Invoice Management Software for Global AP Teams

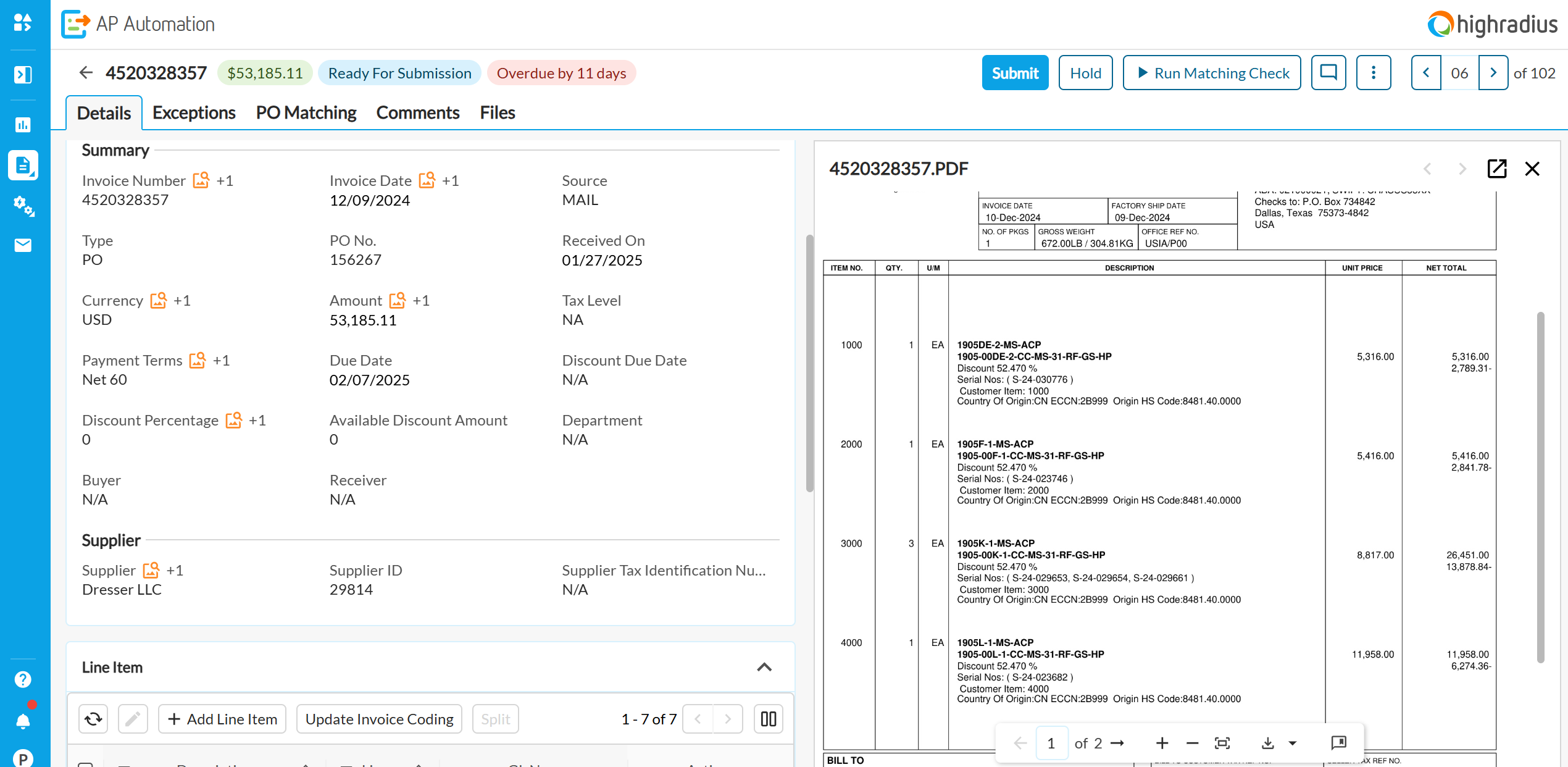

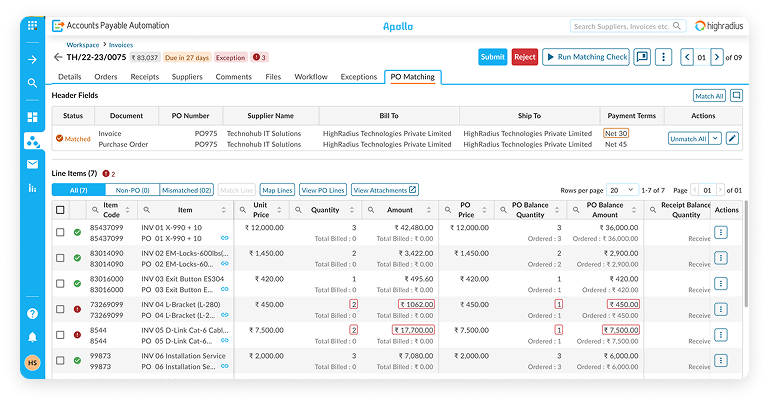

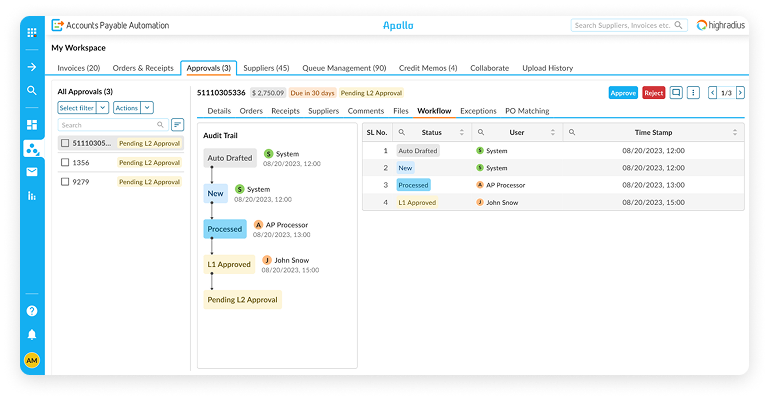

Go beyond approvals to reduce payment delays, protect cash flow, and gain full invoice control

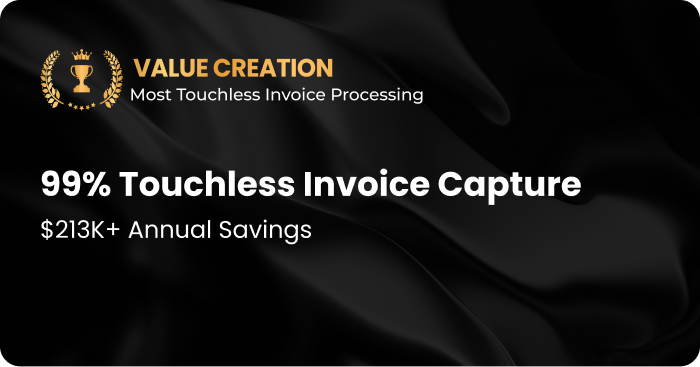

- Capture up to 98% of early payment discounts

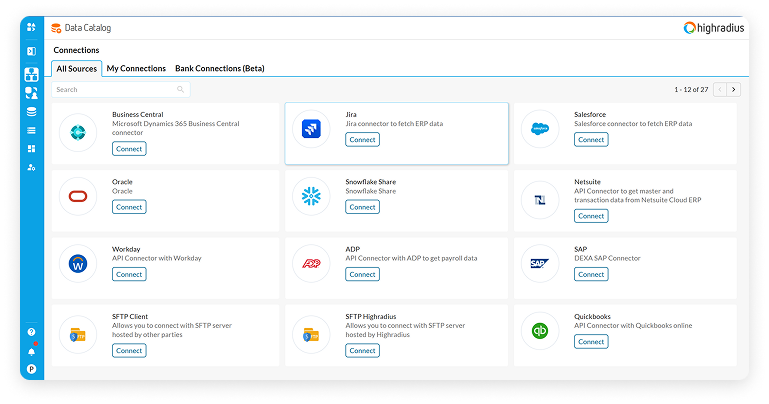

- ERP integration for real-time financial accuracy

- Audit-ready visibility across global entities

Trusted by 1300+ Global Businesses