Order-to-Cash Process Metrics

This e-book outlines the 15 metrics recommended by the Hackett Group to help you benchmark yourself against World-Class organizations, with a specific focus on the Order-to-Cash process KPIs. These KPIs are crucial indicators used to assess the efficiency of the order-to-cash process.

By tracking and comparing these order to cash performance metrics against best practices, organizations can gain valuable insights into their performance and identify areas for improvement in order management, invoicing, collections, and overall cash flow management.

Order-to-Cash Process KPIs & Metrics

Credit Management

1. Average Days It Takes to Complete New Credit Reviews

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Implementation of best-of breed online credit application

- Automated† correspondence for missing information such as bank/trade references, backups

- Providing real-time tracking of application status

Benefits:

- Improve customer experience with greater visibility

- Reduced manual errors

†

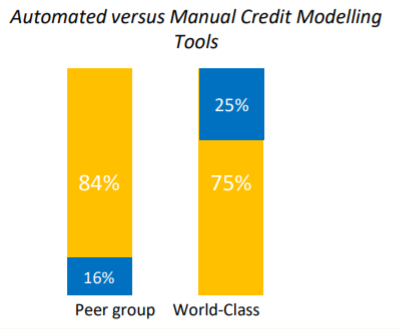

2. Automated Versus Manual Credit Modelling Tools

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Automated stakeholder correspondence for all credit decisions

- Integrating with country-specific and industry specific credit agencies, public financials and Insurance bureaus

- Automated capture of the fields from† the credit application form

Benefits:

- Standardize credit operation across various platforms

- Improved productivity to work on high value customers

Billing and Invoicing

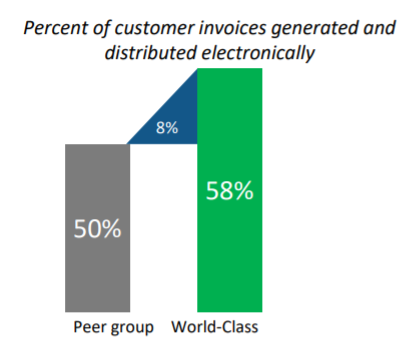

3.Percent of Invoices Generated & Distributed Electronically

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Adopt automated e-invoicing portal

- Deliver invoice according to customer preferred channel such as portal and e-mail

- Track conversion of customers from paper to†† e-invoice

Benefits:

- Self-service customer portal saves print+ mail costs

- Eliminate low-value tasks in billing and invoicing such as dealing with paper, doing back-and-forth

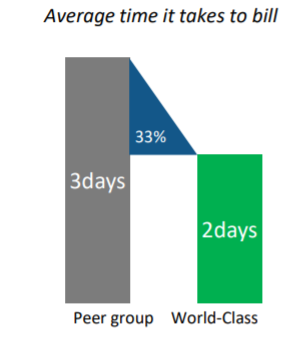

4. Average Time It Takes to Bill

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Self-service customer portal for viewing invoices

- Using a single portal which includes all relevant backup documents such as PODs, BOls

- Streamlined collaboration between internal teams

Benefits:

- Lower payment cycles

- Improved customer experience

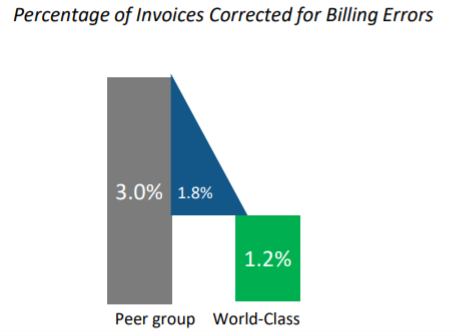

5. Percentage of Invoices Corrected for Billing Errors

Effectiveness Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Automated invoice generation from ERP open invoices

- Inbuilt correspondence templates and packages with auto-attached documents

Benefits:

- Lower deductions

- Faster collections

- Better customer experience

6. Percent of Customers Who Access Accounts via Web-based Application

Effectiveness Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Invoicing customers electronically via email, portals

- Allowing customers to pay in electronic payment formats ACH, Credit cards and e-Checks through payment portal

- Offering incentives to customers to bring them onto Web-based portals

Benefits:

- Faster payments

- Improve E-adoption

- Better customer experience

Cash Application

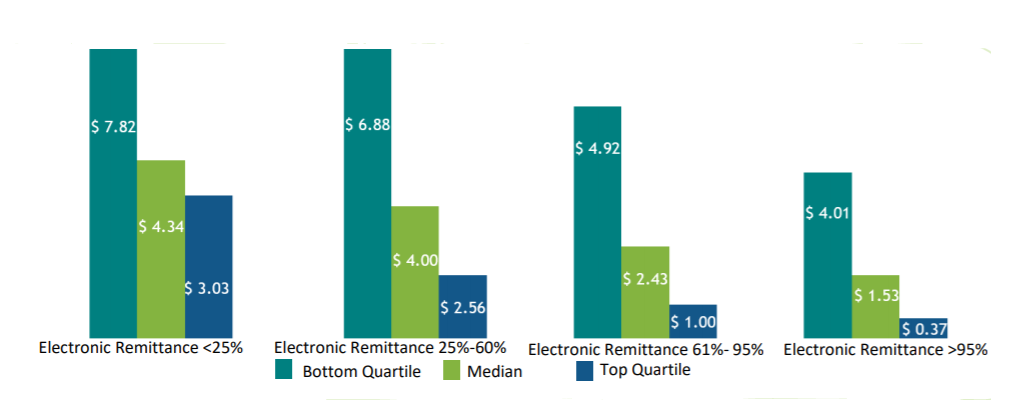

†7. Process Cost per Customer Remittance

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Standardized processing for different e-remittance types

- Automated aggregation of remittances from portals,e-mails and EDI

Benefits:

- Easy e-adoption in payments

- Lower cost in process payments

8. Automatic Remittance Posting Matching Rate

Efficiency Metrics  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Template-agnostic remittance capture

- Aggregating the remittances from multiple sources( mails, EDI, web-portals)

- AI enabled payment matching & exception handling

Benefits:

- Reallocate users

- Reduced costs

Deductions Management

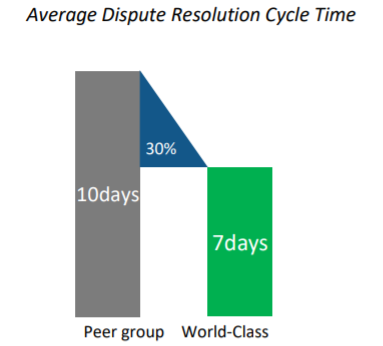

9. Average Dispute Resolution Cycle Time

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Identifying deductions at Cash Application

- A single repository for all the backup documents such as notes, claims across internal and external teams

- Track deductions aging

Benefits:

- Improved recovery of invalid deductions

- Better adherence to big box retailers such as Walmart

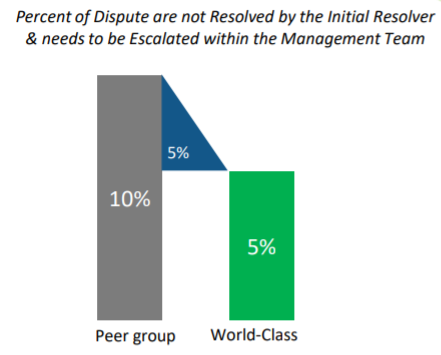

10.Percent Of Dispute Are Not Resolved By The Initial Resolver

†& Needs To Be Escalated Within The Management Team Effectiveness Metric

Best Practices from World-Class Organizations:

- Providing visibility into resolution status and progress of the dispute

- Seamless collaboration between internal teams

- Easing the research process by having all the documents at one single place

Benefits:

- Lowers DDO

- More bandwidth to work on invalid deductions

Collections Management

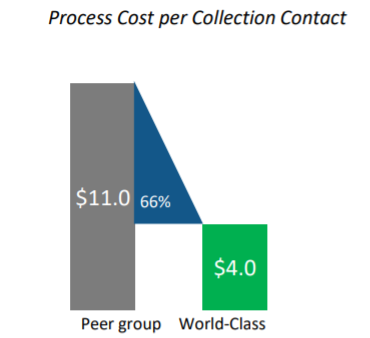

11. Process Cost per Collection Contact

Efficiency Metrics  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Providing a prioritized worklist for collectors

- Adopting automatic correspondence approach versus dial for dollar approach

- Having single source of truth across various platform to access backup documents such as invoices copies, claims documents

Benefits:

- Design scalable collections operation

- Facilitates reaching out to a broader customer base

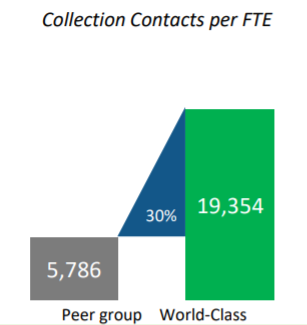

12. Collection Contacts per FTE

Efficiency Metrics  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Inbuilt correspondence templates and packages with auto-attached back-up documents to save time

- Sending pro-active reminder to customer prior to the payment due date

- Automated correspondence to different customer buckets

Benefits:

- Restricting phone calls to only select high-risk customers

- Reduce aging/ past dues

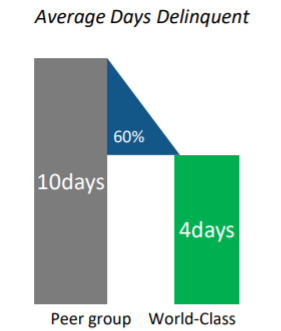

13. Average Days Delinquent

Effectiveness Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Sending automated proactive reminders before payment due date

- Predict when the customer is about to pay using Artificial Intelligence

- Provide customers with self-service portal for viewing invoices and making payments

Benefits:

- Improve working capital

- Reduce dependence on banks for short-term banking

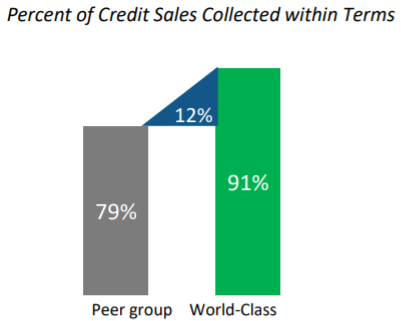

14. Percent of Credit Sales Collected within Terms

Effectiveness Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Provide incentives for early payments

- Enable payment features such as auto-pay, schedule pay

Benefits:

- Improve Days Sales Outstanding

- Minimize missed payments

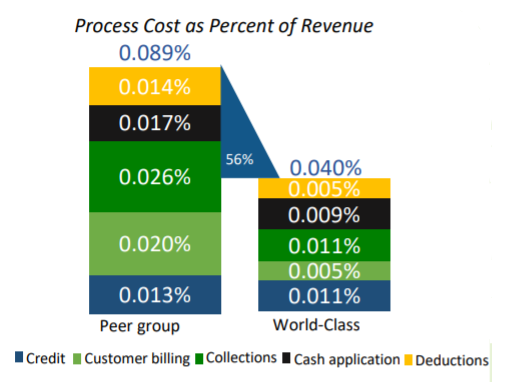

Order-to-Cash

15. Process Cost as Percent of Revenue

Efficiency Metric  Best Practices from World-Class Organizations:

Best Practices from World-Class Organizations:

- Ensure high employee productivity by eliminating manual error prone tasks

- E-adoption from paper

- Keep a track on high-risk customers to ensure there is minimal bad-debt and write-off

Benefits:

- Improved working capital and cash flow

- Easier cash management