In today’s fast-paced business environment, accounting departments face increasing pressure to deliver accurate financial information quickly and efficiently. Manual processes are not only time-consuming but also prone to errors, which can hinder decision-making and delay financial closes. Automated accounting offers a transformative solution by leveraging advanced technologies to streamline financial operations, enhance accuracy, and boost overall productivity.

In this guide, we will explore the key benefits of automated accounting and provide practical tips to help you implement these technologies effectively. Whether you’re looking to improve reconciliation processes, optimize financial close management, or ensure compliance, this comprehensive overview will equip you with the knowledge to optimize your accounting practices and drive your business forward.

Accounting automation software uses technology that automatically performs repetitive accounting tasks such as reconciliations, journal entry creation, variance analysis, approvals, documentation, sub-ledger tie-outs, and compliance checks.

Instead of relying on manual steps, the system pulls data from ERPs and financial systems, matches transactions, identifies exceptions, prepares entries, routes items for approval, and generates audit-ready records, all with minimal human intervention.

Businesses lose an average of $118K due to financial inefficiencies.

Is manual accounting draining your revenue?

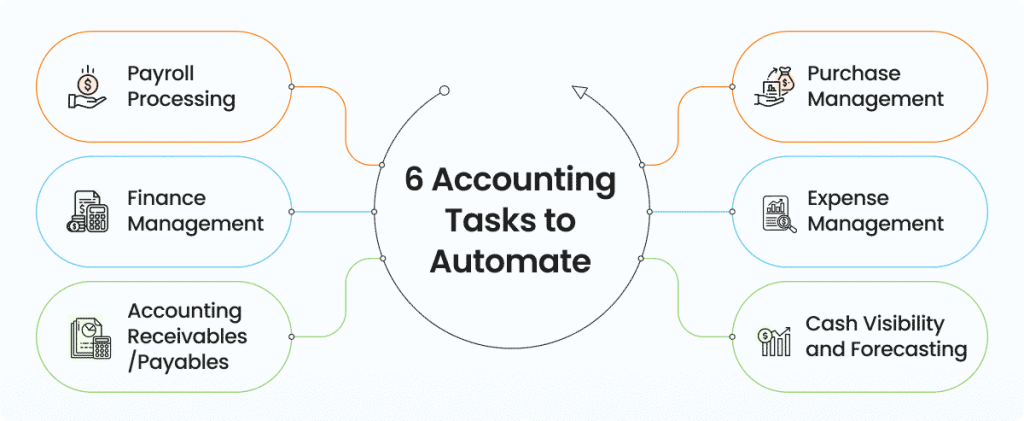

Accounting automation software is reshaping how finance teams manage day-to-day operations. By replacing manual, spreadsheet-heavy tasks with automated workflows, businesses can streamline reconciliation, reporting, and transaction management. This not only reduces errors but also accelerates processes like month-end close and accounts payable. For example, global enterprises use accounting automation software to reconcile thousands of transactions within minutes, ensuring compliance and accuracy while freeing teams to focus on strategic decision-making. The result is faster reporting, improved cash visibility, and stronger financial insights that help companies stay competitive in today’s dynamic market. Let us explore six accounting tasks that you need to automate right now to enhance your team’s productivity:

– Error detection, verification, and correction

– Maintaining compliance with tax deductions

– Retrieving missing invoices and receipts lost during the transfer of data from one system to another

– Identifying anonymous payments

Manual accounting presents several challenges that can significantly hinder the efficiency and accuracy of financial management within an organization. Below are some of the key challenges associated with manual accounting:

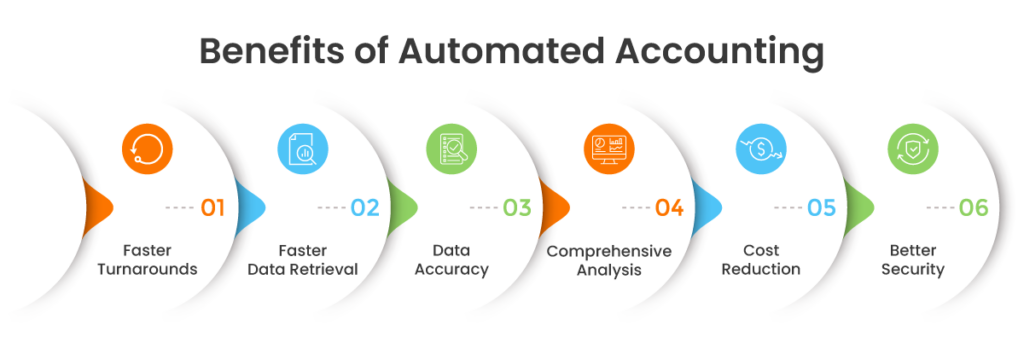

Automated accounting systems have revolutionized the way businesses manage their financial processes, offering a streamlined and efficient approach to handling everything from transaction tracking to financial reporting. By leveraging advanced technology, these systems reduce manual work, enhance accuracy, and improve overall productivity. Let us explore six key benefits of automated accounting systems, highlighting how they can help businesses optimize their financial operations, save time, and make more informed decisions.

Faster turnaround: Automated accounting systems help save your accountant’s time and effort. Your accounting team can now give results quicker and with more accuracy. This scalability enables you to take on more clients and expand your market presence.

Enhanced data accuracy: Data accuracy is critical to financing operations and maintaining a good reputation with clients. Even the most cautious and thorough professionals may make mistakes, such as misplacing a number or forgetting a decimal. Automated accounting helps reduce the possibility of errors and ensures better accuracy. For example, HighRadius Journal Entry Management automates the entire process of journal entry right from journal entry preparation to posting, resulting in a 40% increase in close productivity due to data accuracy.

Cost reduction: Accounting automation software helps automate mundane tasks, helping you save on costs. Automation can process more records in less time and at a lower cost. When using accounting software, you do not need to invest in a large accounting team to complete transactions.

Comprehensive analysis: Accountants and AR analysts need relevant and accurate data to track trends, identify fraud, and calculate various metrics that indicate a business’s financial strength. Data collection and compilation can be made easier with automation. Self-service analytics features in automated accounting solutions allow even non-IT staff to create reports and visualize data easily. For instance, by leveraging Transaction Matching organizations can automate data extraction, match line-level transactions from two or multiple data sources using AI-based rule discovery, resulting in a 90% transaction auto match rate.

Better security: Traditional accounting systems involve a lot of paperwork, like large ledger books, journal entry records, and more. There’s a high chance of these papers getting lost, leading to inefficiencies due to the loss of backup. Automated accounting systems help ensure that data is organized and stored securely on the cloud or in on-premises data centers.

Swift data retrieval: In pre-digital days, hundreds of paper-based files and books were stored in rows of cabinets. To extract a document, you had to scout through bundles of records. This is a tedious way to search for information. With automation solutions, locating and retrieving data is easy. You can search with the file name, owner name, or other meta tags to locate the document. Archiving data is also easier and less expensive with automated accounting systems.

The best accounting automation software goes beyond bookkeeping to streamline end-to-end financial processes. Here are the key features to look for:

With these features, treasury and accounting teams can shift focus from manual tasks to delivering real-time insights that drive business strategy.

While spreadsheets and manual processes have long been the backbone of accounting, they no longer meet the speed, accuracy, and scalability demands of modern finance. Here’s how accounting automation software stacks up against traditional methods:

| Feature / Aspect | Traditional Tools (Manual & Spreadsheets) | Accounting Automation Software |

| Accuracy | High risk of human error | Automated checks minimize errors |

| Efficiency | Time-consuming, repetitive tasks | Streamlined workflows save hours |

| Scalability | Difficult to manage large data volumes | Handles high-volume transactions easily |

| Visibility | Limited real-time insights | Real-time dashboards and reporting |

| Compliance & Audit | Manual tracking, prone to gaps | Automated audit trails ensure compliance |

| Resource Utilization | Teams tied up in data entry | Finance teams focus on strategy and growth |

By adopting accounting automation software, companies gain speed, accuracy, and insight, transforming finance from a reactive function into a strategic driver of business growth.

Switching to accounting system automation is inevitable as businesses go digital. Here are a few tips to help you successfully implement automated accounting software solutions.

Step 1: Assess your current accounting process and identify areas for improvement.

Step 2: Look for the best accounting automation software that fits your business needs and is within your budget.

Step 3: Choose accounting automation software that provides you with customized invoice templates and integrates well with your ERPs, banks, and so on.

Step 4: Assign a project owner who can create and manage your workflows so that data migration can be more accessible.

Step 5: Provide your team with proper training and the necessary time to get familiar with the software.

Step 6: Schedule a transition period and notify all staff members affected by the change, notably the CFO, your accountant, and the finance department.

HighRadius offers a cloud-based Record to Report Software that helps accounting professionals streamline and automate the financial close process for businesses. We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting.

Our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%. The workspace is connected and allows users to assign and track tasks for each close task category for input, review, and approval with the stakeholders. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it.

Our Account Reconciliation Software provides an out-of-the-box formula set that can configure matching rules and match line-level transactions from multiple data sources and create templates to automate various transaction processing required for month-end close. Our solution has the ability to prepare and post journal entries, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ throughout the financial period so that teams can avoid the month-end rush. The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies. We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes.

Accounting automation software is responsible for automatically completing tasks such as bookkeeping and accounting. The software automatically identifies discrepancies in data and by identifying entries from invoices, forms, and bank statements using AI automates data extraction and entry process.

Automated accounting processes with AI enhance efficiency and precision but require a blend of human intelligence. Thus, automated accounting will not replace CPAs, in fact they will elevate their position enabling them to focus on high-value strategic tasks.

AI automates processing of payslips, invoices, and bank statements, speeding up retrieval of financial information like trial balances and income statements. Organizations adopt AI for document automation, data extraction, and predictive analytics, enhancing efficiency and decision-making.

When choosing accounting software, look for features like automation of key tasks (e.g., invoicing, reconciliation), integration with existing systems, scalability to grow with your business, strong security measures, and real-time reporting. Ease of use and customer support are also essential.

Examples include invoice processing, expense approvals, payroll management, journal entry approvals, reconciliation of accounts, and month-end financial closing. These workflows streamline and automate routine tasks to improve efficiency.

Yes, many accounting tasks such as data entry, reconciliations, and reporting are already being automated. While human oversight is still needed for strategic decision-making, AI and automation tools are rapidly transforming routine accounting processes.

Automation in accounting refers to using software and technology to perform routine accounting tasks such as data entry, transaction recording, and financial reporting. This streamlines processes, reduces errors, and allows accountants to focus on strategic activities rather than manual tasks.

Accounting tasks that are repetitive and rule-based, like data entry and reconciliation, are relatively easy to automate. However, automating complex tasks that require judgment, such as financial analysis or decision-making, is more challenging and often requires advanced AI and machine learning technologies.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center