“The accounting functions are just not user friendly”

-Vice President, Corporate Controller, Brokerage

Opening up about the usability of ERP systems, the VP of a Brokerage firm shared how finance management systems have a steep learning curve. It is true that one of the invisible bottom line wreckers is the cumbersome user experience within accounting systems. There’s a fine line between adopting a new financial management system and making sure that your AR team understands it well.

As a result, business agility suffers from silo-ed workflows that hamper smooth AR functioning. Complicated, heavy, and linear user interfaces in accounting systems add to your finance teams’ challenges. Rigid accounting modules make it difficult to customize the systems to meet your business needs.

Putting things into perspective, it’s crucial to understand the strengths and weaknesses of your business operations in order to optimize them. Hearing about the shortcomings of AR functions first-hand from finance leaders, it’s clear that businesses realize the gaps and are willing to optimize their existing financial functions to accelerate growth. Learn more about the

questions you should keep in mind while adopting an AR automation solution.

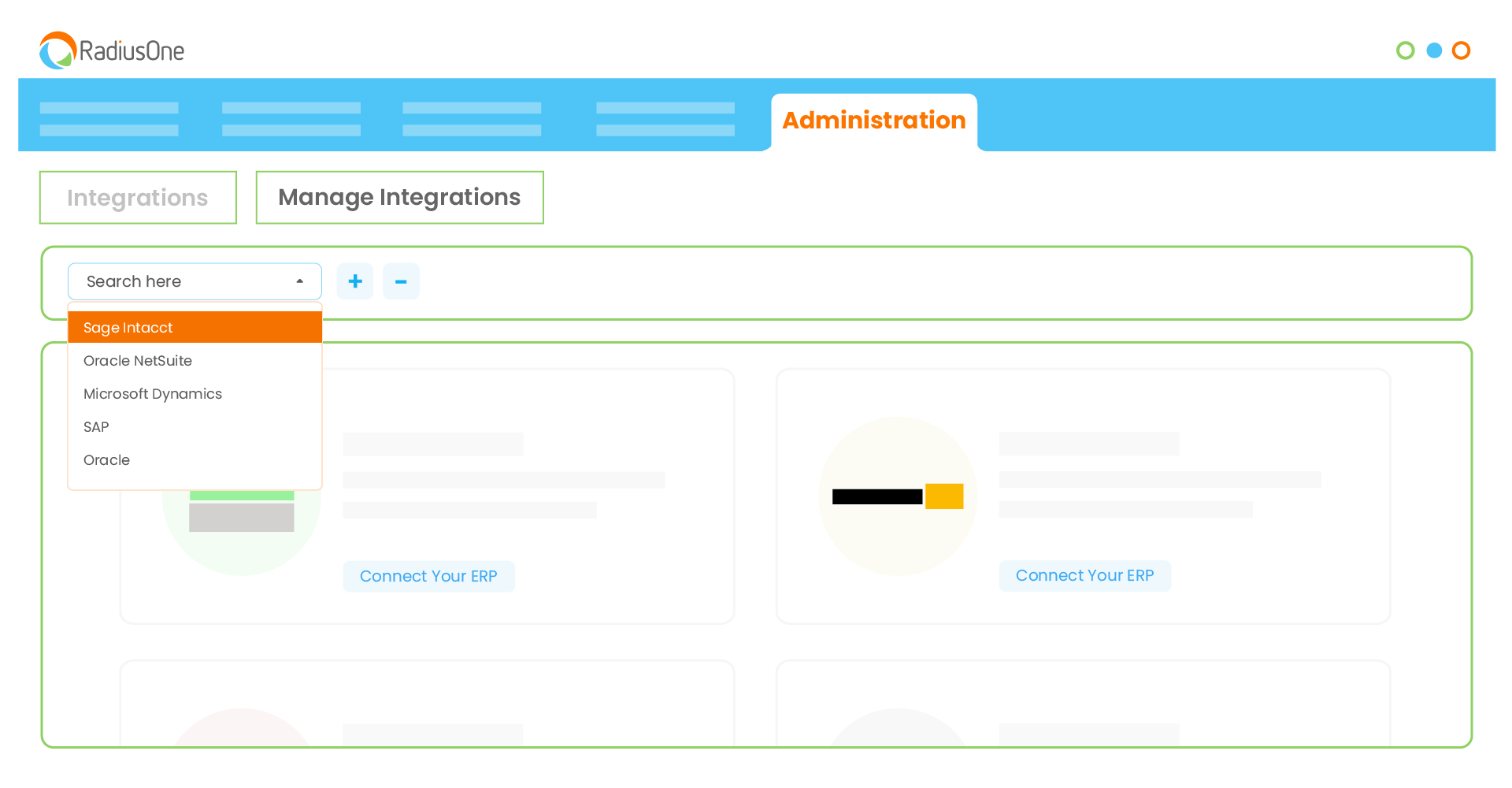

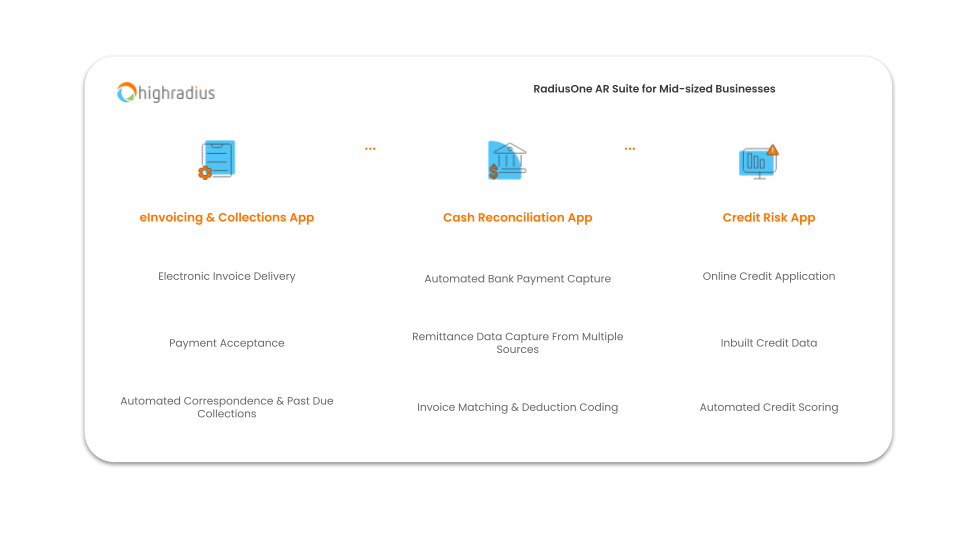

At HighRadius, we offer our customers a cost-effective, fast and easy to deploy, and functionality-rich solution with great ROI. Built to seamlessly complement ERPs such as NetSuite, Sage Intacct, and Microsoft Dynamics, RadiusOne AR helps your business optimize cash flow operations and focus on business expansion and growth. Get a demo of RadiusOne AR Suite for your business today.

The Magic Wand: HighRadius Advantage

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company that leverages Artificial Intelligence-based Autonomous Systems to help 600+ industry-leading companies automate their Accounts Receivable and Treasury processes. Processing over $2.23 trillion in receivables transactions annually, HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

- 1600+ Finance Transformation Projects

- $2.23 Tr Processed Across mid-market & enterprise companies

- 92+ Countries Truly Global SaaS with Users Around The World

- 77%+ CAGR Global-ready end to end platform

Securing a Scalable Future

HighRadius is dedicated to providing solutions across the different stages of business growth. Starting with SMBs having a single ERP system, two to five FTEs, to enterprise-grade companies that have multiple ERPs and dedicated FTEs for handling different operational functions and global implementations, or Fortune 100 companies with shared services and multiple business units – the company caters to every business need. HighRadius’ scalable approach to the Order to Cash portfolio of solutions ranges from the RadiusOne AR Suite to the Autonomous Integrated Receivables Platform.

Why RadiusOne AR Suite?

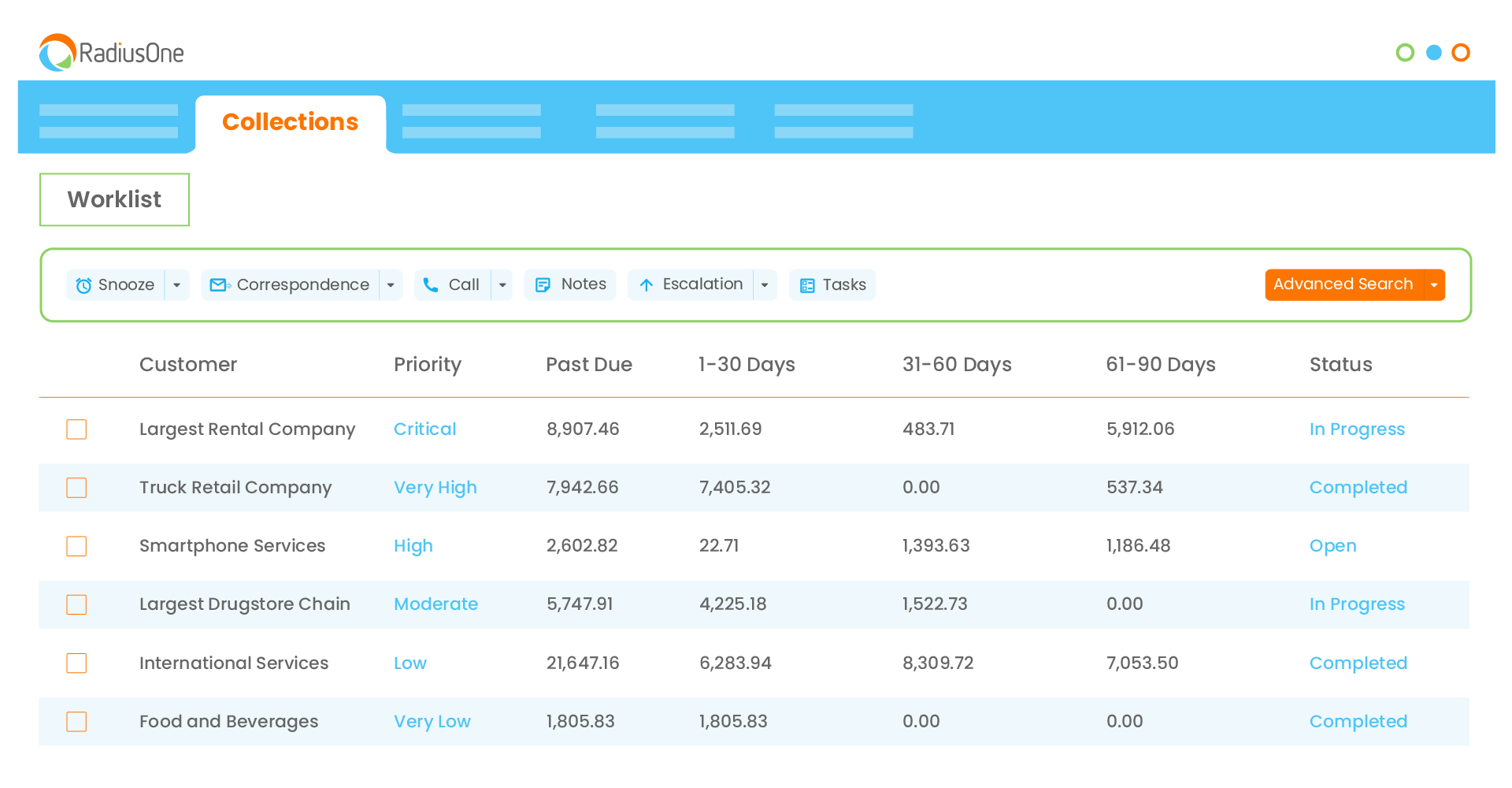

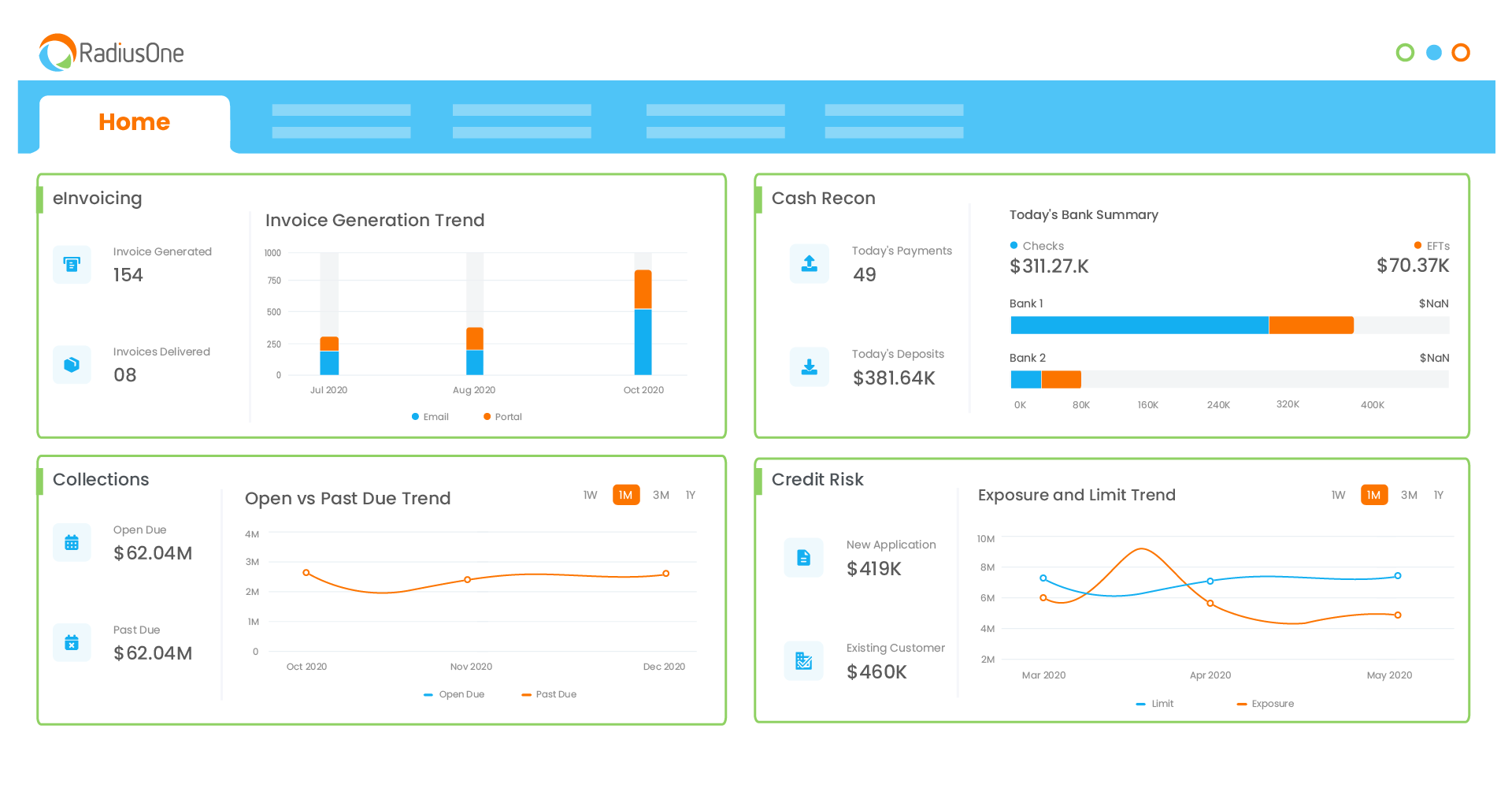

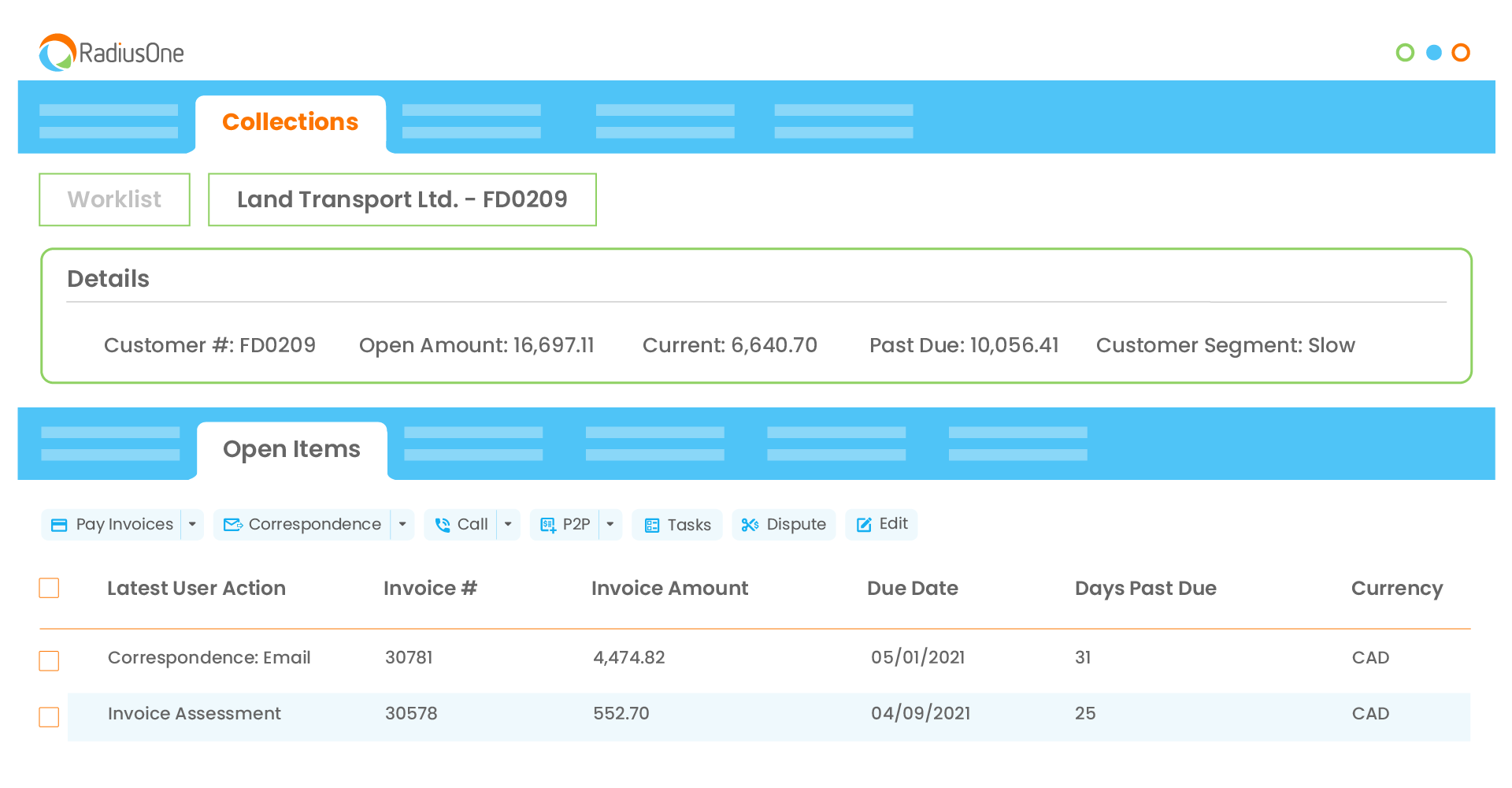

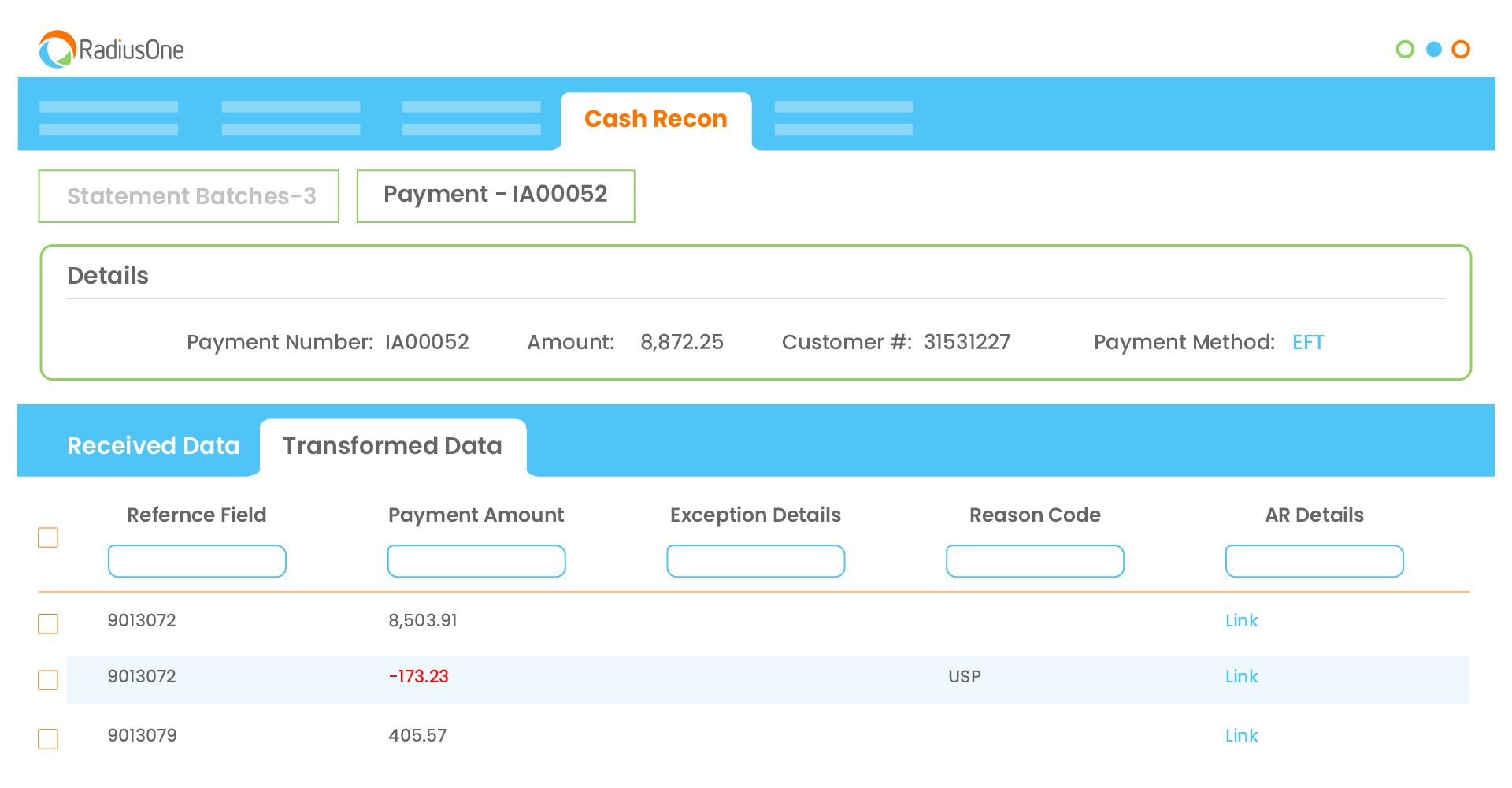

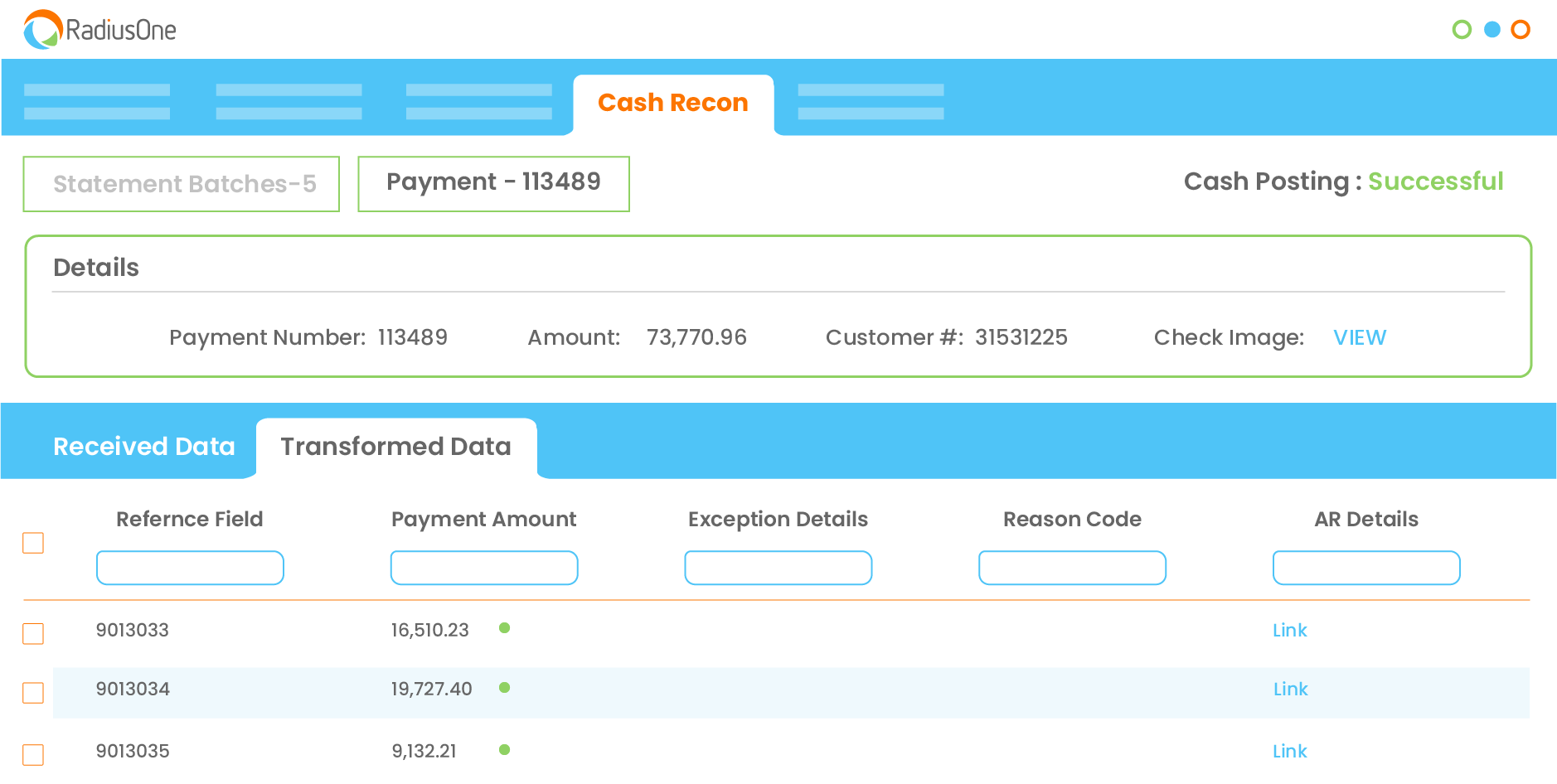

The RadiusOne AR Suite by HighRadius is a complete accounts receivables solution designed for mid-sized businesses to put their order-to-cash on auto-pilot with AI-powered solutions. It leverages automation to fast-track key accounts receivable functions including eInvoicing & Collections, Cash Reconciliation, and Credit Risk Management powered by RadiusOne AR Apps to improve productivity, maximize working capital, and enable faster cash conversion.