compliance, fraud protection, and improved cash flow.

When it comes down to the question of survival, cash flow is oxygen for businesses. Having better visibility and getting paid faster with lower transaction fees are critical for finance executives. Real-time payment methods can accelerate cash flow while avoiding the high cost of manually processing traditional paper-based checks. Owing to digitalized payment methods, a faster payment cycle would result in positive cash flow.

This e-book outlines the changing dynamics in the B2B accounts receivable (AR) payments landscape within mid-sized businesses. Understand the challenges involved in traditional payment methods and how it affects the overall cash flow. Explore key market trends and emerging digital payment methods that provide opportunities to improve cash flow and make a positive impact on working capital.

The Landscape of Payments

Traditionally, invoices, receipts, and disbursements were all manually paid and processed either through cash or checks. These payment methods resulted in an increasing rate of financial complexity, delays, and risk. Fast forward to the present, digitalization has proven to be a key enabler to change the entire landscape of payments.

2.1 Ways to Pay: Emerging Payment Formats

While traditional paper check-based payment systems continue to drive the majority of the cash management cycle, there’s an ongoing worldwide reform to switch to real-time payments. Let’s go over the basic payment systems in place and understand the necessity of improving efficiency with reduced operational risks.

Figure: Different Payment Methods

2.2 The Potential in Mid-Sized Businesses

According to Mastercard, the financial sector within the B2B space stands at a range of USD 25 trillion, annually.

Furthermore, according to the National Middle Market Summit, up to 55% of businesses face challenging issues in terms of maintaining a balanced working capital. With opportunities in obtaining valuable information through payments, mid-sized B2B companies can leverage digitally produced insights to address complex problems such as handling the processing of consumer payments while managing regulatory, compliance, and cost-based challenges.

2.3 Trends Redefining the Payment Landscape: Driving Forces of Change

Let’s go over some of the trends that continue to redefine the entire payment landscape.

- Ongoing digital transformation – Improving business efficiency: Mid-sized businesses continue to recognize the many benefits of digitizing payments that provide better control with minimal manual intervention. So, the interest in investing in new-age solutions is primarily to streamline workflows while reducing the overall operational costs involved.

- Managing customer expectations: Customers in today’s fast-paced world are growing accustomed to convenient payment methods. Financial ecosystems within mid-sized businesses need to get used to the consumer demands for better customization, speed, and personalization of payments.

Payment Challenges Faced by Mid-Sized Businesses

In order to stay ahead of the curve, it’s important to recognize and address multiple issues in terms of operation and delivery service of payments. Conventional business payment structures continue to face vexing challenges in terms of increased high levels of usability, flexibility, and responsiveness in transactions. Here are some of the challenges faced by businesses –

3.1 Payment Processing Challenges

- High Processing Costs: Traditional paper-checks come with an overhead cost that may prove to be harmful in the long run. As per reports by the Bank of America, there’s an estimated cost of USD 4 to 20 per payment for checks. This can accumulate annually to severely harm a company’s revenue.

- Delay in Payments Affecting Cash Flow: The lag time between when a paper-check is written to when it’s reflected in the bank is always a concern. With a longer payment cycle and delayed, manual payment processing, there’s an increase in Days Sales Outstanding (DSO) which negatively affects the overall cash flow. When customers don’t pay on time, the cash outflow would outweigh the total cash inflow causing an imbalance.

- Decoupled Payments: Matching individual payments to a particular invoice often requires manual intervention. The process gets even more complicated because remittance information has to be gathered from different sources such as web-portals and emails. Furthermore, the information gathered might not be recorded correctly which makes it a very error-prone process that could create a bottleneck in completing a payment cycle.

3.2 Fraud Risk

With poor authorization controls for B2B transactions, the risk of fraud is very high. Some of the top risk segments include check-forgery and cyber fraud. As per reports by the American Bankers Association, 60% of attempted fraud is check related fraud. Businesses following a paper-based manual process are much more likely to be exposed to these risks involved in B2B payments.

3.3 Poor Visibility

With disparate payment methods and processing challenges, there is a lack of visibility into additional costs, error-prone delays, and chargebacks in individual accounts. Furthermore, companies are not able to take care of payment disputes as it is impossible to get a clear picture of finances.

A Map to Curb Challenges

4.1 The Future with Digital Payments: Multiple Payment Formats, RDC and Mobile Payments

In order to have a competitive advantage, businesses need to accommodate the buyer’s preferred method of payment. The availability of multiple payment formats such as Same-day ACH, Virtual Cards, and Wire makes it possible for businesses to get real-time payments.

Digital payments are not just limited to cards and payment portals, businesses are now taking advantage of Remote Deposits for check payments. Customers can conveniently make remote check deposits using a mobile device. On the customer side, this saves a lot of time, money, and effort of having to go to banks for making a physical deposit. The adaptability of these payment formats helps in taking better cash management and working capital decisions.

Figure: Remote Deposit Capture Process

4.2 Benefits of Enabling Digital Payments

1. Better Payment Processing

- Faster Reconciliation: As compared to paper-checks which can take days to be processed by banks and finally reflect in the AR, digital payments are real-time. This means that payments get applied and updated simultaneously in the open AR as customers pay for invoices via integrated payment portals.

With the availability of payment portals, customers can choose to pay for individual or multiple invoices at the same time. As particular invoices are already accounted for in this method, businesses can focus on higher-value tasks instead of manually reconciling individual payments with remittance and invoice information. This removes the risk of human error and provides better control of finances.

- Lower Processing Costs: The cost of manually processing paper-checks is a lot higher compared to processing digital payments. Owing to the reduced manual intervention and reconciliation efforts, digital payments are more cost-effective as compared to traditional payment methods.

2. Better Compliance

- To maintain a secure payment framework – Payment Card Industry (PCI) compliance is mandated by credit card companies. The Payment Card Industry Data Security Standard (PCI DSS) is defined as a set of requirements that ensure secure processing, storing, or transmission of the credit card information.

- New age PCI DSS compliant solutions provide a frictionless experience by protecting the business along with their customers’ data. This ensures that the payment information is securely handled. Electronic payments are offered with multi-layered security that encrypts the payment information. For example, virtual cards use the method of tokenization which restricts payment to a fixed amount of transaction. This process can provide better working capital benefits with improved control of the overall cash flow. Opting for a PCI DSS compliant solution may come with high costs so it’s advisable to carefully read through the payment terms before settling on a solution.

3. Better Cash Flow and Visibility

- Improved Cash Flow: In today’s economy, enabling customers to pay in their preferred format could make all the difference between getting paid and accounts going delinquent. With digital payment formats, businesses not only get payments in their bank accounts instantly but they could also fast-track processing for a faster cash conversion cycle.

- Better Visibility: Digital payments allow access to real-time revenue performance with strategic insights for better cash management. With a digitized framework, businesses can track open AR and payment trends to identify potential risks and delinquent accounts.

4. Improved Customer Experience

The availability of multiple payment formats makes it easier for customers to pay for invoices on time. This will result in a reduction in the overhead of the open AR.

Figure: Benefits of Enabling Digital Payments

Summary

In the B2B payments space, adapting to the changing needs of the business and customers will have a ripple effect going forward. Businesses must determine where they stand in their digital payment journey. Mid-sized business owners can benefit from this digital transformation with faster payments, better customer experience, and improved operational efficiency leading to positive cash flow. The first step is to determine the overall cost and benefits of different payment methods that specifically cater to their business goals.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company that leverages Artificial Intelligence-based Autonomous Systems to help 600+ industry-leading companies automate their Accounts Receivable and Treasury processes.

Processing over $4.7 Trillion in receivable transactions annually, HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

HighRadius is the industry’s most preferred solution for Accounts Receivable & Treasury and has been named a Leader by IDC MarketScape twice in a row.

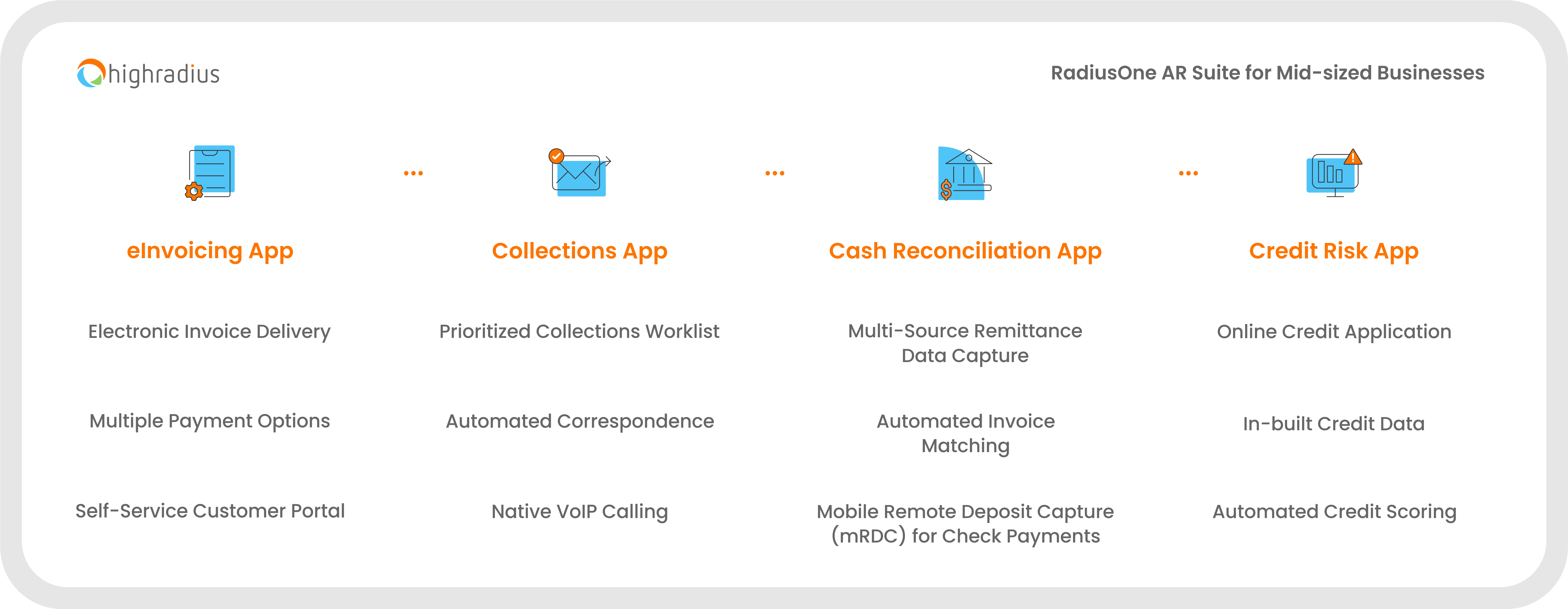

RadiusOne AR Suite

The RadiusOne AR Suite by HighRadius is a complete accounts receivable solution built for mid-sized businesses to put their order-to-cash on auto-pilot with AI-powered solutions. With out-of-the-box integration, the solution can be deployed in under four weeks without borrowing support and time from internal IT teams. It supports robust API-based connectors for lightning-fast remote deployment.

RadiusOne is designed to automate and fast-track key receivable functions including eInvoicing, Collections, Cash Reconciliation, and Credit Risk Management.

With flexible integration support for popular ERPs such as Oracle NetSuite, Sage Intacct, Microsoft Dynamics, SAP, and many more; the solution aims at streamlining AR processes while eliminating hours of manual and paper-based workload, enabling improved visibility, control, and efficiency.

For more information, visit www.highradius.com