Key Takeaways

- SOX Compliance refers to adhering to regulations aimed at ensuring transparent and accurate financial reporting in public companies.

- Enhanced accuracy, stronger governance, boosted investor confidence, fraud prevention, transparent communication, and reduced legal risks are key gains from SOX compliance.

- Gain insights into specific SOX compliance requirements, including CEO and CFO responsibilities, data security policies, documentation, and internal controls at the IT level.

- Implement a thorough SOX compliance checklist covering vital areas like data security, access control, reporting, incident response, segregation of duties, audit trail, and backup systems.

Introduction

Regulatory frameworks play a pivotal role in ensuring transparency, accountability, and the integrity of financial reporting. Among these, the Sarbanes-Oxley Act (SOX) stands out as one of the key financial regulations, shaping the way businesses operate and disclose financial information.

SOX Compliance is designed to protect shareholders and the general public from accounting errors and fraudulent practices within organizations. Enacted in 2002 in response to corporate scandals that shook investor confidence, SOX aims to restore trust in financial markets by establishing stringent standards for financial reporting.

This blog serves as a comprehensive guide, breaking down the key components of SOX compliance. From understanding the types and titles associated with SOX to navigating the regulatory landscape, we aim to provide clarity on the essentials that organizations must grasp. We’ll also take a close look at the SOX compliance checklist which is a crucial tool that organizations can use to ensure they follow regulatory requirements systematically and effectively.

What is SOX Compliance?

SOX compliance refers to adherence to the Sarbanes-Oxley Act, a set of regulations to enhance transparency and accountability in financial reporting by public companies. It was a response to corporate scandals, setting standards to prevent fraud and ensure accurate financial disclosures.

The Sarbanes-Oxley Act places a strong emphasis on internal controls for financial records, demanding meticulous oversight. Key figures, including the CEO and CFO, are required to sign statements affirming the accuracy of financial reports. This commitment to accountability aims to prevent fraudulent reporting, with increased fines and criminal sentences serving as deterrents.

History of SOX

In the wake of high-profile corporate scandals involving Enron and WorldCom, Senator Paul Sarbanes (D-MD) and Representative Michael G. Oxley (R-OH-4) co-authored the Sarbanes-Oxley Act (SOX) to restore trust in financial markets. These incidents revealed a lack of financial reporting and transparency, resulting in substantial losses for investors, the public, and government agencies.

The Act primarily targets publicly traded companies, aiming to protect investors and the public from accounting errors and fraudulent practices. It mandates rigorous internal controls, requiring companies to assess and disclose the effectiveness of their financial reporting processes. The Act has significantly influenced corporate governance practices, reshaping how companies approach financial transparency and responsibility.

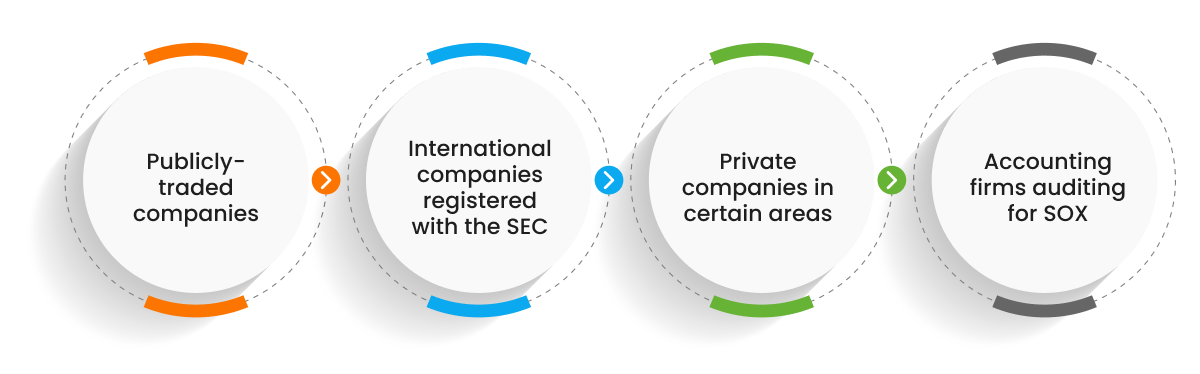

Who Must Comply with SOX?

SOX comprises eleven provisions, primarily applicable to publicly traded U.S. companies or foreign companies conducting business in the U.S. These entities are obligated to establish and maintain internal controls, subject to audits. Reporting and auditing requirements, including the engagement of an independent accounting firm, are integral to the compliance process. Off-balance-sheet actions also require reporting. Here’s a breakdown of the key entities falling under the purview of SOX:

1. Publicly-traded companies

- SOX is mandatory for all publicly traded companies based in the United States.

- It extends to wholly-owned subsidiaries and foreign companies with publicly traded stocks conducting business in the U.S.

2. International companies registered with the SEC

- International companies with stocks or securities registered with the U.S. Securities and Exchange Commission (SEC) are subject to SOX regulations.

3. Private companies in certain areas

- SOX compliance for private companies may be necessary, particularly if engaged in specific areas of financial reporting, extending the regulatory scope to comply with SOX provisions.

- Notably, private companies planning an initial public offering (IPO) should prepare for SOX compliance ahead of going public.

4. Accounting firms auditing for SOX

- Accounting firms conducting audits for companies subject to SOX compliance are themselves regulated by SOX.

Benefits of SOX Compliance

SOX compliance guidelines bring forth a multitude of benefits that extend beyond mere adherence to standards. By instilling financial integrity and accountability, SOX compliance contributes to the overall health and credibility of organizations. Here are key benefits derived from a robust SOX compliance framework:

- Enhanced financial accuracy: SOX compliance imposes stringent internal controls, resulting in heightened accuracy in financial reporting. This systematic approach to financial processes minimizes errors, instilling confidence in the reliability of reported financial data.

- Strengthened corporate governance: The pivotal role of boards of directors in overseeing SOX compliance enhances corporate governance. Active board engagement ensures alignment with compliance requirements, nurturing a culture of responsible and ethical business practices.

- Improved investor confidence: SOX compliance establishes a level playing field for investors by ensuring consistent and transparent financial reporting. The increased accuracy and reliability of financial statements contribute to improved investor confidence in the organization’s financial health.

- Prevention of fraud and mismanagement: The stringent SOX requirements act as a robust deterrent against fraudulent activities and financial mismanagement. Provisions such as CEO and CFO attestations create a system of checks and balances that significantly reduce the likelihood of fraudulent reporting.

- Transparent communication: SOX compliance necessitates clear reporting and disclosure obligations for publicly traded companies. Transparent communication about internal controls and any identified deficiencies builds trust among stakeholders, including investors and the public.

- Mitigation of legal risks: By adhering to SOX compliance, organizations can effectively mitigate legal risks associated with financial malpractice. Following the Act’s provisions demonstrates a commitment to ethical business practices, reducing the likelihood of legal challenges.

Challenges involved in SOX Compliance

Implementing SOX compliance measures introduces a set of challenges that organizations must navigate diligently. These challenges, if not addressed effectively, can hinder the seamless adherence to regulatory standards aimed at ensuring financial integrity.

- Financial strain on resources: The process of implementing and maintaining SOX compliance measures can strain financial resources. Costs associated with technology upgrades, personnel training, and external audits may pose challenges, especially for smaller organizations with limited budgets.

- Complexity of compliance processes: SOX compliance involves intricate processes related to internal controls, reporting, and documentation. The inherent complexity of these processes can overwhelm organizations, particularly those lacking prior experience or adequate resources to manage the intricacies involved.

- Continuous monitoring and reporting: SOX mandates continuous monitoring of internal controls and the prompt reporting of any deficiencies. The demand for real-time oversight adds a layer of complexity, requiring organizations to invest in robust systems and processes to ensure compliance.

- Rapidly evolving regulatory landscape: The regulatory landscape, including SOX requirements, is subject to changes and updates. Organizations must stay vigilant to adapt quickly to evolving regulations, adding a layer of uncertainty to compliance efforts as they navigate the dynamic regulatory environment.

- IT system integration challenges: Achieving SOX compliance often necessitates integration with existing IT systems. Organizations may face challenges aligning their current systems with compliance requirements, requiring investments in technology and expertise to ensure a seamless integration process.

- Human factor and employee training: Employees play a critical role in maintaining SOX compliance. Ensuring that staff understands and adheres to compliance measures requires effective training programs. However, providing comprehensive employee training can be resource-intensive.

SOX Compliance Requirements

Ensuring SOX compliance involves meeting specific requirements aimed at fortifying financial transparency and corporate accountability. Here are the fundamental SOX compliance requirements:

- CEO and CFO responsibilities

- Data security policies

- Documentation and continuous monitoring

- Internal controls at the IT level

1. CEO and CFO responsibilities

CEOs and CFOs shoulder direct responsibility for the accuracy, documentation, and submission of financial reports to the SEC. SOX mandates an internal control report, placing the onus on management to maintain an adequate internal control structure for financial records.

Prompt reporting of any deficiencies up the chain of command is crucial to the compliance process.

2. Data security policies

SOX mandates the establishment of formal data security policies that are consistently communicated and continuously enforced. Companies are encouraged to develop a comprehensive data security strategy to safeguard all financial data used during normal operations, ensuring resilience against potential breaches.

3. Documentation and continuous monitoring

Companies must diligently maintain and provide documentation demonstrating the continuous monitoring and measurement of SOX compliance objectives throughout the year. This documentation serves as tangible evidence of the organization’s ongoing commitment to adhering to SOX requirements.

4. Internal controls at the IT level

Internal controls in a digital SOX environment necessitate the management of various components, including access control, security and cybersecurity, segregation of duties, change management, and backup systems. These measures collectively contribute to building a secure IT infrastructure aligned with SOX compliance standards.

These requirements collectively establish a robust framework for SOX compliance, ensuring organizations adhere to standards that foster financial integrity, transparency, and trust.

Preparing for a SOX Compliance Audit

A SOX audit serves as a critical evaluation of an organization’s internal controls, financial reporting processes, and overall commitment to financial integrity. The audit focuses on four crucial internal controls, each integral to SOX compliance, and the effectiveness of your practices in these areas will be scrutinized:

- Access controls

The audit encompasses both physical and electronic access controls. Physical measures, including biometric scanners and secure doors, guarantee that only authorized personnel can access vital areas. Electronic controls, such as login policies and least privileged access, are indispensable.

Maintaining a least-privilege model aligns seamlessly with SOX requirements, ensuring users have access only as necessary for their roles.

- Security measures

A critical evaluation is undertaken to assess how organizations identify and safeguard sensitive data against potential cyberattacks. The audit demands monitoring of data access and robust mechanisms to detect and respond to security incidents.

The development of a comprehensive cybersecurity incident response plan, orchestrated by management and executives, adds an additional layer to address security concerns in line with SOX compliance.

- Data backup procedures

The assessment of data backup practices assumes pivotal importance in minimizing disruption and data loss during a system-wide disaster. Adherence to SOX compliance standards is imperative for both original systems and data center devices containing backups.

Proactive organizations consider maintaining SOX-compliant offsite backups of financial records, showcasing a commitment to safeguarding critical data.

- Change management processes

Well-defined processes for adding and maintaining users, installing new software, and making changes to databases or applications managing financials are integral components of compliance. Any changes, be it in personnel, infrastructure, or software, necessitate meticulous recording and monitoring for potential abnormalities, ensuring the transparency mandated by SOX.

SOX Compliance Checklist

Crafting a comprehensive SOX compliance checklist involves addressing key areas that safeguard financial data and aligning systems with SOX accounting requirements. Let’s delve into a curated checklist that covers essential components derived from industry insights:

- Data security breaches

- Data storage and retrieval

- Access control

- Verifiable reporting

- Incident escalation

- Segregation of duties

- Audit trail

- Backup systems and data restoration

1. Data security breaches

- Can your organization promptly detect and respond to data security breaches?

- Is there a dedicated incident response team in place, equipped to handle various threats such as ransomware and phishing attacks?

- Do you utilize advanced software for breach detection across databases, websites, and storage?

2. Data storage and retrieval

- Is your data stored in compliance with SOX requirements, considering different data types?

- Is the data easily searchable, retrievable, and encrypted?

- Are data centers aligned with SOX regulations?

3. Access control

- How is access to sensitive data managed?

- Are unique login credentials assigned to users, and can user sessions be traced?

- Is there a systematic approach to tracking and managing access changes, especially during employee role transitions?

4. Verifiable reporting

- Beyond financial and business records, is there automatic and verifiable reporting for data security?

- Do you possess security tools that maintain searchable and filterable logs, with controls to prevent tampering?

5. Incident escalation

- When a security incident occurs, does your system generate tickets for timely resolution?

- Is there a structured escalation process in place to address and resolve security issues?

6. Segregation of duties

- Are employees well-versed in SOX requirements, particularly in separating duties within job roles?

- Are strategies implemented to prevent and detect various types of fraud, including those related to the separation of duties?

7. Audit trail

- Is real-time timestamping implemented for data and user access?

- Are systems in place to create an auditable trail of activities as required by SOX?

8. Backup systems and data restoration

- Do you have a documented policy for backing up systems, including quarterly restoration tests?

- How do you ensure the accuracy and tamper-proof nature of backups?

By formalizing this comprehensive checklist, organizations can proactively address SOX compliance, safeguard financial data, and establish robust controls to meet the stringent requirements of the Sarbanes-Oxley Act. Implementation of these measures not only ensures compliance but also strengthens overall data security and risk management practices.

SOX Compliance with HighRadius

As organizations worldwide recognize the crucial need for maintaining financial integrity and meeting regulatory standards, HighRadius’ Record to Report solution emerges as a key ally in this pursuit. It introduces a robust Maker Checker Workflow, strategically designed to fortify control and collaboration within the accounting function. At its core is the concept of segregation of duties, ensuring a diligent division of responsibilities. This approach minimizes risks associated with critical tasks like journal entries by engaging multiple stakeholders.

The software orchestrates a seamless task lifecycle, managing each stage from preparation to review and final approval with precision. This meticulous orchestration not only minimizes errors but also cultivates a culture of accountability, transforming SOX compliance from a requirement to an opportunity for operational excellence.

HighRadius’ R2R software prioritizes transparency with its Task Audit Log, offering a concise, chronological history of every task action. Compliance-related events are meticulously recorded, making them easily traceable for comprehensive monitoring. This not only maintains transparency but also empowers organizations to effectively monitor and manage compliance, setting the stage for enhanced financial integrity and regulatory adherence.

HighRadius’ R2R software isn’t just a solution; it’s a strategic investment in elevating your financial processes. With transparency, collaboration, and compliance at its core, HighRadius ensures that your organization not only meets regulatory standards but exceeds them, setting the stage for enhanced financial integrity and operational excellence.

FAQ

1. What is SOX testing?

SOX testing refers to the evaluation of internal controls mandated by the Sarbanes-Oxley Act. It ensures financial data accuracy, safeguards against fraud, and verifies compliance, fostering transparency and accountability in corporate financial reporting.

2. What is a SOX audit?

A SOX auditing is an examination of a company’s internal controls & financial reporting processes to ensure compliance with the Sarbanes-Oxley Act. It aims to enhance transparency, accountability, & the accuracy of financial disclosures to protect investors and restore confidence in financial markets.

3. What is the difference between SOX and SOX 404?

SOX is a financial regulation, while SOX Section 404 specifically focuses on internal control assessment. SOX 404 compliance requires management to assess and report on the effectiveness of internal controls over financial reporting, ensuring accuracy and reliability in financial statements.

4. What is SOX compliance used for?

SOX compliance, under the Sarbanes-Oxley Act, is used to ensure transparency, accountability, and accuracy in financial reporting by public companies. It aims to prevent fraud, protect investors, and rebuild confidence in financial markets post-corporate scandals.

5. Who is SOX applicable to?

SOX primarily applies to publicly traded U.S. companies. It also extends to international companies with stocks registered with the U.S. SEC, certain private firms in specific reporting areas, and accounting firms conducting audits for companies subject to SOX compliance.

![Excel for Accountants: Everything You Need to Know [+ Free Templates]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2021/12/Untitled-design-20.png)