Key Takeaways

- The significance of the matching principle is in ensuring consistency in financial statements, determining financial status, spreading out depreciation costs, and determining profits.

- The common steps accountants follow in the matching process.

- Best practices for preparing a journal entry are identifying and categorizing accounts, applying accounting rules, and recording transactions.

- How complex revenue recognition can make the matching principle difficult for accountants.

- The use cases of HighRadius’ Autonomous Accounting Software in implementing the matching principle accurately.

Introduction

The matching principle is a fundamental concept in financial reporting that allows accountants to match a company’s expenses with its corresponding revenues in the same accounting period. This ensures that financial statements are prepared by following the generally accepted accounting principles (GAAP) and accurately reflect a company’s financial performance. For instance, if a company makes a sale in December but receives payment in January of the following year, the sale’s revenue is recognized in December by applying the matching concept in accounting.

Understanding the matching principle is crucial for producing accurate financial reports, but manual implementation can be time-consuming, error-prone, and complex. According to Gartner, 86% of finance executives aim to achieve a faster, real-time close by 2025, with more than half of respondents already investing in general ledger technology and workflow automation. Moreover, 70% of companies that have automated more than one-fourth of their accounting functions report moderate or substantial ROI.

Read on to understand the significance of the matching concept in accounting, the steps involved, the common challenges in the process, and some tips to improve the process.

Understanding the Matching Principle in Accounting

What is the matching principle?

The matching principle in accounting is a process that involves matching a company’s expenses with its corresponding revenues in the same accounting period. This ensures accurate financial reporting and adherence to generally accepted accounting principles.

The following example represents the matching principle for the Cost of Goods Sold (COGS).

Matching Principle Example

Suppose a software company named Radius Cloud sells a license for $5,000 that costs $1,000 to develop. The cost of goods sold is $1,000, which should be recognized in the same period as the revenue is recognized, aligning with the matching principle.

Importance of the Matching Principle

Why the Matching Principle is Critical for Accountants

The following are the reasons why the matching principle is critical for accountants:

-

Helps determine the company’s financial status by keeping financial statements consistent: The matching principle in accounting aligns expenses and revenues, ensuring consistency in financial statements and preventing misrepresenting of financial results. It improves accuracy in reflecting a company’s financial status, providing a reliable representation of its financial position, and aiding stakeholders in making better decisions.

For example, Radius Cloud sells $10,000 worth of products in Dec 2022 but incurs $5,000 in expenses in Jan 2023. Without the matching principle, their financial statements were inconsistent. However, recognizing expenses in Dec 2022 helped them maintain consistency and accurately reflect the company’s financial performance for both months.

-

Allows depreciation and amortization costs to be spread out over time: The matching principle allows the cost of an asset to be spread out over its useful life by allocating a portion of the asset’s cost to each period in which it is used to generate revenue. So, instead of recognizing the entire cost of the asset as an expense in the acquired year, the cost is spread out over the number of periods that the asset is expected to be profitable. Recognizing depreciation and amortization expense over time ensures that the asset’s cost is spread out and matched with the revenue it generates.

For example, if a company named RadiusKarzz purchases machinery for $100,000 with a useful life of 10 years, it can allocate an annual depreciation expense of $10,000. This ensures that the financial statements reflect the gradual wear and tear of the machinery accurately.

-

Reduces the chance of reporting incorrect profits during a specific accounting period: Failure to follow the matching principle can cause inconsistencies, leading to an overstatement of profitability in one period and understatement in another. Matching revenues and expenses promotes accurate and reliable income statements, which investors can rely on to understand a company’s profitability.

For example, if a company mistakenly recognizes $10,000 in expenses in the current period when they belong to the next period, it would lower the net income for the current period. Conversely, delaying the recognition of $10,000 in expenses to the next period would inflate the net income for the current period. The matching principle prevents such misstatements of profits.

How does the matching principle work in accounting?

Steps in the Matching Principle Commonly Followed by Accountants

The following are the steps commonly followed to apply the matching principle effectively:

-

Identify the revenues during a specific accounting period. The revenues can come from various sources, such as sales of goods or services, interest income, or rental income.

For instance, a software company named Radius Cloud recognizes $10,000 in revenue from sales of its software licenses.

-

Determine the expenses that are directly associated with generating those revenues. These expenses may include the cost of goods sold, salaries of employees involved in the sales production, rent, utilities, and other operating expenses.

For instance, the company incurs $3,000 in advertising expenses to promote the software and $2,000 in salaries for the sales team selling the licenses.

-

Assess the appropriate timing for recognizing those expenses, ensuring they align with the revenues they helped generate.

Suppose Radius Cloud incurs advertising expenses evenly over three months. In this case, they allocate $1,000 monthly to match the advertising costs with the corresponding revenue.

-

Adhere to accrual basis accounting, recognizing revenues and expenses when earned or incurred.

For example, Radius Cloud recognized the $50,000 revenue in 2022 when they sold a software license with $10,000 in expenses. They’ll recognize $4,167/month revenue in 2023 since the license is valid for a year, adhering to accrual accounting principles.

-

Allocate expenses using a reasonable method if expenses cannot be directly traced to a specific revenue item. Adjust entries at the end of the accounting period.

To match revenues and expenses, the company allocated $2,000 in overhead costs proportionally across software licenses sold based on revenue contribution and recognized $1,000 in accrued sales team salaries for last month’s work to be paid later.

-

Prepare financial statements, including the income statement, after adjusting entries to show net income or loss. Analyze them by comparing them with previous periods or industry benchmarks to assess performance and profitability.

For example, Radius Cloud’s income statement reflects $10,000 in revenue and $6,000 in expenses, resulting in $4,000 net income after adjusting entries. They can evaluate expense management and profitability by comparing this with previous periods or industry benchmarks.

One of the ways to implement the matching concept in accounting is to do a journal entry. Journal entries are formal records of financial transactions that help implement the matching principle by ensuring revenues are recognized when earned, and expenses are matched in the same period, aligning with accrual accounting. Moreover, journal entries help accurately document and reflect the matching of revenues and expenses, contributing to accurate financial statements.

Let’s explore how to do a journal entry effectively below.

Steps to Prepare a Journal Entry

-

Identify accounts involved by determining at least two accounts: one debited, and one credited, depending on the transaction nature.

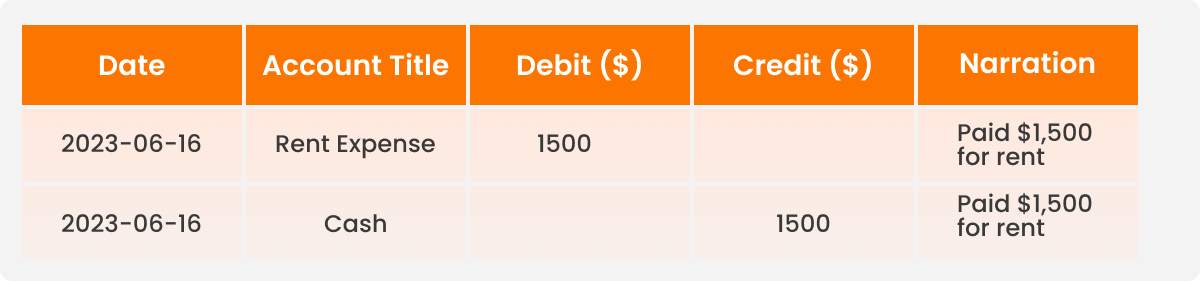

For example, Radius Cloud paying $1,500 for rent involves debiting “Rent Expense” and crediting “Cash” accounts. “Cash” represents the funds used by the company for payment.

-

Categorize accounts as assets, liabilities, equity, revenue, or expenses to ensure correct debit and credit recording.

For example, in the previous example, “Rent Expense” is an expense account, and “Cash” is an asset account.

-

Follow accounting rules to record transactions accurately, where debits increase assets and expenses decrease liabilities, equity, and revenue, while credits do the opposite.

For instance, expenses increase with debts, so the “Rent Expense” account would be debited with $1,500. Assets decrease with credits, so the “Cash” account would be credited with $1,500.

-

Record a journal entry in the general journal, including amounts and a brief description or narration, to provide context and help understand the purpose of the transaction.

In this case, the journal entry for the rent payment will be recorded as

Find more examples of journal entries here.

Although these are the common steps, manually following these can lead to a surge in challenges.

The next section discusses the various challenges accountants face in matching revenue with expenses.

Challenges of Matching Principle: Why It’s Difficult for Accountants

The following are the challenges in implementing the matching principle effectively:

-

Increasing complexity of revenue recognition: Revenue recognition is complex due to factors such as project completion timing and revenue allocation for different product parts. Establishing a direct cause-and-effect relationship between revenue and expenses is also challenging, as business operations, multiple revenue streams, and external factors can influence revenue generation and expense levels. Contract changes can further complicate expense tracking and allocation, requiring careful management. Revenue recognition is challenging due to various factors. Firstly, if a project takes a long time to complete, it can be tricky to determine when to recognize the revenue earned from that project.

For example, revenue recognition complexity for a software company named Radius Cloud stems from bundled offerings, such as combining software licenses with ongoing maintenance and support services. Determining the appropriate revenue allocation between the initial license sale and recurring services becomes challenging. Similarly, revenue derived from additional services like customization or consulting is intertwined with software license revenue, making it difficult to establish a direct cause-and-effect relationship between revenue and expenses.

-

Challenges in matching revenues with expenses for marketing campaigns: When running a marketing campaign, a company incurs upfront expenses for advertising, promotions, and creative development. However, the revenue generated from the campaign may be realized over an extended period as customers gradually respond to the marketing efforts and make purchases. This delay makes it difficult to accurately align the timing of expenses with the corresponding revenue.

For instance, a company named Radius Cloud runs a one-month advertising campaign with upfront expenses, but the resulting revenue from increased product sales is realized over several months as customers respond to the campaign. The mismatch in timing makes the implementation of the matching principle difficult.

-

Uncertainty and timing differences: Uncertainty arises when the outcome of a transaction is uncertain, such as in cases of potential legal disputes or contingent liabilities. Timing differences occur when the recognition of revenue or expenses is spread over multiple accounting periods due to factors like long-term contracts or installment payments. Uncertainty makes it difficult to predict transaction outcomes, while timing differences can lead to discrepancies between cash flows and their recognition in financial statements.

For example, Radius Construction’s accountants must analyze contracts, change orders, and project progress reports to accurately determine when to recognize revenue and expenses. This is important due to uncertainty in project scope, unforeseen issues, and material cost fluctuations, which can cause expenses to occur at different stages of the project and revenue recognition to depend on project milestones or specific deliverables.

-

Difficulty accounting for non-cash items and non-monetary transactions: Non-cash items such as depreciation, amortization, and stock-based compensation don’t involve actual cash outflows or inflows, making it difficult to match them precisely with the related revenues. Similarly, non-monetary transactions, such as barter exchanges or transactions involving assets other than cash, further complicate the matching process. Accounting for these expenses requires careful judgment and estimation.

For instance, Radius Cloud receives stock as payment, making revenue recognition tricky. Valuing the stock is complicated by its fluctuating value, requiring judgment and estimation. The stock may need to be held for a certain period before its value can be realized.

Want to learn how to get rid of these challenges? Read on to learn how HighRadius’ Autonomous Accounting Software helps you get rid of manual matching processes that lead to reporting inaccuracies.

How HighRadius’ Autonomous Accounting Software Helps

Features of HighRadius’ Autonomous Accounting Software that Helps Implement the Matching Principle

The following are the ways HighRadius’ Autonomous Accounting Software helps companies match revenues with expenses accurately:

- Streamlined data extraction and aggregation: HighRadius’ autonomous accounting software uses AI-powered data extraction to automate data fetching, recording, and analysis. It integrates with ERP systems and automates journal entry posting, closing the loop between anomaly detection and correction. This can help accountants reduce errors and save time.

- Automated reconciliation: The accounting software has a set of matching rules and algorithms that enable automatic reconciliation of different data sets, such as General Ledger and Sub-Ledger, or General Ledger and bank statement. This feature helps accountants quickly identify discrepancies, reconcile accounts, and minimize errors, saving time.

- AI-powered anomaly detection: The software detects potential anomalies and provides suggestions for resolving them. This helps accountants address issues proactively rather than waiting until month-end for adjustment. The software also provides suggestions for correcting journal entries for some anomaly patterns, reducing errors, and improving the accuracy of financial reporting.

- Month-end close checklist: It provides a detailed project plan containing all the tasks that the accounting team needs to perform to complete the month-end close process. This helps accountants reduce manual effort and improve the accuracy of the month-end close process. Moreover, accountants and reviewers can share the work papers for each close task category for input, review, and approval.

- Automated period-end closing: The software automates period-end closing, accurately recording and matching expenses and revenues to their corresponding periods. This feature saves accountants time and allows them to focus on more strategic tasks. Automation improves accounting efficiency by streamlining the process and minimizing the risk of errors.

Tangible Benefits from HighRadius’ Autonomous Accounting Software

- 50% automation of manual tasks: Currently, 80% of Financial Close & Account Reconciliation work happens outside ERP R2R systems in Excel. HighRadius’ LiveCube can replace Excel and automate data fetching, modeling, analysis, and journal entry proposal, resulting in significant time savings and reduced errors.

- 30% reduction of days to close: Most companies take 5 to 15 Days to close their books. Anomaly detection would drive continuous closing vs. waiting till the end of the month to begin closing tasks. Automation would result in less time required to close tasks.

- Easy month-end close with LiveCube’s journal entry table: Our LiveCube application simplifies the month-end close process by allowing accountants to create a table in a LiveCube Stack that captures all the required information for posting transactions into the ERP. This feature is available across all close and reconciliation tasks, making the process more straightforward and efficient for accountants.

- Accurate auditing with journal entry Excel template: Accountants can download a journal entry Excel template from our platform. This template can be pre-configured to their existing format. The template is populated with the results of the workings and can be attached to the closed task. When the stakeholder approves the close task, the journal is automatically posted into the ERP, with a trace of the posting populating back for audit purposes.

FAQs

How does the matching principle apply to depreciation?

In the case of depreciation, the expense is recognized over the asset’s useful life rather than in the period in which the asset was acquired. This allows for better matching of expenses to the revenues generated by the asset over its useful life.

What is the difference between accrual and the matching principle?

The accrual principle recognizes revenues and expenses in the period they are earned/incurred, while the matching principle requires expenses to be recognized in the same period as related revenues. The former focuses on timing, while the latter links expenses to revenues.

What is the revenue recognition principle?

The revenue recognition principle requires revenue to be recognized when it is earned, not when payment is received. This principle ensures accurate financial reporting by requiring revenue to be recorded in the accounting period in which it is earned.

What is the relationship between the matching principle and revenue recognition?

The matching principle links expenses to the related revenues, while the revenue recognition principle requires revenue to be recognized when it’s earned. They ensure accurate financial reporting by recognizing revenue in the period it’s earned and linking expenses to the revenues they generate.

What is the matching principle for accrued expenses?

The matching principle requires expenses to be recognized in the period in which the related revenues are earned. Accrued expenses are recognized when incurred, regardless of payment timing. This ensures expenses are matched with revenues generated, providing accurate financial reporting.