Setting smart goals for finance departments is critical for driving long-term success in the ever-changing market dynamics.

Finance teams can leverage technology, upskill, restructure, and prioritize innovation to maximize their financial potential and achieve their goals.

Partnering with a technology vendor can provide the right solutions and support to achieve finance team objectives.

As a finance professional, you are responsible for managing your company’s financial resources, ensuring that budgets are met, and making sound financial decisions that drive growth and profitability. Setting smart goals for finance managers is becoming increasingly challenging in the ever-changing market dynamics. However, doing so is critical for finance teams to keep up and drive long-term success.

In this article, we explore the seven macro goals and objectives for a finance department needed for setting smart goals. We’ll discuss how finance teams can leverage technology, upskill, reduce costs, and drive growth through innovation to maximize their financial potential. By setting and achieving smart finance department goals and objectives, finance teams can unlock their full potential, improve financial performance, and drive long-term success for their organizations. So let’s dive in and learn how to set smart goals for finance teams in 2023 and beyond.

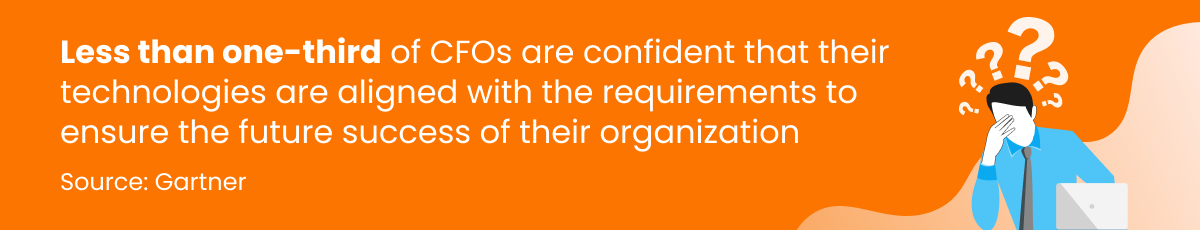

In today’s fast-paced business environment, finance teams need to constantly assess their technology and functional gaps to stay competitive. While adopting digital tools and technologies is a good start, it’s important to identify areas where automation can further reduce operational costs and maximize efficiency.

Automation technologies are the best bet to reduce operational costs, maximize efficiency, and get competitive advantage. As we move into a new year, finance teams will need to identify and budget for the best automation technologies.

Improved data analytics solutions, conversational chatbots, and machine learning and AI for complex processes are some technologies that you can look at implementing. You’d also want to keep an eye out for developments in the blockchain space, IoT (Internet of Things) in finance, and security measures such as strategic tokenization.

Advances in artificial intelligence, big data, and machine learning now dictate the way we work, market, build customer relations, and most importantly, make decisions. This is no different for finance teams. All finance functions including accounts receivables, payables, taxation management, and reporting are being transformed by these automation technologies.

But keeping up with the pace of technological advances is no easy job. Finding skilled employees for the different roles is a key challenge for most companies. Upskilling their existing workforce and hiring best-in-class talent who are adept at finance and business would be key goals for organizations in 2023.

CFOs should always be on the lookout for new talent as well as ways to upskill or re-skill their existing workforce. According to Gartner, lack of data literacy skills can cost a company as much as 1% in revenues, and finance leaders need to plan well to bridge this costly gap.

The pandemic brought unprecedented changes to the way finance teams operate. With the pandemic forcing many companies to adopt remote work, finance teams had to quickly adapt to new ways of working with little prior experience.

As the world continues to evolve, finance teams must be prepared to experiment with new structures and workflows to remain competitive. This may involve rethinking traditional centralized structures in favor of more decentralized, business-unit aligned teams. Gartner predicts that finance team structures will become flatter and more autonomous, driven by the automation of repetitive workflows and a focus on empowering employees to make independent decisions.

With changing regulations, disruptive technologies, and ongoing pandemic-related challenges, it’s more important than ever for finance teams to be flexible and adaptable. By embracing new team structures and empowering employees with the latest tools and technologies, finance teams can position themselves for success in the ever-changing business landscape.

Innovation is the fuel that propels growth, and finance teams must work cross-functionally to ensure their businesses can thrive regardless of changes in market dynamics. This may involve investing in upskilling teams, acquiring new technologies, and expanding R&D practices to stay at the forefront of emerging trends.

Cash-rich companies may also consider smart acquisitions and launching new business ventures to create a more competitive and diverse organization. By focusing on innovation, finance teams can help their organizations stay agile and adaptable in the face of ongoing disruption and change.

To make innovation a priority, finance teams must adopt a growth mindset and embrace a culture of experimentation and risk-taking. This may involve breaking down silos between departments, encouraging collaboration and knowledge-sharing, and empowering employees to think creatively and pursue new ideas.

After subdued economic conditions in 2021 and a moderate recovery in 2022, CFOs will be looking to raise more funds in 2023 as the global economy bounces back.

Finance leaders, especially at small and mid-sized companies, should gear up to lure investors to fund their businesses. Showing growth trends, commitment to R&D, and digital agility are some areas that CFOs need to work on to convince investors to partner with them.

Whether it’s a series A for growth capital, an IPO for the initial investors, or a future public issuance to fund an acquisition, CFOs need to have their goals and strategy clear in 2023.

In 2023, finance teams face the challenge of reducing operating costs while driving growth in a challenging economic environment. To achieve this, they must adopt a strategic approach to cost optimization, focusing on both cost drivers and value drivers.

Cost drivers include anything that affects the total cost of an operation, and finance teams must carefully analyze and control these drivers to ensure optimal cost control. Value drivers, on the other hand, are anything that increases the value of a business or product in the event of a sale.

To balance cost concerns with growth initiatives, finance teams must evaluate multiple projects based on their ROI and long-term alignment with the business’s goals. They can also adopt new technologies and tools to improve operational efficiency, invest in employee training and development programs to promote innovation, and foster a culture of continuous improvement and cost consciousness.

By taking a holistic view of their operations and focusing on cost optimization, finance teams can reduce operating costs while driving growth and creating value for their organizations.

Studies show that workplaces that focus on diversity, equality, and inclusion (DEI) do better on various metrics such as employee retention and innovativeness. CFOs need to prioritize DEI metrics not just to drive growth but also to help build the company brand.

Assess how the finance function as well as the organization has done with respect to diversity in the workplace,and spread awareness about DEI. Step up the efforts by having DEI-focused hiring measures, active network groups to support workforce diversity, and formalized succession planning. CFOs, as strategic leaders, can play a key role in helping their business grow while remaining committed to DEI goals.

Like ESG goals ,DEI goals are crucial not only for large enterprises but also for SMBs that seek hyper-growth and rapid expansion of their client base.

Setting smart goals for your finance team is critical to driving success in 2023 and beyond. One effective way to achieve these goals is by partnering with a technology vendor that can provide the right solutions and support to achieve your finance team objectives. HighRadius’ RadiusOne AR Suite is an excellent choice for midsized companies looking to automate and fast-track accounts receivable functions.

With a set of AI-powered solutions designed to streamline AR processing, the RadiusOne AR Suite can help your finance team improve efficiency, reduce costs, and drive growth. Pre-loaded with industry best practices and ready-to-use with popular ERPs, such as NetSuite, Sage Intacct, Microsoft Dynamics, and Infor, our solutions can help your finance team achieve their goals and succeed in the ever-changing business landscape.

So, whether you’re looking to reduce operating costs, identify gaps and automate workflows, train employees in AI and ML, or grow through innovation, HighRadius can help you achieve your goals and position your finance team for success in 2023 and beyond.

Some examples of smart goals for financial analysts include increasing revenue, reducing costs, improving profit margins, increasing cash flow, improving financial reporting accuracy, and enhancing financial forecasting capabilities.

Some examples of smart goals for accountants include improving financial reporting accuracy, reducing accounting errors and discrepancies, increasing efficiency in financial processes, improving budget forecasting accuracy, optimizing tax planning and compliance, and enhancing internal controls to prevent fraud.

Some short-term goals for the finance department may include reducing operating costs, improving cash flow, optimizing working capital management, developing effective financial risk management strategies, improving budget forecasting accuracy, and enhancing internal controls to prevent fraud.

Transform your finance department's performance with streamlined O2C operations, in-depth AI-powered insights, and unparalleled visibility

The HighRadius RadiusOne AR Suite is a complete accounts receivable solution designed for mid-sized businesses and SMBs to automate eInvoicing, Collections, Cash Reconciliation, and Credit Risk Management to enable faster cash conversion and maximize working capital.

It is quick to deploy and ready to integrate with ERPs like Oracle NetSuite, Sage Intacct, MS Dynamics, and scales to meet the needs of your order-to-cash process.

Lightning-fast Remote Deployment | Minimal IT Dependency

Prepackaged Modules with Industry-Specific Best Practices.