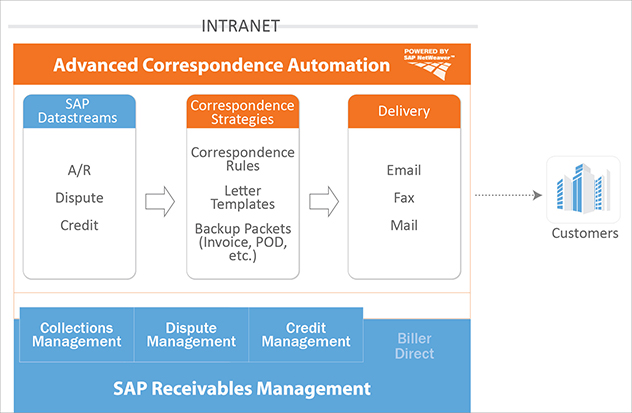

Advanced Correspondence Automation

The HighRadius Advanced Correspondence Automation solution enables the automated creation and distribution of credit, collections, and dispute correspondence. Using data inputs from SAP Financials, Sales & Distribution, and the Receivable Management modules, a robust rules engine automatically drives key decisions in the correspondence process: where to send, what to send, how to send, and when to send. It also dynamically creates the collection correspondence, gathers any backup documentation, and collates it into a package to be sent via email, fax, or mail. The result is a less cumbersome process that reduces errors, increases productivity, and improves KPIs like Days Sales Outstanding (DSO).

Click here or on the image above to view an enlarged version or download its pdf format.

The accelerator is certified by SAP and built on top of the SAP Netweaver platform in ABAP code. This provides real-time data integration and lower total cost of ownership than point solutions that are not native to SAP.

Features

- Library of best practice collection & dispute letters and the ability for end-users to create individual correspondence letters dynamically in SAP without requiring Smart Form development by IT.

- Ability to automatically send collection correspondence such as past due letters, invoices, etc. via email and fax en masse directly from SAP.

- Auto-attachment of additional documentation such as Proofs of Delivery (POD) and Bills of Lading (BOL) to correspondence.

- Ability to mass generate collated claim denial packages for invalid deduction cases including customer denial forms, invoice copies, debit memos, PODs, etc.

- History logs to track all correspondence and the ability to view the original content of each correspondence package.

Benefits

- Automates up to 30% of an analyst’s workload, freeing up valuable time to focus on core credit & collections related activities.

- Lowers Days Sales Outstanding (DSO) via ‘touching’ a big volume of small balance customers that have historically not gotten attention due to capacity constraints.

- Error-free correspondence improves customer relations and quicker resolution.

- Lower Total Cost of IT Ownership (TCO) since the solution can be installed in the existing SAP landscape eliminating the need for additional hardware and a product-specific support team.

Resources

Case Study

How Dr Pepper Snapple Group Achieved 80% Credit & AR Process Automation and Saved $2M

Colleen Zdrojewski, Vice President, Financial Services, Dr Pepper Snapple Group

Jay Tchakarov, Vice President, Product Management, HighRadius