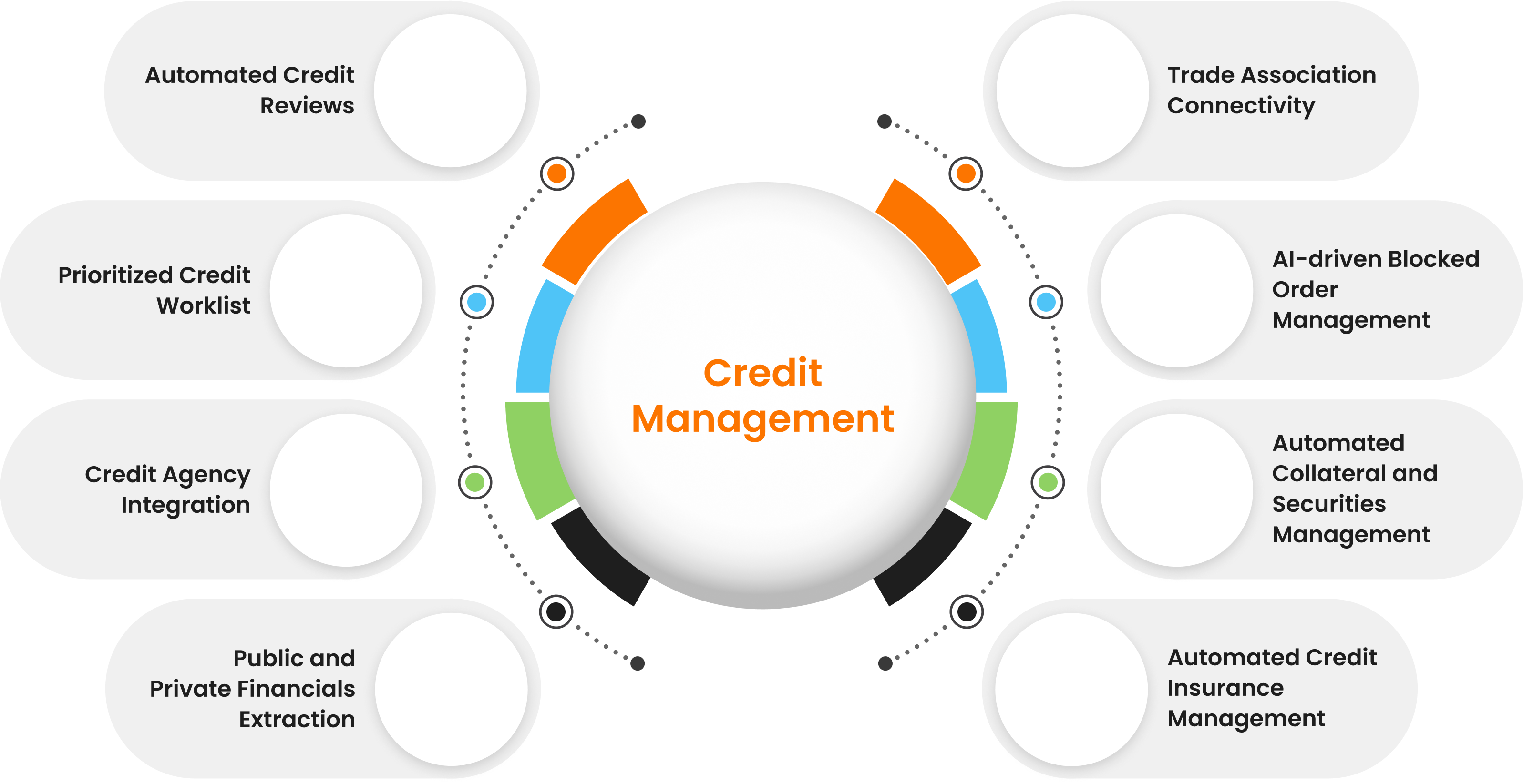

Credit Risk Management

Configurable Online Credit Application

Simplify Prospect Data Collection with a configurable online application for key information

Simplify and Enhance Prospect Engagement: Configure and Brand Online Credit Applications to Collect Vital Information and Documents Seamlessly

Connect now with our digital transformation expert and get your questions answered live.

Chat live with an expert

Explore other features of the Credit application system