Did Finance Say ‘Yes’ To Automation?

Introduction

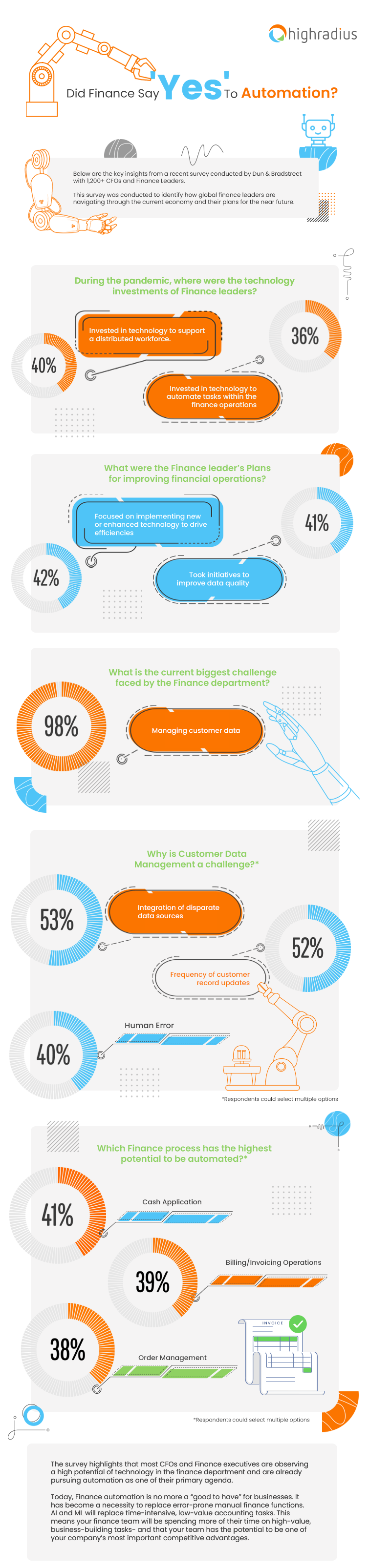

The pandemic-led disruption has made CEOs and departments like sales and operations rely more on the finance function for data. Finance leaders are expected to provide access to high-quality data to help them make decisions with speed and accuracy. However, all that data can be overwhelming as the finance teams continue to operate on spreadsheets by manual methods. This requires hours of time to collect the data and improve the quality, with less or no time to perform analysis and provide a strategic recommendation. Today, finance leaders have realized that automation is the best strategy to eliminate siloed manual processes and enable global visibility, transparency, compliance, and standardization that was not possible before.

There's no time like the present

Get a Demo of Integrated Receivables Platform for Your Business

Request a Demo

HighRadius Integrated Receivables Software Platform is the world's only end-to-end accounts receivable software platform to lower DSO and bad-debt, automate cash posting, speed-up collections, and dispute resolution, and improve team productivity. It leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes and also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier accounts receivable process to the buyer accounts payable process. Integrated Receivables have been divided into 6 distinct applications: Credit Software, EIPP Software, Cash Application Software, Deductions Software, Collections Software, and ERP Payment Gateway - covering the entire gamut of credit-to-cash.