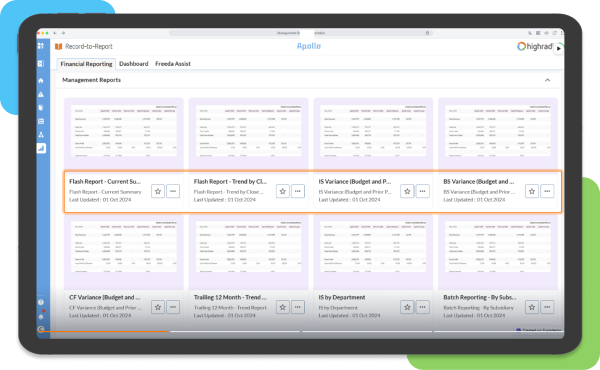

Generate Custom Reports for Real-Time Visibility

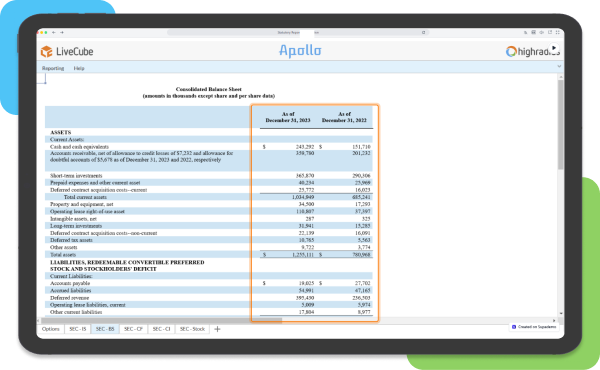

Manual data entry costs firms $28,500 per employee yearly in errors. Switching to an automated reporting builder ensures AI-validated, audit-ready SEC and management disclosures.

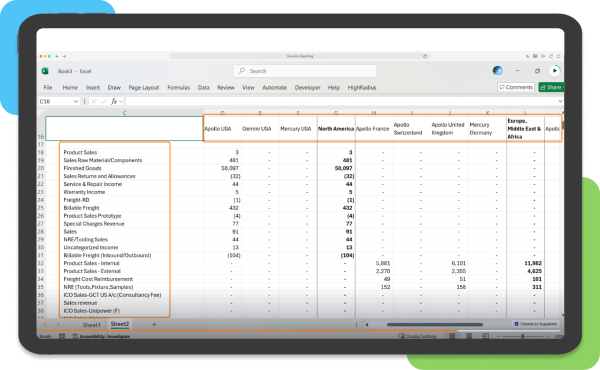

- Unify POS, ERP, and external data sources into live dashboards for a complete, real-time view of financial performance.

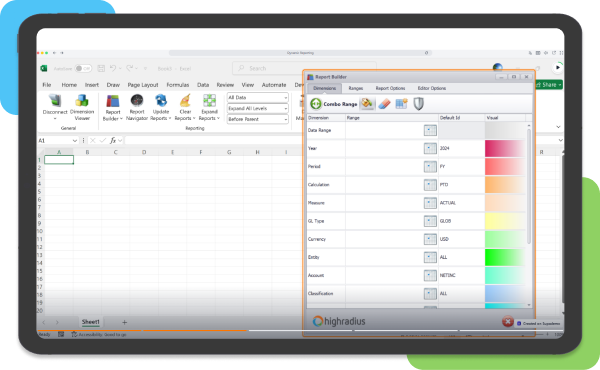

- Build custom SEC, Statutory, and Management reports by using dashboard builder.

- Prevent reporting errors through automated data synchronization, currency rate updates, and AI-driven validation.

Download Feature Guide