Critical Aspects for CFOs to Focus On in 2022

What you’ll learn

- How to sort your priorities as a mid-market CFO

- Three key aspects for CFOs to focus on

- Ways to streamline finance processes with technology

Get the right team onboard

The verdict is out—finance will have a say in the critical decisions in your company. This, in turn, means that as the finance head, you need the right team to support you. According to a recent BDO survey, 42% of CFOs interviewed said that they will increase spending in HR/talent this year. The good news here is that as per the latest findings from PwC’s pulse survey, 31% of the people feel that hybrid work is not a challenge. Your options are no longer limited by geography, and you have a larger pool to choose from.

Your focus should be on a team that can cross the lines between the finance and technology realm with ease because fintech is here to stay. Encourage your team to upskill and cross-skill to bridge the gap between core finance and technical skills. Processes that are manual and have mundane moving parts—like accounts receivables— can be automated. This way, you can have a team that focuses on increasingly strategic initiatives rather than mundane manual tasks.

Business-IT alignment to form the blueprint for growth

As companies plan to grow at warp speed to keep up with the competition, the synergy that combining finance with technology can bring is undeniable. While today’s CFOs need to hone their technology skills, it is crucial to maintain close collaboration with the IT leadership.

Whether it is the deployment of new technology to manage accounts payable (AP) and accounts receivables (AR) processes or Enterprise Resource Planning (ERP) implementation, the collaboration between the heads of finance and technology is critical. All business leaders, including the finance head and IT team, must evaluate fitment in terms of existing technology.

Here are some reasons why the CFO will need to collaborate with the CIO on significant decisions:

- To evaluate if the new solution will integrate with the organization’s IT stack

- Assess the scalability of the solution to cope with the evolving needs of the business

- Avoidance of information silos to enable better decision-making

- Compliance with regulatory data security and privacy mandate

- Need to configure access to information as per RBAC (role-based access control)

- Ensure mobile access depending on the work profile of the team member

Be proactive in implementing technology

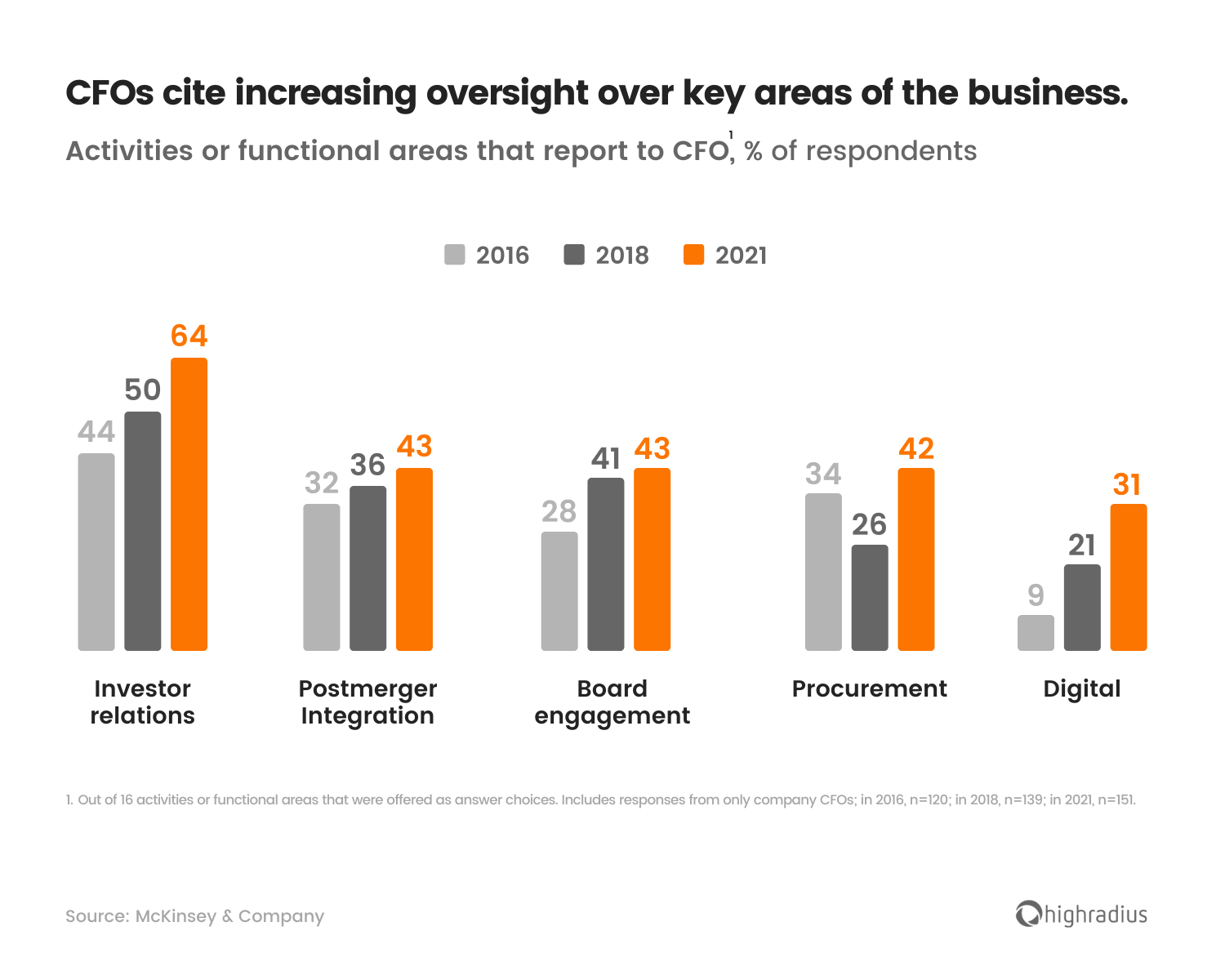

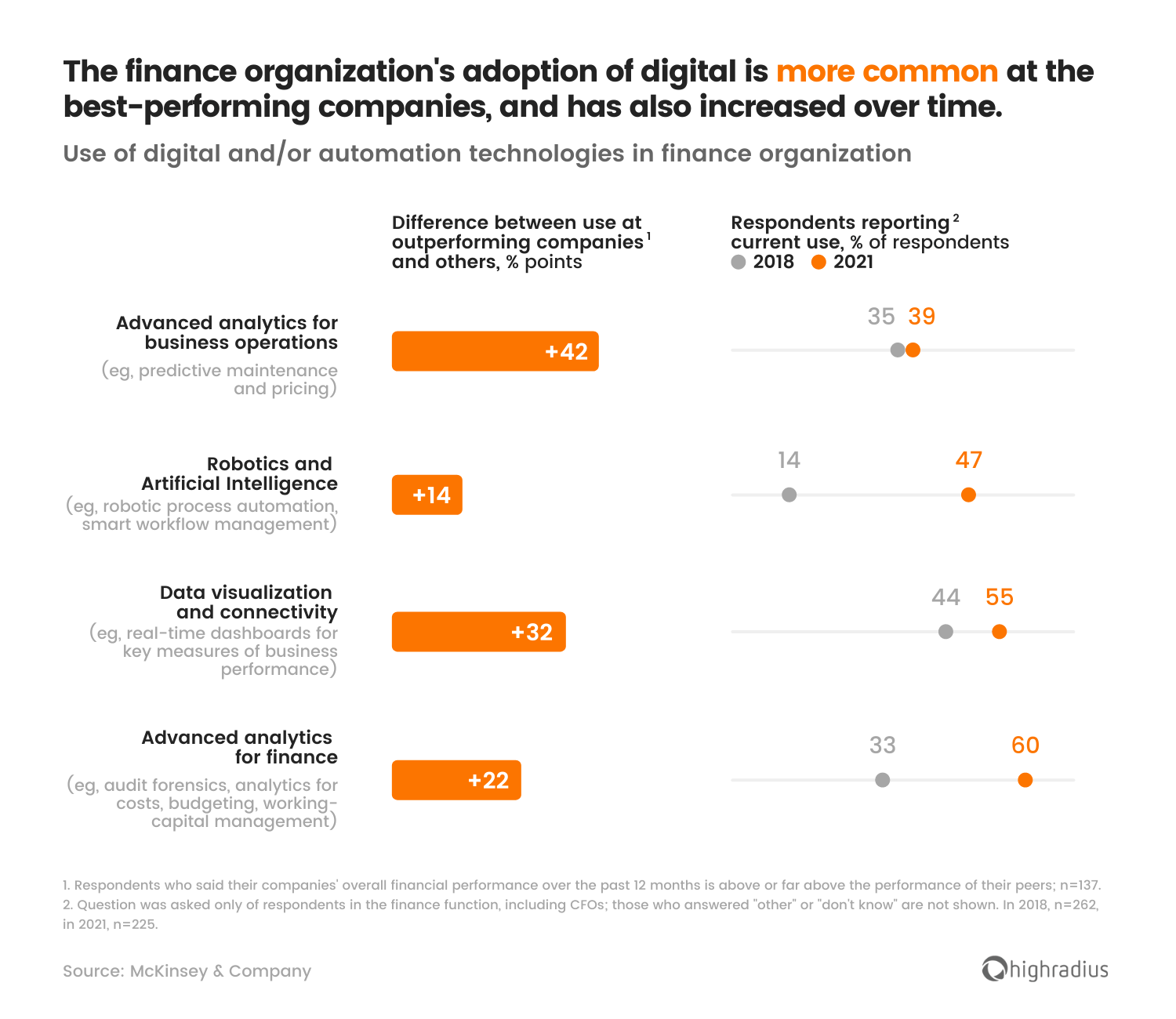

The third aspect that CFOs need to focus on is the logical result of the first two points; building a dynamic team and collaborating with the IT leadership. As per the survey of CFOs by PwC, more than 68% of CFOs planned to focus their investment efforts on digital transformation with automation as a priority.

The automation aspect becomes crucial to ensure better team utilization and business continuity if critical team members leave the job. Some ways in which adoption of technology will help the finance team includes:

- Reduction of manual errors like mistaken entries and missed follow-ups using technology

- Streamline processes like procurement, contract management, supply chain management through AP automation

- Optimize invoicing, enable in-system follow-ups, provide more payment options, ongoing credit risk evaluation, deductions management via AR automation

- Using advanced technology like Machine Learning (ML) to track risk patterns, predict outcomes, and manage risks accordingly

- Improve customer experience by using self-service portals and enabling quality supplies by managing vendors better

Here’s what the road ahead looks like:

As the finance head of a dynamic and ambitious mid-market business, you need to stay ahead of the curve by ensuring that your yearly priorities are clear. At HighRadius, we help our mid-market customers fulfill their digital transformation aspirations with our accounts receivable automation solutions. Often, companies automate some aspects of their accounts receivable processes but may not be leveraging the available tech stack. It is crucial to evaluate how automated your accounts receivables processes are. Here’s a good starting point to learn about your accounts receivable automation score.

Listing out a few of the benefits from using our solutions:

- Improved customer experience with an optimized credit onboarding process

- Optimize team productivity with the automation of the mundane tasks that are part of AR

- On-time invoicing and in-app calling to improve the productivity of collectors

- Priority worklists to ensure that high-risk and high-exposure customers are targeted for collections on priority

- Leverage AI or ML to keep track of internal KPIs, performance metrics and to assess risks externally

Want to get started on your AR transformation journey? Click here to learn more about our solutions.

The HighRadius RadiusOne AR Suite is a complete accounts receivable’s solution designed for mid-sized businesses to put their order-to-cash on auto-pilot with AI-powered solutions. It leverages automation to fast-track key accounts receivable functions including eInvoicing & Collections, Cash Reconciliation, and Credit Risk Management powered by RadiusOne AR Apps to improve productivity, maximize working capital, and enable faster cash conversion. Affordable, quick to deploy, and functionality-rich: it is pre-loaded with industry-specific best-practices and ready-to-plug with popular ERPs such as NetSuite and Sage Intacct. The HighRadius RadiusOne AR Suite is designed to automate labor-intensive processes while streamlining credit and collections activities for faster AR processing, better cash flow and improved profitability.

Lightning-fast Remote Deployment | Minimal IT Dependency Prepackaged Modules with Industry-Specific Best Practices.