Cash management becomes critical when businesses face unexpected sales dips or sudden expenses like payroll or supplier payments. Ineffective cash and liquidity management can disrupt operations and strain financial stability. Strong cash management ensures companies maintain enough liquidity to cover short-term obligations while also optimizing surplus funds for growth.

In today’s volatile financial environment, balancing available cash with strategic investments is essential for resilience. Effective cash management not only safeguards against risks but also strengthens decision-making during economic fluctuations.

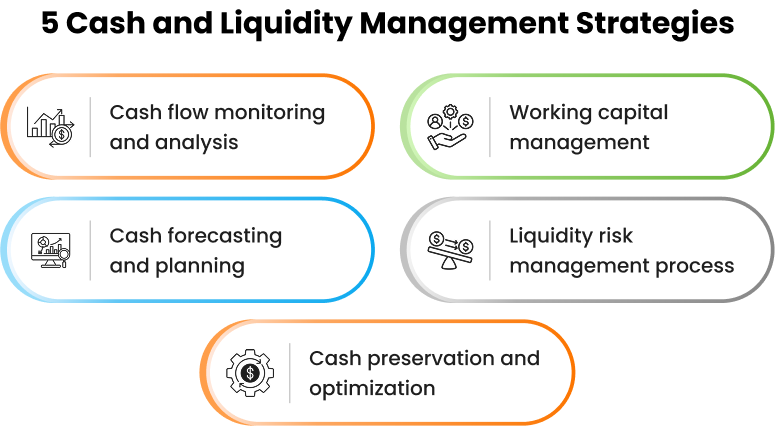

In this blog, we’ll define cash and liquidity management, explain why it matters, and outline five proven strategies to keep your business financially healthy.

Cash and liquidity management refers to the practice of monitoring, controlling, and optimizing cash flows to ensure businesses can meet short-term obligations while strategically using surplus funds for growth and stability. It balances day-to-day liquidity with long-term financial health.

It goes beyond day-to-day transactions by ensuring surplus cash is invested wisely, risks are minimized, and working capital is optimized. Using an advanced cash management software empowers companies to stay liquid during fluctuations, make confident financial decisions, and unlock growth opportunities.

Cash Managers Waste 15+ Hours Weekly on Manual Work. Automation Fixes That!

Cut down reconciliation delays, eliminate portal juggling, and gain real-time cash visibility with automated cash management solutions.

Get the Automation EbookCash and liquidity management primarily focuses on securing immediate operational needs by optimizing cash flows. It involves activities such as monitoring cash balances, processing payments and collections, cash forecasting, and managing risks to ensure smooth daily operations. Let us understand the factors that make cash and liquidity management extremely important:

Proper cash management ensures that the organization can meet its short-term obligations, avoiding insolvency and financial distress. It helps in improving the overall financial health of a company in the long run.

Efficient cash and liquidity management, helps businesses to gain cash visibility and provides a clear picture of their financial health. Cash visibility provides insights into whether there is a cash surplus or deficit, allowing stakeholders to make decisions promptly, able funds, ensuring that critical strategic initiatives receive the necessary investment.

With sufficient liquidity, businesses can operate smoothly and ensure that the company can meet its operational expenses such as payroll, rent, and utilities without interruptions. Effective management prevents disruptions that can occur due to a lack of funds, such as delayed supplier payments or production halts.

Reliable cash flow management builds trust with suppliers, vendors, employees, and stakeholders by ensuring timely payments and financial stability. Consistently paying suppliers and vendors on time fosters a reputation for reliability. This reliability can lead to better credit terms, discounts, and stronger partnerships.

Efficient cash and liquidity management helps minimize idle cash and wisely invest surplus funds, improving overall profitability. With efficient ash management techniques, businesses can minimize cash holding while ensuring that sufficient funds are available to meet immediate needs.

Maintaining optimal cash levels can reduce the need for short-term borrowing and associated interest expenses. Consistently managing cash flows and maintaining adequate liquidity levels can improve a company’s creditworthiness. Lenders view the company as a lower risk, which can lead to lower interest rates on loans.

Effective liquidity management enables businesses to take advantage of growth opportunities and make strategic investments when they arise. Cash management helps prioritize projects based on available funds, ensuring that critical strategic initiatives receive the necessary investment.

Liquidity management involves various strategies and techniques to ensure that a business maintains sufficient liquidity to meet its short-term financial obligations while optimizing its liquid assets’ use to generate returns. Two of the most common types of liquidity management techniques that companies typically use are cash flow monitoring and cash flow planning. Let us understand them in detail:

Cash flow monitoring is a core part of cash management that tracks inflows and outflows to maintain liquidity. The process involves:

Let’s take an example of company XYZ and take a look at their monthly cash flow statement. This statement gives insights into each component of cash inflows and cash outflows from operating, investing, and financial activities. Stakeholders can get a clear picture of the financial health of the company through this statement and get insights on how they can optimize their cash flow.

1. Accurately generate reports: Treasury analysts can gain a thorough understanding of cash flows to build credible, error-free reports for leadership.

2. Identifying improvement areas: Treasury managers can pinpoint efficiency and productivity gaps, focusing on areas that need improvements to achieve their goals.

3. Informed decision-making: CFOs can make informed decisions regarding cash allocation, determining when to expand or cut expenses based on cash flow trends and patterns identified.

Both cash management and liquidity management are vital for financial stability, but they focus on different aspects. Understanding the difference helps CFOs, treasurers, and banking professionals apply the right strategies for cash flow management and long-term growth.

| Aspect | Cash Management | Liquidity Management |

| Definition | Cash management is the process of collecting, handling, and using cash efficiently to ensure a company meets its short-term obligations. | Liquidity management ensures businesses can cover liabilities by optimizing cash, credit lines, and liquid assets. |

| Focus Area | Day-to-day cash management like receivables, payables, payroll, and expenses. | Broader financial health, ensuring enough liquidity for both planned and unexpected obligations. |

| Cash Management Process | Involves monitoring inflows/outflows, reconciling bank data, forecasting cash needs, and preparing daily cash reports. | Focuses on investment decisions, debt management, and maintaining adequate reserves. |

| Cash Management in Banking | Banks offer corporate cash management in banking services such as treasury solutions, payment processing, and fraud prevention. | Banks support liquidity through credit facilities, overdrafts, and investment products. |

| Example | Cash management example: A company automates receivables and payables to maintain steady cash flow. | Liquidity management example: A company invests surplus funds in short-term instruments to ensure liquidity. |

Cash flow planning is a vital component of cash management that helps companies anticipate liquidity needs. It involves reviewing past budgets to make adjustments for current cash flow budgeting, forecasting cash flow for a given time, and allocating funds for various company costs.

The cash flow planning process involves:

A cash flow forecast is the best example of cash flow planning. Let’s take a look at the cash flow forecasting template. By simply filling in the cash inflows and outflows, the template will provide you with the forecasted cash flow. This helps stakeholders determine if they have a cash surplus or cash deficit allowing them to make strategic decisions beforehand to avoid any financial distress.

Cash flow planning is critical in cash management as it helps businesses anticipate liquidity needs, reduce risks, and improve financial health. A strong plan ensures stability, supports growth, and enhances decision-making for CFOs and treasury teams.

Effective cash and liquidity management requires proactive planning, constant monitoring, and strong risk controls. These five proven strategies help businesses, from startups to enterprises, stay resilient and make confident financial decisions.

There are five main strategies that provide a robust framework for effective cash and liquidity management.

Today’s treasurers are looking for solutions that are both comprehensive and flexible. A good cash management solution allows a company to centralize, automate, and streamline payments and cash management within business units or throughout the entire company. HighRadius cloud-based Cash Management Solution is designed to streamline and optimize cash flow management processes for businesses that help them make better financial decisions with features like cash positioning, reconciliation, liquidity management, debt and investment management, and treasury analytics. It offers the following benefits to enable you to execute industry best practices for cash and liquidity management:

A company with a monthly revenue of $100,000 collects 70% within 30 days and the remaining 30% within 60 days. To manage cash disbursements, it incurs monthly expenses of $60,000 for raw materials, salaries, and other OPEX and negotiates supplier payment terms to settle invoices within 45 days.

Liquidity management focuses on managing cash and cash equivalents to meet short-term and long-term obligations. On the other hand, cash management focuses on daily cash handling, including activities like cash collection, disbursements, pooling, and cash positioning.

The four commonly used ratios to assess the liquidity of a company are:

Current ratio: Current Assets / Current Liabilities

Quick ratio: (Current Assets – Inventory) / Current Liabilities

Cash ratio: Cash and Cash Equivalents / Current Liabilities

Operating cash flow ratio: Operating Cash Flow / Current Liabilities

To manage excess cash and liquidity, consider short-term investments like money market funds, diversifying across asset classes, and reinvesting in the business for growth. Evaluate debt repayment, dividend payments, and maintaining adequate reserves while regularly reviewing and adjusting strategies for optimal results.

Cash management services encompass a range of financial solutions that help businesses optimize their cash flow, liquidity, and financial operations. These services may include cash pooling, account reconciliation, payment processing, and liquidity forecasting to enhance efficiency and maximize returns.

Best practices for effective cash and liquidity management include creating accurate forecasts, centralizing data from banks and ERPs, monitoring daily positions, and automating the cash management process. Companies should also review historical trends and strengthen liquidity buffers to ensure stability and growth.

Treasury and cash management software, ERP integrations, and AI-based forecasting tools help manage cash and liquidity effectively. These solutions automate the cash management process, provide real-time visibility, and improve decision-making for banking, payments, and liquidity risks.

Businesses can prevent liquidity shortages by adopting proactive cash management practices such as daily cash flow monitoring, accurate forecasting, and scenario planning. Using cash management in banking tools and automation ensures timely fund availability and reduces liquidity risk.ing to enhance efficiency and maximize returns.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center