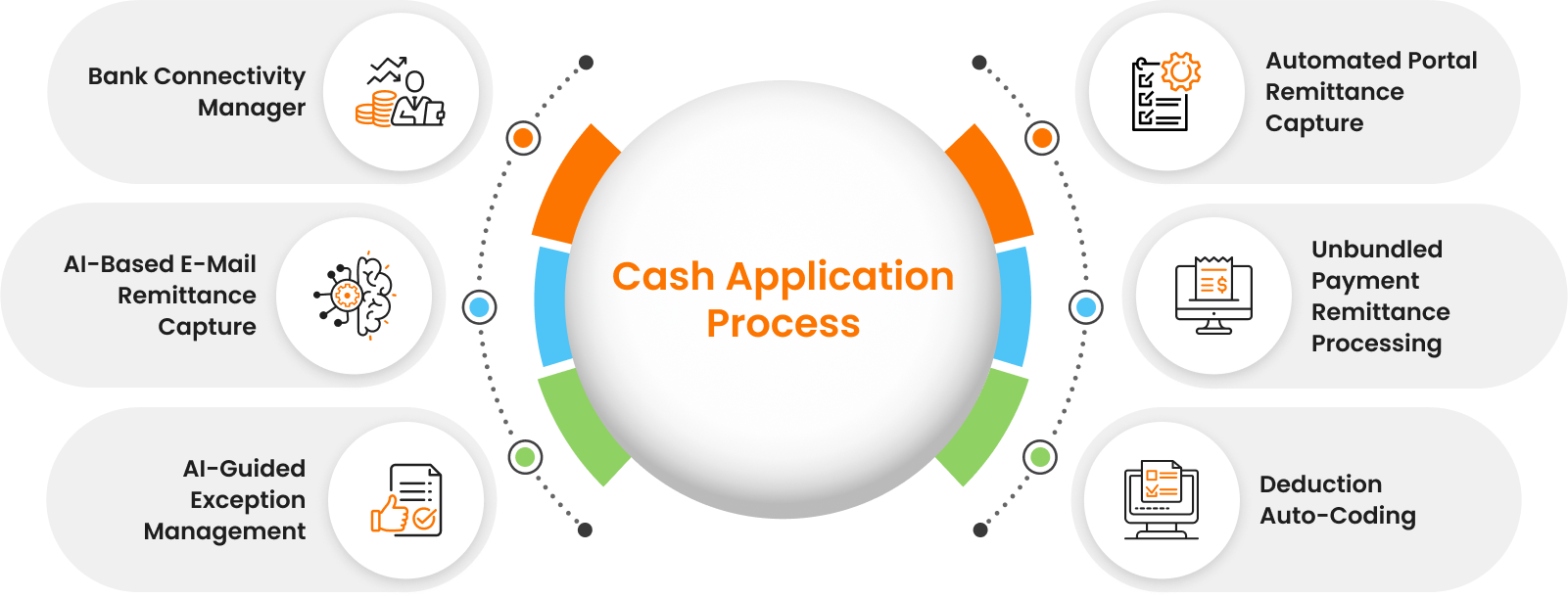

Cash Application Software

Automated Portal Remittance Capture

Capture Remittance information from Customer Portals by leveraging out-of-the-box Robotic Process Automation (RPA) Bots and match the extracted information to the payments, further sent to ERP for auto application.