This is the second ebook in a series that analyzes why the month end financial close takes time. In our previous ebook, we provided an overview of the bottlenecks slowing the closing process and the reasons causing the financial close bottlenecks. In this ebook, we explore the first challenge that creates these bottlenecks, the need for real time data to support a continuous close process.

For most companies, the close process starts two to three days before the end of the month. The pre-close process focuses on preparing all the data that can be prepared while waiting for the month end cutoff to start the race.

The first challenge is data is only made available at month end. This prevents a continuous close process and it burdens the month end close process to manage a delicate balance between:

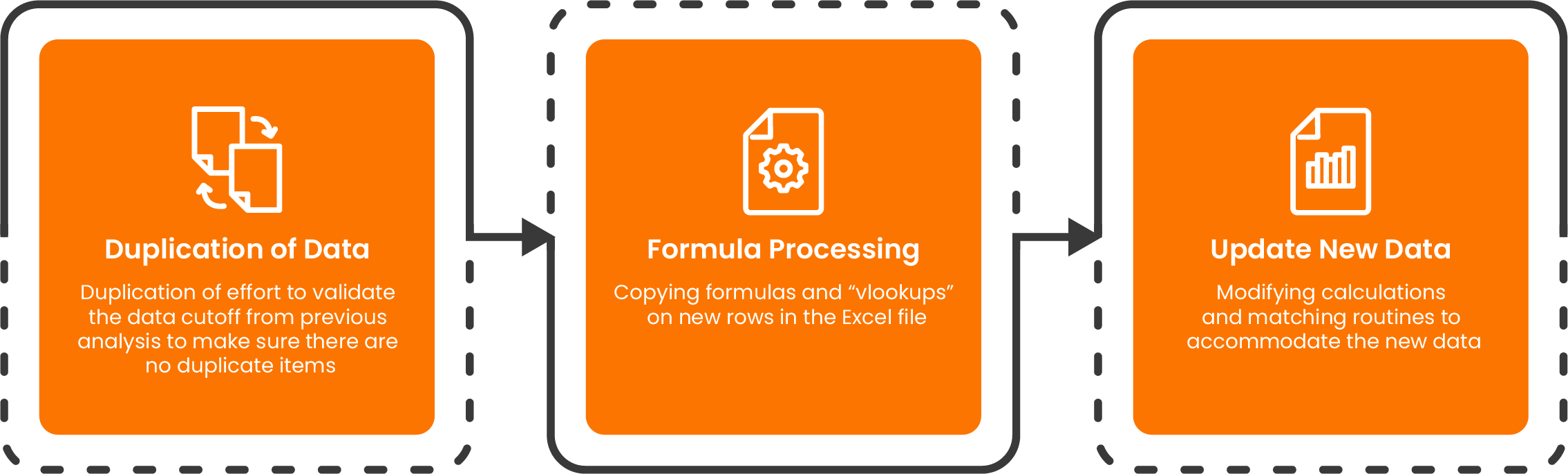

When trying to implement a continuous close process the biggest hurdle that is stopping a continuous close is data. The month end close process isn’t performed throughout the month because data isn’t easily available and able to be incrementally consumed. Typically, at the month end, the close information is pulled into Excel (.csv format) from the general ledger, sub-ledgers, the bank, and other external systems on a batch basis. While this could be done mid-month, the csv data is not incrementally consumed, meaning each csv file retrieve requires:

This increases the resources required during the month end, increases the possibility of errors in the manual Excel processes, and only marginally shortens the time to close at month end.

The second challenge is that data comes from different internal and external systems with different levels of granularity and needs to be normalized and matched. Some data comes in at a summary level, like information from the General Ledger. The summary ledger data is used to validate and match against the detailed transaction information from the different sub-ledgers, schedules, or listing of transactions used for accruals or for timing cutoffs, etc.

Real-time data updates the Excel workpapers incrementally on a daily basis so that processes like reconciliation and account analysis can be performed incrementally without worrying about data cut-off, duplication of transactions, and errors created from copying formulas to the new information.

Even though 40-60% of all transactions happen at month end, once you have access to real-time data you can create a schedule to pre-close accounts through the month rather than waiting for month end and then incrementally check out the new transactions that happen at month end. This greatly reduces the effort at month end and cuts days off of the month end closing process.

Real-time data is a multi-system challenge. Here are a few examples why:

In many cases, Excel is the system used to perform, analyze and manage the close, which makes real time data more challenging because Excel is disconnected from all the other systems. This means data is brought in at the end of the month in batch, information analyzed and reconciled, correcting journal entries calculated in Excel, and then someone manually enters the journal entries back into the ERP system.

The use of disconnected Excel with disconnected data only makes the financial close more challenging. It creates an audit challenge when the justification for adjusting and correcting journal entries at month end are Excel files on many different desktops and shared drives.There is no central binder of all month end adjustments and corrections.

The first step is to automate the financial software with an end to end financial close central system for performing the financial close processes just like you have an accounts payable system for recording expenses and paying vendors.

The second step is to make sure the financial close system supports real-time data integration with all the source systems, including:

Even though 40-60% of all transactions happen at the month end, once you have access to real-time data you can create a schedule to pre-close accounts through the month rather than waiting for month end. Then, the “after” month end process becomes incrementally verifying the new transactions during the month-end.

Financial close software should also store all the spreadsheet analysis and calculations in a connected workspace, so you have a close binder for each month rather than having close workpapers stored on every accountant’s desktop. Having a connected workspace type system for managing the spreadsheets allows for incremental updates to the close workpapers to streamline interim reconciliation and validation close processes.

In our next ebook, we will go deeper into the need for connected workspaces as an integral part of the workflow and collaboration of financial close management to organize and manage the process.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Talk to our experts