A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

A Gartner Magic Quadrant Invoice-to-Cash Leader

Highest in Execution | Furthest in Vision

AI agents to prioritize right accounts and automate outreach to accelerate cash flow and reduce DSO.

Reduce past dues by 20%

Increase collector productivity by 30%

Product

Value Creation

Automated collections management solution streamlines repetitive tasks to help you get paid faster. It automatically uploads invoices to customer portals, tracks payment status, and sends payment notifications with embedded payment links. This frees your team to focus on resolving disputes and managing complex customer relationships instead of manual data entry.

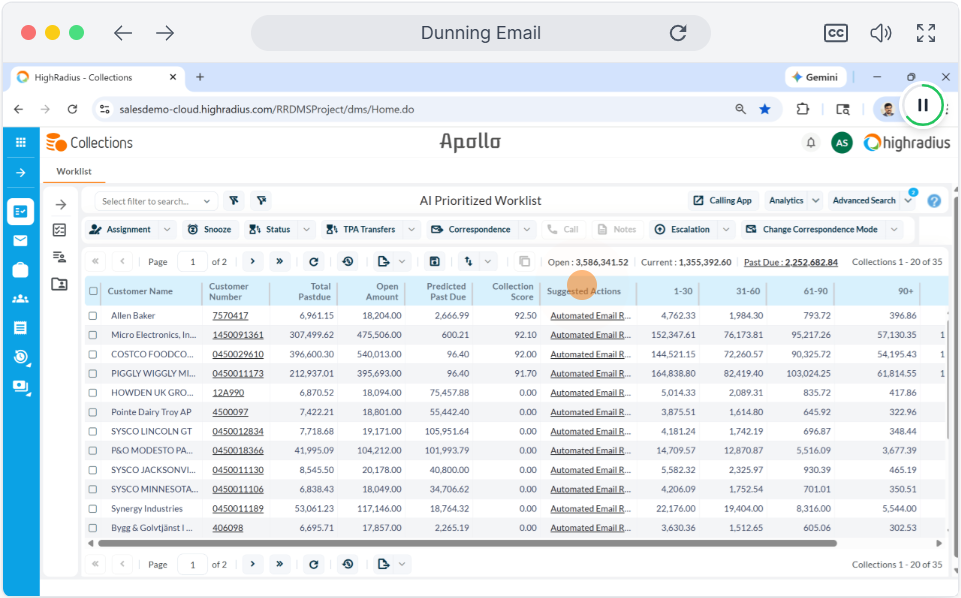

It reduces DSO by prioritizing high-risk accounts and automating follow-ups. AI collections solutions analyze payment patterns to predict late payers, so your team contacts the right customers at the right time. Automated notifications and payment links accelerate payments, while real-time dashboards track DSO improvement.

Choose collections solutions that automate repetitive tasks, predict payment risks, and integrate seamlessly with your ERP. Look for proven ROI through DSO reduction, the ability to scale as you grow, and compliance with security standards like SOC 2 and GDPR. A collections solutions comparison should focus on which platform reduces manual work while improving cash flow.

Yes. A collections tool provides predictive intelligence vs static aging, automates data-entry tasks like auto AP portal uploads and email dunning, and enables global standardization across multiple ERPs and regions. B2B collections software also measures ROI through DSO reduction and efficiency gains, metrics ERPs don’t track.

Collections solutions integrate easily with minimal IT effort. Most platforms are system-agnostic, offering flexible options like API endpoints and SFTP for connecting with ERPs, banking systems, and customer portals. Implementation typically takes weeks, not months, and relies on configuration rather than custom coding.

Yes. A collections platform supports different collection strategies for enterprise and SMB customers. Teams can apply high-touch, collector-led workflows for large accounts while using automated notifications, emails, and payment links for SMBs. This allows finance teams to focus effort where it matters most without running separate processes or tools.

AI collections solutions evaluate payment behavior, historical patterns, and credit risk alongside current financial indicators. It analyzes days late and invoice aging to identify urgency. The collections system creates a prioritized worklist showing who to call, who to email, and who will likely pay without contact. This ensures your team focuses on accounts that need attention, not just the oldest invoices.

Collection solutions scale automatically as your business grows. Automation handles increasing invoice volumes without adding headcount. Whether you process 1,000 or 100,000 invoices monthly, the debt collection software maintains consistent follow-up, prioritization, and tracking. You scale revenue without proportionally scaling costs.

The collection process and management involve several key steps. First, send accurate invoices promptly, including clear payment terms. Follow up with automated payment reminders before and after the due date to ensure timely payments.

Regularly monitor accounts receivable to identify and address overdue invoices. Engage with customers to understand any payment delays and negotiate payment plans if necessary. If payments remain unpaid, escalate the issue by sending formal notices or involving a collections agency. Finally, accurately record payments in the accounting system and update account statuses accordingly.

Yes, our Cloud Based Credit and Collections Software seamlessly integrates with your ERP. It offers out-of-the-box connectivity with major ERPs like SAP, Oracle NetSuite, Microsoft Dynamics, and Sage Intacct. Additionally, it supports API integration for Quickbooks, Sage Intacct, and Microsoft Business Central.

The implementation time for HighRadius Collections Management Software varies based on the complexity of your organization’s requirements. However, our Speed to Value methodology guarantees swift implementation and ROI realization within 3 to 6 months, setting an industry benchmark.

The Collections Management Software requires minimal IT involvement. With seamless plug-and-play integration into ERPs using real-time APIs and Hex (SFTP) connectors, along with pre-built modules and industry-specific best practices, customers can deploy it remotely with ease, reducing heavy IT dependencies.

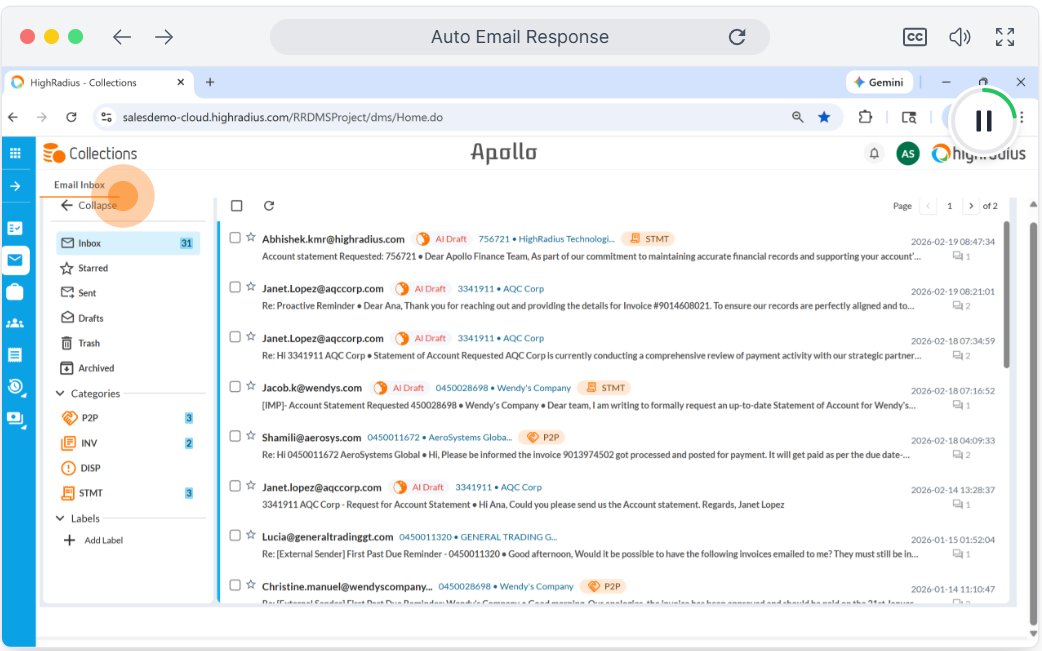

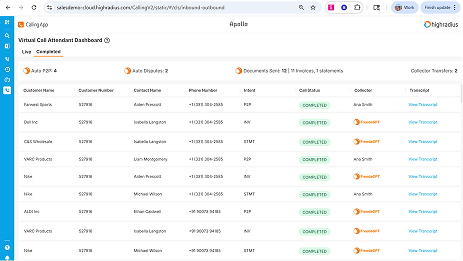

HighRadius AI-powered Collections Automation Management software offers significant advantages for efficiency and effectiveness in handling accounts receivable. It leverages AI algorithms to prioritize tasks, optimize collector workload, & automate routine processes. FreedaGPT simplifies and enhances business processes with its suite of features. It auto-drafts personalized collection email responses, generates intuitive reports and dashboards from simple prompts, captures call details, and provides quick issue resolution through self-service prompts. These features collectively improve collector efficiency by over 30%, and reduce past-due accounts by 20%, resulting in faster collections and improved cash flow.

The Collections Management Software assigns different customers to various collectors using the AI Prioritized Worklist. This system predicts future delinquencies and calculates a Collections score for each customer based on factors like past due amounts, credit risk, and payment history. The software then creates a prioritized worklist for each collector, ensuring a balanced workload based on collector bandwidth. Suggested actions, such as calls or emails, are assigned to collectors, enabling efficient and targeted collection efforts. This AI-driven approach optimizes collector productivity and improves overall collection performance.