Managing enterprise finances begins with mastering two core processes that shape the flow of money in and out of a business: accounts payable and accounts receivable.

Accounts payable (AP) is the money a business owes to its suppliers or vendors. Accounts receivable (AR) is the money customers, distributors, or partners owe to the business. These two financial concepts are nowhere near simple bookkeeping tasks, they stand as the twin pillars of a company’s financial health.

For finance leaders, understanding the difference between accounts payable and accounts receivable is not just about accounting accuracy. It supports stronger cash flow decisions, reduces operational risk, and unlocks real-time visibility across the finance function.

In this guide, we’ll break down accounts payable vs accounts receivable, walk through how each function operates, and highlight why they matter at a strategic level.

The financial ecosystem of every business centers on two basic accounting concepts that track money flow. These two pillars of financial record-keeping are the foundations of daily business operations and long-term financial health.

Accounts Payable (AP) refers to the money that a business owes to suppliers for goods or services purchased on credit. This liability appears on the company’s balance sheet and represents amounts due to be paid within a specified period, such as 30, 60, or 90 days.

For example, when a company orders raw materials from a supplier and receives an invoice with payment terms like “Net 30,” the business is required to pay the supplier within 30 days. Until that payment is made, the amount is recorded as accounts payable in the company’s financial records.

The accounts payable process starts when businesses receive goods or services from suppliers with an invoice. After verification, companies record this invoice in their general ledger as a credit to accounts payable and a debit to the right expense account. Companies should not mix up accounts payable with expenses on the income statement. These are liabilities that show up on the balance sheet. They’re also different from notes payable, which use written promissory notes and usually represent longer-term obligations.

Let’s say a retail company purchases inventory from a wholesaler. The wholesaler sends an invoice with net-30 terms. The company’s finance team records this as accounts payable in the accounting system, indicating that payment is due in 30 days. During this time, the company tracks the liability until payment is made.

Recording accounts payable accurately is critical to managing liabilities and ensuring proper financial tracking. In the company’s accounting system, an accounts payable entry is made by debiting the relevant expense accounts (e.g., inventory or office supplies) and crediting the accounts payable account.

Example entry:

Once payment is made, the entry is reversed:

This ensures that the company’s accounts payable are properly recorded, and the payment is reflected accurately.

Looking at the other side of the financial equation, accounts receivable represents money customers or clients owe to a company. This means amounts due to businesses for products or services they’ve delivered but haven’t been paid for yet. Accounts receivable counts as a current asset on a company’s balance sheet because businesses expect payment within 30, 60, or 90 days.

A sale on credit kicks off the accounts receivable process. Companies create a transaction in their accounts receivable subledger by debiting accounts receivable and crediting a revenue account. When customers pay, businesses credit accounts receivable and debit cash. Accounts receivable represents a customer’s legal obligation to pay their debts. These assets have high liquidity and businesses can use them as collateral for loans to meet short-term obligations. They’re the life-blood of a company’s working capital.

Imagine a software company that sells a subscription to a client. The client receives the product and agrees to pay within 60 days. The company records this amount as accounts receivable in its books. Until payment is received, this amount is tracked and considered an asset on the company’s balance sheet.

Recording accounts receivable is essential for maintaining accurate financial records and ensuring that cash flow is properly tracked. Here’s how it’s typically done:

Once the payment is received, the company records the following entry:

Accounts payable and receivable are vital concepts in accrual accounting. This system recognizes revenue when earned and expenses when incurred – whatever time the cash actually changes hands. This method gives a clearer picture of a company’s financial health than cash-basis accounting, which only recognizes revenue after receiving payment.

These accounts affect a business’s working capital and key financial metrics directly. The accounts receivable turnover ratio shows how well a company collects debts, while Days Sales Outstanding (DSO) reveals the average collection time. Days Payable Outstanding (DPO) tracks vendor payment speed.

Managing both accounts payable and accounts receivable effectively helps maintain liquidity and operational efficiency. Cash flow suffers when too much money gets stuck in receivables, while poor payables management can hurt supplier relationships or waste discount opportunities. Together, these metrics reveal a company’s financial position and its ability to handle both short and long-term obligations. This accurately reflects the receipt of funds and reduces the outstanding AR balance.

As mentioned above, accounts receivable represents money owed to a business by customers for goods or services provided on credit, while accounts payable denotes money owed by a business to suppliers or vendors for goods or services received on credit.

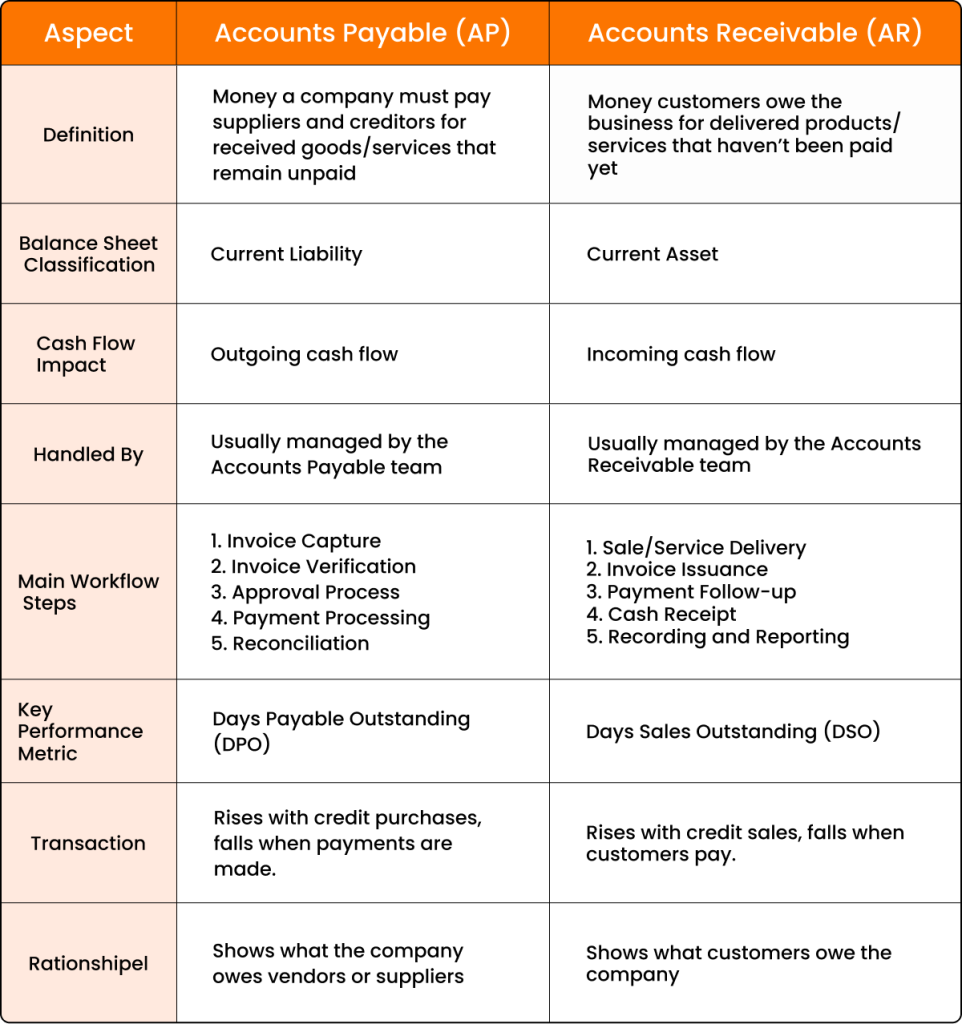

Understanding the accounts payable vs accounts receivable is essential for managing a company’s cash flow effectively. The following table provides a detailed breakdown of the differences between accounts payable vs accounts receivable.

Understanding the contrast between accounts payable and accounts receivable gives finance leaders the clarity to make informed decisions around working capital, liquidity, and financial operations. While both are essential components of the accounting cycle, their roles, accounting treatment, and impact on cash flow differ significantly.

Let’s take a closer look at the key differences across four fundamental categories.

The way companies place their financial obligations on balance sheets tells us significant information about their financial health. A business’s ability to handle debts and create future income becomes clear when you understand where accounts payable and receivable show up.

Companies list accounts payable under current liabilities on their balance sheets. These obligations are short-term debts that need payment within 12 months or less. Money flows out of the company through accounts payable to pay vendors, suppliers, and creditors.

Keep in mind that accounts payable differs from expenses on the income statement. Accounts payable shows what a company owes for goods and services bought on credit. This difference matters because expenses directly change profit and loss calculations, while payables show how much the company owes.

The size of accounts payable can substantially affect how people view a company’s finances. To cite an instance, Apple Inc. owed about $69 billion in accounts payable, which made up much of their total current liabilities of $176.30 billion. These numbers show how accounts payable can become a major part of a company’s short-term financial commitments.

Accounts receivable sits on the other side of the balance sheet as a current asset. Money should flow into the company within a year. Companies list receivables as assets because they expect to get this cash soon.

Companies can use receivables as loan collateral because they represent legal payment obligations from customers. This helps businesses meet their short-term needs. In spite of that, receivables come with risks since some customers might not pay their debts.

Both accounts payable and receivable directly shape working capital, which is the gap between current assets and current liabilities. This vital financial measure shows if a company can pay its bills and run daily operations.

Working capital connects to these accounts in simple ways:

Financial managers often write working capital as: Working Capital = AR + Inventory – AP. This formula shows that higher payables lead to lower working capital, so the company might have less cash available.

Companies with positive working capital can cover their short-term debts as they come due. Negative working capital happens when a company owes more than it owns in the short term. This could spell trouble if it continues.

Financial analysts call the time between collecting receivables and paying bills the “working capital funding gap”. Companies need extra working capital when this gap is positive, but negative gaps mean they might not need additional working capital.

Smart management of both accounts helps companies keep enough cash while putting spare money to better use elsewhere.

Money moves through a business in specific ways that affect its financial health and operations. The relationship between accounts payable and accounts receivable shapes a company’s cash flow in opposite directions.

Accounts payable shows future cash outflows from a company to vendors and suppliers. Credit purchases create accounts payable that need payment, which leads to money leaving the organization. When businesses pay their bills, cash reserves drop and limit funds available for other uses.

The way accounts payable affects cash flow might surprise you. Your cash flow actually improves when accounts payable goes up because you keep cash longer by paying bills later – within agreed terms. To name just one example, if you extend payment terms from 10 to 20 days, you could free up twice the daily purchase amount during that extra time.

The opposite happens when accounts payable decreases. Companies that pay vendors faster than usual see negative cash flow. This means cash leaves the business quickly and could drain reserves needed elsewhere.

Accounts receivable represents predicted cash inflows from customers buying on credit. These expected payments are vital to a company’s future cash position and help meet financial obligations.

The relationship between accounts receivable and immediate cash flow works differently. A rise in accounts receivable means customers take longer to pay, which reduces available cash temporarily. This negative effect on cash reserves might limit a business’s ability to reinvest, pay debts, or grow.

Cash flow gets better as customers pay their invoices and accounts receivable drops. This collection process turns “money owed” into real cash, which boosts liquidity and lets the business meet its commitments.

Financial systems run smoothly because of daily operational processes that happen behind the scenes. These processes turn accounting theory into practical steps that businesses follow every day.

The accounts payable process involves multiple steps to ensure proper tracking of outstanding payments and to maintain good supplier relationships. Here’s a quick breakdown of the accounts payable process:

1. Invoice Receipt: The company receives an invoice from the supplier, typically via email or through an online portal.

2. Invoice Verification: The invoice is verified against the purchase order and delivery receipt to confirm the accuracy of the amounts and terms.

3. Approval: After verification, the invoice is forwarded to the relevant departments (e.g., procurement or finance) for approval before payment.

4. Payment Processing: Once approved, the payment is processed according to the payment terms. The accounts payable team ensures that payments are made on time.

The accounts payable process is critical to maintaining smooth operations. For efficient management, businesses can implement accounts payable reporting systems to track and measure KPIs. A comprehensive accounts payable management approach helps mitigate risks and enhance operational efficiency.

The accounts receivable process involves several steps that ensure timely collection of payments and accurate tracking of what’s owed. Here’s a look at the typical accounts receivable process:

1. Sale or service delivery: The business provides goods or services to the customer, and an invoice is generated with payment terms (e.g., Net 30, 60).

2. Invoice issuance: The company sends an invoice to the customer, detailing the amount due and payment instructions.

3. Payment follow-up: If the payment is not received within the agreed timeframe, reminders or follow-ups may be sent.

4. Cash receipt: Upon receipt of the payment, the accounts receivable account is updated, reducing the outstanding balance.

Companies need clear metrics to review how well they manage their accounts payable vs accounts receivable. These financial vital signs alert management teams about potential problems before they become serious issues.

DPO shows how long a company takes to pay its suppliers after getting invoices. This metric helps understand cash flow management and vendor relationships better. The formula DPO = (Accounts Payable ÷ Cost of Goods Sold) × Number of Days reveals how quickly a business pays its obligations.

A high DPO means the company keeps cash longer, which creates opportunities for short-term investments. However, very high values might point to cash flow problems or difficulty in paying bills on time. Smart companies balance their DPO with industry standards while keeping good supplier relationships.

DSO tells you how many days a company needs to collect payment after a sale. This vital metric shapes cash flow and working capital. You can calculate it using: DSO = (Accounts Receivable ÷ Total Net Credit Sales) × Number of Days in Period.

Most businesses aim for a DSO under 45 days, though ideal numbers vary by industry. Rising DSO numbers often show collection problems that need policy changes. Lower DSO values mean collection processes are getting better.

This ratio shows how often a company collects its average accounts receivable in a given period. The formula is: Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable. Higher numbers mean better collection processes.

Let’s look at an example. A company with $90 million yearly credit sales and $12 million average accounts receivable has a turnover ratio of 7.5. This means they collected their average receivables 7.5 times that year – roughly every 49 days.

The working capital ratio (or current ratio) shows if a company can pay its short-term bills. The calculation Working Capital Ratio = Current Assets ÷ Current Liabilities paints a picture of financial health and liquidity.

A ratio between 1.5 and 2 points to good financial health, showing enough assets to cover debts. Numbers below 1 mean negative working capital – debts exceed assets. Ratios above 3 might suggest the company isn’t using its assets well enough.

These balanced metrics help businesses optimize their accounts payable vs receivable management, boost cash flow, and stay financially stable.

Finance leaders must ensure that both accounts payable and accounts receivable are recorded and reported in accordance with Generally Accepted Accounting Principles (GAAP). These standards form the backbone of accurate, consistent, and compliant financial reporting across U.S. businesses, particularly those that issue audited financial statements or operate in regulated industries.

Here’s how GAAP impacts the handling of AP and AR:

When managing accounts payable, GAAP emphasizes timing, accuracy, and transparency in financial obligations:

Accounts receivable must also adhere to GAAP principles that emphasize revenue recognition and credit risk visibility:

By aligning AP and AR practices with GAAP, finance teams can ensure that their financial statements reflect a fair, timely, and transparent view of the company’s obligations and receivables, laying the foundation for sound financial decision-making and investor trust.

Effectively managing accounts receivable involves timely invoicing, monitoring aging reports to identify overdue accounts, and implementing a robust collection process to minimize bad debts. For accounts payable, efficient management includes negotiating favorable payment terms with suppliers, tracking due dates to avoid late fees, and optimizing cash flow by prioritizing payments based on urgency and available funds. Regular reconciliation and clear communication with both customers and suppliers are essential to maintaining healthy financial relationships and ensuring the business operates smoothly.

Over the last few years, the payments industry has undergone significant changes; these changes can significantly impact AR and AP, making it essential to understand the implications for your business.

For example, implementing online portals for electronic invoices can enhance efficiency, but it may also create challenges for AR teams if suppliers have to deal with multiple portals and processes. To achieve optimal performance, your credit and accounts receivable team can do four things.

1. Clean up your master files – By reviewing your customer lists and removing duplicate accounts, identifying related accounts, and ensuring that your existing accounts have current and validated contact information, you can streamline your billing and collections processes. In an electronic environment, it’s important to avoid wasting time correcting outdated or inaccurate information that can slow down the entire process.

2. Accept more than one form of electronic payment – To eliminate as many paper checks as possible, consider accepting payment via ACH, credit cards, and wire transfers. Work with your credit card merchant to ensure that you qualify for high-ticket rates so that credit cards can be accepted for even more transactions.

3. Overhaul your customer enrollment tactics – Segment your buyers by transaction volume and size so that you can start a comprehensive enrollment campaign. Your goal should be to maximize the dollars flowing through the EIPP (Electronic Invoice Presentment and Payment) system. New customers should automatically be entered into the EIPP system and not be given the choice of receiving paper invoices or paying by check.

4. Communicate and train – Ensure that every team member with responsibilities related to the order-to-cash process understands the dynamics of an EIPP system and can support the product and its enrollment process. Good communication and training are essential to ensuring everyone is on the same page, and the system is used to its fullest potential.

Successful businesses understand the importance of optimizing accounts payable and accounts receivable through streamlined workflows powered by automation. Embracing automated processes enables them to simplify their operations, minimize errors, and expedite essential financial tasks, ensuring a more efficient and effective financial management system. Let’s explore how automation can transform your AR and AP processes for better cash flow management.

The automation of crucial yet mundane and time-consuming AP and AR tasks has become easier and more affordable with the advent of RPA, AI, and other technologies. Modern AR automation software lets you check the status of your receivables, track correspondence with your customers, and schedule alerts for payments. Keeping in touch with customers through emails and alerts about payments helps you avoid bad debt and speed up the cash cycle.

For payables, you can almost completely automate all the steps involved except for the approvals, which can be done in a few clicks. Automation software can also help you diagnose problems in your AP workflow and provide insights into your payments with analytics tools. AP automation also improves your payment accuracy. The best AP automation tools in the market capture invoice data at 99.5% accuracy.

Manual data entry and processing can be error-prone, leading to delays, incorrect payments, and even financial losses. Automation of AP and AR processes reduces the risk of human errors by eliminating the need for manual data entry and processing. Automated workflows ensure that invoices are processed accurately, payments are made on time, and reminders are sent to customers for overdue payments. This saves time, reduces the risk of errors, and improves the overall efficiency of your finance operations.

Automation software provides real-time reporting and analytics that give you a complete view of your cash flow and financial health. With automated accounts receivable and payable processes, you can easily track payments, invoice statuses, and customer balances and monitor your cash flow in real time. This enables you to quickly identify and address any issues or bottlenecks in your finance operations. You can also generate customized reports and dashboards that provide detailed insights into your financial performance, helping you make informed decisions to improve your cash flow and profitability.

By embracing automation in your AP and AR processes, you can streamline your finance operations, reduce errors, improve efficiency, and gain better visibility into your cash flow. This will save you time and money and help you make informed decisions, enabling you to grow and scale your business more effectively.

Streamline AR & AP With HighRadius

See how top finance teams cut reconciliation time by 50% using connected workflows.

For finance leaders, managing accounts payable and accounts receivable isn’t just about processing transactions. It’s about gaining control over cash flow, reducing risk, and unlocking working capital. But without automation, these processes are often manual, error-prone, and time-consuming.

HighRadius offers AI-powered solutions that automate and unify your AP and AR processes so your team can focus less on chasing payments or approvals and more on strategic decisions.

The HighRadius Accounts Payable Automation solution helps eliminate bottlenecks in invoice processing and vendor payments:

By automating AP, you reduce cycle times, prevent late payments, and build stronger supplier relationships while maintaining complete audit readiness.

With Accounts Receivable Automation, HighRadius helps you bring in cash faster and with fewer touchpoints:

By modernizing AR, you improve visibility into cash inflows, reduce bad debt, and create a smoother experience for customers and collectors alike.

By automating and aligning your accounts payable and accounts receivable processes, you not only improve operational efficiency but also gain tighter control over cash flow, reduce financial risk, and enable smarter, faster decision-making across the finance function.

Whether you’re looking to scale finance operations, reduce manual workload, or unlock working capital, optimizing AP and AR is a critical step toward building a more agile and resilient enterprise.

The AR process involves managing money owed to a company by its customers, including invoicing and payment collection. The AP process involves managing money a company owes to its suppliers, including receiving invoices, verifying them, and making payments. AR focuses on incoming funds, while AP deals with outgoing funds.

Reconciling AP and AR involves matching records in the company’s accounting system with bank statements and other financial documents. For AR, this means ensuring all payments received are recorded correctly. For AP, it involves verifying that all payments made match invoices received and recorded.

AP and AR are crucial for maintaining a company’s financial health. Efficient management of AR ensures timely revenue collection, supporting cash flow. Effective AP management controls outgoing payments, ensuring liquidity and strong supplier relationships.

Yes, in smaller businesses, one person may handle both accounts payable (AP) and accounts receivable (AR). However, in larger companies, these functions are often split between departments for better accuracy, accountability, and efficiency in managing finances and workflows.

AP and AR both play essential roles in cash flow management. AP ensures that outgoing payments are made promptly to avoid late fees, while AR focuses on collecting incoming payments on time. Effectively managing both processes helps maintain liquidity and ensures the business operates smoothly without cash shortages.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center