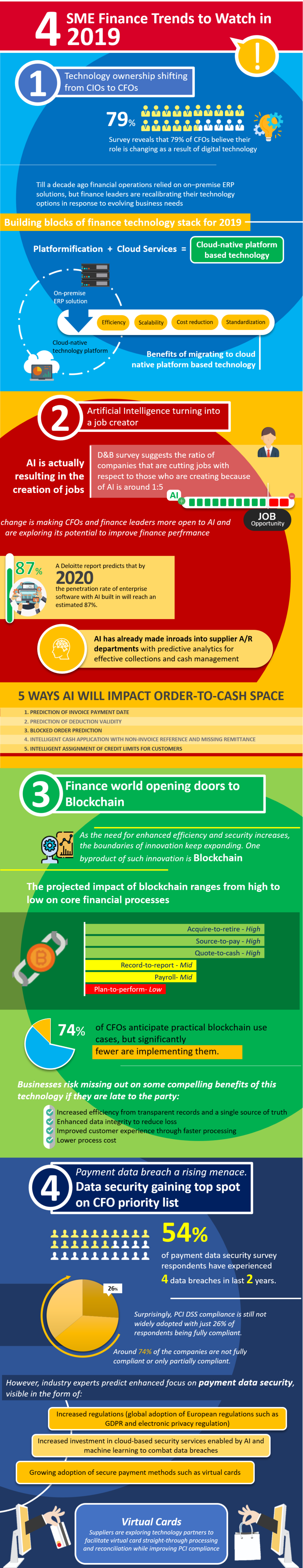

4 SME Finance Trends to Watch in 2019

What you’ll learn

- Learn the benefits of migrating to cloud-native platform-based technologies.

- Learn how AI helps with predictive analysis for collections and cash management.

- Find out about how using innovations in technology can increase efficiency.

- Learn how data security could help you achieve secure payments.

Introduction

2019 could be the year of transformation in the finance space. With more and more companies becoming a part of the digital revolution in the order-to-cash space, what A/R professionals today need is to up their game and be one step ahead at all times. In order to achieve this particular objective, let us take a look at the trends that would disrupt the finance space in 2019, and how companies should prepare themselves for the same. Survey sources

The 6 Major Blockchain Trends For 2018 Outlined By DeloitteFrom bottom line to front line

AI a Job Creator?

The State of Payment Security

Learn more

Artificial Intelligence for Finance in 2019: Job Losses Vs Job Creation

The Success Framework for Faster B2B Payments Same-Day ACH, Real-Time Payments and Virtual Cards

Blockchain: A Game-Changer in Accounts Receivable?

Survey sources

The 6 Major Blockchain Trends For 2018 Outlined By DeloitteFrom bottom line to front line

AI a Job Creator?

The State of Payment Security

Learn more

Artificial Intelligence for Finance in 2019: Job Losses Vs Job Creation

The Success Framework for Faster B2B Payments Same-Day ACH, Real-Time Payments and Virtual Cards

Blockchain: A Game-Changer in Accounts Receivable?

There's no time like the present

Get a Demo of Integrated Receivables Platform for Your Business

Request a Demo

HighRadius Integrated Receivables Software Platform is the world's only end-to-end accounts receivable software platform to lower DSO and bad-debt, automate cash posting, speed-up collections, and dispute resolution, and improve team productivity. It leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes and also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier accounts receivable process to the buyer accounts payable process. Integrated Receivables have been divided into 6 distinct applications: Credit Software, EIPP Software, Cash Application Software, Deductions Software, Collections Software, and ERP Payment Gateway - covering the entire gamut of credit-to-cash.