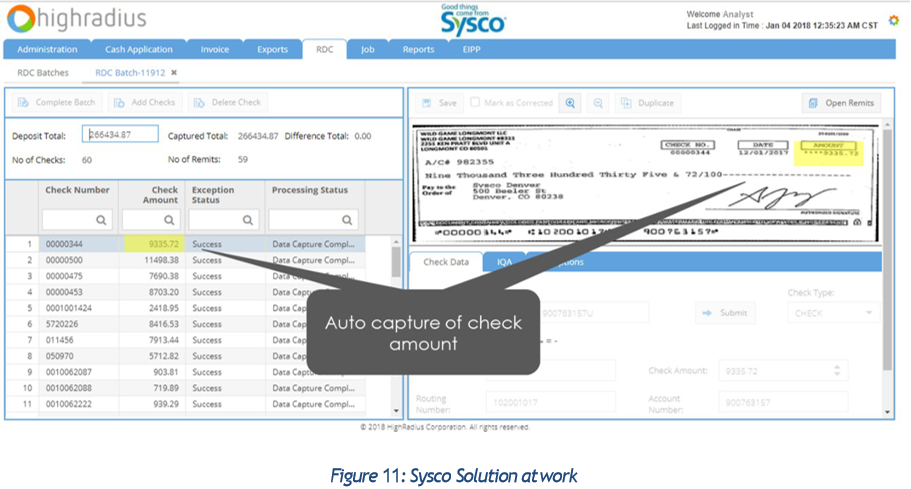

6. Case Study: The Sysco Story

This e-book will walk you through the options for processing checks on the parameters of processing cost, check float reduction and resource requirement.

6. Case Study: The Sysco Story

The major roadblocks Sysco was facing were:

The major roadblocks Sysco was facing were:

- 72 business units

- No centralized cash application

- Multiple deposit accounts

- In-house processing of all deposits

Sysco processed 3 million line-items every year. Remittance information was not used for cash application and they achieved a hit-rate of only of 30-40%. These bottlenecks did not allow them to apply cash the same day. With HighRadius Remote Control Deposit 2.0 they achieved:

- Centralized cash application with decentralized scanning

- Effectively process remittances across all formats

- Allow one payment across 72 operating companies

- Process checks and remittances in one go

They achieved same day cash application along with 85%+ hit rate.