Key Takeaways

- Receive a step-by-step guide to post closing entries effectively.

- Understand the impact of closing entries on various accounts, such as revenue, expenses, and retained earnings.

- Explore a practical trial balance example and closing entries’ role in ensuring accurate financial statements.

Introduction: The Accounting Cycle

The accounting cycle is like a well-choreographed dance, consisting of 8 sequential steps that lead us through the intricate world of financial accounting. At the tail end of this cycle, in step 8, we encounter the often-overlooked closing entries.

Closing entries patiently await their turn once we’ve wrapped up the creation of financial statements for each accounting period. But what do these entries entail?

Let’s roll up our sleeves and delve into the nitty-gritty details.

What Is a Closing Entry?

A revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). It helps prepare the books for the next accounting period.

Purpose of Closing Entries

These entries serve two primary purposes:

- To transfer temporary account balances to permanent accounts

- To reset temporary accounts to zero for the new period

What are Temporary and Permanent Accounts?

Permanent Accounts:

- Assets, liabilities, and equity are permanent accounts.

- They reside in the general ledger, and their closing balances at the end of an accounting period carry forward to the next period.

- Permanent accounts reflect the ongoing financial position of a business.

Temporary Accounts:

- Revenues, expenses, and dividends are temporary accounts.

- They also reside in the general ledger but are specific to a particular accounting period. At the end of the period, their closing balances need to be reset to zero.

- This resetting process is accomplished using closing entries.

In summary, permanent accounts hold balances that persist from one period to another. In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries.

Closing Entry Example

Let's investigate an example of how closing journal entries impact a trial balance. Imagine you own a bakery business, and you're starting a new financial year on March 1st.

The trial balance is like a snapshot of your business's financial health at a specific moment. It lists the current balances in all your general ledger accounts. In this case, since it's an opening trial balance, we're just getting started with the accounting cycle (Step 1).

The Opening Trial Balance Snapshot:

Permanent Accounts (Balance Sheet):

- Assets: Cash, Accounts Receivables, Inventory

- Liabilities: Accounts Payable, Salaries, Loans

- Equity: Share Capital, Retained Earnings

These permanent accounts form the foundation of your business's balance sheet. They carry over their balances from the previous year.

However, you might wonder, "Where are the revenue, expense, and dividend accounts?" Trial balances often filter out accounts with zero balances. If we expand the view, we'll find the usual suspects—the temporary accounts. These accounts were reset to zero at the end of the previous year to start afresh.

Temporary Accounts (Reset to Zero):

- Revenue: Sales, Service Revenue

- Expenses: Cost of Service, Overhead Expense, Interest Expense, Tax

- Dividends: Owner's Withdrawals

As we progress through the accounting cycle, we reach a crucial milestone: the adjusted trial balance (step 6). Let's fast forward to February 28th.

The Adjusted Trial Balance Snapshot:

This adjusted trial balance reflects an accurate and fair view of your bakery's financial position. It encompasses an entire year's worth of transactions.

Temporary Accounts (Now Complete):

- Revenue: $20,000,000

- Expenses: $16,050,000

- Dividends: $500,000

Now, all the temporary accounts stand tall with their respective figures, showcasing the revenue your bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year.

How to Post Closing Entries

To smoothly transfer temporary account balances to permanent accounts (step 8), we can use either the long or short-form method to post closing entries. Let's focus on the long-form method and break it down into manageable steps:

Long-Form Method:

This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.

What is an income summary account?

The income summary account is a temporary account solely for posting entries during the closing process. It is a holding account for revenues and expenses before they are transferred to the retained earnings account.

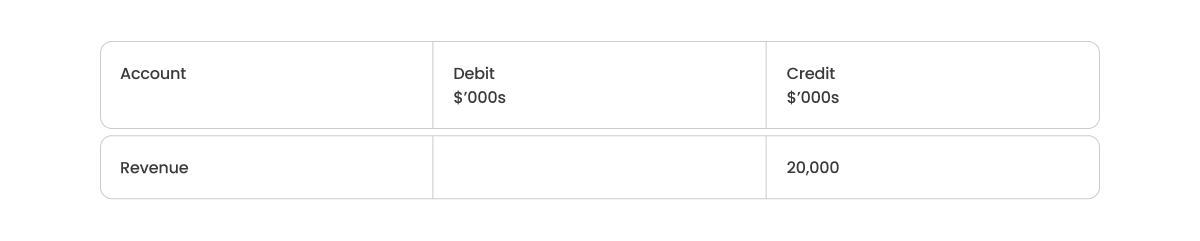

Step 1: Clear revenue to the income summary account

Identify the Temporary Revenue Account:

- Within the adjusted trial balance, locate the revenue account that needs to be reset to zero.

- Ensure you're adjusting the revenue under the temporary accounts tab, not the accrued or deferred revenue found under assets and liabilities, respectively, as these are permanent accounts.

Adjust the Revenue Account:

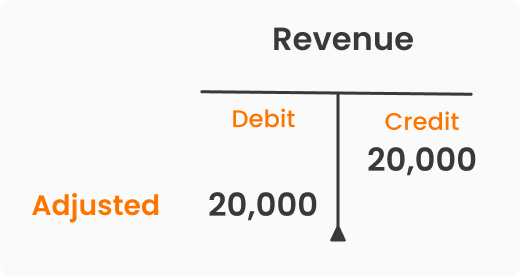

- Your business has earned $20 million this year, reflecting a credit balance in the revenue "T" account (right-hand-side).

- Post a closing journal entry on February 28th to reset this temporary account to zero.

- Debit the revenue account by $20 million and credit the income summary account with the same amount.

- The closing entry transfers the balance from the revenue account to the income summary account.

- As a result, the revenue account now shows a balance of zero dollars, while the income summary account reflects $20 million.

Step 2: Clear expenses to the income summary account

Identify the Temporary Expenses Account:

- Locate the expense accounts in the adjusted trial balance that need to reset to zero.

- There are four expense accounts: cost of services, overhead expenses, interest, and tax.

- Ignore accrued expenses, as it is a permanent liability account.

Adjust the Expense Accounts:

- Post a closing entry similar to step one to reset the expense accounts to zero.

- Expenses reflect a debit balance in the revenue "T" account (left-hand-side)

- Post equal and opposite credits to each account to reset them to nil.

- The total balance is $16,050,000, which will be debited to the income summary account.

Balance the Journal Entry:

- The debit column's total must match the credit column's in every journal.

- Credit the right-hand side of each expense account to reset them to zero.

- Debit the left-hand side of the income summary account, giving it a new balance of $3,950,000, a net credit on the right-hand side.

Step 3: Clear the balance in the income summary account to retained earnings

Clear out the Income Summary Account:

- Look at the income summary account in your trial balance, which has a credit balance of $3,950,000.

- The income summary account represents the combination of your business's revenues and expenses for the year.

- To clear this balance, you must debit the income summary account by the same amount and credit the balance to retained earnings.

Post the Closing Entry:

- The closing entry for this step is straightforward. Debit the income summary account by $3,950,000.

- Then, credit the same amount to retained earnings.

- By posting this entry, your business's retained earnings, or profits held for future use, will increase to $13,950,000.

Step 4: Clear the dividends straight to retained earnings

Reset Dividends and Adjusting Retained Earnings:

- Reset the current year's dividends to zero and clear the balance to retained earnings.

- Your business declared dividends of $500,000 this year, which represents profits distributed to owners and shareholders.

- Since retained earnings reflect profits held for future use, issuing dividends reduces the balance in retained earnings.

Closing Entry for Dividends:

- The dividends account is a debit account, so we will credit the dividend account by $500,000 in the closing entry.

- Simultaneously, debit retained earnings by the same amount.

- By posting this closing entry, your business's dividends will be reset to zero, and its retained earnings will decrease to $13,450,000.

Post Closing Trial Balance Snapshot:

All the temporary accounts, including revenue, expense, and dividends, have been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings.

Short-Form Method:

In the short way, we can clear all temporary accounts to retained earnings with a single closing entry. By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings.

Note: In double-entry accounting, every transaction has at least two equal and opposite sides. When we post this closing entry, all temporary accounts are reset to zero.

With the use of modern accounting software, this process often takes place automatically. Learn more about the future of accounting here.

Closing Entries Best Practices

At HighRadius, we recently surveyed seasoned accountants across industries to gather their expertise on closing entries. Based on their insights, here are the five biggest practical takeaways to follow:

- Maintain Consistency:

Perform closing entries steps consistently at the end of each accounting period, whether monthly, quarterly, or annually to minimize errors and maintain accurate financial records. - Streamline Intercompany Transactions:

Scrutinize transactions between related entities or departments, eliminating or appropriately consolidating intercompany revenues and expenses for consolidated financial statements. - Adjust for Timing Differences:

Account for timing differences in revenue and expenses, ensuring all relevant transactions from the accounting period are included to prevent misstatements. - Conduct Comparative Analysis:

Compare current financial statements with prior periods to detect significant variances or anomalies. Analyze differences and investigate unexpected fluctuations for accurate and consistent financial reporting. - Leverage Accounting Software:

Streamline the closing entry process by utilizing modern and dependable accounting software features that automate calculations, generate reports, and ensure accurate execution.

Closing Entries Accounting with Automation

Most organizations appear to be doing well on the surface while underlying accounting management issues silently sabotage. Lengthy accounting cycles and inaccurate projections can result in revenue leaks costing companies millions.

This challenge becomes even more daunting as your business expands. Manual processes struggle to handle the increasing volume of financial transactions and complexities.

Automating accounting management to increase projection velocity

That’s where automation tools like Autonomous Accounting come in. It effortlessly sifts through large amounts of data and generates closing entries automatically. This ensures that your financial operations infrastructure can scale with your business’s growth.

Frequently Asked Questions on Closing Entries

1. How are closing entries posted in the general ledger?

Yes, closing entries are posted to the general ledger. The general ledger is the central repository of all accounts and their balances, including the closing entries.

2. In which journal are closing entries typically recorded?

Closing entries are typically recorded in the general journal. The general journal is used to record various types of accounting entries, including closing entries at the end of an accounting period.

3. Which types of accounts do not require closing entries?

Permanent accounts do not need closing entries. These accounts include asset accounts, liability accounts, and equity accounts.

4. Should closing entries be performed before or after adjusting entries?

No, closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensure that revenues and expenses are appropriately recognized in the correct accounting period.

Once adjusting entries have been made, closing entries are used to reset temporary accounts and transfer their balances to permanent accounts.

5. Which accounts remain unaffected by closing entries?

Permanent accounts are not affected by closing entries.

These accounts have continuous balances that carry forward from one accounting period to another. Examples of accounts not affected by closing entries include asset, liability, and equity accounts.

6. How to close revenue accounts?

To close revenue accounts, subtract the total revenue earned during a period from the initial balance. This leaves you with the net revenue. This is crucial for accurately tracking profits and losses.